Italy Sports Nutrition Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Sports Protein Products (Protein/Energy Bars, Sports Protein Powder, Sports Protein RTD), Sports Non-Protein Products), Sales Channel (Retail Offline, Retail Online), Ingredients (Vitamins and Minerals, Proteins and Amino Acids, Carbohydrates, Probiotics, Botanicals/Herbals, Others), Functionality (Energy, Muscle growth, Hydration, Weight Management, Others), End User (Bodybuilders, Athletes, Lifestyle Users)

- Food & Beverage

- Dec 2025

- VI0658

- 125

-

Italy Sports Nutrition Market Statistics and Insights, 2026

- Market Size Statistics

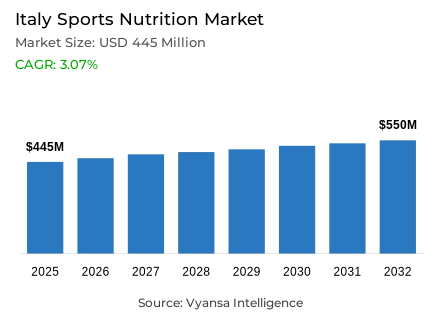

- Sports nutrition in Italy is estimated at USD 445 million.

- The market size is expected to grow to USD 550 million by 2032.

- Market to register a cagr of around 3.07% during 2026-32.

- Product Type Shares

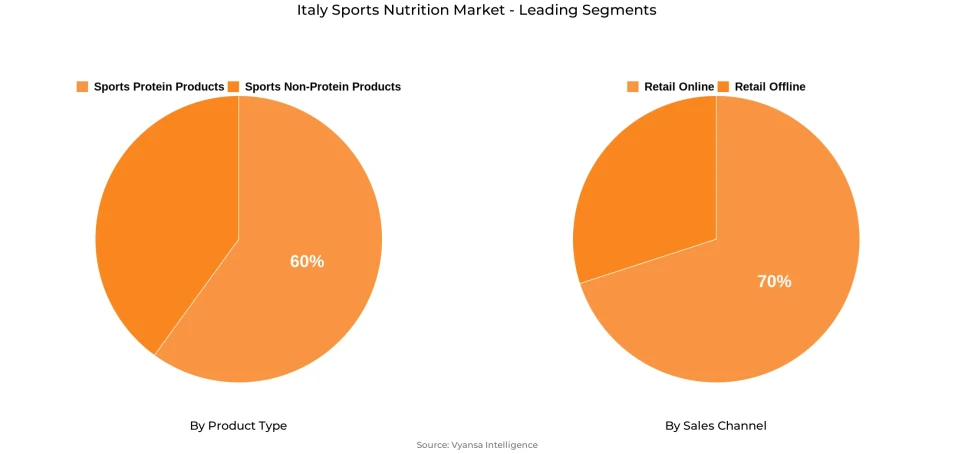

- Sports protein products grabbed market share of 60%.

- Competition

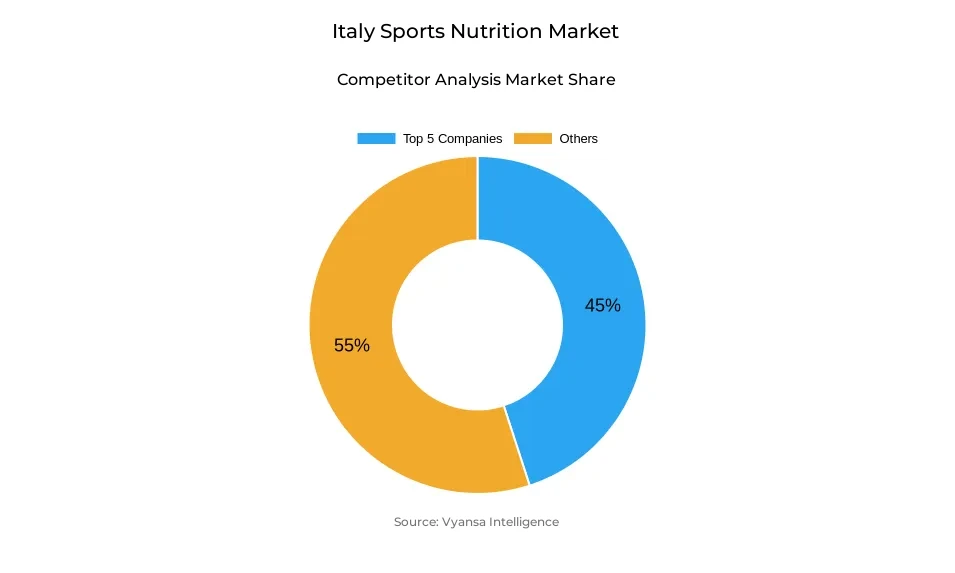

- More than 15 companies are actively engaged in producing sports nutrition in Italy.

- Top 5 companies acquired around 45% of the market share.

- +Watt Srl; Herbalife Italia SpA; A&D SpA - Gruppo Alimentare & Dietetico; Enervit SpA; Hut.com Ltd etc., are few of the top companies.

- Sales Channel

- Retail online grabbed 70% of the market.

Italy Sports Nutrition Market Outlook

The Italy sports nutrition market is showing steady growth. It is valued at around USD 445 million in 2025 and is expected to reach around USD 550 million by 2032, growing at a CAGR of around 3.07% during 2026-2032. This rise in demand comes from end user focus on health, fitness, and sports. End users are joining gyms, taking part in sporting activities, and looking for products that improve energy, strength, and recovery.

Sports protein products make up the largest part of the market, accounting for around 60% of overall sales. Protein powders are most popular since they are convenient, easy to prepare and provide good value. Many end users prefer them as they can mix the powder as needed to meet personal fitness goals. Ready to drink proteins are also gaining momentum among those who need quick and easy nutrition.

Retail online accounts for around 70% of overall sales. Retail online stores provide convenient access to wide variety of products and enable end users to compare prices and read information before purchasing. Convenience and faster delivery are making retail online the primary channel for sports nutrition products in the nation.

The market is also quite competitive, with the top five companies together holding about 45% of total share. Many brands are focusing on better quality, cleaner ingredients, and products for specific needs like vegan or women focused nutrition. As awareness about fitness continues to grow, these factors are expected to keep supporting steady market expansion through 2032.

Italy Sports Nutrition Market Growth DriverGrowing Interest in Sports Supporting Steady Growth

End users are joining clubs, playing sports, and staying active, thereby helping the category to develop steadily. The more end users get involved in physical activities, they seek products that enhance performance, helps in recovery, and maintain the body's strength while exercising. This increasing enthusiasm for fitness is leading to greater demand for sports nutrition products. Despite the fact that prices are going up because raw materials are becoming more expensive, end users are ready to pay extra because they see these protein products as necessary items and helpful in achieving their fitness goals.

Moreover, this steady increase in sports participation keeps demand high for sports nutrition products across the country. End users now include not just athletes but anyone who wants to stay fit and healthy. The belief that these products improve performance and energy is keeping the interest at a high level, ensuring the category continues to grow even with higher prices.

Italy Sports Nutrition Market ChallengeRising Competition from High Protein Foods

Sports nutrition brands are facing intense pressure from foods foods that carry high protein health and wellness claims. Such products are gaining popularity because they allow end users to add protein to everyday meals with ease, without having to consume a separate products such as protein powder. They integrate seamlessly into daily eating habits, making them convenient and enjoyable for regular usage.

These foods are also packed with additional nutrients like vitamins, Omega-3, and minerals to form a more balanced and complete choice. They are in line with the end users focus on overall well being and health rather than just the performance in fitness. Due to this, sports nutrition companies are now trying to make their products unique and meet the needs of different end users, particularly as protein rich foods start gaining popularity to replace sports protein products.

Italy Sports Nutrition Market TrendNew Sports Boosting Demand for Non-Protein Products

New kinds of sports are becoming popular as end users show interest in different physical activities, and this is leading more end users to focus on sports non-protein products. Sports such as swimming, cycling, MMA, paddle boarding, and trail running are attracting many end users. These sports require a different type of nutrition than bodybuilding or CrossFit since they emphasize on energy, endurance, and hydration rather than muscle building. With more end users getting involved in these sports, demand for the non-protein products continues to rise.

Moreover, end users are getting more interested in products that allow them to remain active for more longer durations, helps in replenishing lost fluids, and recover faster after training. Due to this, companies are working on developing new and better products that cater to these demands. With growing interest in endurance sports continuing to guide the sports nutrition category development and expansion.

Italy Sports Nutrition Market OpportunityGrowing Preference for Convenient Ready to Drink Protein Products

Sports protein RTDs will witness strong growth over the next few years as more end users look for convenient and ready to drink solutions. Although many end users, still like to prepare protein powders at home, RTDs provide an instant and effortless alternative for busy lives. Due to their convenience and portable nature, they are ideal for end users who seeking instant nutrition, without putting the effort for preparing the protein mix.

Additionally, in the future, this rising demand for convenience can help the segment expand even more. With enhanced taste, flexibility, and protein levels, companies can attract more end users who prioritize health and convenience. As more end users realize the advantages of RTDs, the products will increase in popularity, opening up new space for growth in the sports nutrition segment.

Italy Sports Nutrition Market Segmentation Analysis

By Product Type

- Sports Protein Products

- Sports Non-Protein Products

Sports protein products hold the largest share in the market, with around 60% of overall sales. They remain at the top because end users end users widely use protein powders to gain strength and maintain fitness result. They prefer powders since they can easily blend them with milk or water and maintain the quantity of protein depending on their requirements. Their flexibility and cost effectiveness keep them the most trusted choice among fitness focused end users.

Moreover, ready to drink proteins options are slowly gaining attention from end users who want quick and easy nutrition. Still, powder based protein products remain the main choice, as end users believe they offer better control over protein intake and taste. Such strong loyalty helps sports protein products maintain their market dominance in the coming years.

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share under the sales channel is retail online, which has a market share of around 70%. The retail online channel continues to be the dominant platform for purchasing sports nutrition products. It has helped numerous end users to discover a wide variety of options like protein powders, energy booster, and recovery products. The convenience, better pricing, and easy accessibility through the internet has further ensure the popularity of the retail online channel among health conscious end user.

In addition, retail online is not only a place to buy products but also a key source of information for end users. It allows brands to share product benefits, ingredients, and usage details, helping end users to make more informed decisions. With retail online channels continuously expanding and providing faster delivery, this segment will continue to support the growth of sports nutrition across the country.

List of Companies Covered in Italy Sports Nutrition Market

The companies listed below are highly influential in the Italy sports nutrition market, with a significant market share and a strong impact on industry developments.

- +Watt Srl

- Herbalife Italia SpA

- A&D SpA - Gruppo Alimentare & Dietetico

- Enervit SpA

- Hut.com Ltd

- Named SpA

- Proaction Srl

- Foodspring GmbH

- Tripoint GmbH

- Eurosup Srl

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Italy Sports Nutrition Market Policies, Regulations, and Standards

4. Italy Sports Nutrition Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Italy Sports Nutrition Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Sports Protein Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Protein/Energy Bars- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Sports Protein Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Sports Protein RTD- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Sports Non-Protein Products- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Sales Channel

5.2.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Ingredients

5.2.3.1. Vitamins and Minerals- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Proteins and Amino Acids- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Carbohydrates- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Probiotics- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Botanicals/Herbals- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Functionality

5.2.4.1. Energy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Muscle growth- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Hydration- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Weight Management- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By End User

5.2.5.1. Bodybuilders- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Athletes- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Lifestyle Users- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. Italy Protein Products Sports Nutrition Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Ingredients- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Functionality- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Italy Non-Protein Products Sports Nutrition Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Ingredients- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Functionality- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Enervit SpA

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Hut.com Ltd, The

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Named SpA

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Proaction Srl

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Foodspring GmbH

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.+Watt Srl

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Herbalife Italia SpA

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.A&D SpA - Gruppo Alimentare & Dietetico

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Tripoint GmbH

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Eurosup Srl

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Sales Channel |

|

| By Ingredients |

|

| By Functionality |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.