India Fire Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (Overhung Pumps, Vertical Inline, Horizontal End Suction), Split Case Pumps (Single/Two Stage, Multi Stage)), Positive Displacement Pumps (Diaphragm Pumps, Piston Pumps), By Mode of Operation (Diesel Fire Pump, Electric Fire Pump, Others), By End-User (Residential, Commercial, Industrial)

- Energy & Power

- Feb 2026

- VI0503

- 125

-

India Fire Pump Market Statistics and Insights, 2026

- Market Size Statistics

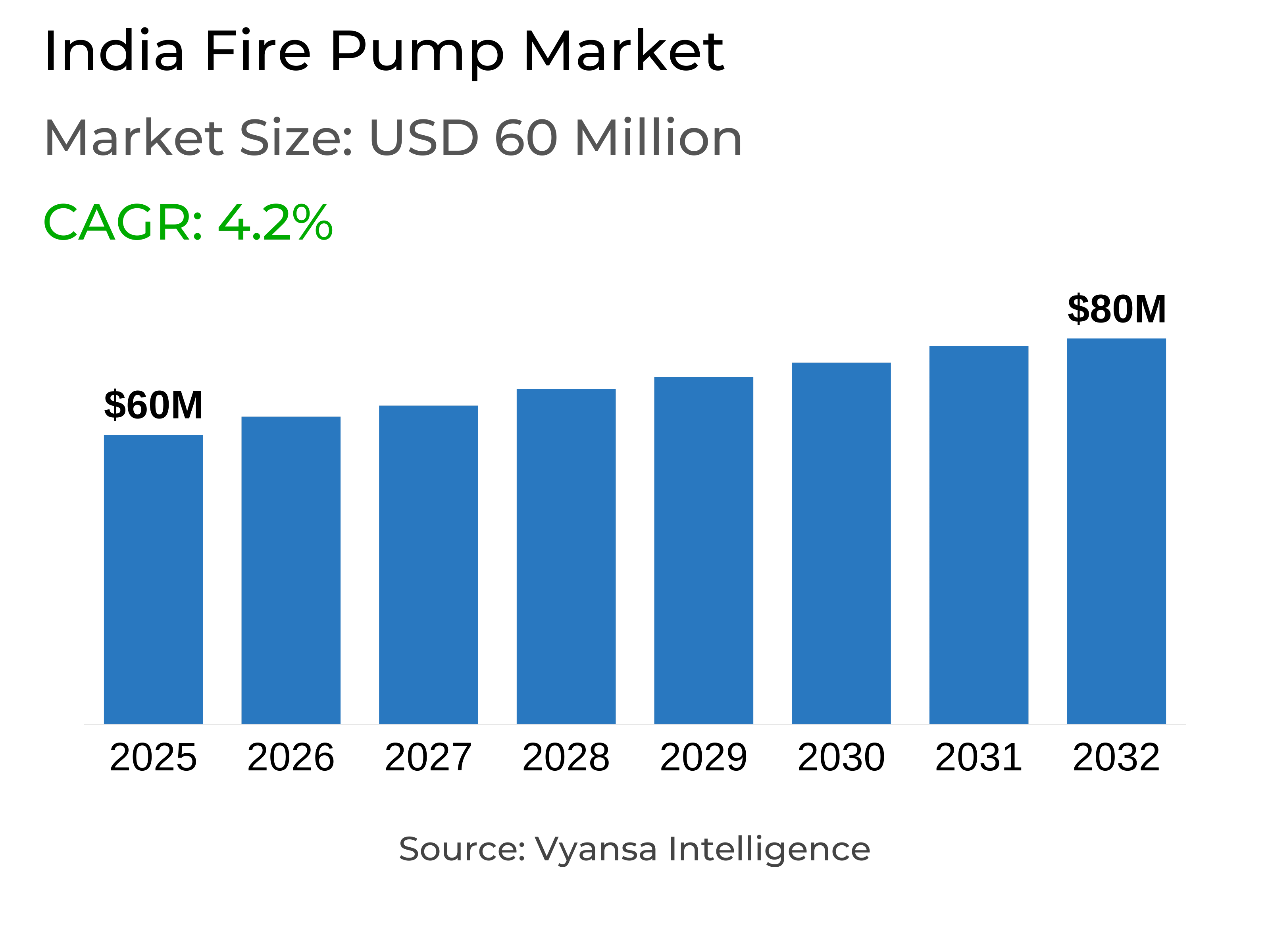

- Fire Pump in India is estimated at $ 60 Million.

- The market size is expected to grow to $ 80 Million by 2032.

- Market to register a CAGR of around 4.2% during 2026-32.

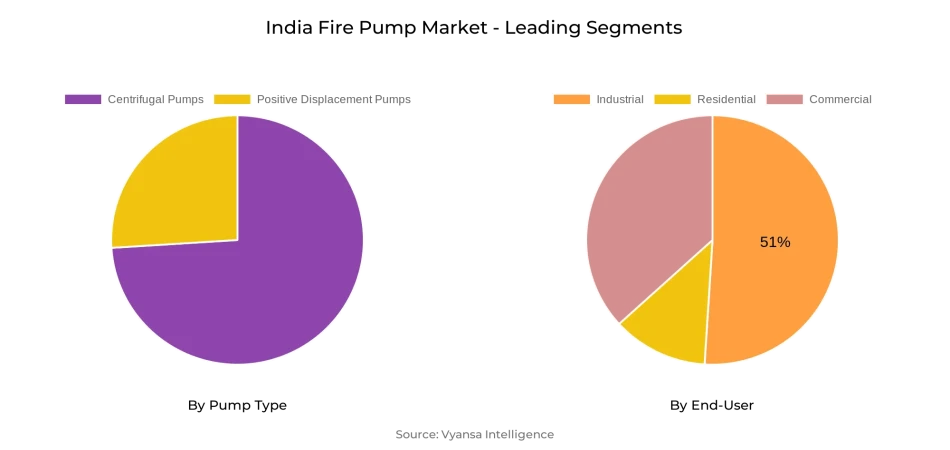

- Pump Type Segment

- Centrifugal Pumps continues to dominate the market.

- Competition

- More than 10 companies are actively engaged in producing Fire Pump in India.

- Top 5 companies acquired the maximum share of the market.

- WILO SE, Ebara Corporation, ITT Goulds Pumps, Flowserve Corporation, Pentair PLC etc., are few of the top companies.

- End-User

- Industrial grabbed 51% of the market.

India Fire Pump Market Outlook

The India fire pump market is picking up strong pace with increased industrial accidents, increasing urbanization, and expanding infrastructure projects. With the number of worker deaths in chemical plants and more than 130 significant chemical accidents within two years, the need for sophisticated fire safety systems has become urgent. The market for India fire pumps is worth USD 60 million in 2025 and is expected to reach USD 80 million by 2032, with steady demand over the forecast period.

Industrial applications continue to be the biggest driver of market growth at 51% of overall installations. Markets like chemicals, power generation, automotive, and oil & gas rely significantly on dependable pumping systems to address safety regulations and minimize operational risks. Centrifugal pumps lead the technology, popular for their toughness, energy efficiency, and capacity to handle gigantic industrial and municipal applications with little need for maintenance.

The construction industry also fuels demand, with India's big push for infrastructure under the Smart Cities Mission, metro rail expansions, and airport development projects. Government capital spending, representing 3.4% of GDP in FY 2024–25, guarantees recurring investment in advanced fire protection equipment. This is also in sync with increasing acceptance in residential projects, where city housing schemes and improving safety consciousness are turning fire pumps into a norm in new complexes.

Advances in technology like IoT-supported monitoring, AI-based detection, and interfacing with smart building systems are redefining the fire safety landscape. They enable predictive maintenance and quicker emergency response, fueling adoption in high-risk buildings. While cost is a deterrent for smaller businesses, regulatory pressures and demand for smart infrastructure mean that fire pump installations will continue to grow steadily till 2032.

India Fire Pump Market Growth Driver

Expanding Industrial Base Strengthens Fire Safety Demand

The fast-paced industrialization of India keeps mounting the call for strong fire safety infrastructure. With more than 6,500 worker deaths in factories across a period of five years and several major chemical disaster incidents, the need for sophisticated protection systems has turned into an imperative. Andhra Pradesh and Tamil Nadu, among other states, have seen over 200 deaths due to major accidents in ten years, the seriousness of which demands the adoption of modern fire prevention practices in factories and chemical complexes. The increasing magnitude and sophistication of industrial activities increase the risk further and necessitate effective suppression systems to make operations robust.

Moreover, a study found more than 130 significant chemical accidents from 2020 to 2022, resulting in 218 fatalities and more than 300 injuries, pointing to critical gaps in fire safety enforcement. Numerous facilities do not have basic measures like functional fire extinguishers, firefighting equipment, and compulsory No-Objection Certificates. India also has fewer than 40% of necessary urban fire stations, with consequent long response delays in emergencies. This shortage considerably increases the uptake of fire pumps and associated safety measures to fill infrastructure gaps.

India Fire Pump Market Challenge

Persistent Barriers in Compliance and Implementation

Not withstanding the existence of regulatory policies such as the National Building Code 2016, enforcement is still inconsistent across industries and states. Regular safety audits are not done, and violations often attract penalties that are too small to induce compliance. Several establishments have poor compliance with minimum standards, with regulatory agencies often not having the necessary manpower and technical training to conduct inspections efficiently. This leads to uneven usage of fire safety systems, particularly in highly populated urban and semi-urban areas.

Another hindrance is the cost of installation, which deters adoption by smaller firms and residential schemes. The initial investment costs and intricate system integration limit entry, especially for price-sensitive segments. In addition, supply chain disturbances have tempered year-after-year market growth to approximately 6% according to the U.S. International Trade Commission. Manufacturers then have to strike a balance between affordability and sophisticated technology features since low-cost substitutes tend to sacrifice reliability and efficiency. This leaves a market void that continues to constrain the penetration of high-quality fire pump systems.

India Fire Pump Market Trend

Integration of Smart Technology Reshaping Market Landscape

India's fire safety infrastructure is facing a technological upsurge through the use of Internet of Things (IoT), artificial intelligence (AI), and smart building automation. IoT-based fire detection and suppression systems offer predictive analytics and real-time notifications, lowering response times drastically in the event of an emergency. Highly developed systems now have the capability of sensing minute changes in the environment and sending automated notifications to fire stations and building administrators, enhancing protection levels in high-risk sectors.

Smart fire safety solutions market is growing at a rate of 20–25% annually, backed by the government's smart city initiatives and private sector investments in state-of-the-art infrastructure. AI-based fire detection systems based on pattern recognition and thermal imaging technologies are being widely used for early detection. Wireless fire alarm systems are also becoming popular with ease of installation and reduced maintenance expenses. Incorporation of these technologies with centralized building management systems is revolutionizing emergency readiness and facilitating synchronized responses in times of crisis.

India Fire Pump Market Opportunity

Infrastructure Expansion Creates Growth Opportunities

India's massive infrastructure development projects are creating substantial opportunities for fire safety equipment suppliers. ₹11.11 lakh crore of capital expenditure has been allocated by the government for FY 2024–25, or 3.4% of GDP, which will likely pick up fire safety system installations in new projects. The Smart Cities Mission itself has invested ₹1,44,237 crore such that advanced fire protection mechanisms are imbedded into urban infrastructure. These advancements generate recurring demand for high-tech fire pumps and monitoring solutions.

The building industry, estimated to grow to USD 1,031.71 billion by 2030, continues to be one of the key drivers of fire safety acceptance. Building infrastructure commands high market shares, with support from high-value initiatives like the Delhi-Mumbai Expressway, metro connectivity, and building 20 airports under UDAN 4.0. All these projects require end-to-end fire safety infrastructure, laying high growth opportunities for manufacturers, system integrators, and related services providers during the forecast period.

India Fire Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- Positive Displacement Pumps

Centrifugal pumps remain the technology leaders, fueled by their efficiency, endurance, and broad usage in industrial processes. Their high flow rate and moderate-to-high pressure handling capabilities make them a necessity for high-capacity fire protection systems, whether in chemical facilities, power plants, or municipal water supply systems. Their ease of installation and low maintenance further add to their popularity, with them being the go-to option compared to positive displacement pumps.

Mechanical efficiency also plays its part in their dominant market share because centrifugal pumps break down less frequently due to fewer moving parts, thus minimizing downtime. The growing power generation industry underpins their continued dominance, with India's thermal power capacity exceeding 237.26 GW as of June 2023. Centrifugal pumps have large-scale cooling water circulation and strong fire suppression systems required by these facilities to maintain their leadership in both industrial and infrastructural applications.

By End-User

- Residential

- Commercial

- Industrial

Industrial uses comprise 51% of all fire pump installations, and thus this category is the market's leading source of demand. Industrial applications like chemicals, power generation, automotive, and oil & gas depend significantly on strong fire protection systems to secure business continuity and regulatory compliance. High accident risk and stringent industry-specific safety standards compel plant owners and manufacturers to invest in highly technical pumping solutions that are capable of meeting high-volume and high-pressure requirements.

The residential segment, although smaller in size, is turning out to be the quickest-growing end-user segment, with a 3.11% CAGR. Growth is catalyzed by trends in urbanization, escalating awareness of safety, and government-sponsored housing programs such as the Pradhan Mantri Awas Yojana, which requires fire safety installations in sanctioned projects. With new residential projects spreading wide in Tier 1 and Tier 2 cities, fire pump uptake in residential complexes will also gain traction, backed by the robust industrial base.

Top Companies in India Fire Pump Market

The top companies operating in the market include WILO SE, Ebara Corporation, ITT Goulds Pumps, Flowserve Corporation, Pentair PLC, Sulzer Limited, Grundfos Holding A/S, KSB SE & Co. KGaA, Patterson (Gorman Rupp), Armstrong, etc., are the top players operating in the India Fire Pump Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. India Fire Pump Market Policies, Regulations, and Standards

4. India Fire Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. India Fire Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.1. Overhung Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.2. Vertical Inline- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.3. Horizontal End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.1. Single/Two Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.2. Multi Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Diaphragm Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Piston Pumps - Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Mode of Operation

5.2.2.1. Diesel Fire Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Electric Fire Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End-User

5.2.3.1. Residential- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Commercial- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Industrial- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. India Centrifugal Fire Pump Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Mode of Operation- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End-User- Market Insights and Forecast 2022-2032, USD Million

7. India Positive Displacement Fire Pump Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Mode of Operation- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End-User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Flowserve Corporation

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Pentair PLC

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Sulzer Limited

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Grundfos Holding A/S

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.KSB SE & Co. KGaA

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.WILO SE

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Ebara Corporation

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.ITT Goulds Pumps

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Patterson (Gorman Rupp)

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Armstrong

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Mode of Operation |

|

| By End-User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.