India Pet Products Market Report: Trends, Growth and Forecast (2026-2032)

By Product (Cat Litter, Pet Healthcare (Flea/Tick Treatments, Pet Dietary Supplements, Worming Treatments, Others), Other Pet Products (Beauty Products, Accessories, Others)), By Sales Channel (Retail Offline, Retail E-Commerce, Veterinary Clinics)

- FMCG

- Dec 2025

- VI0293

- 122

-

India Pet Products Market Statistics and Insights, 2026

- Market Size Statistics

- Pet Products in India is estimated at $ 105 Million.

- The market size is expected to grow to $ 170 Million by 2032.

- Market to register a CAGR of around 7.13% during 2026-32.

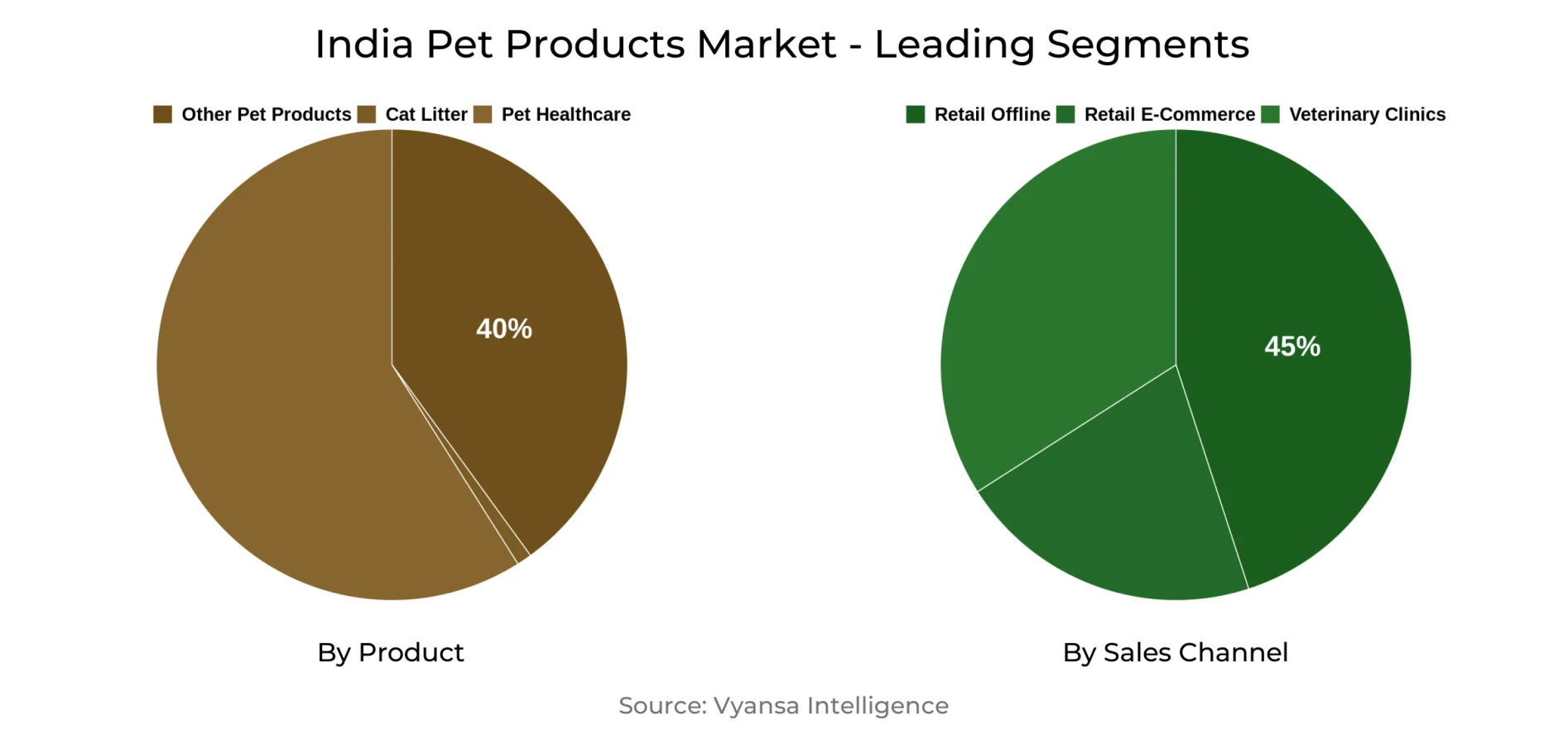

- Product Shares

- Other Pet Products grabbed market share of 40%.

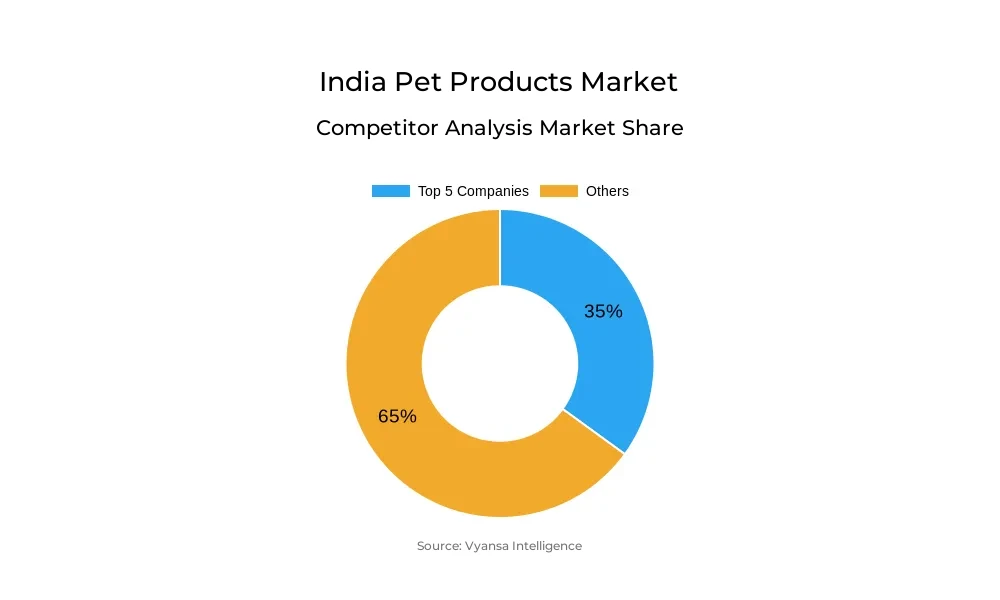

- Competition

- More than 15 companies are actively engaged in producing Pet Products in India.

- Top 5 companies acquired 35% of the market share.

- ABK Imports Pvt Ltd, Vétoquinol India, Indian Broiler Group, Himalaya Drug Co, The, Cargill India Pvt Ltd etc., are few of the top companies.

- Sales Channel

- Retail Offline grabbed 45% of the market.

India Pet Products Market Outlook

The India pet products market is estimated to expand at a moderate pace from $105 million in 2025 to $170 million by 2032. The growth will be sustained by increasing pet keeping, pet humanisation, and the need for more intelligent, technologically enabled solutions. Urban pet owners, particularly in metropolitan cities, are adopting items such as GPS collars, automatic feeders, and intelligent toys to take care of their pets' needs efficiently. Players like Goofy Tails and Heads Up for Tails are responding to this trend by launching innovations such as automatic water dispensers and intelligent pet cameras.

Sustainability is also becoming the center of attention, particularly among more eco-friendly Millennial and Gen Z pet owners. Pet owners want environmentally friendly pet bedding, biodegradable poop bags, and organic pet grooming products. Indian companies such as Dogsee Chew and Barkbutler are answering back with chemical-free, natural pet treats and accessories. Health-centric products like dietary supplements, flea medicines, and joint-care products are also trending as pet owners turn to preventive healthcare.

Omnichannel retail initiatives are getting stronger, with digital platforms such as Amazon, Flipkart, and Supertails broadening their reach in tier-2 and tier-3 cities. Offline retail still holds the maximum market share of 45%, aided by pet stores and experience stores. This equilibrium has prompted several brands to embrace a unified approach for enhancing accessibility and interaction.

With more than 15 companies in India currently manufacturing pet products, the leader five account for about 35% of the market. The market is also witnessing an increasing trend toward customised, breed-based products and subscription plans, which create value and convenience to End users. All these changing trends are likely to drive the market in a positive direction up to 2032.

India Pet Products Market Growth Driver

Growing concern among end users and escalating veterinary expenses are fueling robust demand for pet healthcare products in India. As greater numbers of people understand the importance of medical treatment and preventive health for pets, firms are launching pet insurance schemes that provide coverage for treatment costs. The increased trend toward pet insurance is a part of a broader move toward planned and preventive care for pets, which is promoting the consumption of associated products.

In addition to insurance, there is an increasing need for veterinary specialist pet healthcare products like probiotics, dental chews, and joint-care supplements. Pet owners are increasingly concerned with daily and long-term health, and so the application of flea and tick treatments and skin and body care products increases. The strengthening relationship between pets and owners continues to underpin this, as owners place greater emphasis on their animals' health and spend on repeat-care solutions.

India Pet Products Market Trend

Product design and functionality innovation is propelling growth in the India pet products market. The Himalaya Drug Co is leading the way by launching solutions such as Fresh Coat No Rinse Spray, which has a two-in-one benefit—providing a bath without water and being a post-grooming spray to make pets fresh and clean. Along with this, Indian Broiler Group is also gaining valuable value share in the market using its Purepet brand, which operates in high-growth segments such as cat litter, alongside a trusted position in dog and cat food. These instances best exemplify how firms are leveraging innovation to satisfy changing pet care requirements.

This innovation wave is directly related to the increasing demand for wellness and sustainable products. Indian start-ups such as Dogsee Chew and Barkbutler are answering with chemical-free, natural treats and accessories. The trend is primarily being led by Millennial and Gen Z pet parents, who care more about pet well-being and sustainability.

India Pet Products Market Opportunity

India pet products market will see a strong rise between 2025 and 2030. Growth will be widespread in all categories, with cat litter experiencing the most rapid increase. This is because there is an increasing cat population and more stringent regulations on using litter in high-rise buildings, producing a strong pull in demand from a low base.

As pet keeping becomes increasingly diversified in India, brands will have an important chance to meet shifting consumer demands. Urban pet owners in particular will seek out more breed-specific products, grooming kits, personalized accessories, and customized nutrition plans. Pet humanisation, which is on the rise, will also fuel such demand further and prompt brands such as Just Dogs and others to develop their specialized products and leverage this new consumer paradigm.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2026-32 |

| USD Value 2025 | $ 105 Million |

| USD Value 2032 | $ 170 Million |

| CAGR 2026-2032 | 7.13% |

| Largest Category | Other Pet Products segment leads with 40% market share |

| Top Drivers | Increasing Interest in Pet Health Drives Product Demand |

| Top Trends | Innovation and Sustainability Shaping the Pet Product Landscape |

| Top Opportunities | Increased Demand for Customised and High-End Pet Care Solutions |

| Key Players | ABK Imports Pvt Ltd, Vétoquinol India, Indian Broiler Group, Himalaya Drug Co, The, Cargill India Pvt Ltd, Virbac Animal Health India Pvt Ltd, Zoetis India Ltd, Bayer (India) Ltd, Scientific Remedies Pvt Ltd, Mars International India Pvt Ltd and Others. |

India Pet Products Market Segmentation Analysis

By Product

- Cat Litter

- Pet Healthcare

- Other Pet Products

The market leader in the product channel segment is Other Pet Products, with a market share of 40% of the total market. influenced by the extensive range of products offered under this category. Pet owners in India, particularly in metro cities such as Mumbai, Delhi, and Bangalore, are increasingly preferring innovative and technology-facilitated products that provide convenience and efficiency.

With growing digital penetration and growing urbanisation, smart pet products like automatic feeders, GPS collars, app-controlled toys, and smart water dispensers are picking up pace. Businesses like Goofy Tails and Heads Up for Tails are serving this demand by providing remote monitoring solutions in the form of smart pet cameras. With pet parents still following busy lifestyles, the need for such sophisticated solutions is expected to increase further during the forecast period.

By Sales Channel

- Retail Offline

- Retail E-Commerce

- Veterinary Clinics

The top-selling segment in the sales channel is Retail Offline, with a market share of 45% of the India Pet Products Market. The channel remains dominant as a result of consumers' high preference for physically inspecting products prior to purchase. Most pet owners still prefer in-store shopping for its trust element and on-hand availability of products. Physical outlets provide the ability to view, touch, and compare merchandise, thus allowing customers to make better choices for their pets.

To complement the offline shopping experience, brands are embracing an omnichannel strategy, combining both online and offline strategies. Retailers such as Just Dogs and Heads Up For Tails have established experience stores in large cities, which consist of consultations in-store, grooming services, and carefully curated product offers. These stores aim to enhance customer interactions and foster brand loyalty by engaging both digital-native and traditional consumers alike.

Top Companies in India Pet Products Market

The top companies operating in the market include ABK Imports Pvt Ltd, Vétoquinol India, Indian Broiler Group, Himalaya Drug Co, The, Cargill India Pvt Ltd, Virbac Animal Health India Pvt Ltd, Zoetis India Ltd, Bayer (India) Ltd, Scientific Remedies Pvt Ltd, Mars International India Pvt Ltd, etc., are the top players operating in the India Pet Products Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. India Pet Products Market Policies, Regulations, and Standards

4. India Pet Products Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. India Pet Products Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Cat Litter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Pet Healthcare- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Flea/Tick Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Pet Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Worming Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Other Pet Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Beauty Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Sales Channel

5.2.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Retail E-Commerce- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Veterinary Clinics- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Competitors

5.2.3.1. Competition Characteristics

5.2.3.2. Market Share & Analysis

6. India Cat Litter Products Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. India Pet Healthcare Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. India Other Pet Products Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Himalaya Drug Co, The

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Cargill India Pvt Ltd

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Virbac Animal Health India Pvt Ltd

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Zoetis India Ltd

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Bayer (India) Ltd

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.ABK Imports Pvt Ltd

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Vétoquinol India

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Indian Broiler Group

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Scientific Remedies Pvt Ltd

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Mars International India Pvt Ltd

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.