India Premium Beauty and Personal Care Market Report: Trends, Growth and Forecast (2025-2030)

By Product (Colour Cosmetics, Fragrances, Deodorants, Hair Care, Skin Care, Bath and Shower, Baby and Child-specific Products), By End User (Men’s, Women’s, Unisex), By Sales Channel (Online, Offline)

- FMCG

- Dec 2025

- VI0033

- 124

-

India Premium Beauty and Personal Care Market Statistics, 2025

- Market Size Statistics

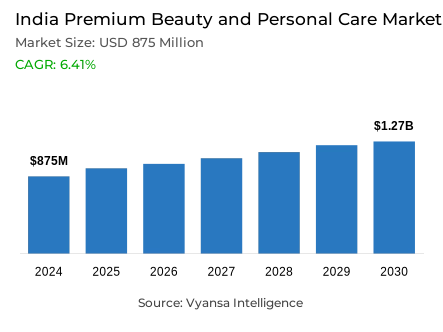

- Premium Beauty and Personal Care in India is estimated at $ 875 Million.

- The market size is expected to grow to $ 1.27 Billion by 2030.

- Market to register a CAGR of around 6.41% during 2025-30.

- Product Shares

- Premium Hair Care grabbed market share of 30%.

- Competition

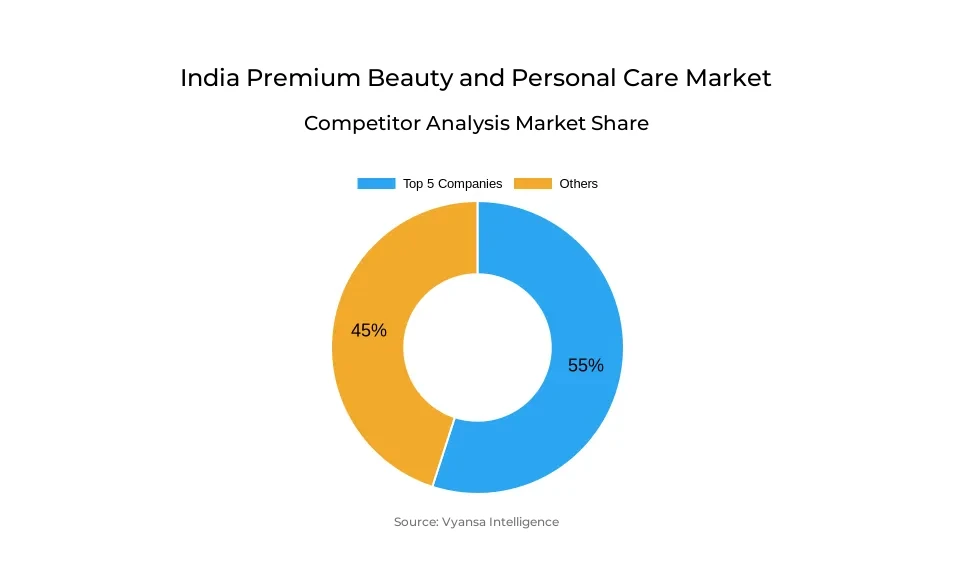

- More than 15 companies are actively engaged in producing Premium Beauty and Personal Care in India.

- Top 5 companies acquired 55% of the market share.

- Wella India Haircosmetics Pvt Ltd, Jyothy Labs Ltd, Deciem Asia Pacific Co Ltd, Elca Cosmetics Pvt Ltd, L'Oréal India Pvt Ltd etc., are few of the top companies.

India Premium Beauty and Personal Care Market Outlook

India premium beauty and personal care market is projected to continue with strong double-digit growth between 2025 and 2030. Product categories such as colour cosmetics, skin care, and deodorants are spearheading this growth, particularly due to changing consumer demand from mass to premium products. Economic growth, growing disposable income, and higher workforce participation, particularly among women, are key drivers of this transition. As people look for improved quality and more aspirational goods, the market is witnessing a distinct shift from mass or unbranded to masstige and premium brands.

E-commerce and social media will remain pivotal in driving the premium segment. Websites such as Nykaa and Tira have brought international premium brands within reach with strategic alliances. Social media influencers and beauty tutorials are also influencing consumer purchasing habits, raising awareness and trust in premium brands. Offline events like Rare Beauty's launch in collaboration with influencers are also creating brand presence and driving in-store experiences.

Colour cosmetics are expected to grow more rapidly than skin care on the back of the revival in social events, work-place presence, and renewed concern for self-image. Skin care development has reduced in pace as consumers move to a more reduced approach post-pandemic. Global players like Estée Lauder and The Ordinary are gaining traction based on the consumer desire for ingredient disclosure and clinical efficacy.

Finally, increasing popularity of mini-sized goods is anticipated to underpin broader takeup of premium beauty products. Such "small luxuries" allow uncertain consumers to sample high-end products before committing wholeheartedly. Minis are also convenient, increase trial volumes, and drive trading up from mass to premium, further driving market growth to 2030.

India Premium Beauty and Personal Care Market Growth Driver

India's robust economic expansion, with a real GDP growth of 6% in 2023, is fuelling disposable incomes and persuading consumers to switch to premium and international beauty and personal care brands. Consumers are switching from unbranded or mass brands to masstige and premium brands, indicating that the market is mature, where consumers are looking for high-quality products that reflect their aspirational lifestyle.

While this is happening, the increasing entry of women into the workforce is widening the consumer base and building demand for high-quality beauty solutions. With increased buying power and decision-making capability, working women are powering premium beauty and personal care products growth. Combined, these factors are poised to contribute meaningfully to the market's growth in the coming years.

India Premium Beauty and Personal Care Market Trend

Social media continues to redefine the India premium beauty and personal care market by providing brands with direct access to technology-enabled consumers. Via content such as tutorials, reviews, and influencer partnerships, brands can now foreground product benefits in real time and drive purchase decisions. Offline events organized by influencers—such as Rare Beauty's Sephora India 2023 launch—are also building hype, store traffic, and organic content online.

In the future, brands will increasingly depend on social sites for product launches, targeted advertising, and more robust influencer collaborations. With internet and smartphone penetration continuing to grow throughout India, social media will be the most important discovery and shopping platform for high-end beauty products. Social media influencers' opinions will have a bigger impact on consumer choices, validating confidence and building brand awareness.

India Premium Beauty and Personal Care Market Opportunity

Increased consumption of premium beauty and personal care products in India is being fueled by increased exposure through e-commerce websites and social media. As consumers' disposable incomes rise, consumers are more likely to spend on high-end beauty products. But consumers have been hesitant to buy full-size products, prompting premium brands to launch miniature versions of their core products. The minis serve as a low-risk introduction for consumers trying out premium segments.

Items such as Mac lipsticks, Estée Lauder foundations, and Kayali perfumes in the mini sizes are becoming increasingly popular throughout India. These convenient and attractive packaging units entice customers through lower up-front costs, enabling them to test before committing to full-size products. This strategy fosters brand allegiance and supports a gradual transition from mass to premium products. Consequently, minis are likely to be one of the most significant contributors to premium product consumption through the forecast period.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 875 Million |

| USD Value 2030 | $ 1.27 Billion |

| CAGR 2025-2030 | 6.41% |

| Largest Category | Premium Hair Care segment leads with 30% market share |

| Top Drivers | Strong Economic Growth and Rising Workforce Participation Driving Market Growth |

| Top Trends | Social Media to Play a Key Role in Driving Brand Visibility and Consumer Engagement |

| Top Opportunities | Rising Popularity of Miniature Versions to Accelerate Product Adoption |

| Key Players | Wella India Haircosmetics Pvt Ltd, Jyothy Labs Ltd, Deciem Asia Pacific Co Ltd, Elca Cosmetics Pvt Ltd, L'Oréal India Pvt Ltd, Baccarose Perfumes & Beauty Products Pvt Ltd, Mountain Valley Springs Pvt Ltd, Tarz Distribution India Pvt Ltd, Beauty Concepts Pvt Ltd, Amway India Enterprises Pvt Ltd and Others. |

India Premium Beauty and Personal Care Market Segmentation

The highest market share segment in the India Premium Beauty and Personal Care Market is Premium Hair Care, fuelled by intense consumer demand and greater emphasis on hair health and appearance. Consumers continue to spend on premium shampoos, conditioners, serums, and hair oils, particularly those that provide natural ingredients and targeted benefits. The segment is strong because of frequent usage patterns and greater awareness of scalp care and prevention of hair damage.

Though, Premium Colour Cosmetics is growing at a faster pace compared to premium skin care, a trend that is set to persist until 2025–30. Although the pandemic had caused consumers to invest in elaborate skin care regimens early on, most of them have turned towards a minimalistic approach now, impeding its growth. Demand for colour cosmetics, on the contrary, has picked up pace with people going back to offices, parties, and social events. The addition of new premium brands has also increased competition and customer demand in this category.

Top Companies in India Premium Beauty and Personal Care Market

The top companies operating in the market include Wella India Haircosmetics Pvt Ltd, Jyothy Labs Ltd, Deciem Asia Pacific Co Ltd, Elca Cosmetics Pvt Ltd, L'Oréal India Pvt Ltd, Baccarose Perfumes & Beauty Products Pvt Ltd, Mountain Valley Springs Pvt Ltd, Tarz Distribution India Pvt Ltd, Beauty Concepts Pvt Ltd, Amway India Enterprises Pvt Ltd, etc., are the top players operating in the India Premium Beauty and Personal Care Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. India Premium Beauty and Personal Care Market Policies, Regulations, and Standards

4. India Premium Beauty and Personal Care Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. India Premium Beauty and Personal Care Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Colour Cosmetics- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Eye Make-Up- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. Facial Make-Up- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.3. Lip Products- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.4. Nail Products- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Fragrances- Market Insights and Forecast 2020-2030, USD Million

5.2.1.3. Deodorants- Market Insights and Forecast 2020-2030, USD Million

5.2.1.4. Hair Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5. Skin Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5.1. Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5.2. Facial Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5.3. Sun Protection- Market Insights and Forecast 2020-2030, USD Million

5.2.1.6. Bath and Shower- Market Insights and Forecast 2020-2030, USD Million

5.2.1.7. Baby and Child-specific Products- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By End User

5.2.2.1. Men’s- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Women’s- Market Insights and Forecast 2020-2030, USD Million

5.2.2.3. Unisex- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Sales Channel

5.2.3.1. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. India Premium Colour Cosmetics Market Outlook, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By End User- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. India Premium Fragrances Market Outlook, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By End User- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. India Premium Deodorants Market Outlook, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By End User- Market Insights and Forecast 2020-2030, USD Million

8.2.2.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

9. India Premium Hair Care Market Outlook, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By End User- Market Insights and Forecast 2020-2030, USD Million

9.2.2.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

10. India Premium Skin Care Market Outlook, 2020-2030F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Product- Market Insights and Forecast 2020-2030, USD Million

10.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

11. India Premium Bath and Shower Market Outlook, 2020-2030F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By End User- Market Insights and Forecast 2020-2030, USD Million

11.2.2. By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

12. India Premium Baby and Child-specific Products Market Outlook, 2020-2030F

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in US$ Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

13. Competitive Outlook

13.1. Company Profiles

13.1.1. Elca Cosmetics Pvt Ltd

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. L'Oréal India Pvt Ltd

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Baccarose Perfumes & Beauty Products Pvt Ltd

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. Mountain Valley Springs Pvt Ltd

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. Tarz Distribution India Pvt Ltd

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. Wella India Haircosmetics Pvt Ltd

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. Jyothy Labs Ltd

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. Deciem Asia Pacific Co Ltd

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. Beauty Concepts Pvt Ltd

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

13.1.10. Amway India Enterprises Pvt Ltd

13.1.10.1. Business Description

13.1.10.2. Product Portfolio

13.1.10.3. Collaborations & Alliances

13.1.10.4. Recent Developments

13.1.10.5. Financial Details

13.1.10.6. Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.