India Wearable Electronics Market Report: Trends, Growth and Forecast (2025-2030)

By Product (Activity Wearables, Smart Wearables), By Application (Healthcare, Entertainment, Industrial, Others), By Sales Channel (Offline, Online)

|

Major Players

|

India Wearable Electronics Market Statistics, 2025

- Market Size Statistics

- Wearable Electronics in India is estimated at $ 1.87 Billion.

- The market size is expected to grow to $ 3.15 Billion by 2030.

- Market to register a CAGR of around 9.08% during 2025-30.

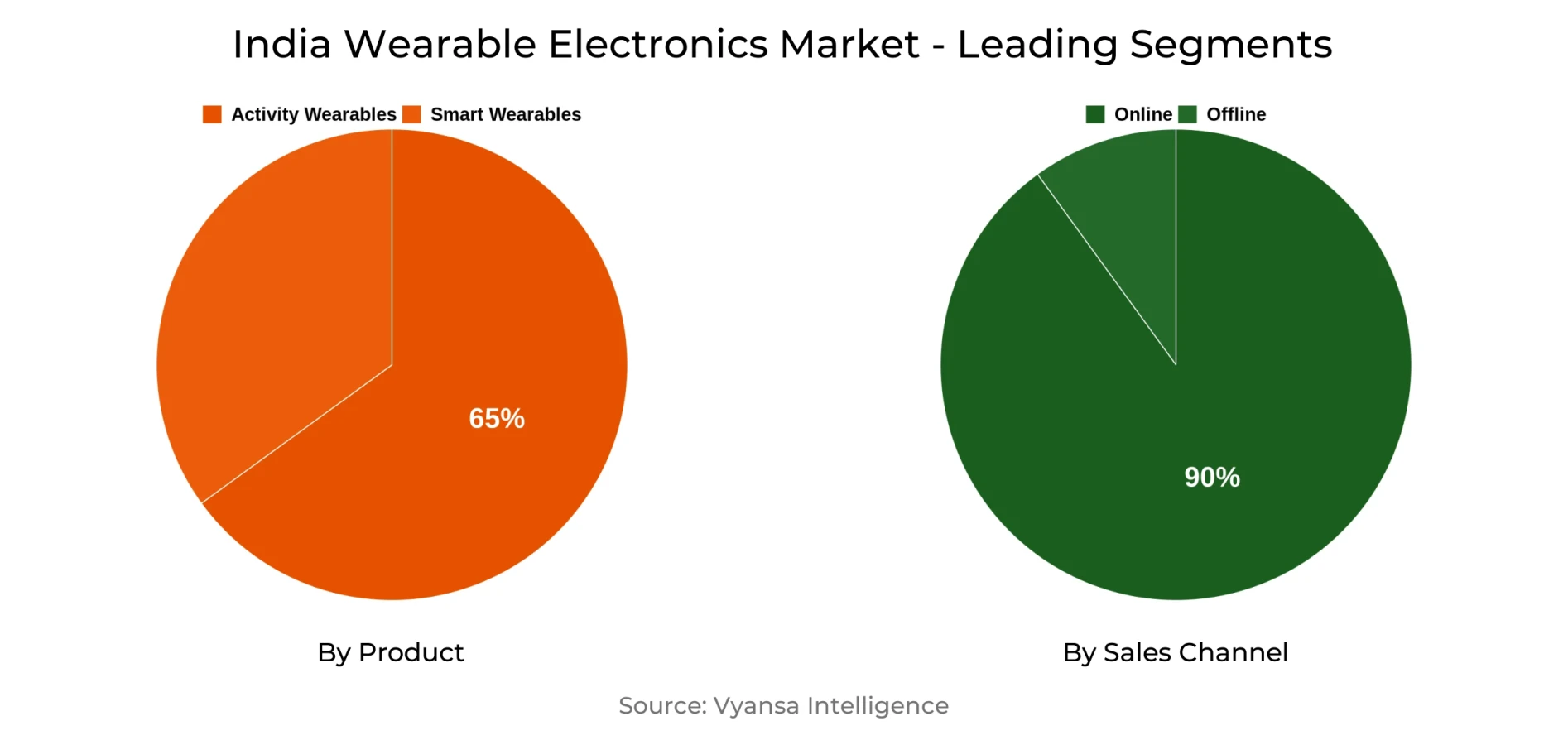

- Product Shares

- Activity Wearables grabbed market share of 65%.

- Activity Wearables to witness a volume CAGR of around 7.77%.

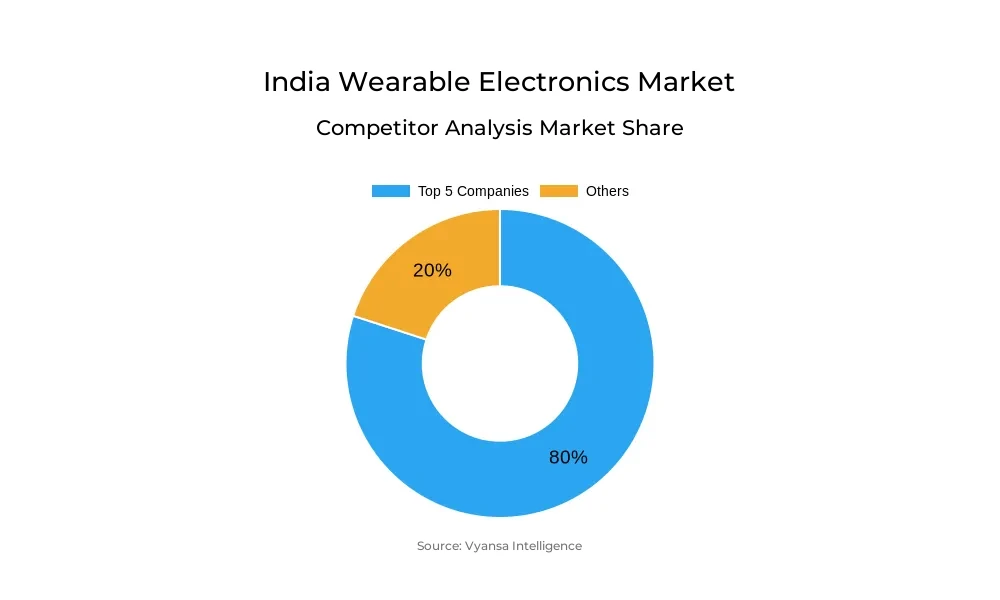

- Competition

- More than 10 companies are actively engaged in producing Wearable Electronics in India.

- Top 5 companies acquired 80% of the market share.

- GOQii Technologies Pvt Ltd, Apple India Pte Ltd, Garmin India Pvt Ltd, Boltt Games Pvt Ltd, Nexxbase Marketing Pvt Ltd etc., are few of the top companies.

- Sales Channel

- Retail E-Commerce grabbed 90% of the market.

India Wearable Electronics Market Outlook

The Indian wearable electronics market is anticipated to exhibit steady growth between 2025-30, with the aid of growing awareness of health, smartphone penetration, and surging disposable incomes. Customers are rapidly moving away from simple activity bands and towards digital activity watches and smartwatches due to their wider application and minute price variations. This is also backed by rising demand for real-time health information, which is used for making sound fitness and lifestyle decisions. Premiumisation remains significant, with a high percentage of consumers being prepared to pay extra for advanced and feature-laden products.

The market is extremely competitive with contenders such as Fire-Boltt and Noise becoming increasingly popular with frequent product launches. Fire-Boltt dominates in terms of retail volume through innovations such as the Android-powered Dream Wristphone. Noise is following close behind with budget-friendly and health-centric offerings such as the ColorFit Ore. With affordability being the deciding factor, particularly for price-conscious Indian consumers, a brand that provides an effective balance between cost and features will reign supreme.

Retail e-commerce continues to be the primary channel of distribution with more than 90% of the volume of retail sales. Online websites make products from tier-2 and tier-3 cities accessible to a vast array of choices, compare specifications, and enjoy discounts. This phenomenon is set to increase, with brands consolidating their online presence on both marketplaces and websites.

In the future, local manufacturing will gain increased strength, supported by efforts such as the Phased Manufacturing Program. Companies such as BoAt already have local manufacturing units, but there are issues with sourcing and skilled manpower. The more investments in domestic manufacturing, the lower the prices are expected to go, and there will be improved availability of affordable, high-quality wearables customized to Indian requirements.

India Wearable Electronics Market Growth Driver

India wearable electronics industry is expected to register strong growth between 2025-30, supported by increasing smartphone penetration, increasing disposable incomes, and increasing health and fitness monitoring trends. With increasing consumers looking for devices that are simple to pair with their smartphones and come equipped with smart features, consumer demand for wearable electronics will continue to increase. Consumers are also increasingly moving away from standard activity bands towards premium wearables that provide high-end technology, fashionable design, and comfort.

This transition is complemented also by the growing aspirational need in tier-2 and tier-3 cities. Rising internet penetration, increasing awareness, and a need to be on top of the latest technology are motivating individuals in smaller cities to adopt wearable devices. With higher disposable incomes and the growing interest in monitoring personal health parameters, wearable electronics are becoming the necessary element of contemporary lifestyles in both urban and semi-urban areas.

India Wearable Electronics Market Challenge

One of the biggest challenges for the market is the consistent decrease in activity band demand. These devices provide a narrow range of features, mostly tracking steps, calories, and sleep patterns. Comparatively, digital activity watches and smartwatches provide a far broader set of features, including music control, location services, contactless payment, and access to calls and notifications. This disparity is compelling consumers to move towards more complex and multifunctional offerings.

In addition, growing availability of affordable smartwatches is making them increasingly viable for a larger population of customers. With decreasing prices and increasing features, smartwatches are becoming an increasingly viable alternative to mere activity bands. This trend will continue throughout the projection period, with activity bands progressively being substituted with feature-rich devices.

Unlock Market Intelligence

Explore the market potential with our data-driven report

India Wearable Electronics Market Trend

Over the past few years, increased attention to health and wellness has continued to drive robust growth in wearable electronics. While retail volume expansion weakened in 2024, it still rested in double digits thanks to growing affordability and premiumisation. Buyers are gradually shifting away from minimalist activity bands and towards digital activity watches and intelligent wearables, with improved value and greater functionality at just a slightly higher cost than previously.

This increasing demand for high-end products indicates that shoppers are prepared to pay extra for wearables that extend beyond plain tracking. They now want real-time information so that they can make the right choices about exercise and diet. This has prompted some companies to add other health-tracking features to their smartwatches. In general, the health-oriented attitude remains a key driver of growth for the wearable electronics market in India.

India Wearable Electronics Market Opportunity

Locally made wearable electronics will see their share rise in 2025-30 as homegrown brands and international brands alike keep pushing production to India. Much of this shift has been made possible due to the phased manufacturing program (PMP) that is favorable to domestic manufacturing. One such example is BoAt of Imagine Marketing Pvt Ltd, which makes the majority of its products domestically through a joint venture with Dixon and also designs them locally.

But even with the transition, challenges still exist because of continued dependence on China for technical and engineering support, leaving little value addition locally. In order to beat this, firms will have to face challenges such as sourcing raw material and a lack of trained labor. With sustained efforts by the government to position India as a hub for electronics manufacturing, value addition within the country will increase, meaning there will be reduced costs, less supply chain disruptions, and improved quality products developed specifically for Indian consumers.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 1.87 Billion |

| USD Value 2030 | $ 3.15 Billion |

| CAGR 2025-2030 | 9.08% |

| Largest Category | Activity Wearables segment leads with 65% market share |

| Top Drivers | Rising Smartphone Penetration & Health Awareness Fueling Demand |

| Top Challenges | Declining Popularity of Activity Bands Hindering Market Growth |

| Top Trends | Health & Wellness Trend Fuels Shift Toward Premium Wearables |

| Top Opportunities | Rising Shift Toward Domestic Production Creating Growth Potential |

| Key Players | GOQii Technologies Pvt Ltd, Apple India Pte Ltd, Garmin India Pvt Ltd, Boltt Games Pvt Ltd, Nexxbase Marketing Pvt Ltd, Imagine Marketing Pvt Ltd, Realme Mobile Telecommunications (India) Pvt Ltd, Xiaomi Technology India Pvt Ltd, Samsung India Electronics Pvt Ltd, Fitbit Inc and Others. |

Unlock Market Intelligence

Explore the market potential with our data-driven report

India Wearable Electronics Market Segmentation Analysis

The leading segment in the India Wearable Electronics Market in terms of market share between 2025-30 is retail e-commerce. It commanded over 90% of retail volume sales in 2024 alone, and this trend will be maintained during the period of forecast. Wearable electronics consumers are typically tech-literate and choose online shopping because it is easy to compare product specifications, read reviews, and browse various brands and models.

Additionally, ease of shopping online and greater access to deals and discounts fuel this further. Tier-2 and tier-3 consumers also get the benefit, as online platforms provide them with wider access to products that would otherwise not be available at physical outlets. To counter this, most manufacturers have boosted their online presence on platforms such as Amazon and Flipkart or through individual websites, thereby making their products more accessible and widespread throughout the nation.

Top Companies in India Wearable Electronics Market

The top companies operating in the market include GOQii Technologies Pvt Ltd, Apple India Pte Ltd, Garmin India Pvt Ltd, Boltt Games Pvt Ltd, Nexxbase Marketing Pvt Ltd, Imagine Marketing Pvt Ltd, Realme Mobile Telecommunications (India) Pvt Ltd, Xiaomi Technology India Pvt Ltd, Samsung India Electronics Pvt Ltd, Fitbit Inc, etc., are the top players operating in the India Wearable Electronics Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. India Wearable Electronics Market Policies, Regulations, and Standards

4. India Wearable Electronics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. India Wearable Electronics Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.1.2.By Unit Sold (Thousand Units)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Activity Wearables- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Activity Bands- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. Activity Watch- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2.1. Analogue- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2.2. Digital- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Smart Wearables- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.1. Eye Wear- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.2. Body Wear- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Application

5.2.2.1. Healthcare- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Entertainment- Market Insights and Forecast 2020-2030, USD Million

5.2.2.3. Industrial- Market Insights and Forecast 2020-2030, USD Million

5.2.2.4. Others- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Sales Channel

5.2.3.1. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. India Activity Wearable Electronics Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.1.2.By Unit Sold (Thousand Units)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By Application- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. India Smart Wearable Electronics Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.1.2.By Unit Sold (Thousand Units)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Application- Market Insights and Forecast 2020-2030, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Boltt Games Pvt Ltd

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Nexxbase Marketing Pvt Ltd

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Imagine Marketing Pvt Ltd

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Realme Mobile Telecommunications (India) Pvt Ltd

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Xiaomi Technology India Pvt Ltd

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.GOQii Technologies Pvt Ltd

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Apple India Pte Ltd

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Garmin India Pvt Ltd

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Samsung India Electronics Pvt Ltd

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Fitbit Inc

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Application |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.