Argentina Herbal/Traditional Products Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Topical Analgesics, Sleep Aids, Cough, Cold & Allergy Remedies, Digestive Remedies, Dermatologicals, Paediatric Dietary Supplements, Dietary Supplements, Tonics), By Form (Capsules/Tablets, Powder, Syrups, Oils & Ointments, Others), By Health Benefit (General Wellness, Cardiovascular Health, Cognitive & Mental Health, Digestive & Gut Health, Immunity Support, Respiratory Health, Bone & Joint Health, Others), By Source (Leaves, Roots, Barks, Flowers, Seeds, Others), By Ingredient Type (Single-Herb Products, Multi-Herb Products), By Function (Preventive Care, Curative/Relief Care), By End User (Adults, Geriatric Population, Children), By Prescription Type (Over-the-Counter (OTC), Prescription Herbal Medicines), By Sales Channel (Retail Offline, Retail Online)

- Healthcare

- Jan 2026

- VI0724

- 125

-

Argentina Herbal/Traditional Products Market Statistics and Insights, 2026

- Market Size Statistics

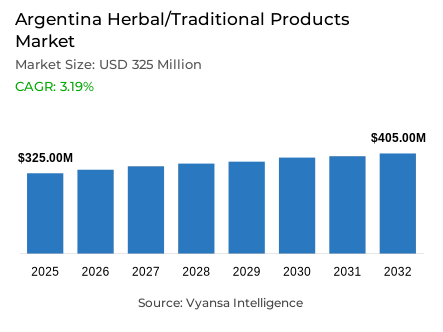

- Herbal/traditional products in Argentina is estimated at USD 325 million in 2025.

- The market size is expected to grow to USD 405 million by 2032.

- Market to register a cagr of around 3.19% during 2026-32.

- Category Shares

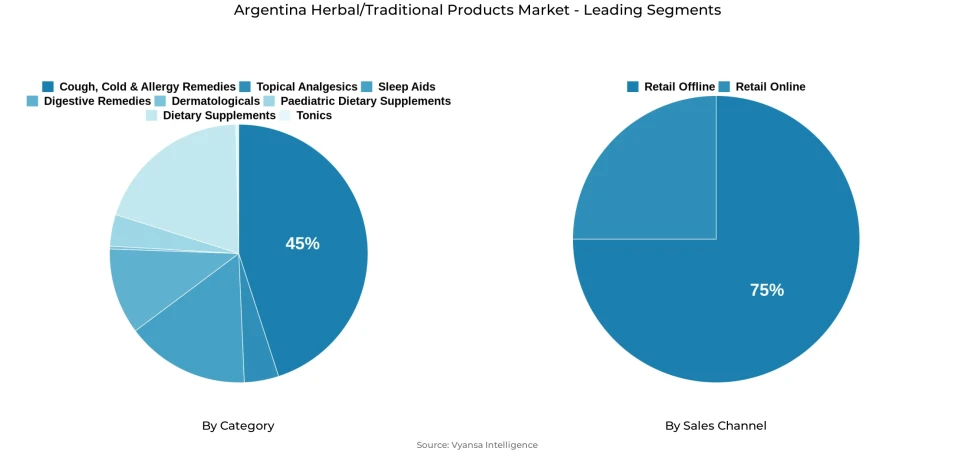

- Cough, cold & allergy remedies grabbed market share of 45%.

- Competition

- More than 15 companies are actively engaged in producing herbal/traditional products in Argentina.

- Top 5 companies acquired around 30% of the market share.

- Ivax Argentina SA; Laboratorios Bagó SA; Formulab SA; Arcor SAIC; Mondelez Argentina SA etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

Argentina Herbal/Traditional Products Market Outlook

Argentina herbal/traditional products market is expected to move at a positive rate till 2032. With increased consumption of natural products and economic improvements, this sector is also expected to boost. At present, in 2025, this market has been valued at USD 325 million. However, by 2032, this is expected to reach USD 405 million. It is expected to register a CAGR of 3.19%. As people show increased concerns for healthcare, medicated confectionery in the herbal/traditional cough, cold & allergy remedies sector is expected to be major. It has already captured 45% shares.

There is also an emerging wellness culture that is influencing product demand, where Argentinians increasingly turn to perceived safer natural remedies. This trend is supplemented by the growth of dieteticias, which have enhanced point of sale offline networks that presently corner 75% of market share. These shops carry a range of herbal products preferred by consumers who seek more natural methods of healing compared to conventional medications. Direct sales also continue to register faster growth due to low operating expenses and strong brand names such as Herbalife, Omnilife, and Amway.

Demographics also offer long-term demand support. The age factor, with over six million people expected to be 65+ by 2028, will continue to create demand for natural products to address health issues. Simultaneously, innovation in the supplements and topical segments will increase the range of products available to address weight, immune, and general health issues. Recently developed products such as spirulina, chia oil, cranberries, maca, and Florelia algae are expected to grow in demand.

Looking forward, the herbal or traditional product range will continue to be the preferred option for many people in Argentina, irrespective of the economic challenges. This is because the premium pricing of the products by the end users for the natural and plant-based alternatives will drive the growth of the category, while the rising number of health food shops and product developments will assist in the increased adoption of the products.

Argentina Herbal/Traditional Products Market Growth Driver

Increased Demand for Natural Prevention and Immune Support

The driving factor for the demand for herbal and traditional products in Argentina is the increasing support from end user who favor natural means and strategies for building the immune system, especially after the experience with the pandemic. end user favoritism towards natural ingredients such as garlic, ginseng, ginkgo, and chia is consistent with their usage and support at the current time and is also supported by existing health trends globally, as about 80% of the total population from more than 170 member states of the World Health Organization depend on herbal medicine and traditional medicine to cater to their major healthcare requirements, showing a clear message about the acceptance and influence at the global level, ultimately having a major impact on the perception level in Argentina regarding such products.

Economic realities in recent times have also impacted the demand for herbal products, as end user increasingly see herbal supplements as an economical alternative solution for health maintenance and wellness prevention. This is because herbal and traditional supplements are seen as an affordable investment for long-term health goals, which still fall within reach even when budgets are limited. This positioning of herbal supplements as an important complement to health and wellness, both in terms of perceived effectiveness and affordability, ensures a consistent demand for herbal supplements despite macroeconomic uncertainties.

Argentina Herbal/Traditional Products Market Challenge

Reduced Purchasing Power Restricts Product Affordability

High inflation rates continue to be a severe hindrance in the acceptance of herbal and traditional products within Argentina, and it is a fundamentally limiting factor within the country, hindering household purchasing power. According to government records, Argentina experienced a year-over-year inflation level of 211.4% as of December 2023, and it is a record-high condition that outperformed earlier international expectations. In such a highly adverse condition, the purchasing power of end users gets highly deteriorated, and end users are forced to focus upon essential expenses related to food, energy, and necessary commodities, while expensive herbal supplements and traditional products become relatively less accessible within middle and lower class sections of the population, who tend to purchase fewer herbal products because of decreased purchasing power, thus hindering growth within premium segments.

Income instability and poverty levels contribute to the exacerbation of income-sensitive consumption patterns and low adoption of herbal categories, as income consumption patterns remain erratic and income levels are low, thus failing to meet the continued consumption patterns vital for herbal categories to grow to the next level and beyond this niche market to other income levels and demographics. According to INDEC (National Institute of Statistics and Census), poverty levels for the second half of 2023 stand at 41.7% for the total population of Argentina, with 19.4 million of this population living in poverty; this poverty level is an indication of the structural financial struggles experienced by the population, which, in turn, limits spending on health and wellness products due to higher priorities in addressing immediate financial survival and survival for the day rather than addressing health and wellness preventive measures and products for the long-term.

Argentina Herbal/Traditional Products Market Trend

Increasing Consumer Interest in CBD & Plant-Based Topicals

A key trend influencing the Herbal and Traditional Products Market in Argentina is the rising preference for CBD-infused topical pain relievers and herbal wellness solutions for pain management. An increasing number of end users are now preferring herbal pain relief solutions over the standard pharmacological solutions due to growing concerns over the side effects caused by the latter. World health information shows that musculoskeletal disorders have become a growing source of disability and dysfunction across the globe, making end users across the globe welcoming of herbal pain solutions like CBD-infused topical solutions.

This consumer trend for plant-based topicals is reflective of a regulatory landscape that is increasingly recognizing scientific support for CBD and cannabis-infused wellness products. In 2020, the UN Commission on Narcotic Drugs rescheduled cannabis for pharmaceutical and scientific purposes, giving global endorsement towards the therapeutic value of CBD-infused products and fueling end user acceptance worldwide. Such changing trends in end users and regulation are considered crucial by manufacturers who are looking towards herbal and plant-based topicals as innovative approaches for end users who are searching for a complementary means of alleviating pain through a natural approach compared to using pharmaceutical-grade pain relief drugs.

Argentina Herbal/Traditional Products Market Opportunity

Ageing Population Boosts Demand for Natural Remedies

The aged population structure in Argentina is another significant long-term market opportunity, with a substantial rise in the senior population aged 65+ contributing to a constant demand for offerings that relate to enhancing joint, circulation, digestion, and overall health, for which herbal and traditional remedies already historically enjoy robustappeal and a demonstrated perception of efficacy. Demographic information includes that of Argentine senior citizens aged 65+, totaling approximately 5.8 million in 2024, expected to reach closer to 6 million in the latter part of the 2020s, with life expectancy on a rise and fertility rates lower than replacement rates. This senior age group is normally primed for natural remedies with a perception of fewer adverse reactions, especially among seniors needing to control a multitude of chronic illnesses.

This major shift in the demographics of the population also occurs during a time when there is an increased consumer need for antioxidant-based and functinal botanicals related to disease prevention and support for healthy ageing. Non-communicable diseases were responsible for 63.2% of all deaths in Argentina in 2020, and this is attributed to being the leading cause of mortality, which shows that there is a high disease burden affecting the aging population that requires constant support for managing and maintaining preventative treatments like resveratrol, maca, and cranberry supplements and other botanicals that are marketed through the lens of prevention and wellness. Herbal and traditional supplements that focus on the validation of clinical safety and efficacy, and which support wellness, stand to grow exponentially in this untapped high-demand elderly population base.

Argentina Herbal/Traditional Products Market Segmentation Analysis

By Category

- Topical Analgesics

- Sleep Aids

- Cough, Cold & Allergy Remedies

- Digestive Remedies

- Dermatologicals

- Paediatric Dietary Supplements

- Dietary Supplements

- Tonics

The segment with highest market share under category is Cough, Cold & Allergy Remedies, capturing around 45% in this market due to its strong presence with menthol and herb-based medicated confectioneries like eucalyptus and mint lozenges that remain accessible to most end users despite being relatively inexpensive in most markets, especially with respect to natural remedies for cold symptoms like respiratory ailments during flu seasons.

The market is also expected to remain at the top position in the period 2026-32, owing to the increasing habits of self-medication, along with the choices made by end users for natural, cheap, and effective solutions for mild respiratory ailments. The product is likely to see an increasing acceptance rate, due to the increasing prevalence of preventive healthcare, along with the rising consumption of natural products. With the stabilising economy, there is also a likely expansion in the number of health food stores, leading to increasing visibility for this market.

By Sales Channel

- Retail Offline

- Retail Online

This segment has the greatest share under sales channel, is retail offline, which accounted around 75% of share. Health and personal care stores, including dietéticas, continue to be the favored channels because they offer the greatest variety in terms of herbal supplements, teas, oils, and topical preparations. These stores enjoy the greatest end user trust, particularly since the herbal/natural positioning resonates well within the preferences of the elderly and health-conscious population of Argentina.

Looking forward to the period between 2026 and 2032, retail offline is forecast to retain its number one position, thanks to the continued growth of dieteticas and the fact that customers are hesitant to rely solely on the online shopping option for natural health-related products. The advantage of receiving personalized suggestions, viewing products physically, and enjoying an extended range of products not found in shopping centers and online shopping websites will continue to endear retailing offline to the market and keep them at the focal point of herbal/traditional merchandise distribution.

List of Companies Covered in Argentina Herbal/Traditional Products Market

The companies listed below are highly influential in the Argentina herbal/traditional products market, with a significant market share and a strong impact on industry developments.

- Ivax Argentina SA

- Laboratorios Bagó SA

- Formulab SA

- Arcor SAIC

- Mondelez Argentina SA

- Laboratorio Elea SACIF y A

- Spedrog Caillon SAI y C

- Mega Labs Argentina SAU

- Natufarma SA

- Omnilife de Argentina SA

Competitive Landscape

Arcor SAIC was a leader in the herbal/traditional category in 2025, mainly due to the continuation of the successes of its Menthoplus medicated confectionery line, which acted as a cheap alternative within the herbal segment and was a competitor of Mondelez Argentina’s Halls brand in the areas of expectorants, cold products, and allergy remedies. However, direct sales companies like Herbalife International Argentina, Omnilife de Argentina, and Amway Argentina Inc. also picked up pace with cheap and unconventional methods of sales, a factor that appealed to them and consumers in a high-inflationary state. In fact, the battle for leadership was still pegged along the parameters of cost, convenience, and the proliferation of health and personal care stores that carried a wide number of herbs and natural products.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Argentina Herbal/Traditional Products Market Policies, Regulations, and Standards

4. Argentina Herbal/Traditional Products Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Argentina Herbal/Traditional Products Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Topical Analgesics- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Sleep Aids- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Cough, Cold & Allergy Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Digestive Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Dermatologicals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Paediatric Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.8. Tonics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Form

5.2.2.1. Capsules/Tablets- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Syrups- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Oils & Ointments- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Health Benefit

5.2.3.1. General Wellness- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Cardiovascular Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Cognitive & Mental Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Digestive & Gut Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Immunity Support- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Respiratory Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.7. Bone & Joint Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Source

5.2.4.1. Leaves- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Roots- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Barks- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Flowers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Seeds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Ingredient Type

5.2.5.1. Single-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Multi-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Function

5.2.6.1. Preventive Care- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Curative/Relief Care- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By End User

5.2.7.1. Adults- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Geriatric Population- Market Insights and Forecast 2022-2032, USD Million

5.2.7.3. Children- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Prescription Type

5.2.8.1. Over-the-Counter (OTC)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Prescription Herbal Medicines- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Sales Channel

5.2.9.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.9.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.10. By Competitors

5.2.10.1. Competition Characteristics

5.2.10.2. Market Share & Analysis

6. Argentina Topical Analgesics Herbal/Traditional Products Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

6.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Argentina Sleep Aids Herbal/Traditional Products Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

7.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Argentina Cough, Cold & Allergy Remedies Herbal/Traditional Products Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

8.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Argentina Digestive Remedies Herbal/Traditional Products Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

9.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Argentina Dermatologicals Herbal/Traditional Products Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

10.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Argentina Paediatric Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

11.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

11.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Argentina Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

12.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

12.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

12.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

12.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Argentina Tonics Herbal/Traditional Products Market Statistics, 2022-2032

13.1. Market Size & Growth Outlook

13.1.1. By Revenues in USD Million

13.2. Market Segmentation & Growth Outlook

13.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

13.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

13.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

13.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

13.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

13.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

13.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

14. Competitive Outlook

14.1. Company Profiles

14.1.1. Arcor SAIC

14.1.1.1. Business Description

14.1.1.2. Product Portfolio

14.1.1.3. Collaborations & Alliances

14.1.1.4. Recent Developments

14.1.1.5. Financial Details

14.1.1.6. Others

14.1.2. Mondelez Argentina SA

14.1.2.1. Business Description

14.1.2.2. Product Portfolio

14.1.2.3. Collaborations & Alliances

14.1.2.4. Recent Developments

14.1.2.5. Financial Details

14.1.2.6. Others

14.1.3. Laboratorio Elea SACIF y A

14.1.3.1. Business Description

14.1.3.2. Product Portfolio

14.1.3.3. Collaborations & Alliances

14.1.3.4. Recent Developments

14.1.3.5. Financial Details

14.1.3.6. Others

14.1.4. Spedrog Caillon SAI y C

14.1.4.1. Business Description

14.1.4.2. Product Portfolio

14.1.4.3. Collaborations & Alliances

14.1.4.4. Recent Developments

14.1.4.5. Financial Details

14.1.4.6. Others

14.1.5. Mega Labs Argentina SAU

14.1.5.1. Business Description

14.1.5.2. Product Portfolio

14.1.5.3. Collaborations & Alliances

14.1.5.4. Recent Developments

14.1.5.5. Financial Details

14.1.5.6. Others

14.1.6. Ivax Argentina SA

14.1.6.1. Business Description

14.1.6.2. Product Portfolio

14.1.6.3. Collaborations & Alliances

14.1.6.4. Recent Developments

14.1.6.5. Financial Details

14.1.6.6. Others

14.1.7. Laboratorios Bagó SA

14.1.7.1. Business Description

14.1.7.2. Product Portfolio

14.1.7.3. Collaborations & Alliances

14.1.7.4. Recent Developments

14.1.7.5. Financial Details

14.1.7.6. Others

14.1.8. Formulab SA

14.1.8.1. Business Description

14.1.8.2. Product Portfolio

14.1.8.3. Collaborations & Alliances

14.1.8.4. Recent Developments

14.1.8.5. Financial Details

14.1.8.6. Others

14.1.9. Natufarma SA

14.1.9.1. Business Description

14.1.9.2. Product Portfolio

14.1.9.3. Collaborations & Alliances

14.1.9.4. Recent Developments

14.1.9.5. Financial Details

14.1.9.6. Others

14.1.10. Omnilife de Argentina SA

14.1.10.1.Business Description

14.1.10.2.Product Portfolio

14.1.10.3.Collaborations & Alliances

14.1.10.4.Recent Developments

14.1.10.5.Financial Details

14.1.10.6.Others

15. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Form |

|

| By Health Benefit |

|

| By Source |

|

| By Ingredient Type |

|

| By Function |

|

| By End User |

|

| By Prescription Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.