Argentina Dermatologicals Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Medicated Shampoos, Topical Antifungals, Vaginal Antifungals, Hair Loss Treatments, Nappy (Diaper) Rash Treatments, Antiparasitics/Lice (Head and Body) Treatments, Antipruritics, Cold Sore Treatments, Haemorrhoid Treatments, Paediatric Dermatologicals, Topical Allergy Remedies/Antihistamines, Topical Germicidals/Antiseptics), By Dispensing Status (Prescription-based Drugs, Over-the-counter Drugs), By Route of Administration (Topical Administration, Oral Administration, Parenteral Administration), By Drug Type (Branded, Generics), By Skin Condition (Acne, Dermatitis, Psoriasis, Skin Cancer, Rosacea, Alopecia, Fungal Infections, Others), By End User (Hospitals, Cosmetic Centers, Dermatology Clinics, Homecare, Others), By Sales Channel (Retail Offline, Retail Online)

- Healthcare

- Jan 2026

- VI0737

- 120

-

Argentina Dermatologicals Market Statistics and Insights, 2026

- Market Size Statistics

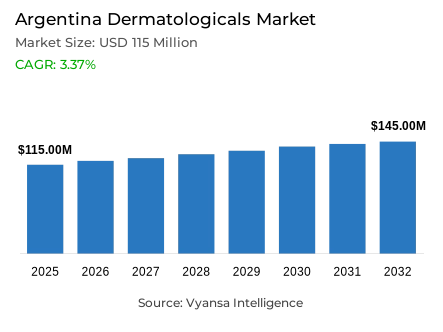

- Dermatologicals in Argentina is estimated at USD 115 million in 2025.

- The market size is expected to grow to USD 145 million by 2032.

- Market to register a cagr of around 3.37% during 2026-32.

- Category Shares

- Topical germicidals/antiseptics grabbed market share of 52%.

- Competition

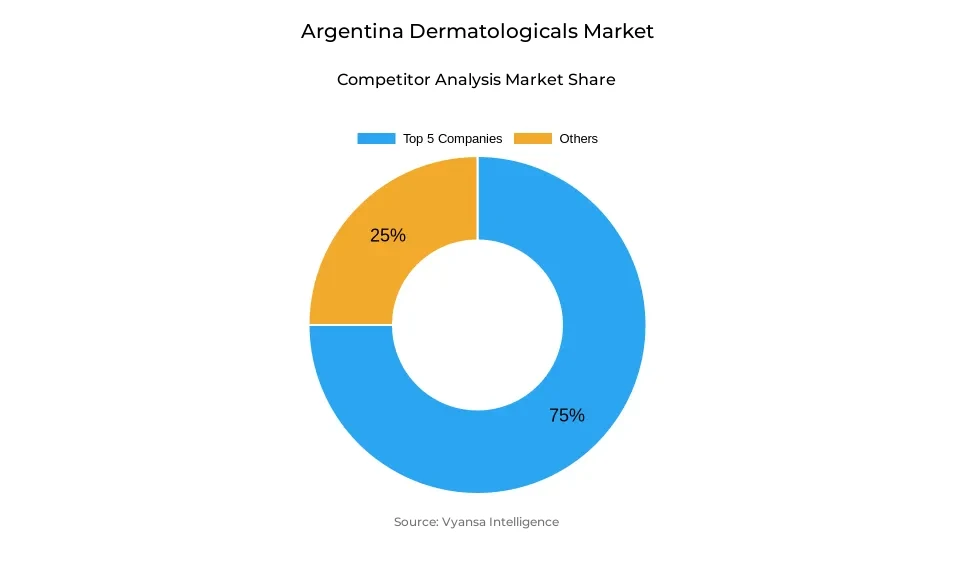

- More than 20 companies are actively engaged in producing dermatologicals in Argentina.

- Top 5 companies acquired around 75% of the market share.

- Reckitt Benckiser Argentina SA; Formulab SA; Mega Labs Argentina SAU; Laboratorio Elea SACIF; Bayer Argentina SA etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 70% of the market.

Argentina Dermatologicals Market Outlook

The Argentinia dermatologicals market reflects a steady growth trend towards 2032, supported by progressive economic stabilization and expanding end users adoption of specialized dermatological interventions. The market value has reached USD 115 million in 2025, which is projected to grow further to reach approximately USD 145 million by 2032, indicating a CAGR of about 3.37%. The middle and high-income households form the main demand segments. They display consistent integration of dermatological products into routine healthcare applications. Topical germicidals and antiseptics maintain leading positions with a market share of about 52% due to established brand equity and high household penetration.

However, the retail infrastructure evolution will take a prime role in shaping market development during the forecast period. Retail offline channels hold a 70% distribution share in retail, and major chains are adopting intensive network expansion strategies with strategic acquisitions and innovative store formats. Supporting this centrality of pharmacies are regulatory inhibitions to online pharmaceutical sales of OTC molecules. This encourages manufacturers to explore investment avenues in increasing in-store visibility, building professional counseling infrastructure, and impulse merchandising. Meanwhile, direct selling channels will also gain incremental share due to advantages in operation costs and flexible distribution models.

Product innovation is the main growth driver during the 2026-2032 timeframe. Companies tend to focus on various high-growth areas such as nappy rash treatments, antiparasitic/lice formulation, antipruritics, and hemorrhoid care. Climate-related demand factors—such as temperature rise, increases in moisture levels, and heightening mosquito-borne diseases—will continue the growth of the germicidal and antipruritic category at regular market momentum.

Hair-loss therapeutics present the most exciting opportunity category throughout the forecast period. Increased end users awareness, greater product availability, and sustained new launches targeted at both male and female segments will drive significant demand acceleration. As pharmaceutical labs continue to develop their formulation technologies and expand their product ranges, hair-loss treatments are set to become the most dynamic growth category, underpinning the fundamental performance of Argentina's dermatologicals market

Argentina Dermatologicals Market Growth Driver

Economic stabilisation and recovering middle- and high-income spending underpin dermatologicals recovery

The Argentinea dermatologicals market witnessed strong current value growth in 2025, bolstered by macroeconomic stabilisation and the resumption of discretionary spending across affluent end users groups. According to the International Monetary Fund, real GDP growth of 4.5% is forecast for Argentina in 2025, underpinned by improving economic fundamentals that support non-essential healthcare expenditure among middle and high-income groups.

However, the market operates within a complex inflationary environment, with the IMF forecasting end users-price inflation of 41.3% for 2025. This dual dynamic of solid GDP expansion, combined with persistent price pressures, generated pronounced demand segmentation. Premium segments with expanded product portfolios captured disproportionate gains for manufacturers targeting them, while price-sensitive households continued prioritizing essential categories.

Argentina Dermatologicals Market Challenge

Persistent inflation and uneven labour-market recovery constrain broad-based category expansion

Despite value-growth momentum, structural macroeconomic constraints limit comprehensive market penetration across socioeconomic strata. According to Economy.com, the unemployment rate in Argentina reached approximately 7.6% in Q2 2025, underlining continued labour-market vulnerability that restrains discretionary healthcare spending among lower-income segments. At the same time, persistent inflationary pressures—despite disinflation trajectories that were expected according to the analyst surveys by Reuters—keep price sensitivity pronounced and foster downward trading.

These conditions present dual operational challenges for dermatological manufacturers: firstly, the difficulty of converting casual purchasers into consistent repeat buyers in conditions of unstable disposable income patterns and, secondly, how to manage complex pricing architectures balancing affordability imperatives with margin preservation against sustained input-cost pressures, particularly affecting mid-to-lower price competitors.

Argentina Dermatologicals Market Trend

Therapeutic demand shifts toward hair-loss and antiparasitic treatments amid public-health

Product-category dynamics reflect significant growth in hair-loss therapeutics and antiparasitic/antipruritic segments impelled by both clinical and epidemiological factors. Vector-borne disease activity in regional areas, especially high incidents of dengue as reported in different bulletins from the Pan American Health Organization and various Ministries of Health, have strongly increased demand for antiparasitic and antipruritic remedies to meet public-health needs.

At the same time, post-pandemic clinical observations, as noted in the literature within PMC, record increased hair-loss presentations post-SARS-CoV-2 infection, driving end users interest in hair-regrowth formulations. This is bringing manufacturers together to shift their attention toward offering therapeutically positioned, clinically validated dermatological solutions rather than just cosmetic ones, with extended portfolios to include topical antiseptics, antiparasitic treatments, and evidence-based hair-loss therapeutics.

Argentina Dermatologicals Market Opportunity

Concentration in the pharmacy network and macro recovery create a platform for premiumisation and innovation

A consolidated pharmacy distribution infrastructure in Argentina, added to favourable macroeconomic projections, sets up very compelling growth platforms for premium dermatological innovations. For 2025, the OECD forecasts that GDP growth in Argentina will reach about 5.2%, reflecting strengthening private consumption and investment capacity supportive of higher-value product launches and portfolio premiumization strategies.

The healthcare ecosystem in Argentina shows higher engagement propensity, informed by WHO datadot, which reports current health expenditure of about 9.7% of GDP, indicating population receptivity to clinically positioned dermatological interventions. These structural advantages favor manufacturers investing in evidence-based product innovation-particularly in the categories of hair-loss therapeutics, climate-adaptive antipruritics, and antiparasitic categories-complemented by clinical communication strategies and targeted pharmacy-channel merchandising to capture the middle- and high-income end users segments.

Argentina Dermatologicals Market Segmentation Analysis

By Category

- Medicated Shampoos

- Topical Antifungals

- Vaginal Antifungals

- Hair Loss Treatments

- Nappy (Diaper) Rash Treatments

- Antiparasitics/Lice (Head and Body) Treatments

- Antipruritics

- Cold Sore Treatments

- Haemorrhoid Treatments

- Paediatric Dermatologicals

- Topical Allergy Remedies/Antihistamines

- Topical Germicidals/Antiseptics

The segment with highest market share under category is Topical Germicidals/Antiseptics, holding about 52% of the market. This is because Argentina has been highly exposed to dermatological infections and hygiene-sensitive conditions due to its warm and humid climatic patterns in many provinces. According to the documentation by the WHO, the growing incidence of mosquito-borne diseases and skin pathologies further increases demand for antiseptics and germicidal solutions as a means of preventive healthcare.

This is further driven by an advanced urbanisation rate of about 92%, according to the World Bank, which amplifies category penetration due to concentrated pharmacy infrastructure and access to healthcare. Changes in behavior associated with heightened hygiene brought about post-pandemic have institutionalized the use of germicidal products, making this category the main driver of demand through 2032 in Argentina's dermatologicals landscape.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under sales channel is retail offline channels, with about 70% of dermatological distribution. This is due to the fact that Argentina's pharmaceutical regulatory framework prohibits free online distribution of OTC dermatological products. Its large network of pharmacies—about 13,000 establishments according to a report by the Embassy of India's Pharmaceutical Sector in Argentina, 2024—serves to offer full physical access and further solidifies preferences for face-to-face transactions.

This extensive offline infrastructure guarantees convenience and consumer confidence, especially in large metropolitan markets such as Buenos Aires, Córdoba, Santa Fe, and Mendoza. PAHO regional analysis confirms that throughout Latin America, pharmacies are the first-order distribution channel for OTC and semi-regulated health products, ratifying Argentina's offline retail dominance. While pharmacy chains increasingly modernize and dedicate shelf space to specialized dermatology merchandising sections, offline retail is forecast to remain the leading distribution channel

List of Companies Covered in Argentina Dermatologicals Market

The companies listed below are highly influential in the Argentina dermatologicals market, with a significant market share and a strong impact on industry developments.

- Reckitt Benckiser Argentina SA

- Formulab SA

- Mega Labs Argentina SAU

- Laboratorio Elea SACIF

- Bayer Argentina SA

- Laboratorios Gramon Millet SA

- Laboratorios Andrómaco SA

- Genomma Laboratories Argentina SA

- Laboratorio EJ Gezzi

- Pierre Fabre Dermo Cosmetique SA

Competitive Landscape

Argentina dermatologicals market competitive landscape in 2025 is characterized by marked concentration among a few domestic pharmaceutical laboratories that have consolidated their positions through selective acquisitions, aggressive brand building, and targeted portfolio expansion. Laboratorio Elea SACIF y A leads the market, its position significantly strengthened by the acquisition of Laboratorio Phoenix and with the purchase of rights to Adermicina A, while also maintaining heavy advertising support for Pervinox and ongoing innovation in its Nopucid franchise to further entrench its position in germicidal, antiparasitic, and nappy rash categories. Laboratorios Gramon Millet SA was the most dynamic competitor in 2025, gaining share through its well-established brand franchises such as Merthiolate, Merthiolate Bebé, and Hexa-Defital NF across various therapeutic categories. While pharmacies continue to be the core distribution channel for dermatologicals, the consolidation of major chains-most notably Farmacity, FarmaPlus, and Open Farma-has increased competition for premium shelf exposure. Meanwhile, direct-selling brands such as Herbalife and Omnilife took incremental share operating outside of traditional retail structures and offering flexible purchase options that appeal to price-conscious consumers facing ongoing inflationary pressures.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Argentina Dermatologicals Market Policies, Regulations, and Standards

4. Argentina Dermatologicals Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Argentina Dermatologicals Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Medicated Shampoos- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Topical Antifungals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Vaginal Antifungals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Hair Loss Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Nappy (Diaper) Rash Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Antiparasitics/Lice (Head and Body) Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Antipruritics- Market Insights and Forecast 2022-2032, USD Million

5.2.1.8. Cold Sore Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.9. Haemorrhoid Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.10. Paediatric Dermatologicals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.11. Topical Allergy Remedies/Antihistamines- Market Insights and Forecast 2022-2032, USD Million

5.2.1.12. Topical Germicidals/Antiseptics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Dispensing Status

5.2.2.1. Prescription-based Drugs- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Over-the-counter Drugs- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Route of Administration

5.2.3.1. Topical Administration- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Oral Administration- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Parenteral Administration- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Drug Type

5.2.4.1. Branded- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Generics- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Skin Condition

5.2.5.1. Acne- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Dermatitis- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Psoriasis- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Skin Cancer- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Rosacea- Market Insights and Forecast 2022-2032, USD Million

5.2.5.6. Alopecia- Market Insights and Forecast 2022-2032, USD Million

5.2.5.7. Fungal Infections- Market Insights and Forecast 2022-2032, USD Million

5.2.5.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Hospitals- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Cosmetic Centers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Dermatology Clinics- Market Insights and Forecast 2022-2032, USD Million

5.2.6.4. Homecare- Market Insights and Forecast 2022-2032, USD Million

5.2.6.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Argentina Medicated Shampoos Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Argentina Topical Antifungals Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Argentina Vaginal Antifungals Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Argentina Hair Loss Treatments Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Argentina Nappy (Diaper) Rash Treatments Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Argentina Antiparasitics/Lice (Head and Body) Treatments Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Argentina Antipruritics Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

12.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

12.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Argentina Cold Sore Treatments Market Statistics, 2022-2032

13.1. Market Size & Growth Outlook

13.1.1. By Revenues in USD Million

13.2. Market Segmentation & Growth Outlook

13.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

13.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

13.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

13.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

13.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

14. Argentina Haemorrhoid Treatments Market Statistics, 2022-2032

14.1. Market Size & Growth Outlook

14.1.1. By Revenues in USD Million

14.2. Market Segmentation & Growth Outlook

14.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

14.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

14.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

14.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

14.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

14.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

15. Argentina Paediatric Dermatologicals Market Statistics, 2022-2032

15.1. Market Size & Growth Outlook

15.1.1. By Revenues in USD Million

15.2. Market Segmentation & Growth Outlook

15.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

15.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

15.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

15.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

15.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

15.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

16. Argentina Topical Allergy Remedies/Antihistamines Market Statistics, 2022-2032

16.1. Market Size & Growth Outlook

16.1.1. By Revenues in USD Million

16.2. Market Segmentation & Growth Outlook

16.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

16.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

16.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

16.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

16.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

16.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

17. Argentina Topical Germicidals/Antiseptics Market Statistics, 2022-2032

17.1. Market Size & Growth Outlook

17.1.1. By Revenues in USD Million

17.2. Market Segmentation & Growth Outlook

17.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

17.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

17.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

17.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

17.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

17.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

18. Competitive Outlook

18.1. Company Profiles

18.1.1. Laboratorio Elea SACIF y A

18.1.1.1. Business Description

18.1.1.2. Product Portfolio

18.1.1.3. Collaborations & Alliances

18.1.1.4. Recent Developments

18.1.1.5. Financial Details

18.1.1.6. Others

18.1.2. Bayer Argentina SA

18.1.2.1. Business Description

18.1.2.2. Product Portfolio

18.1.2.3. Collaborations & Alliances

18.1.2.4. Recent Developments

18.1.2.5. Financial Details

18.1.2.6. Others

18.1.3. Laboratorios Gramon

18.1.3.1. Business Description

18.1.3.2. Product Portfolio

18.1.3.3. Collaborations & Alliances

18.1.3.4. Recent Developments

18.1.3.5. Financial Details

18.1.3.6. Others

18.1.4. Laboratorios Andrómaco SA

18.1.4.1. Business Description

18.1.4.2. Product Portfolio

18.1.4.3. Collaborations & Alliances

18.1.4.4. Recent Developments

18.1.4.5. Financial Details

18.1.4.6. Others

18.1.5. Genomma Laboratories Argentina SA

18.1.5.1. Business Description

18.1.5.2. Product Portfolio

18.1.5.3. Collaborations & Alliances

18.1.5.4. Recent Developments

18.1.5.5. Financial Details

18.1.5.6. Others

18.1.6. Reckitt Benckiser Argentina SA

18.1.6.1. Business Description

18.1.6.2. Product Portfolio

18.1.6.3. Collaborations & Alliances

18.1.6.4. Recent Developments

18.1.6.5. Financial Details

18.1.6.6. Others

18.1.7. Formulab SA

18.1.7.1. Business Description

18.1.7.2. Product Portfolio

18.1.7.3. Collaborations & Alliances

18.1.7.4. Recent Developments

18.1.7.5. Financial Details

18.1.7.6. Others

18.1.8. Mega Labs Argentina SAU

18.1.8.1. Business Description

18.1.8.2. Product Portfolio

18.1.8.3. Collaborations & Alliances

18.1.8.4. Recent Developments

18.1.8.5. Financial Details

18.1.8.6. Others

18.1.9. Laboratorio EJ Gezzi

18.1.9.1. Business Description

18.1.9.2. Product Portfolio

18.1.9.3. Collaborations & Alliances

18.1.9.4. Recent Developments

18.1.9.5. Financial Details

18.1.9.6. Others

18.1.10. Pierre Fabre Dermo Cosmetique SA

18.1.10.1.Business Description

18.1.10.2.Product Portfolio

18.1.10.3.Collaborations & Alliances

18.1.10.4.Recent Developments

18.1.10.5.Financial Details

18.1.10.6.Others

19. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Dispensing Status |

|

| By Route of Administration |

|

| By Drug Type |

|

| By Skin Condition |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.