Japan Water Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (Overhung Pumps (Vertical Line, Horizontal End Suction), Split Case Pumps (Single/Two Stage, Multi Stage), Vertical Pumps (Turbine, Axial, Mixed Flow), Submersible Pumps (Solid Handling, Non-Solid Handling)), Positive Displacement Pump (Diaphragm Pumps, Piston Pumps, Gear Pumps, Lobe Pumps, Progressive Cavity Pumps, Screw Pumps, Vane Pumps, Peristaltic Pumps, Others)), By End User (Oil & Gas, Power, Residential, Agriculture & Irrigation, Commercial Building, HVAC, Chemical, Water & Wastewater, Food & Beverage, Others)

- Energy & Power

- Dec 2025

- VI0319

- 117

-

Japan Water Pump Market Statistics and Insights, 2026

- Market Size Statistics

- Water Pump in Japan is estimated at $ 3.05 Billion.

- The market size is expected to grow to $ 3.62 Billion by 2032.

- Market to register a CAGR of around 2.48% during 2026-32.

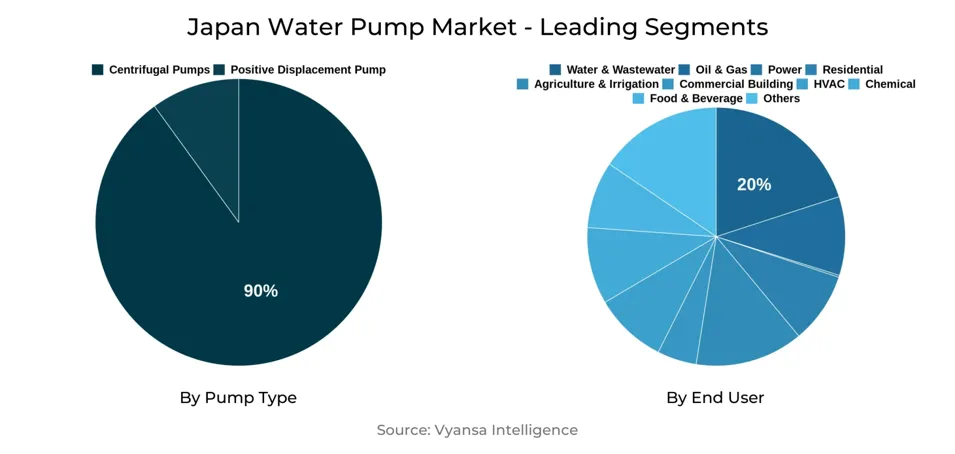

- Pump Type Segment

- Centrifugal Pumps grabbed market share of 90%.

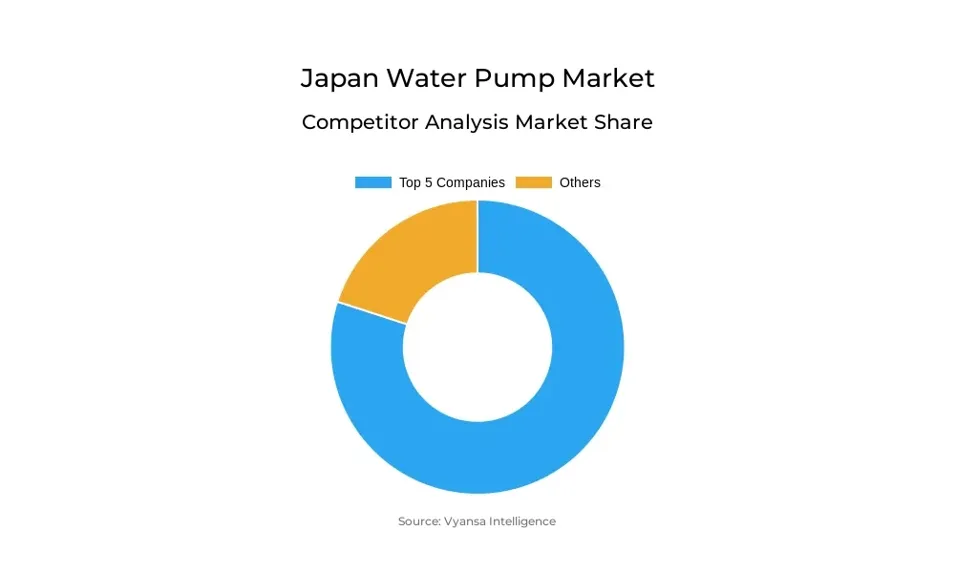

- Competition

- More than 10 companies are actively engaged in producing Water Pump in Japan.

- Top 5 companies acquired the maximum share of the market.

- ITT, IDEX, Dover, Flowserve, Sulzer AG etc., are few of the top companies.

- End User

- Water & Wastewater grabbed 20% of the market.

Japan Water Pump Market Outlook

The Japan water pump market, which was worth USD 3.05 billion in 2026, is expected to grow to USD 3.62 billion by 2032. Expansion is facilitated by the adoption of smart monitoring and IoT-enabled control, which provides real-time monitoring for detecting wear and leakages. This transition is critical for Japan's old infrastructure, facilitating predictive maintenance that minimizes downtime and prolongs equipment lifespan. The trend is also reinforced by the increased adoption of subscription-based maintenance programs, whereby more than 30% of industrial customers now have service contracts that reduce unplanned failures by 25%.

Energy efficiency also plays a main role as businesses experience volatile electricity prices. Variable frequency drives provide up to 15% in energy savings over fixed-speed drives, and thus retrofit projects are boosted on both industrial and municipal fronts. Government assistance comes into play with up to 30% subsidies under the Energy Conservation Promotion Program to upgrade buildings with high-efficiency pumps. The replacement of old machines, many being more than 15 years old, with IE4-rated units generates 20% more energy efficiency, with large-scale facilities saving as much as ¥1 million a year.

Environmental compliance provides additional impetus. Japan requires IE3 efficiency and noise levels of under 70 dB(A) for urban installation, and certifications by the Japan Electrical Safety & Environment Technology Laboratories add 2–3 months of lead time. Wastewater treatment regulations also require corrosion-proof materials, adding up to 8% in costs but providing assurance of longevity. Municipalities' stricter discharge standards under the Water Pollution Control Act continue to drive investment into sophisticated systems.

From a market structure point of view, centrifugal pumps lead with 90% market share because they are universally applicable across applications ranging from cooling towers to irrigation. End user demand is followed by the water and wastewater industry, which represents 20% of the market since treatment facilities make extensive use of submersible and vertical turbine pumps. Meanwhile, power generation is the fastest-growing segment, expected to expand at 5.7% CAGR, driven by the need for high-pressure pumps in thermal and renewable facilities.

Japan Water Pump Market Growth Driver

Manufacturers more and more incorporate smart monitoring and IoT-powered controls into pump systems to optimize operational efficiency and minimize downtime. The transition helps Japan's aging infrastructure, enabling real-time identification of wear and leakages before failure. The transition to predictive maintenance also complements Japan's Industry 4.0 programs, helping facilities have high uptime with minimized lifecycle cost.

Energy-saving motor adoption is increasing as businesses seek to reduce electricity costs in the face of volatile energy prices. Variable frequency drives (VFDs) save up to 15% of energy by adjusting pump speed to meet demand, compared with fixed-speed applications. These advancements fuel pump replacement cycles and retrofitting initiatives in industrial and municipal markets.

Japan Water Pump Market Challenge

Japan's strict environmental standards require pumps to achieve IE3 efficiency levels and restrict noise below 70 dB(A) for installations in urban environments. Manufacturers are required to certify their products via Japan Electrical Safety & Environment Technology Laboratories (JET), extending lead times by 2–3 months on average.

At the same time, new policies for wastewater treatment require corrosion-resistant materials to process high-chloride effluents. Production costs are boosted by as much as 8% in response, testing suppliers' ability to meet requirements while keeping prices competitive. Balancing these priorities is essential with municipalities tightening discharge standards under the new Water Pollution Control Act.

Japan Water Pump Market Trend

Subscription maintenance plans are revolutionizing customer relationships with ongoing performance warranties and remote diagnostics. More than 30% of industrial consumers today choose service agreements that package predictive analytics, lowering surprise breakdowns by 25%.

Cloud-based dashboards integrate data from across sites, which allows for monitoring and decision-making centrally. This shift hastens takeup of modular pump units that are easily integrated with digital platforms, supporting fast scalability for OEMs and end customers both.

Japan Water Pump Market Opportunity

A substantial proportion of Japan's installed base of pumps is more than 15 years old, which translates into a profitable retrofit market. Replacing old units with IE4-rated pumps provides 20% improved energy efficiency, which means annual cost savings of up to ¥1 million per large facility.

In addition, government incentives provide grants of up to 30% for projects to upgrade to high-efficiency pumps under the Energy Conservation Promotion Program. These grants reduce the overall investment barrier for water utilities and factories, creating retrofit momentum.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2026-32 |

| USD Value 2025 | $ 3.05 Billion |

| USD Value 2032 | $ 3.62 Billion |

| CAGR 2026-2032 | 2.48% |

| Largest Category | Centrifugal Pumps segment leads with 90% market share |

| Top Drivers | Driving Growth through Technological Adoption |

| Top Challenges | Navigating Regulatory Complexities |

| Top Trends | Rising Traction Towards Digital Service Models |

| Top Opportunities | Unlocking Retrofit Opportunities |

| Key Players | ITT, IDEX, Dover, Flowserve, Sulzer AG, KSB, Xylem, Grundfos, Ebara, SPX Flow and Others. |

Japan Water Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- Positive Displacement Pump

The largest market share within Pump Type is captured by the Centrifugal Pumps segment, which takes 90% of installations. Their simplicity, scalability, and versatility for use in a wide range of applications from cooling towers to irrigation mean that it is the most popular choice among industrial and municipal consumers alike.

Positive displacement pumps meet more niche requirements, including high-viscosity or metering applications, but account for a smaller portion of the total market. With new impeller designs pushing centrifugal technology forward, this dominance will likely continue.

By End User

- Oil & Gas

- Power

- Residential

- Agriculture & Irrigation

- Commercial Building

- HVAC

- Chemical

- Water & Wastewater

- Food & Beverage

- Others

The most prominent market share within the category of End User is Water & Wastewater, taking 20% of total pump demand. Submersible and vertical turbine pumps are crucial to municipal treatment plants for handling large amounts of water with minimal energy usage.

The most rapidly increasing End User segment is Power Generation, with a CAGR of 5.7% as thermal and renewable power plants increase capacity. These facilities prefer rugged, high-pressure pumps to handle boiler feedwater and cooling loops.

Top Companies in Japan Water Pump Market

The top companies operating in the market include ITT, IDEX, Dover, Flowserve, Sulzer AG, KSB, Xylem, Grundfos, Ebara, SPX Flow, etc., are the top players operating in the Japan Water Pump Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Japan Water Pump Market Policies, Regulations, and Standards

4. Japan Water Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Japan Water Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.1.2.By Units Sold in Million Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Overhung Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.1. Vertical Line- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.2. Horizontal End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.1. Single/Two Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.2. Multi Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Vertical Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. Axial- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. Mixed Flow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Submersible Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.1. Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.2. Non-Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Diaphragm Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Piston Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Gear Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Lobe Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.5. Progressive Cavity Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.6. Screw Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.7. Vane Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.8. Peristaltic Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.9. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By End User

5.2.2.1. Oil & Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Power- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Residential- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Agriculture & Irrigation- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Commercial Building- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. HVAC- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Chemical- Market Insights and Forecast 2022-2032, USD Million

5.2.2.8. Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.2.9. Food & Beverage- Market Insights and Forecast 2022-2032, USD Million

5.2.2.10. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Competitors

5.2.3.1. Competition Characteristics

5.2.3.2. Market Share & Analysis

6. Japan Centrifugal Pump Water Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.1.2.By Units Sold in Million Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Japan Positive Displacement Pump Water Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.1.2.By Units Sold in Million Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Torishima Pump Mfg. Co., Ltd

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Ebara Corporation

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Flowserve Corporation

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.KSB SE & Co. KGaA

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.WILO SE

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Tsurumi Manufacturing Co., Ltd

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Sulzer Ltd

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Xylem

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.ITT INC

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. The Weir Group PLC

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.