Japan Water & Wastewater Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (End Suction, Split Case, Vertical (Turbine, Axial Pump, Mixed Flow Pump), Submersible Pump), Positive Displacement Pumps (Progressing Cavity, Diaphragm, Gear Pump, Others)), By Application (Water, Wastewater), By End User (Industrial Water & Wastewater, Municipal Water & Wastewater)

- Energy & Power

- Dec 2025

- VI0483

- 130

-

Japan Water & Wastewater Pump Market Statistics and Insights, 2026

- Market Size Statistics

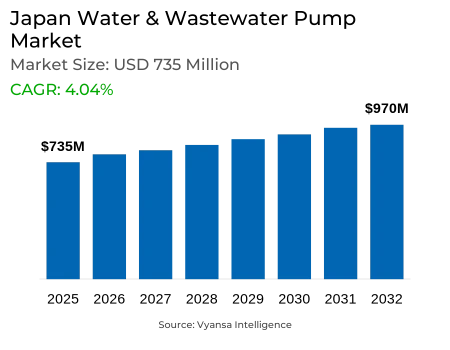

- Water & Wastewater Pump in Japan is estimated at $ 735 Million.

- The market size is expected to grow to $ 970 Million by 2032.

- Market to register a CAGR of around 4.04% during 2026-32.

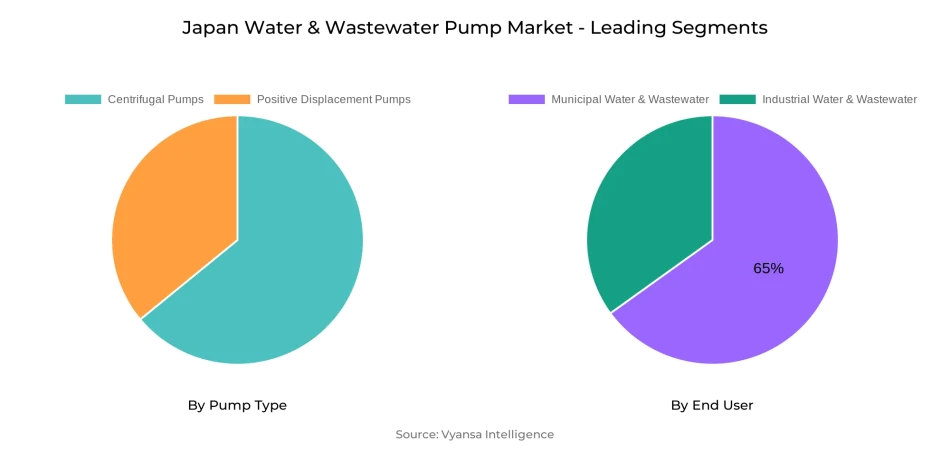

- Pump Type Segment

- Centrifugal Pumps continues to dominate the market.

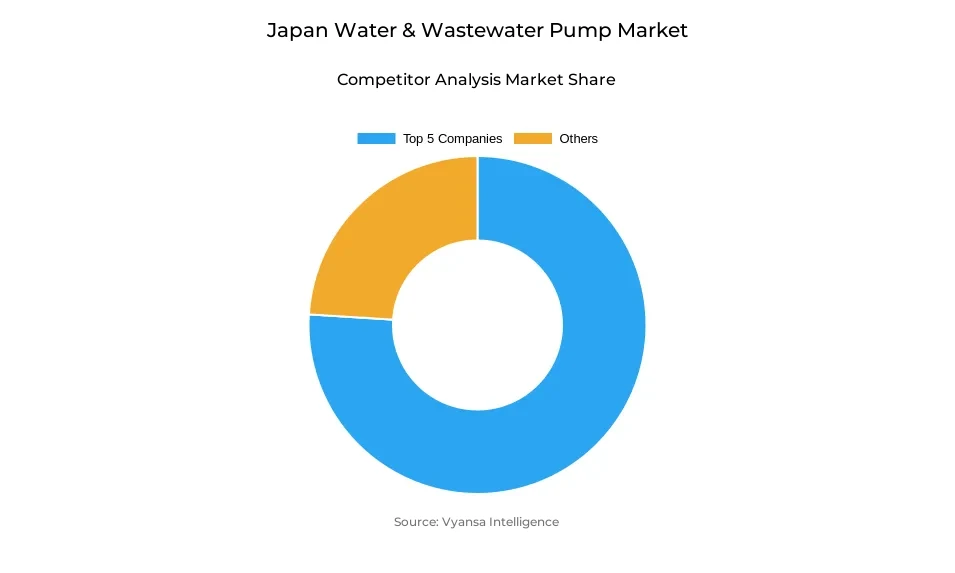

- Competition

- More than 10 companies are actively engaged in producing Water & Wastewater Pump in Japan.

- Top 5 companies acquired the maximum share of the market.

- ITT, IDEX, Dover, Flowserve, Sulzer AG etc., are few of the top companies.

- End User

- Municipal Water & Wastewater grabbed 65% of the market.

Japan Water & Wastewater Pump Market Outlook

Japan's water and wastewater pump industry is in line for sustainable growth as the nation wrestles with aging infrastructure and seismic risks. With its estimated 490,000 kilometers of sewer networks, almost 16% are set to hit the 50-year mark in 2030, spiking to 34% in 2040. That aging network results in more than 3,000 road cave-ins every year, making way for pressing replacement demands. In 2025, the market value was USD 735 million and is anticipated to increase to USD 970 million by 2032, reflecting demand for newer, more resilient pumping equipment.

Government policies are at the heart of market momentum. The 2024 adjustment under the infrastructure department promotes Water PPP schemes, shifting maintenance and replacement tasks to private hands. Seismic susceptibility adds urgency, with only 13.2% of Tokyo's water treatment plants seismic-reinforced as of 2022, well below the country-wide average of 43.4%. The government's plan for earthquake-proofing 69% of plants by 2031 guarantees long-term demand for high-end, earthquake-resistant pumping equipment.

Technological change further influences the market. Intelligent water management, IoT-based monitoring, and AI-based predictive analysis are becoming more popular to enhance efficiency and environmental regulation compliance. Smart pumping systems with IoT sensors and predictive maintenance support are becoming popular under government initiatives like subsidies and smart city projects. Moreover, Johkasou decentralized wastewater treatment technology opens opportunities for specialty pumps for distributed facilities.

Among pump types, centrifugal pumps dominate the market due to their efficiency, reliability, and suitability for high-volume municipal and industrial use. By end user, Municipal Water & Wastewater leads with a 65% share, highlighting the sector’s critical role in serving Japan’s highly urbanized population. At the same time, the Industrial Water & Wastewater segment is emerging as the fastest-growing segment, growing at a CAGR of 5.92% driven by increasing regulations and the trend towards sustainable industrial practices.

Japan Water & Wastewater Pump Market Growth Driver

Infrastructure Modernization Driving Enhanced Efficiency

Japan's aging water infrastructure offers a major driver for market expansion. Approximately 490,000 kilometers of sewer systems currently operate nationwide, with 16% expected to reach the 50-year mark by 2030, rising to 34% by 2040. This deterioration manifests in real challenges - over 3,000 annual road cave-ins occur due to sewerage pipeline failures since 2004. Around 22,000 kilometers of sewerage pipes have already exceeded their 50-year service life, representing 5% of total length, with projections showing this will rapidly increase to 76,000 kilometers (16%) within a decade.

Government programs proactively deal with these infrastructural shortfalls via exhaustive modernization initiatives. The 2024 realignment within the infrastructure ministry encourages Water PPP (public-private partnership) initiatives, which allow local governments to outsource maintenance, management, and replacement of water supply and sewerage infrastructure to private sectors as bundled packages. There are also around 1,600 rainwater pumping stations in Japan, of which 1,200 facilities (75% of the total) have exceeded their 20-year standard service life, generating huge replacement demand for effective pumping systems.

Japan Water & Wastewater Pump Market Challenge

Seismic Vulnerability and Budget Constraints

Water systems throughout Japan are plagued with extreme seismic risks that undermine system reliability. A mere 13.2% of Tokyo's water treatment plants are seismic upgraded through 2022, which is significantly lower than the national average of 43.4%. The government aims to earthquake-proof 69% of water infrastructure by 2031, up from just 14% in 2020. Historical earthquake impacts demonstrate the severity - the 2011 Great East Japan Earthquake left 2.57 million households in 19 prefectures without water, while the 2016 Kumamoto earthquakes caused all 326,000 households to lose water access.

Financial constraints further compound these challenges as municipalities struggle with declining budgets and aging workforces. Japanese water utilities have operational ratios of 49% for water and 67% for sewer utilities, which are indicative of robust operating margins, although cost recovery ratios in sewerage stand at a lowly 53%. The shift from investment on construction to maintenance of facilities has redirected funding sources away from bonds and government subsidies and more internally. This economic burden, coupled with seismic retrofitting requirements on a massive scale, poses serious procurement challenges for sophisticated pumping systems that can operate consistently under earthquake conditions.

Japan Water & Wastewater Pump Market Trend

Digital Transformation and Smart Water Technologies

Smart water management solutions are seeing high rates of adoption in Japan's industrial and municipal sectors. IoT for portable water monitoring in particular exhibits faster growth. These solutions allow real-time monitoring of water quality parameters such as pH, turbidity, conductivity, and dissolved oxygen, which in turn allow utilities to make informed data-driven decisions for optimizing resources.

Artificial intelligence and machine learning integration revolutionizes water quality monitoring using adaptive learning algorithms, predictive analytics, and anomaly detection functionalities. Government laws enforced by the Ministry of the Environment and Ministry of Health, Labour and Welfare force industrial and municipal facilities to implement real-time monitoring solutions. Smart city projects, public-private partnerships, and supportive government policies such as subsidies and innovation incentives are powerful growth drivers. The digital transformation movement creates demand for intelligent pumping systems with IoT sensors, remote monitoring, and predictive maintenance.

Japan Water & Wastewater Pump Market Opportunity

Decentralized Treatment and Energy Efficiency Programs

Japan's decentralized treatment strategy for wastewater offers vast market potential by means of Johkasou technology growth. These small, energy-saving systems treat wastewater to the same standard as those in centralized plants with more flexibility for difficult geography or sparse populations. The government sees Johkasou as an acceptable long-term solution over a stopgap measure, and this legitimizes decentralized strategies as exportable technologies. This positioning provides market opportunity for specialized pumping equipment engineered for distributed treatment facilities.

Energy efficiency standards under the amended Act on Rationalising Energy Use, implemented April 2023, require a 1% annual improvement in industrial sectors. The Top Runner Program introduces increasingly stringent energy efficiency requirements for equipment, currently including 32 items such as pumps and ancillary systems. Government subsidies for energy conservation projects are granted in particular to advanced energy conservation projects, with JOGMEC offering grants under approved business plans. Such regulatory frameworks provide strong incentives for procuring high-efficiency pumping systems that satisfy energy conservation mandates and ensure Japan's carbon neutrality goal of 2050.

Japan Water & Wastewater Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- Positive Displacement Pumps

Centrifugal Pump segment holds the largest market share in the category of Pump Type. Centrifugal pumps remain the market leaders because of their better performance characteristics and universal applicability across water and wastewater treatment processes. They are best suited to transport large amounts of water with smooth flow rates and thus find wide applications in municipal water distribution systems, industrial processes, and sewerage treatment plants.

Centrifugal pumps lead the field because they have shown their reliability in the demanding infrastructure conditions in Japan. They are well-suited to operate in the country's conditions with low maintenance needs, which fits the long-term operational stability focus of the nation. As Japan upgrades its aging water systems, the dominance of centrifugal pumps resonates with their tried-and-true performance in mission-critical water management applications where system failure has the potential to compromise public health and safety significantly.

By End User

- Industrial Water & Wastewater

- Municipal Water & Wastewater

The Municipal Water & Wastewater segment leads in terms of market share under the End User category. Municipal Water & Wastewater captured 65% of the market, showing the pivotal role public water systems play in Japan's ultra-urbanized society. This leadership shows the widespread network of municipal treatment plants serving Japan's over 125 million people concentrated in urban metropolitan areas.

The Industrial Water & Wastewater segment is the fastest growing end user segment with a CAGR of 5.92%. The growth is boosted by tighter environmental regulations obligating industrial facilities to improve wastewater treatment capabilities, higher usage of water recycling systems to help contain operational expenses, and growth in manufacturing industries that require high-quality process water. Japan's adoption of sustainable industrial practice and circular economy focuses drives this growth path in industrial water treatment applications.

Top Companies in Japan Water & Wastewater Pump Market

The top companies operating in the market include ITT, IDEX, Dover, Flowserve, Sulzer AG, KSB, Xylem, Grundfos, Ebara, SPX Flow, etc., are the top players operating in the Japan Water & Wastewater Pump Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Japan Water & Wastewater Pump Market Policies, Regulations, and Standards

4. Japan Water & Wastewater Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Japan Water & Wastewater Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Vertical- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. Axial Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. Mixed Flow Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Submersible Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Progressing Cavity- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Diaphragm- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Gear Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End User

5.2.3.1. Industrial Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Municipal Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Japan Centrifugal Water & Wastewater Pump Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Japan Positive Displacement Water & Wastewater Pump Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Flowserve Corporation

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Ebara Corporation

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.WILO SE

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Sulzer Limited

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Grundfos Holding A/S

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Xylem Inc.

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.KSB SE & Co. KGaA

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Kirloskar Brothers Limited (KBL)

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Franklin Electric

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Pentair PLC

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Application |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.