India Diabetes Monitoring Devices Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Self-Monitoring Blood Glucose (SMBG) Devices (Blood Glucose Meters, Testing Strips, Lancets & Lancing Devices), Continuous Glucose Monitoring (CGM) Devices (Sensors (Disposable Sensors, Reusable Sensors), Transmitters, Receivers)), Testing Site (Fingertip Testing, Alternate Site Testing), Application (Type 2 Diabetes, Type 1 Diabetes, Gestational Diabetes, Prediabetes Monitoring), Patient Care Setting (Hospitals & Clinics, Home-Care Settings, Diagnostic Centers, Diabetes Specialty Centers), Sales Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Diabetes Clinics / Direct Sales), End User (Pediatric / Adolescent Patients (0-17 years), Adults (18-59 years), Geriatric Patients (60 years and above))

- Healthcare

- Jan 2026

- VI0719

- 130

-

India Diabetes Monitoring Devices Market Statistics and Insights, 2026

- Market Size Statistics

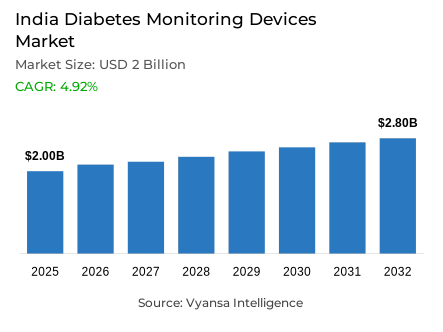

- Diabetes monitoring devices in India is estimated at USD 2 billion in 2025.

- The market size is expected to grow to USD 2.8 billion by 2032.

- Market to register a cagr of around 4.92% during 2026-32.

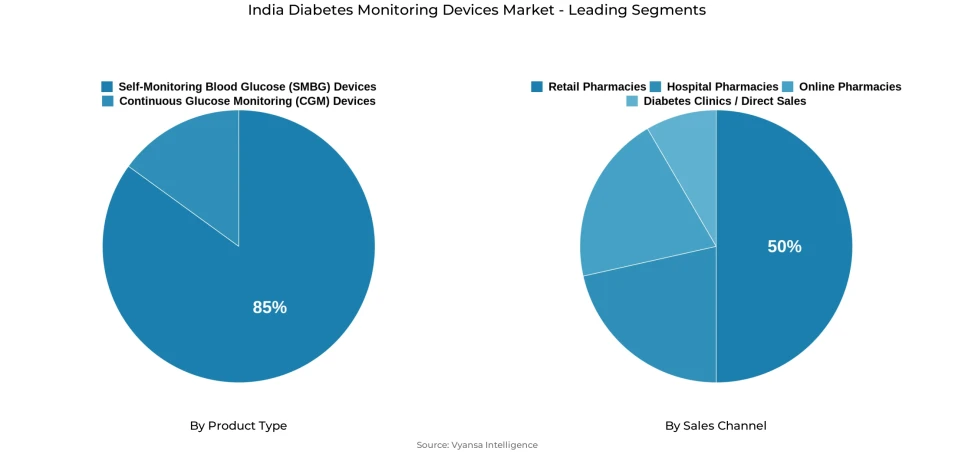

- Product Type Shares

- Self-monitoring blood glucose (smbg) devices grabbed market share of 85%.

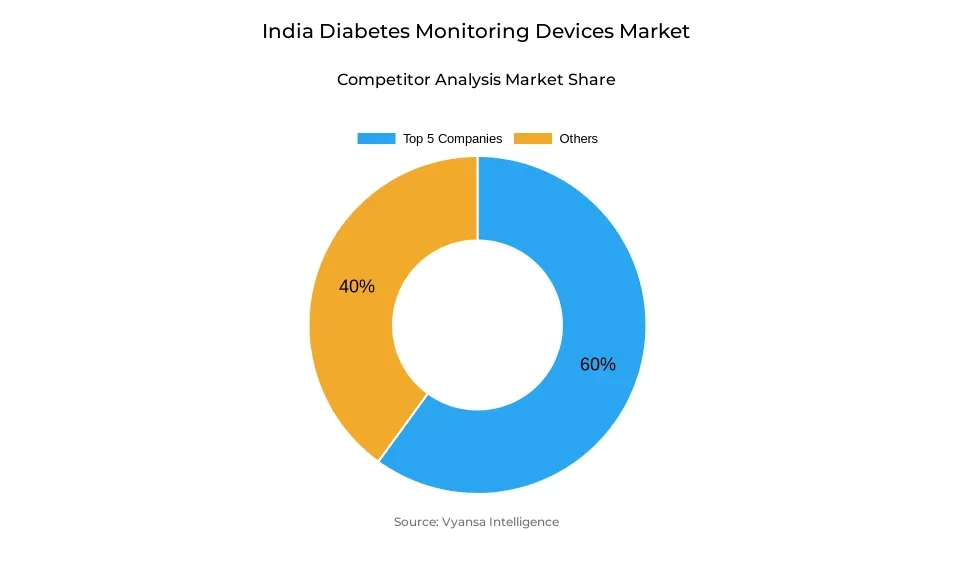

- Competition

- More than 20 companies are actively engaged in producing diabetes monitoring devices in India.

- Top 5 companies acquired around 60% of the market share.

- LifeScan Inc.; Arkray Inc.; i-SENS Inc.; Abbott Laboratories; Roche Diabetes Care AG etc., are few of the top companies.

- Sales Channel

- Retail pharmacies grabbed 50% of the market.

India Diabetes Monitoring Devices Market Outlook

The India Diabetes Monitoring Device Market is projected to grow from $2 billion at the end of 2025, to $2.8 billion by the end of 2032, resulting in a Compound Annual Growth Rate (CAGR) of 4.92% from 2026 to 2032. The number of diabetes cases in India has increased rapidly, with an estimated 89.8 million adults (10.5% of the adult population) affected by diabetes in 2024. Numerous initiatives by the Indian government, including the Ayushman Bharat Digital Mission, eSanjeevani Telemedicine Services and government-funded structured screening programs, support the use of Diabetes Monitoring Devices by assisting end users in monitoring their condition, adhering to prescribed treatments, and living a healthy lifestyle. The overall market for Diabetes Monitoring Devices is increasing because of these efforts and increased awareness of diabetes, as well as the availability of early detection programs for individuals.

The Self-Monitoring Blood Glucose (SMBG) device is the dominant Diabetes Monitoring Device category in terms of market share, with approximately 85% of the market. SMBG devices are currently the most clinically proven and cost effective method for patients to monitor their blood glucose levels in the convenience of their own homes. While CGM systems and Non-Invasive devices are gaining popularity in the market, their market share is limited due to their cost and lack of reimbursement options. However, the future of CGM and Non-Invasive devices will continue to grow in market share as India expands its Digital Health Infrastructure and provides government support for diabetes management programs and the future of Diabetes Monitoring Devices in India will likely continue to be SMBG devices.

Given the number of challenges experienced by rural areas, diabetes management is often a struggle for people in rural communities. Many rural residents lack access to health care services, have few specialists available, and have difficulty traveling long distances for appointments, in addition to facing high out-of-pocket costs. Only 39% of rural residents have nearby diagnostic facilities and only 12.2% of rural residents have access to subsidized medicines. The implementation of telemedicine and Digital Health Initiatives (e.g. Ayushman Bharat) will address many of the gaps in diabetes management in under-served rural communities, allowing for more opportunities for rural residents to obtain Diabetes Monitoring Devices.

Retail Pharmacies are currently the largest channel of sales for Diabetes Monitoring Devices, accounting for 50% of total sales in this market. The reason that retail pharmacies are the leading sales channel for Diabetes Monitoring Devices is the widespread availability of retail pharmacies, the long-standing relationships that retail pharmacies build with their end-users and the fact that retail pharmacies consistently carry SMBG consumables. Ayurman Bharat and Jan Aushadhi programs further support the retail pharmacy channel by offering easy access to Diabetes Monitoring Devices for both urban and rural populations. Additionally, increased support for digital health initiatives and growing government awareness and assistance in India are expected to result in continued growth of the Diabetes Monitoring Device Market between 2026 and 2032.

India Diabetes Monitoring Devices Market Growth DriverEscalating Diabetes Prevalence Driving Device Adoption

According to 2024 estimates, the number of adults in India aged 20 to 79 years (with 89.8 million cases) suffering from diabetes will reach 10.5 per cent of total adult population. The number of diabetes patients in India has increased from 61.3 million in 2011 to an anticipated 156.7 million cases by 2050. In addition, 43 per cent (approximately 38.6 million) of those who have diabetes have not yet been diagnosed, highlighting the urgency of monitoring and early detection.

The increasing prevalence of diabetes in India has created an increased need for systems that allow for effective monitoring and early detection of the disease. The need for proactive management and compliance with treatment protocols will increase the demand for diabetes monitoring services, while Government initiatives aimed at providing access to preventative screenings and early detection of diabetes provide additional incentives for patients. In addition, the Ayushman Bharat Digital Mission (ABDM) has resulted in over 73 crore (730 million) Individualised Health Accounts (IHAs) for patients and registration of over 5 lakh (500,000) healthcare professionals, as well as the use of eSanjeevani telemedicine service providing 276 million consultations primarily focusing on diabetes and hypertension. Both of these Government Programs will provide the largest available addressable market for the development of SMBG Devices and other diabetes monitoring solutions. These Government initiatives provide support for SMEs to provide end-users with improved tools to manage their diabetes.

India Diabetes Monitoring Devices Market ChallengeLimited Rural Healthcare Infrastructure Restricting Device Uptake

Urban-rural disparities in healthcare access represent the largest constraint on the India Diabetes Monitoring Devices market. An ongoing shortage of specialists is evidenced by the number of full-time specialists working in Rural Community Health Centres (CHCs), as of March 2023 there were only 4,413 in operation versus a requirement for 21,964; a shortfall of 79.9%. Due to the specialist shortage, the effectiveness of utilisation is limited by the inability to provide patients with adequate education, clinical support, and follow-up care, which are necessary for successful device utilisation. Additionally, diagnostic resources can only be accessed by 39% of the rural population within a reasonable distance from their homes and only 12.2% received subsidised medicines, resulting in less than optimal opportunity to continue, or initiate, the use of these devices.

Surgeons, paediatricians, and physicians are all lacking trained professionals; in fact, surgeons have an 83.3% shortage, paediatricians have an 80.5% shortage, and physicians have a 69% shortage. Travel distances to medical care is immense; almost 86% of all medical visits are greater than 100 km and the financial burden placed upon rural households is compounded by their limited insurance coverage (50% of rural households have insurance). The above constraints limit device utilisation and management of patients in rural areas and therefore limit the opportunities to expand the market into these underserved areas.

India Diabetes Monitoring Devices Market TrendExpansion of Digital Health Infrastructure Enabling Remote Monitoring

As the digital health ecosystem in India grows, the adoption of connected diabetes monitoring devices is increasing. By January 2025, there will be over 73 crore ABHA accounts created and greater than five lakh healthcare professionals who have registered, serving as a foundation for device integration. The eSanjeevani platform is just over 276 million consultations with 93% being done through a provider-assisted model, allowing patients with diabetes to manage their condition remotely.

These digital initiatives allow for better engagement between patients and providers, improved continuous monitoring, and integration of telemedicine services. These initiatives through government programs such as the Jan Aushadhi program (which has over 14,000 locations operating) and a large pharmacy retail market provide a strong supply chain to distribute monitoring devices at scale and enable users to receive care from remote locations while adhering to treatment protocols in an ever-connected health ecosystem.

India Diabetes Monitoring Devices Market OpportunityPolicy Support Driving Domestic Manufacturing and Affordability

Numerous government initiatives that have been introduced will provide opportunities to grow the manufacture of Diabetes monitoring devices in India, with the National Medical Device Policy 2023 having put forth as its objective a reduction from the current import dependence (30%) and positioning India as one of the five (5) major Manufacturing Countries of medical devices worldwide. The various initiatives to achieve this include a single-window approach to apply for a manufacturer's licence, financial grants of up to ₹20 crore towards creating common Manufacturing Facilities, a network of Centres of Excellence and R&D support for new Device Development. By developing the Manufacture Industry, these programmes will ultimately contribute to lowering the costs of diabetes monitoring devices to the end user, thus increasing accessibility.

Growth in Investment by Governments in Healthcare has encouraged the use of Diabetes Monitoring Devices. In the 2024-2025 Healthcare Budget of ₹90,958,000,000, the current year's budget represents an increase of 12.96% from last year's Budget, while more than 6.11 million Hospital Admissions have been approved under the Ayushman Bharat Scheme, which will cover approximately 55 million People. Likewise, the Production Linkage Incentive (PLI) Scheme coupled with four (4) Medical Device Parks will generate a strong Manufacture Infrastructure necessary to support the manufacture of cost-effective Diabetes Monitoring Devices, and provide for their availability at all Income Levels, thus inspiring additional Adoption.

India Diabetes Monitoring Devices Market Segmentation Analysis

By Product Type

- Self-Monitoring Blood Glucose (SMBG) Devices

- Continuous Glucose Monitoring (CGM) Devices

Self-Monitoring Blood Glucose (SMBG) devices dominate the India Diabetes Monitoring Devices Market with an 85% share due to their clinical utility, proven efficacy, and widespread familiarity among end users. SMBG devices allow home-based glycemic monitoring, enabling timely interventions and supporting adherence to diabetes management protocols. Their affordability and integration into standard treatment practices across income segments reinforce their market dominance.

Emerging technologies, including Continuous Glucose Monitoring (CGM) systems and non-invasive monitoring solutions, are gaining attention but hold smaller market shares due to higher costs and limited reimbursement. The expansion of digital health infrastructure via ABHA accounts and eSanjeevani telemedicine facilitates remote monitoring and integration of these complementary devices. As affordability improves through domestic manufacturing and government support, demand for diversified monitoring technologies is expected to increase while SMBG devices retain their leadership position.

By Sales Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Diabetes Clinics / Direct Sales

Retail pharmacies lead the sales of diabetes monitoring devices, accounting for 50% of the market share, owing to their broad presence, accessibility, and trusted relationships with end users. They provide immediate availability, personalized guidance, and continuity in supply, especially for SMBG devices requiring frequent replenishment of consumables such as test strips and lancets. This established network ensures devices reach both urban and rural populations effectively.

Government schemes such as Ayushman Bharat, covering 55 crore individuals, and the Jan Aushadhi program, currently operating 14,000 centers with plans to expand to 25,000, strengthen the retail pharmacy ecosystem. Online pharmacies remain secondary due to regulatory limitations and end user preference for immediate access. The entrenched position of retail pharmacies highlights their central role in enabling device accessibility, convenience, and continuity of care for diabetes monitoring across India.

List of Companies Covered in India Diabetes Monitoring Devices Market

The companies listed below are highly influential in the India diabetes monitoring devices market, with a significant market share and a strong impact on industry developments.

- LifeScan Inc.

- Arkray Inc.

- i-SENS Inc.

- Abbott Laboratories

- Roche Diabetes Care AG

- Medtronic plc

- Dexcom Inc.

- Ascensia Diabetes Care Holdings AG

- Terumo Corporation

- Ypsomed Holding AG

Market News & Updates

- Abbott Laboratories, 2025:

Launched the FreeStyle Libre 2 Plus sensor in India on August 20/21 2025, offering automatic glucose readings every minute with scan‑free monitoring via smartphone for adults and children aged 2 and above.

- LifeScan Inc., 2025:

Entered a pre‑arranged Chapter 11 financial restructuring in July 2025 to reduce over 75% of debt, while continuing to serve 20+ million customers across 50+ countries with OneTouch® products and expecting to emerge by end‑2025.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. India Diabetes Monitoring Devices Market Policies, Regulations, and Standards

4. India Diabetes Monitoring Devices Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. India Diabetes Monitoring Devices Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Self-Monitoring Blood Glucose (SMBG) Devices- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Blood Glucose Meters- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Testing Strips- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Lancets & Lancing Devices- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Continuous Glucose Monitoring (CGM) Devices- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Sensors- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.1. Disposable Sensors- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.2. Reusable Sensors- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Transmitters- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Receivers- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Testing Site

5.2.2.1. Fingertip Testing- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Alternate Site Testing- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Application

5.2.3.1. Type 2 Diabetes- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Type 1 Diabetes- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Gestational Diabetes- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Prediabetes Monitoring- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Patient Care Setting

5.2.4.1. Hospitals & Clinics- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Home-Care Settings- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Diagnostic Centers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Diabetes Specialty Centers- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel

5.2.5.1. Hospital Pharmacies- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Retail Pharmacies- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Online Pharmacies- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Diabetes Clinics / Direct Sales- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Pediatric / Adolescent Patients (0-17 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Adults (18-59 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Geriatric Patients (60 years and above)- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. India Self-Monitoring Blood Glucose (SMBG) Devices Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Testing Site- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Patient Care Setting- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

7. India Continuous Glucose Monitoring (CGM) Devices Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Testing Site- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Patient Care Setting- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Abbott Laboratories

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Roche Diabetes Care AG

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Medtronic plc

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Dexcom Inc.

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Ascensia Diabetes Care Holdings AG

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.LifeScan Inc.

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Arkray Inc.

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.i-SENS Inc.

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Terumo Corporation

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Ypsomed Holding AG

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Testing Site |

|

| By Application |

|

| By Patient Care Setting |

|

| By Sales Channel |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.