India Herbal/Traditional Products Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Topical Analgesics, Sleep Aids, Cough, Cold & Allergy Remedies, Digestive Remedies, Dermatologicals, Paediatric Dietary Supplements, Dietary Supplements, Tonics), By Form (Capsules/Tablets, Powder, Syrups, Oils & Ointments, Others), By Health Benefit (General Wellness, Cardiovascular Health, Cognitive & Mental Health, Digestive & Gut Health, Immunity Support, Respiratory Health, Bone & Joint Health, Others), By Source (Leaves, Roots, Barks, Flowers, Seeds, Others), By Ingredient Type (Single-Herb Products, Multi-Herb Products), By Function (Preventive Care, Curative/Relief Care), By End User (Adults, Geriatric Population, Children), By Prescription Type (Over-the-Counter (OTC), Prescription Herbal Medicines), By Sales Channel (Retail Offline, Retail Online)

- Healthcare

- Jan 2026

- VI0738

- 115

-

India Herbal/Traditional Products Market Statistics and Insights, 2026

- Market Size Statistics

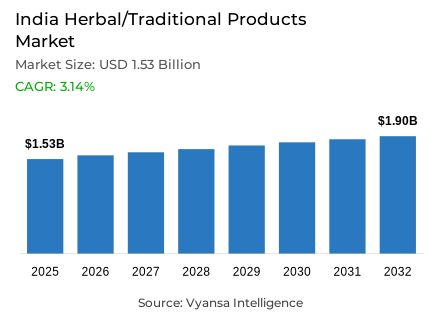

- Herbal/traditional products in India is estimated at USD 1.53 billion in 2025.

- The market size is expected to grow to USD 1.9 billion by 2032.

- Market to register a cagr of around 3.14% during 2026-32.

- Category Shares

- Dietary supplements grabbed market share of 40%.

- Competition

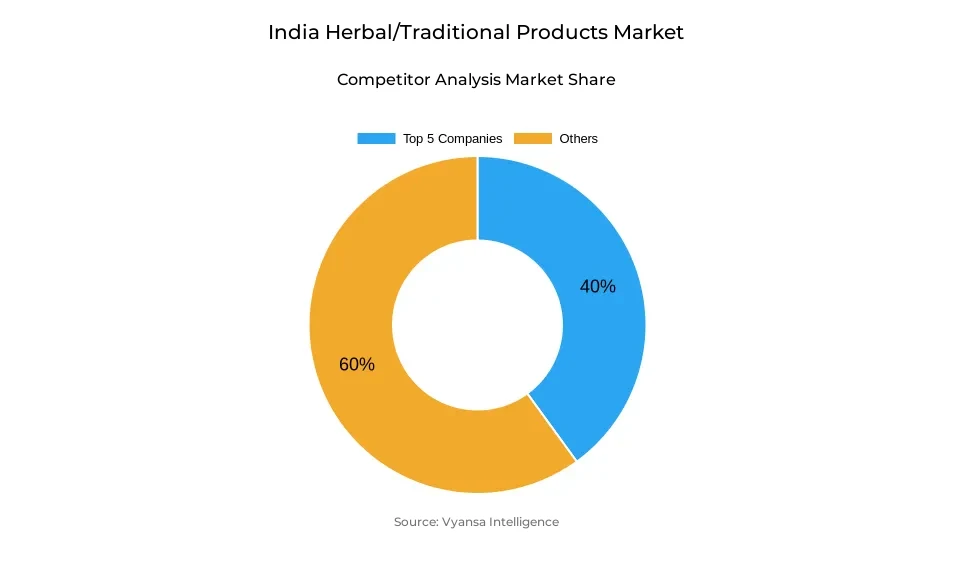

- More than 20 companies are actively engaged in producing herbal/traditional products in India.

- Top 5 companies acquired around 40% of the market share.

- GSK Consumer Healthcare; Ranbaxy Laboratories Ltd; Herbalife International India Pvt Ltd; Dabur India Ltd; Emami Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

India Herbal/Traditional Products Market Outlook

The India herbal/traditional products market, with a value around USD 1.53 billion in 2025, is set to reach around USD 1.9 billion by 2032, growing with a CAGR of 3.14% in the future. This is primarily driven by herbal/traditional dietary supplements, accounting for 40% of the indian market, thanks to the rapidly growing health and wellness end user culture in the nation. As people become increasingly aware of the importance of good health in the long term, the use of herbal supplements with components including ashwagandha, giloy, turmeric, and moringa is being promoted. This is because the products are known to naturally function, enhance health for the prevention of illnesses, and are known to cause fewer adverse reactions compared to allopathic products.

As far as boosting end user trust in natural ingredients, it can be further ascertained through transparent communication in terms of their extraction and composition. In 2024, brands introduced a trend of flaunting the major ingredients of Ayurvedic medicine on packs in order to stress their authenticity. This comes in sync with the growing acceptance of immuno boosters, mentally health-related products, as well as overall health remedies. As of now, retail offline accounts around 85% of sales. Therefore, the greatest interface for end users would be pharmacies and retail stores.

The forecast period will see the continuing influence of the indian culture strong association with ayurveda. This is because the ingredients used in ayurveda, such as turmeric, amla, and shatavari, are extremely recognized and accepted, thus fueling demand. But in the segments of cough, cold, and allergies, the robust acceptance of home remedies such as ginger tea and turmeric milk will act as a restraint on the market.

Competitions are set to increase, and this comes with the entry of FMCG and nutraceutical firms increasing their herbal products. Competitions are set to rise, and this takes place due to expansion and entry into the sector. More firms are set to position and differentiate, and this takes place through emphasis on authenticity and scientific substantiation. All these factors combined ensure that growth.

India Herbal/Traditional Products Market Growth DriverDeep-Rooted Traditional Medicine Adoption Reinforces Daily Use

Herbal or conventional forms in India have the cultural heritage of Ayurvedic practices. Conventional practices include Ayurveda, Siddha, Unani, or Folk practices that use thousands of plant species, which have been part of conventional health practices with around 70% use in rural areas under conventional medicinal practices, according to the WHO. This further encourages the use of dietary supplements that use plants like Ashwagandha, Giloy, Turmeric, among others, that have been deeply embedded along with conventional health practices that find meaning in natural practices that generate wellness or health.

Government support enhances this factor. The budget of the Ministry of AYUSH grew by 14.2% in FY26 to USD 461 million, showing that the government is supportive of Ayurvedic and herbal efforts. Because of this, end users welcome herbal supplements into their regular lifestyle for immunity-boosting, stress relief, and maintenance, thereby enhancing the traditional product range from a non-regular offering to a regular offering.

India Herbal/Traditional Products Market ChallengeHome Remedies Hamper Use of Branded Herbal Remedies

A crucial concern for branded herbal and traditional cough, cold, and allergy medications in India is the traditional preference for homemade remedies. Many people opt for homemade remedies for common ailments such as turmeric milk, ginger tea, and a concoction of honey and black pepper because they are easily available and pocket-friendly. This hampers the use of branded herbal products, particularly in semi-rural and rural settings, as homemade remedies are the preferred choice for minor ailments.

Further, there is a cost barrier among the lower-income sections, which derives preparation of the solution from homes, which is also free, and is found effective by word of mouth. Consequently,_REMOTE GROWTH WISE, the formal herbal cure segments also face resistance, due to reluctance to replace that method with the new one, except when presenting a marked advantage.

India Herbal/Traditional Products Market TrendTransparence of Ingredients and Clean Labeling Influences end user Behavior

A major trend shaping the herbal and traditional products market in India is the increasing emphasis on ingredient transparency. End users are now demanding more transparent information about ingredients, which inculcates greater trust among them in the products. In today’s health-conscious era, individuals are opting for products that are free from artificial ingredients and substances and are highlighting the benefits of herbs like immunity and stress management.

To counter this issue, companies are now promoting the ayurveda ingredients and preparations used in the products. For instance, Chyawanprash comes with packaging that markets amla and ashwagandha properties. This increased openness is particularly welcoming among the younger generation of end users who are increasingly turning to the internet for reviews and comparing notes on various products. Through the promotion of high-quality ingredients and purification processes, companies are also increasing end user confidence, which is vital in an increasingly competitive market that is also focused on natural and safety relevance.

India Herbal/Traditional Products Market OpportunityDriven by Prevention and AYUSH Services

The market opportunity for herbal and traditional products in India is substantial, driven by the growing acceptance of preventive healthcare and increasing awareness of non-communicable diseases. The traditional herbal products that promote the Immunity, Digestive, and Overall Wellness function and benefit directly in terms of people wanting to prevent illnesses rather than respond to problems. Momentum from government and market further adds to this potential. The AYUSH market in India is seeing growth with greater funding and rising exports. Exports of AYUSH and herbal product exports have been rising around USD 689 million.

It is a clear signal that the international market has a rising demand for India's natural healthcare products. With rising health awareness in urban sectors and the availability of digital platforms for product knowledge, a brand that caters to preventive healthcare based on holistic principles and has globally recognized scientific formulations can easily tap into a wider market base.

India Herbal/Traditional Products Market Segmentation Analysis

By Category

- Topical Analgesics

- Sleep Aids

- Cough, Cold & Allergy Remedies

- Digestive Remedies

- Dermatologicals

- Paediatric Dietary Supplements

- Dietary Supplements

- Tonics

The segment with the highest share under category is Herbal/Traditional Dietary Supplements, which accounts around 40% of the market share. This dominance reflects strong end user demand for everyday wellness support through natural formulations like ashwagandha for stress, giloy for immunity, and turmeric for inflammation. The long history of Ayurvedic medicine in India supports deep cultural resonance, with traditional herbs widely accepted as safe and holistic health aids. Approximately 70% of the Indian rural population depends on traditional systems of medicine for primary healthcare, underlining the ingrained trust in herbal offerings.

Dietary supplements also benefit from modernization and format innovation, such as gummies, powders, and ready-to-consume mixes, which appeal to younger and urban demographics. As ingredient transparency gains importance, end users gravitate to products with clear Ayurvedic heritage and clean labels, reinforcing the category’s leadership. The segment’s ability to address preventive health concerns—immune support, vitality, stress management—ensures its continued dominance in the herbal/traditional spectrum.

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share under sales channel is Retail Offline, capturing 85% of the market. Retail Offline remains the primary route for herbal/traditional products due to end user habits that favour in-store purchase for health goods, especially when professional advice or tactile assessment of traditional packs is desired. Pharmacies, health-goods stores, and AYUSH outlets are well-established touchpoints where end users often seek reassurance about product authenticity and suitability before buying.

Additionally, in-store presence builds trust in traditional brands that emphasize quality and heritage. Although digital channels are growing, especially in urban centres with high internet penetration, offline remains dominant because it supports established purchase behaviours and provides direct end user interaction. As such, retail offline continues to drive the majority of sales in the Indian herbal/traditional products market, reinforcing its role as a key distribution pillar.

List of Companies Covered in India Herbal/Traditional Products Market

The companies listed below are highly influential in the India herbal/traditional products market, with a significant market share and a strong impact on industry developments.

- GSK Consumer Healthcare

- Ranbaxy Laboratories Ltd

- Herbalife International India Pvt Ltd

- Dabur India Ltd

- Emami Ltd

- Himalaya Drug Co

- Vestige Marketing Pvt Ltd

- Amrutanjan Health Care Ltd

- Forever Living Products India Pvt Ltd

- Hamdard Wakf Laboratories Ltd

Competitive Landscape

The competitive landscape of herbal/traditional products in India in 2024 is led by well-established Ayurvedic players, with Dabur retaining its leadership, supported by the strong equity of Dabur Chyawanprash and its wide herbal dietary supplements portfolio. Emami, through its Zandu brand, closely follows, leveraging Ayurvedic credibility across immunity, digestion, and wellness solutions. Competition is intensifying as both legacy Ayurvedic brands and newer nutraceutical players expand their presence, particularly in herbal dietary supplements. Brands are increasingly differentiating through ingredient transparency, clean-label positioning, and science-backed formulations. The influx of FMCG and wellness-focused entrants is further reshaping the market, raising marketing intensity and innovation as companies compete to capture health-conscious end users seeking natural, preventive solutions.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. India Herbal/Traditional Products Market Policies, Regulations, and Standards

4. India Herbal/Traditional Products Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. India Herbal/Traditional Products Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Topical Analgesics- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Sleep Aids- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Cough, Cold & Allergy Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Digestive Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Dermatologicals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Paediatric Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.8. Tonics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Form

5.2.2.1. Capsules/Tablets- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Syrups- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Oils & Ointments- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Health Benefit

5.2.3.1. General Wellness- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Cardiovascular Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Cognitive & Mental Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Digestive & Gut Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Immunity Support- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Respiratory Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.7. Bone & Joint Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Source

5.2.4.1. Leaves- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Roots- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Barks- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Flowers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Seeds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Ingredient Type

5.2.5.1. Single-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Multi-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Function

5.2.6.1. Preventive Care- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Curative/Relief Care- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By End User

5.2.7.1. Adults- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Geriatric Population- Market Insights and Forecast 2022-2032, USD Million

5.2.7.3. Children- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Prescription Type

5.2.8.1. Over-the-Counter (OTC)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Prescription Herbal Medicines- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Sales Channel

5.2.9.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.9.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.10. By Competitors

5.2.10.1. Competition Characteristics

5.2.10.2. Market Share & Analysis

6. India Topical Analgesics Herbal/Traditional Products Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

6.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. India Sleep Aids Herbal/Traditional Products Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

7.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. India Cough, Cold & Allergy Remedies Herbal/Traditional Products Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

8.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. India Digestive Remedies Herbal/Traditional Products Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

9.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. India Dermatologicals Herbal/Traditional Products Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

10.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. India Paediatric Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

11.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

11.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. India Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

12.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

12.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

12.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

12.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. India Tonics Herbal/Traditional Products Market Statistics, 2022-2032

13.1. Market Size & Growth Outlook

13.1.1. By Revenues in USD Million

13.2. Market Segmentation & Growth Outlook

13.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

13.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

13.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

13.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

13.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

13.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

13.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

14. Competitive Outlook

14.1. Company Profiles

14.1.1. Dabur India Ltd

14.1.1.1. Business Description

14.1.1.2. Product Portfolio

14.1.1.3. Collaborations & Alliances

14.1.1.4. Recent Developments

14.1.1.5. Financial Details

14.1.1.6. Others

14.1.2. Emami Ltd

14.1.2.1. Business Description

14.1.2.2. Product Portfolio

14.1.2.3. Collaborations & Alliances

14.1.2.4. Recent Developments

14.1.2.5. Financial Details

14.1.2.6. Others

14.1.3. Himalaya Drug Co

14.1.3.1. Business Description

14.1.3.2. Product Portfolio

14.1.3.3. Collaborations & Alliances

14.1.3.4. Recent Developments

14.1.3.5. Financial Details

14.1.3.6. Others

14.1.4. Vestige Marketing Pvt Ltd

14.1.4.1. Business Description

14.1.4.2. Product Portfolio

14.1.4.3. Collaborations & Alliances

14.1.4.4. Recent Developments

14.1.4.5. Financial Details

14.1.4.6. Others

14.1.5. Amrutanjan Health Care Ltd

14.1.5.1. Business Description

14.1.5.2. Product Portfolio

14.1.5.3. Collaborations & Alliances

14.1.5.4. Recent Developments

14.1.5.5. Financial Details

14.1.5.6. Others

14.1.6. GSK Consumer Healthcare

14.1.6.1. Business Description

14.1.6.2. Product Portfolio

14.1.6.3. Collaborations & Alliances

14.1.6.4. Recent Developments

14.1.6.5. Financial Details

14.1.6.6. Others

14.1.7. Ranbaxy Laboratories Ltd

14.1.7.1. Business Description

14.1.7.2. Product Portfolio

14.1.7.3. Collaborations & Alliances

14.1.7.4. Recent Developments

14.1.7.5. Financial Details

14.1.7.6. Others

14.1.8. Herbalife International India Pvt Ltd

14.1.8.1. Business Description

14.1.8.2. Product Portfolio

14.1.8.3. Collaborations & Alliances

14.1.8.4. Recent Developments

14.1.8.5. Financial Details

14.1.8.6. Others

14.1.9. Forever Living Products India Pvt Ltd

14.1.9.1. Business Description

14.1.9.2. Product Portfolio

14.1.9.3. Collaborations & Alliances

14.1.9.4. Recent Developments

14.1.9.5. Financial Details

14.1.9.6. Others

14.1.10. Hamdard Wakf Laboratories Ltd

14.1.10.1.Business Description

14.1.10.2.Product Portfolio

14.1.10.3.Collaborations & Alliances

14.1.10.4.Recent Developments

14.1.10.5.Financial Details

14.1.10.6.Others

15. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Form |

|

| By Health Benefit |

|

| By Source |

|

| By Ingredient Type |

|

| By Function |

|

| By End User |

|

| By Prescription Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.