Japan Bottled Water Market Report: Trends, Growth and Forecast (2026-2032)

By Type of Water (Carbonated Bottled Water, Flavoured Bottled Water, Functional Bottled Water, Still Bottled Water (Purified Water, Mineral Water, Spring Water, Plain Water)), By Packaging Material (Plastic Bottles, Glass Bottles, Metal Cans, Others (Tetra Pack Cartons, Bioplastics, etc.)), By Price Point (Mass, Premium), By Sales Channel (On Trade, Off Trade (Retail Offline, Retail Online))

- FMCG

- Feb 2026

- VI0983

- 120

-

Japan Bottled Water Market Statistics and Insights, 2026

- Market Size Statistics

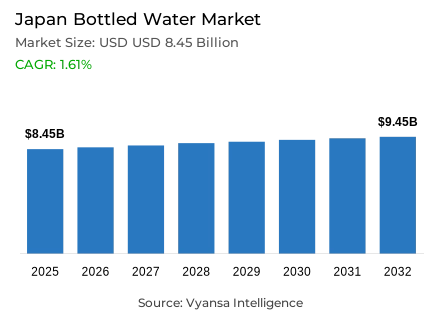

- Bottled water in Japan is estimated at USD 8.45 billion in 2025.

- The market size is expected to grow to USD 9.45 billion by 2032.

- Market to register a cagr of around 1.61% during 2026-32.

- Type of Water Shares

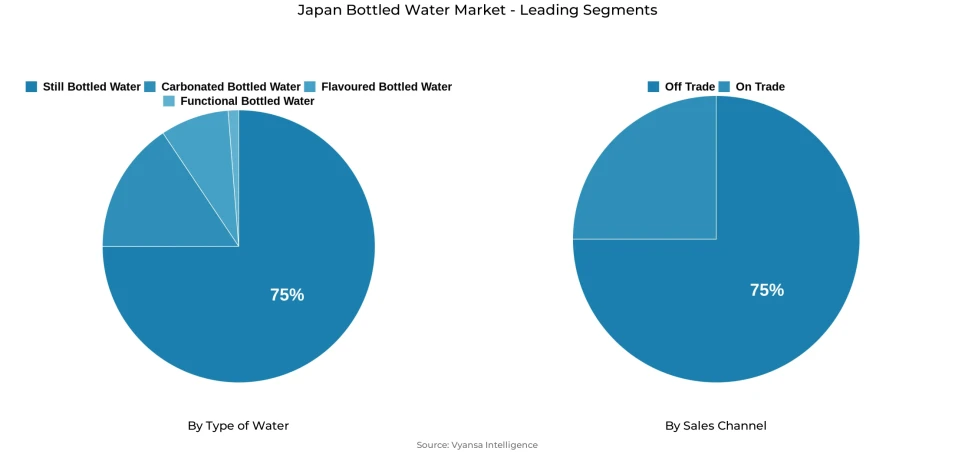

- Still bottled water grabbed market share of 75%.

- Competition

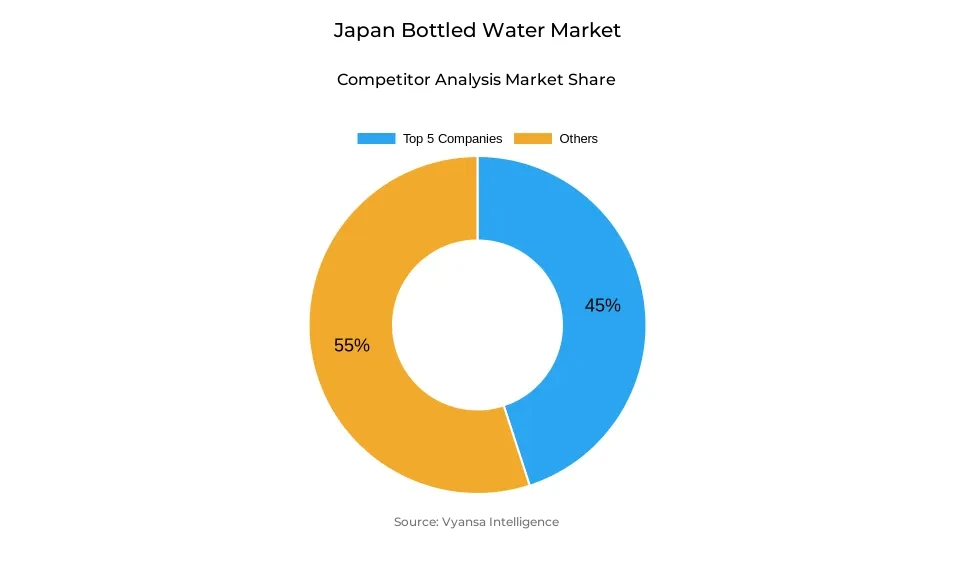

- Bottled water in Japan is currently being catered to by more than 15 companies.

- Top 5 companies acquired around 45% of the market share.

- Nac Co Ltd; ITO EN Ltd; Aqua Clara Inc; Suntory Beverage & Food Ltd; Coca-Cola (Japan) Co Ltd etc., are few of the top companies.

- Sales Channel

- Off trade grabbed 75% of the market.

Japan Bottled Water Market Outlook

The Japan bottled water market is estimated around USD 8.45 billion in 2025 and USD 9.45 billion in 2032, which is a moderate compound annual growth rate of about 1.61% between 2026 and 2032. This forecast is suggestive of a mature market that is struggling with endemic inflation and slow volume growth as opposed to fast growth. The rising cost of living is still affecting the daily spending habits and bottled water is no longer seen as an unchallenged part of daily life. As reliable tap water supply becomes more accessible, consumers are increasingly considering the purchase of bottled water based on their household budgets, which limits the potential growth despite the product being consumed by a large number of people.

At least partially, cost pressures are alleviated by established stock-piling habits related to natural disaster preparedness and habits that were strengthened during the pandemic. Bottled water is still regarded as a vital emergency good, thus maintaining a minimum level of demand among households. However, inflation has diminished volume resilience in the face of routine consumption, leading to a shift in more planned and selective buying of bottled water. This equilibrium stabilises the market on the value front and restrains vigorous growth, particularly as the underlying consumption base is eroded by demographic decline and market saturation.

The consumption trends are also changing, with consumers exploring options like reusable containers, tap-based filtration, and refill stations. The increased cost sensitivity and the rising environmental consciousness drive these changes, leading to a reduced use of packaged water as a source of daily hydration. Bottled water is competing more with non-packaged options and is most relevant to preparedness, travel, and special-purpose use, as opposed to daily use.

In the market structure, Still Bottled Water holds about 75% of the share, which is a manifestation of its identity with safety, neutrality, and household versatility. Off-trade channels also constitute about 75% of the sales, which are supported by supermarkets and convenience stores that enable buying in bulk and emergency stocking. Taken together, these factors indicate a stable but cautious market perspective until 2032.

Japan Bottled Water Market Growth DriverInflationary Pressures Reshape Household Beverage Priorities

The rising cost of living is reshaping spending priorities in the Japan bottled water market, particularly as prolonged inflation reduces discretionary purchasing power. According to official government data, the consumer price index in Japan increased by 3.2% in 2024, marking the third consecutive year of increased inflation and a continuous strain on real household income. Even habitual beverage categories are being reassessed as consumers seek to control day-to-day spending. Despite the continued popularity of bottled water, it is being increasingly evaluated in comparison with other options, as Japan has a reliable system of potable tap water, which reduces the sense of an unquestionable need in the face of fiscal constraint.

Despite these pressures, the deep-rooted stockpiling behavior, influenced by past natural disasters and the pandemic, remains the foundation of the baseline demand. Bottled water is considered an essential preparedness product by households, thus maintaining repeat purchases. However, the inflation has undermined the volume strength, and bottled water is no longer an unquestioned staple, but a category that is under increased budgetary examination, especially with regard to daily use as opposed to emergency use.

Japan Bottled Water Market ChallengeDemographic Contraction and Market Saturation Constrain Volumes

The Japan bottled water market is subject to a constant limitation by structural demographic changes. The official census data indicate that the population has dropped to 124.35 million in 2023, which marks a decline that has been continuing over 15 consecutive years. This shrinking population directly reduces the long-term foundation of regular bottled water use, particularly with the shrinking household sizes and the accelerating ageing. In contrast to the emerging markets, Japan does not have population-based consumption tailwinds, which further increases the pressure to maintain the current level of demand.

This population fact is added to the fact that the market is already saturated. Bottled water has almost universal recognition and is widely available, so there is little room to grow organic volumes. With the economic pressures increasing, even emergency stockpiling behavior becomes more price-sensitive, and the strength of domestic brand loyalty reduces the appeal of more expensive imports. Saturation and population decline in concert increase competition, which supports the stagnation of volumes despite the established position of bottled water in the daily life of the population.

Japan Bottled Water Market TrendGradual Shift Toward Alternative Hydration Solutions

One major change affecting the Japan bottled water market has been the progressive replacement of packaged water with other water brands. This change is caused mainly by the high cost of living among end users, while environmental awareness is also contributing significantly towards increasing demand for reusable bottles, filtered water through taps, and refills. This change aligns with the increasing sustainable credentials detected among the Japanese population generally, with 19.3% reduction in plastic waste generation calculated on a per capita basis from 2019-2023.

Therefore, there are emerging trends where bottled water increasingly competes not only with other beverages but also with non-packaged hydration options. This, although not entirely eliminating consumption, changes instances for use. As such, general and routine use becomes less common, especially in urban environments, whereas emergency relief, travel, and so forth are still viable for bottled water. This new trend seems to indicate a certain shift in trends, although not entirely substitutive, with sustainability and cost drivers at heart.

Japan Bottled Water Market OpportunityWater-as-a-Service and Sustainable Innovation Unlock Value

The changing consumer demands are creating progressive directions that go beyond the conventional bottled products in the Japanese bottled water industry. Refill-based innovations, mineral additions, and tap-water quality solutions are indicators of a transition to the concept of water as a service, not a disposable commodity. These efforts are closely connected with the policy direction, with the Ministry of the Environment of Japan targeting 100% effective use of plastics by 2035 in its Plastic Resource Circulation Strategy, thus triggering interest in alternatives to single-use bottles.

This intersection of policy and practice is the foundation of new value generation to those companies that are ready to change. The ideas that build trust in tap water, make it easy to refill, or significantly decrease the use of plastic are appealing to sustainability goals without compromising the use of water in everyday life. Such models can help brands to remain relevant and active by focusing on environmental and economic issues at the same time, as the traditional volumes of bottled water are challenged by structural and macroeconomic factors.

Japan Bottled Water Market Segmentation Analysis

By Type of Water

- Carbonated Bottled Water

- Flavoured Bottled Water

- Functional Bottled Water

- Still Bottled Water

- Purified Water

- Mineral Water

- Spring Water

- Plain Water

Under the Type of Water segmentation, Still Bottled Water holds the highest market share at around 75%, reflecting its entrenched position within Japanese households. End users continue to associate still water with safety, neutrality, and versatility, making it suitable for direct consumption, cooking, and infant care. These functional attributes reinforce its status as a household staple, particularly in a market shaped by disaster preparedness and hygiene awareness developed over decades.

The segment’s leadership also reflects long-standing behavioural habits formed after major disruption events, when still water became synonymous with emergency readiness. Even under economic pressure, still bottled water retains relevance because it is perceived as a basic necessity rather than a discretionary beverage. This perception allows the segment to maintain dominance despite declining overall volumes, underscoring its resilience relative to flavoured or carbonated alternatives.

By Sales Channel

- On Trade

- Off Trade

- Retail Offline

- Retail Online

Within the Sales Channel segmentation, Off-Trade accounts for approximately 75% of total market share, making it the primary distribution route in the Japan bottled water market. This channel includes supermarkets, convenience stores, local retailers, and online platforms, all of which support home consumption and emergency stockpiling behaviour. Off-trade dominance reflects bottled water’s role as a planned household purchase rather than an impulse-driven item.

Supermarkets play a particularly influential role within off-trade, serving as the preferred destination for bulk and routine purchases. Strong shelf visibility, promotional pricing, and integration with regular grocery shopping reinforce bottled water’s household relevance. Even amid economic pressure, supermarkets continue to anchor off-trade sales by facilitating value-oriented purchasing and reinforcing bottled water’s positioning as a practical, preparedness-oriented staple rather than an occasional indulgence.

List of Companies Covered in Japan Bottled Water Market

The companies listed below are highly influential in the Japan bottled water market, with a significant market share and a strong impact on industry developments.

- Nac Co Ltd

- ITO EN Ltd

- Aqua Clara Inc

- Suntory Beverage & Food Ltd

- Coca-Cola (Japan) Co Ltd

- Asahi Soft Drinks Co Ltd

- Kirin Beverage Corp

- Otsuka Holdings Co Ltd

- Zaiho Group

- Otsuka Foods Co Ltd

Competitive Landscape

Japan’s bottled water market in 2025 remains led by Suntory Beverage & Food Ltd, supported by the strong performance of its Tennensui brand. Suntory’s leadership is reinforced by continuous product optimisation, notably the redesign of its 1-litre bottle into a slimmer, more portable format aligned with personal consumption trends. Despite rising inflation driving some consumers towards private label alternatives, Suntory continues to hold a clear volume lead. Asahi has emerged as a notable challenger, gaining share through innovation in niche segments such as hot bottled water under its Oishii Mizu brand. By expanding pack sizes and improving thermal packaging, Asahi has successfully differentiated its offering. Overall, competition is shaped by packaging innovation, functionality, and value positioning amid shifting consumer preferences.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Japan Bottled Water Market Policies, Regulations, and Standards

4. Japan Bottled Water Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Japan Bottled Water Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Volume (Million Litres)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Type of Water

5.2.1.1. Carbonated Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Flavoured Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Functional Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Still Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Purified Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Mineral Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Spring Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Plain Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Packaging Material

5.2.2.1. Plastic Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Glass Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Metal Cans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Others (Tetra Pack Cartons, Bioplastics, etc.)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Point

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. On Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Off Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Japan Carbonated Bottled Water Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Volume (Million Litres)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Japan Flavoured Bottled Water Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Volume (Million Litres)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Japan Functional Bottled Water Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Volume (Million Litres)

8.2. Market Segmentation & Growth Outlook

8.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Japan Still Bottled Water Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Volume (Million Litres)

9.2. Market Segmentation & Growth Outlook

9.2.1.By Type of Water- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Price Point- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Suntory Beverage & Food Ltd

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Coca-Cola (Japan) Co Ltd

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Asahi Soft Drinks Co Ltd

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Kirin Beverage Corp

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Otsuka Holdings Co Ltd

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Nac Co Ltd

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. ITO EN Ltd

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Aqua Clara Inc

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Zaiho Group

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Otsuka Foods Co Ltd

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Type of Water |

|

| By Packaging Material |

|

| By Price Point |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.