Germany Herbal/Traditional Products Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Topical Analgesics, Sleep Aids, Cough, Cold & Allergy Remedies, Digestive Remedies, Dermatologicals, Paediatric Dietary Supplements, Dietary Supplements, Tonics), By Form (Capsules/Tablets, Powder, Syrups, Oils & Ointments, Others), By Health Benefit (General Wellness, Cardiovascular Health, Cognitive & Mental Health, Digestive & Gut Health, Immunity Support, Respiratory Health, Bone & Joint Health, Others), By Source (Leaves, Roots, Barks, Flowers, Seeds, Others), By Ingredient Type (Single-Herb Products, Multi-Herb Products), By Function (Preventive Care, Curative/Relief Care), By End User (Adults, Geriatric Population, Children), By Prescription Type (Over-the-Counter (OTC), Prescription Herbal Medicines), By Sales Channel (Retail Offline, Retail Online)

- Healthcare

- Jan 2026

- VI0733

- 110

-

Germany Herbal/Traditional Products Market Statistics and Insights, 2026

- Market Size Statistics

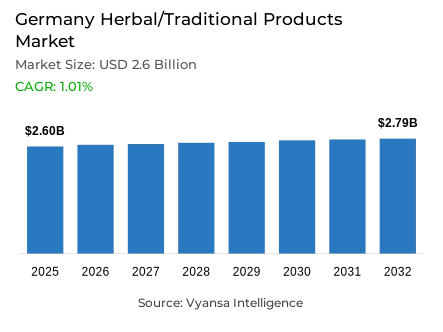

- Herbal/traditional products in Germany is estimated at USD 2.6 billion in 2025.

- The market size is expected to grow to USD 2.79 billion by 2032.

- Market to register a cagr of around 1.01% during 2026-32.

- Category Shares

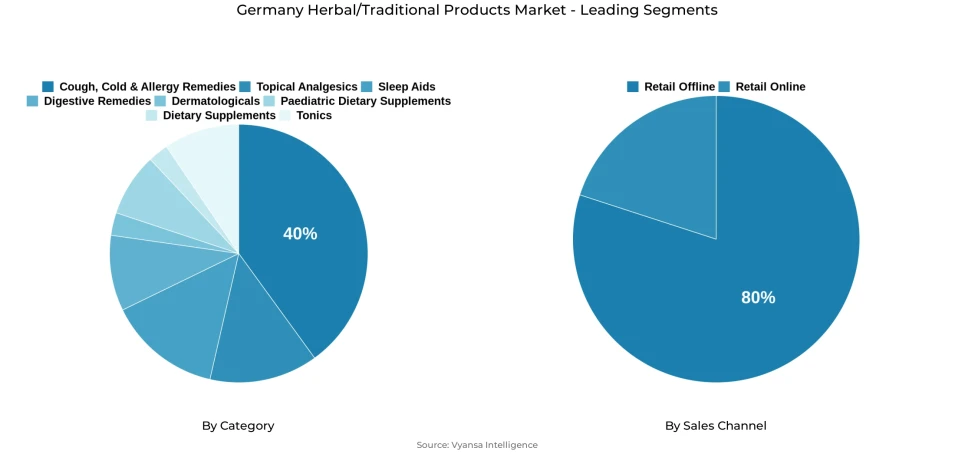

- Cough, cold & allergy remedies grabbed market share of 40%.

- Competition

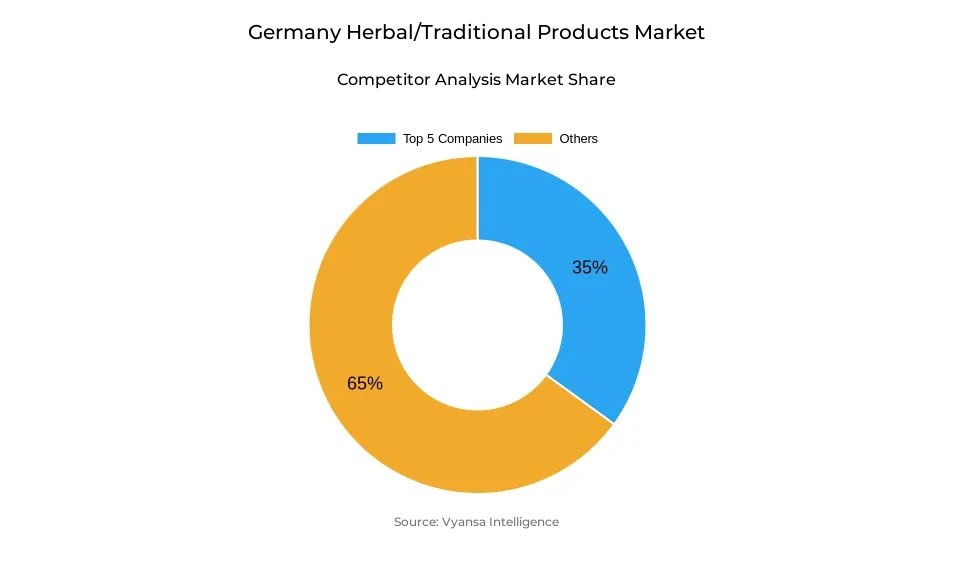

- More than 20 companies are actively engaged in producing herbal/traditional products in Germany.

- Top 5 companies acquired around 35% of the market share.

- Dr Soldan GmbH; Procter & Gamble GmbH; Haleon Germany GmbH; CFP Brands Süßwarenhandels GmbH & Co KG; Bionorica SE etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 80% of the market.

Germany Herbal/Traditional Products Market Outlook

The Germany herbal/traditional products market is valued around USD 2.6 billion in 2025 and is projected to reach around USD 2.79 billion by 2032, growing with a CAGR of 1.01%. This can be attributed to the growing need for gentle, natural, and holistic means of health care, as the population becomes more conscious of the importance of health and wellness. The market shares for products such as cough, cold, and allergy relievers, accounting for 40% market shares, continue to surge since herbal products are well-known and accepted within the German market. The interest for plant-based dietary supplement extracts is also on the increase, especially those containing ashwagandha, an ingredient that offers stress relief among its benefits. Tonics and digestive products are the biggest-growing markets for herbal products since the population is looking for natural means to enhance the immune system.

The competitive environment is becoming more dynamic. Although CFP Brands Süßwarenhandels still maintains a leading position in the market, their share is gradually decreasing with an increased presence of brands like Bionorica. Bionorica’s range of herbs in cough and decongesting preparations is increasing in popularity because of their increased trust in natural products. Simultaneously, new competitors like Nature's Way reflect an increased interest in natural ingredients with more specific end user needs.

Retail offline represents around 80% of total market sales and continues to dominate, particularly through pharmacies. Nonetheless, retail online will soon start to gain momentum in Germany, where their end users will appreciate the advantages offered by internet pharmacies like Shop Apotheke, such as convenience, price comparison, and product range. This trend will also be fueled by people searching for cheaper and more handy access to herbals.

However, the market will see innovation in the types of products, such as sprays, solubles, gummies, and plant-based options. Herbal sleep aids with ashwagandha, or CBD, will also drive the market. The demand for the herbal/traditional segment will remain steady as end users continue to demand added-value solutions with a better safety perception, helping the herbal/traditional segment continue its growth.

Germany Herbal/Traditional Products Market Growth DriverEncouraging Preventive Health Awareness and the Use of Natural Remedies

The growing trends in Germany among end users for proactive healthcare practices and self-administered wellness programs have notably increased demand for herbal and traditional products as essential ingredients within healthcare practices. As per estimates by the German Federal Institute for Risk Assessment (BfR), one-third of end users use dietary supplements on a weekly basis, with another one-sixth using them on a daily basis. The fact that there is so much adoption and so much focus on proactive self-care through vitamins, minerals, and botanicals has led to herbal products being recognized as convenient and effective healthcare solutions.

Cultural predispositions in germany toward herbal products are a major driving force for the herbal supplements category. Cultural traditions in the German country are very entrenched regarding the use of herbal supplements and botanical products for the treatment of common ailments like coughs, colds, and digestive troubles. This cultural acceptance, coupled with the growing emphasis on health awareness and the importance of ingredient clarity, acts as a significant foundation for end users being receptive to herbal supplements for immune system and stress relief products.

Germany Herbal/Traditional Products Market ChallengeCompetition from Conventional over-the-Counter (OTC) and General Dietary Supplements

A key structural challenge facing germany herbal and traditional products market is the combined pressure from competing over the counter pharmaceutical products and the widespread adoption of dietary supplements, which together dilute the distinct plant-based value proposition traditionally associated with herbal remedies. According to a survey, a staggering 65% of the populations in Germany use nutritional supplements like vitamins, minerals, and probiotics. This can undermine the impact created by products with a specialization in plants.

Additionally, due to increased or deteriorated symptoms, there is also a trend among these end users to change to traditional over the counter products, which hampers recall and loyalty to herbal first-line products significantly. Since there are also vitamin and mineral products consumed concurrently among these German end users, who utilize similar communication approaches for similar purposes, it affects herbal products to differentiate extensively and significantly, making it imperative to communicate efficacy effectively scientifically to ensure adoption.

Germany Herbal/Traditional Products Market TrendUse of Herbal and Botanical Supplements on the Rise for General Health Purposes

A notable accelerating trend in germany herbal and traditional products market is the growing integration of botanical supplements as essential components of regular daily wellness routines, specifically supporting immune resilience, stress management, and sustained energy levels. Natural supplement consumption reflects a broader structural shift toward holistic, preventive wellness practices, with end users increasingly valuing plant-derived ingredients for perceived safety and long-term health benefits. Market research confirms that botanical ingredients constitute a meaningful, growing portion of overall supplement consumption, with end users actively seeking products positioned as natural and plant-based.

Evolving end user preferences toward clean-label, transparent formulations substantially accelerate this trend. According to Food Supplements Europe surveys, approximately 60% of German supplement end users consider natural, organic, or GMO-free labelling important when evaluating health products. This strong preference signals clear desire for transparency and authenticity. As German end users demonstrate heightened health consciousness and informed dietary decision-making, systematic integration of herbal supplements into daily preventative health regimes continues strengthening substantially, creating sustained demand for botanicals positioned around specific functional benefits.

Germany Herbal/Traditional Products Market OpportunityRising Demand for Digestive, Stress, and Immune System Herbals

A significant growth opportunity exists for herbal and traditional products positioned around digestive health, stress management, and seasonal illness prevention, as these functional areas align closely with the preventive health behaviours and wellness-oriented practices of german end users. The strong herbal medicine tradition of germany and the very high rate of supplement usage and acceptance make the market in germany highly favorable to herbal products that have identified functional benefits.

German end users show an inclination towards herbals that have transparent, scientifically grounded ingredient labels and credible statements about their health functionality.Based on research, about 60% of the German dietary supplement-buying public regard organic, natural, and GMO-free labels as important criteria, thus establishing authenticity and ingredient transparency as key market differentiators that product manufacturers can leverage to effectively tap this large market potential in the Germany market, where end users value their total health and overall wellness.

Germany Herbal/Traditional Products Market Segmentation Analysis

By Category

- Topical Analgesics

- Sleep Aids

- Cough, Cold & Allergy Remedies

- Digestive Remedies

- Dermatologicals

- Paediatric Dietary Supplements

- Dietary Supplements

- Tonics

The segment with highest market share under category is cough, cold & allergy remedies with around 40% market share. This substantial market share bases its roots within german culture favoring of herbal tea infusions, and respiratory formulas that directly relate to herbs.nIt is apparent that the end-users favor these familiar or conventional herbs due to their associations with safety profiles and fewer side effects compared with conventional non-herbal alleviants.

Demand is also driven by the growing number of herbal products available in the country, such as stress management products like Ashwagandha-based products and herbal immune system supplements. With the growing trend for a holistic and preventive approach to health in the German market, products that are clearly positioned in the natural health domain continue to emerge as very relevant in the market. Innovation in herbal products, tonics, and sleep maintenance supplements is likely to strengthen the herbal products segment and continue its leadership in the market.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under sales channel is retail offline, which accounts around 80% of market share. A significant factor contributing to continued distribution through pharmacies is end user trust, physician/pharmacist recommendations, and easy access to them, which are yet to be replaced with online sales as end users also continue to purchase herbal/traditional medicines over-the-counter at retail stores.

Retail offline also has some benefits in terms of established visibility of key brands and constant promotions in pharmacy chains. Even with the rise of convenience and competitive prices being promoted by online platforms, retail offline remains in the lead since the traditional herbal products have already undergone assessments by end users at the point of purchase.

List of Companies Covered in Germany Herbal/Traditional Products Market

The companies listed below are highly influential in the Germany herbal/traditional products market, with a significant market share and a strong impact on industry developments.

- Dr Soldan GmbH

- Procter & Gamble GmbH

- Haleon Germany GmbH

- CFP Brands Süßwarenhandels GmbH & Co KG

- Bionorica SE

- MCM Klosterfrau Vertriebsgesellschaft mbH

- Dr Willmar Schwabe GmbH & Co KG

- Bayer Vital GmbH

- Beiersdorf AG

- Dr Theiss Naturwaren GmbH

Competitive Landscape

The competitive landscape for herbal/traditional products in Germany remains highly fragmented in 2025, with both established and specialist players competing across key therapeutic areas. CFP Brands Süßwarenhandels is expected to retain its leadership position, supported by strong brands such as Ricola and Fisherman’s Friend in herbal cough, cold and allergy remedies, although its retail value share is projected to edge down amid intensifying competition. Bionorica continues to narrow the gap, leveraging its strong scientific positioning and well-recognised herbal formulations in respiratory remedies. Competition is increasingly shaped by innovation around natural ingredients, added-value claims, and expanding online visibility, as brands seek differentiation in a market where end user trust, efficacy perception, and convenience strongly influence purchasing decisions.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Germany Herbal/Traditional Products Market Policies, Regulations, and Standards

4. Germany Herbal/Traditional Products Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Germany Herbal/Traditional Products Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Topical Analgesics- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Sleep Aids- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Cough, Cold & Allergy Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Digestive Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Dermatologicals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Paediatric Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.8. Tonics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Form

5.2.2.1. Capsules/Tablets- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Syrups- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Oils & Ointments- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Health Benefit

5.2.3.1. General Wellness- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Cardiovascular Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Cognitive & Mental Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Digestive & Gut Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Immunity Support- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Respiratory Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.7. Bone & Joint Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Source

5.2.4.1. Leaves- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Roots- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Barks- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Flowers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Seeds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Ingredient Type

5.2.5.1. Single-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Multi-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Function

5.2.6.1. Preventive Care- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Curative/Relief Care- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By End User

5.2.7.1. Adults- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Geriatric Population- Market Insights and Forecast 2022-2032, USD Million

5.2.7.3. Children- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Prescription Type

5.2.8.1. Over-the-Counter (OTC)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Prescription Herbal Medicines- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Sales Channel

5.2.9.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.9.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.10. By Competitors

5.2.10.1. Competition Characteristics

5.2.10.2. Market Share & Analysis

6. Germany Topical Analgesics Herbal/Traditional Products Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

6.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Germany Sleep Aids Herbal/Traditional Products Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

7.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Germany Cough, Cold & Allergy Remedies Herbal/Traditional Products Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

8.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Germany Digestive Remedies Herbal/Traditional Products Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

9.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Germany Dermatologicals Herbal/Traditional Products Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

10.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Germany Paediatric Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

11.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

11.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Germany Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

12.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

12.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

12.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

12.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Germany Tonics Herbal/Traditional Products Market Statistics, 2022-2032

13.1. Market Size & Growth Outlook

13.1.1. By Revenues in USD Million

13.2. Market Segmentation & Growth Outlook

13.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

13.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

13.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

13.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

13.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

13.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

13.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

14. Competitive Outlook

14.1. Company Profiles

14.1.1. CFP Brands Süßwarenhandels GmbH & Co KG

14.1.1.1. Business Description

14.1.1.2. Product Portfolio

14.1.1.3. Collaborations & Alliances

14.1.1.4. Recent Developments

14.1.1.5. Financial Details

14.1.1.6. Others

14.1.2. Bionorica SE

14.1.2.1. Business Description

14.1.2.2. Product Portfolio

14.1.2.3. Collaborations & Alliances

14.1.2.4. Recent Developments

14.1.2.5. Financial Details

14.1.2.6. Others

14.1.3. MCM Klosterfrau Vertriebsgesellschaft mbH

14.1.3.1. Business Description

14.1.3.2. Product Portfolio

14.1.3.3. Collaborations & Alliances

14.1.3.4. Recent Developments

14.1.3.5. Financial Details

14.1.3.6. Others

14.1.4. Dr Willmar Schwabe GmbH & Co KG

14.1.4.1. Business Description

14.1.4.2. Product Portfolio

14.1.4.3. Collaborations & Alliances

14.1.4.4. Recent Developments

14.1.4.5. Financial Details

14.1.4.6. Others

14.1.5. Bayer Vital GmbH

14.1.5.1. Business Description

14.1.5.2. Product Portfolio

14.1.5.3. Collaborations & Alliances

14.1.5.4. Recent Developments

14.1.5.5. Financial Details

14.1.5.6. Others

14.1.6. Dr Soldan GmbH

14.1.6.1. Business Description

14.1.6.2. Product Portfolio

14.1.6.3. Collaborations & Alliances

14.1.6.4. Recent Developments

14.1.6.5. Financial Details

14.1.6.6. Others

14.1.7. Procter & Gamble GmbH

14.1.7.1. Business Description

14.1.7.2. Product Portfolio

14.1.7.3. Collaborations & Alliances

14.1.7.4. Recent Developments

14.1.7.5. Financial Details

14.1.7.6. Others

14.1.8. Beiersdorf AG

14.1.8.1. Business Description

14.1.8.2. Product Portfolio

14.1.8.3. Collaborations & Alliances

14.1.8.4. Recent Developments

14.1.8.5. Financial Details

14.1.8.6. Others

14.1.9. Haleon Germany GmbH

14.1.9.1. Business Description

14.1.9.2. Product Portfolio

14.1.9.3. Collaborations & Alliances

14.1.9.4. Recent Developments

14.1.9.5. Financial Details

14.1.9.6. Others

14.1.10. Dr Theiss Naturwaren GmbH

14.1.10.1.Business Description

14.1.10.2.Product Portfolio

14.1.10.3.Collaborations & Alliances

14.1.10.4.Recent Developments

14.1.10.5.Financial Details

14.1.10.6.Others

15. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Form |

|

| By Health Benefit |

|

| By Source |

|

| By Ingredient Type |

|

| By Function |

|

| By End User |

|

| By Prescription Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.