Italy Industrial Gases Market Report: Trends, Growth and Forecast (2026-2032)

By Gas Type (Nitrogen Gas, Oxygen Gas, Carbon Dioxide Gas, Argon Gas, Helium Gas, Hydrogen Gas, Other), By Supply Mode (Cylinders, Bulk, On-Site Production, Captive, Other), By Application (Combustion and Process Oxygen, Welding and Metal Fabrication, Inerting Blanketing and Heat Treating, Cryogenics and liquefaction, Chemical Synthesis and Hydrogenation, Purging and Purifications, Analytical and Calibration), By End User Industry (General Manufacturing, Food, Metallurgy, Chemicals, Healthcare, Electronics, Refining & Energy, Glass, Pulp & Paper, Others)

|

Major Players

|

Italy Industrial Gases Market Statistics and Insights, 2026

- Market Size Statistics

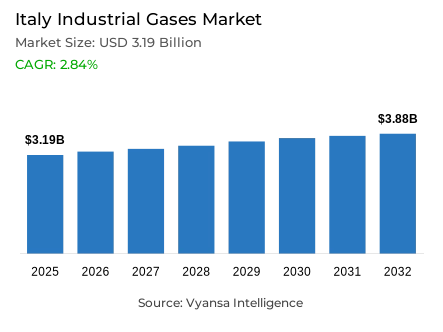

- Industrial gases in Italy is estimated at USD 3.19 billion in 2025.

- The market size is expected to grow to USD 3.88 billion by 2032.

- Market to register a cagr of around 2.84% during 2026-32.

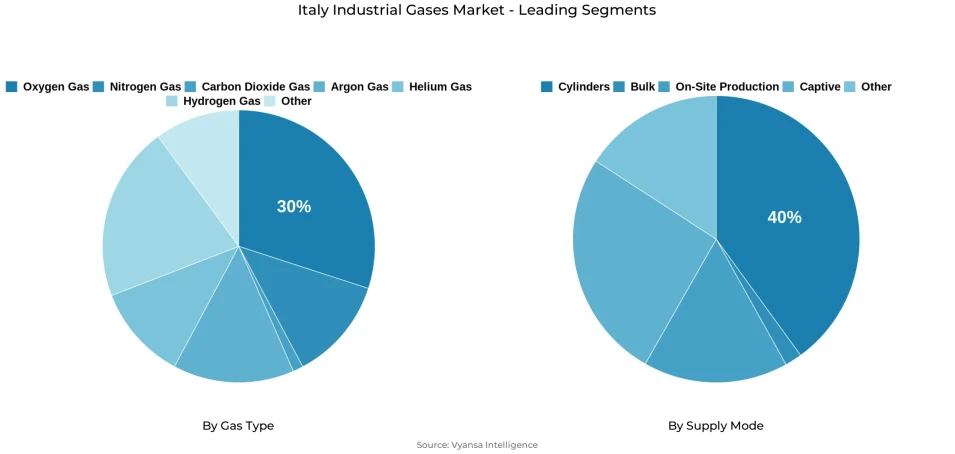

- Gas Type Shares

- Oxygen gas grabbed market share of 30%.

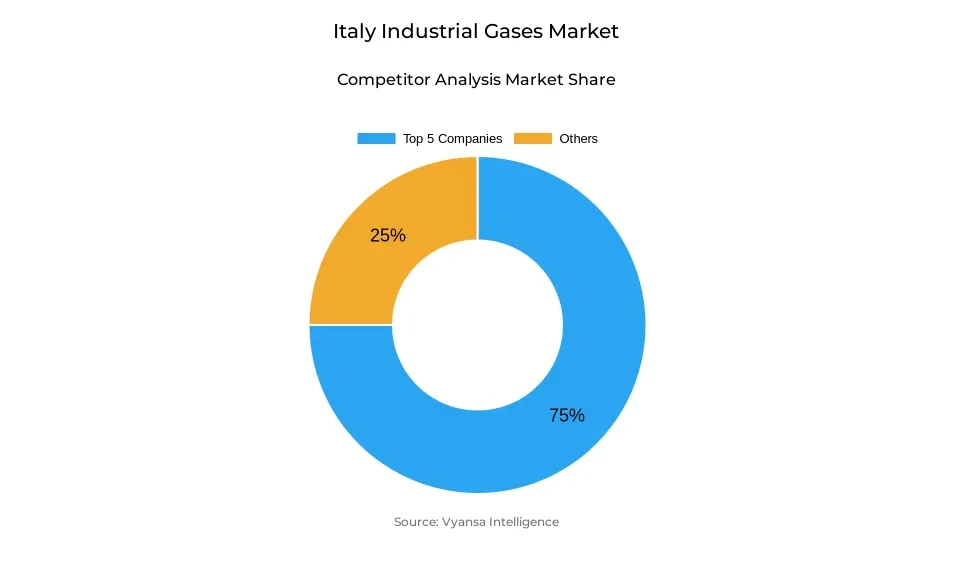

- Competition

- More than 10 companies are actively engaged in producing industrial gases in Italy.

- Top 5 companies acquired around 75% of the market share.

- Messer Group GmbH; Iwatani Corporation; Nippon Gases (Nippon Sanso); Linde; Air Liquide etc., are few of the top companies.

- Supply Mode

- Cylinders grabbed 40% of the market.

Italy Industrial Gases Market Outlook

The Italy industrial gases market will grow at a stable rate from 2026-2032, driven by growing production and rising production volumes within the sectors of electronics, food and beverages, and pharmaceuticals. As of 2025, the market value stood at USD 3.19 billion. It is predicted to reach a value of USD 3.88 billion by 2032, growing at a CAGR of 2.84% during the forecast period. The country’s strong position as Europe’s second-largest steel producer and the prime use of industrial gases within metal fabrication and chemical processing remain prominent factors.

Energy-intensive industries are increasingly stable after times of disruption and are thus contributing to maintain gas demand within automotive, aerospace, and metal working sectors. Although high electricity costs and labor bottlenecks pose challenges for gas production, the recent surge in renewable energy sources, which rose from 73.4 TWh to 88 TWh, presents better opportunities for clean and efficient production. Moreover, government support for its low-carbon agenda with an injection of 550 million euros towards green hydrogen projects enhances market fundamentals.

Oxygen continues to lead as a gas type segment with a market share of 30%, primarily due to its usage in secondary steel production, medical, and water treatment industries. Nitrogen and specialty gases continue to maintain stable demand in food preservation, electronic, and other precision-based industries that necessitate contamination and process control. Cylinders remain at the top with an overall supply mode share of 40%.

Their major advantage is flexibility which makes them apt for SMEs, workshops, and medical centers that have widespread or portable L/G access. Bulk L/G supply and on-site production have seen an increase among large industrial units. It supports uninterrupted high-volume demands and boosts reliability and efficiency.

Italy Industrial Gases Market Growth DriverExpanding Industrial Output Strengthening Gas Utilization

The Italy industrial sector’s growth is on an uptrend with an increase in production at 1.5% YoY in September 2025 after a considerable 2.8% m/m increase. The growth rate of production in computers and electronic products at 12.3%, food and beverages at 9.2%, and pharmaceuticals at 3.8% would clearly indicate that there has been a sector-wise growth that continues to drive demands for oxygen, nitrogen, and various gases. As the respective industries increase production to fulfill demands within and outside the country, there continues to be an ample demand for several gases.

Italy’s role as Europe’s second-largest steel producer, accounting for approximately 21 million tons every year, hence making it more dependent on industrial gases. Electric arc furnace producers alone have an overall contribution rate of more than 80% of the country’s total steel production, with oxygen being a core input necessary for boosted efficiency. The dependence isn’t limited to these production levels. The previously challenged energy-intensive sectors appear stable, and consumption levels for industrial gases are shooting up with subsequent efforts at optimizing and improving production.

Italy Industrial Gases Market ChallengeOperational Pressures from Energy and Workforce Constraints

Italy’s industrial gas market participants remain under strong pressure due to high electricity costs, which stand at around €120/MWh for the first half of 2025, almost twice as high as Spain and France. As air separation plants are based on energy-intensive cryogenic distillation for oxygen and nitrogen production, these discrepancies directly affect production costs. Energy-intensive sectors have been running more than 10% below overall manufacturing production, indicating overall financial troubles and pressing pressures on procurement cycles among end-use participants.

Labor scarcity adds fuel to these problems, with 45% of Italy companies finding it difficult to hire staff in 2023. The production plants for gas are finding it increasingly hard to hire qualified personnel for operating and maintaining equipment, with this situation causing costs associated with running operations to escalate. Moreover, market unpredictability and rising transport costs impact both raw materials and gas distribution.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Italy Industrial Gases Market TrendRising Momentum Toward Hydrogen and Industrial Decarbonization

The Italy country’s approach towards decarbonization is transforming the market for industrial gases, aided by an allocation of €550 million set aside for its Recovery and Resilience Plan that aims at promoting green hydrogen consumption in low-carbon sectors like steel, glass, and paper production. The projects promoted will have to at least reduce emissions by 40% or energy consumption by 20% compared with previous baselines, thus inducing end-users to gradually upgrade to low-carbon energy sources. It should be noted that the above-mentioned plan will generate more business opportunities for all gas suppliers who offer solutions for hydrogen production, transport and storage.

The European Commission additionally accentuates the strategic importance of hydrogen in Italy’s low-carbon transition by facilitating investment in production infrastructure within no-less-than dismissed industrial regions. The role of hydrogen is anticipated to be at least 75% of overall energy sources for eligible industrial activities by 2032, growing to 100% by 2036. As these pilot projects mature and pan out, the Italy industrial gases market will be poised for growth as it adopts a clear regulatory agenda and strengthens on its commitment towards low carbon.

Italy Industrial Gases Market OpportunityExpanding Potential from Renewable Integration and Electrified Production

Italy’s rapid growth in renewable energy production - 88 TWh within January and August 2025 compared with 73.4 TWh within the same period within the previous year - presents encouraging opportunities for cleaner and more inexpensive production methods. Renewable energy sources enable the company to reduce dependence on volatile fossil fuel-based prices and remain on track with emission-reduction requirements. The government’s vigorous support for developing renewable energy capacity will make it more advantageous for gas suppliers with electrified and hybrid production facilities.

The government's pledge to fulfill 69% of its electric generation with renewable sources by 2030, exceeding the global Net Zero scenario set out by IEA at 60%, aligns industrial gases with overall Italy manufacturing plans. Specialized uses of precision gases involving controlled atmospheres and superior surface treatment will allow end-use industries to comply with tight environmental and efficiency demands. Companies with provisions for green gas forms and facilities combining production with renewables will capitalize on rising demands from industries with sustainability agendas.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Italy Industrial Gases Market Segmentation Analysis

By Gas Type

- Nitrogen Gas

- Oxygen Gas

- Carbon Dioxide Gas

- Argon Gas

- Helium Gas

- Hydrogen Gas

- Other

Oxygen holds the leading position in the Italy industrial gases market, accounting for approximately 30% of total market share due to its indispensable role in healthcare, metalworking, and water treatment operations. The gas is especially critical in Italy’s secondary steelmaking industry, where electric arc furnaces—responsible for over 80% of national steel output—depend on oxygen to enhance combustion efficiency and metallurgical performance. Growing healthcare needs driven by an aging population also sustain elevated oxygen demand, particularly for respiratory support and emergency care services across hospitals and clinics.

Nitrogen and specialty gases constitute the remaining segments, supporting applications in food preservation, packaging, electronics manufacturing, and inert-gas industrial operations. Their diverse usage across multiple industries provides market resilience, as demand remains supported by continuous requirements for quality control, process stability, and contamination prevention. As manufacturing processes become more advanced and automation-driven, nitrogen and specialty gases are expected to maintain steady traction among end users prioritizing product integrity and operational precision.

By Supply Mode

- Cylinders

- Bulk

- On-Site Production

- Captive

- Other

Cylinder-based supply mode remains the largest supply mode in the Italy industrial gases market, capturing approximately 40% share. It is particularly favored by small and medium-sized enterprises, specialized workshops, and portable operational settings where flexible, scalable supply is essential. Cylinders continue to play a central role in welding, medical, and maintenance activities, enabling end users to access gas volumes suited to intermittent or decentralized usage without requiring permanent infrastructure. This adaptability reinforces cylinders’ dominance across Italy’s diverse industrial and service ecosystem.

Bulk liquid supply and on-site gas generation systems together comprise the remaining segments, serving large-scale industrial facilities that require continuous, high-volume gas flows. On-site generation offers advantages such as reduced logistics dependence, improved supply security, and long-term cost efficiencies, making it a preferred solution for energy-intensive sectors like steelmaking and chemical manufacturing. As industrial plants increasingly pursue higher operational reliability, these supply modes are expected to expand, complementing cylinder distribution while addressing the evolving needs of major industrial end users.

List of Companies Covered in Italy Industrial Gases Market

The companies listed below are highly influential in the Italy industrial gases market, with a significant market share and a strong impact on industry developments.

- Messer Group GmbH

- Iwatani Corporation

- Nippon Gases (Nippon Sanso)

- Linde

- Air Liquide

- Air Product

- SOL Group

- SIAD S.p.A.

- StealthGas Inc.

- Abello Linde S.A.

Market News & Updates

- SOL Group, 2025:

Reported sales growth of 9.7% in Italy and 13.7% abroad in first half; acquired 100% of Freyco Kohlensäure Service GmbH via subsidiary Airsol Srl; expanded regional presence with diversified gas portfolios.

- SIAD S.p.A, 2025:

Partnered with SOL in €50 million OXY air separation unit joint venture in Zagreb (SIAD 60%/SOL 40%), producing high-purity industrial gases; showcased energy transition technologies at Gastech 2025 Milan.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Italy Industrial Gases Market Policies, Regulations, and Standards

4. Italy Industrial Gases Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Italy Industrial Gases Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Quantity Sold in Tons

5.2. Market Segmentation & Growth Outlook

5.2.1.By Gas Type

5.2.1.1. Nitrogen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.2. Oxygen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.3. Carbon Dioxide Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.4. Argon Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.5. Helium Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.6. Hydrogen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.7. Other- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.By Supply Mode

5.2.2.1. Cylinders- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.2. Bulk- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.3. On-Site Production- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.4. Captive- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.By Application

5.2.3.1. Combustion and Process Oxygen- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.2. Welding and Metal Fabrication- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.3. Inerting Blanketing and Heat Treating- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.4. Cryogenics and liquefaction- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.5. Chemical Synthesis and Hydrogenation- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.6. Purging and Purifications- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.7. Analytical and Calibration- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.By End User Industry

5.2.4.1. General Manufacturing- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.2. Food- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.3. Metallurgy- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.4. Chemicals- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.5. Healthcare- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.6. Electronics- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.7. Refining & Energy- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.8. Glass- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.9. Pulp & Paper- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.10. Others- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Italy Nitrogen Gas Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Quantity Sold in Tons

6.2. Market Segmentation & Growth Outlook

6.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

6.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7. Italy Oxygen Gas Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Quantity Sold in Tons

7.2. Market Segmentation & Growth Outlook

7.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8. Italy Carbon Dioxide Gas Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Quantity Sold in Tons

8.2. Market Segmentation & Growth Outlook

8.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9. Italy Argon Gas Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Quantity Sold in Tons

9.2. Market Segmentation & Growth Outlook

9.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10. Italy Helium Gas Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.1.2. By Quantity Sold in Tons

10.2. Market Segmentation & Growth Outlook

10.2.1. By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10.2.3. By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11. Italy Hydrogen Gas Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.1.2. By Quantity Sold in Tons

11.2. Market Segmentation & Growth Outlook

11.2.1. By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11.2.3. By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Linde

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Air Liquide

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Air Product

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. SOL Group

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. SIAD S.p.A.

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Messer Group GmbH

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Iwatani Corporation

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Nippon Gases (Nippon Sanso)

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. StealthGas Inc.

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Abello Linde S.A.

12.1.10.1.Business Description

12.1.10.2.Product Portfolio

12.1.10.3.Collaborations & Alliances

12.1.10.4.Recent Developments

12.1.10.5.Financial Details

12.1.10.6.Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Gas Type |

|

| By Supply Mode |

|

| By Application |

|

| By End User Industry |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.