India Childrenswear Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Apparel (Baby and Toddler Wear, Boys Apparel, Girls Apparel), Footwear (Boys Footwear, Girls Footwear), Accessories (Boys Accessories, Girls Accessories), Others), By Age Group (Infant/Toddler (Below 2 years), Kids/Children (2 - 14 years)), By Price Category (Mass, Premium), By Sales Channel (Retail Offline, Retail Online)

- FMCG

- Feb 2026

- VI0973

- 125

-

India Childrenswear Market Statistics and Insights, 2026

- Market Size Statistics

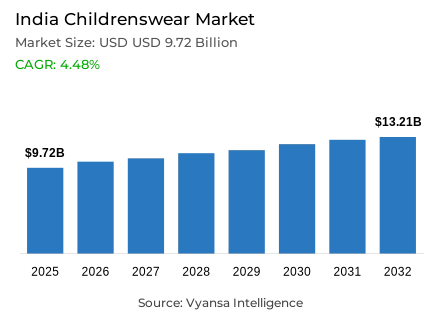

- Childrenswear in India is estimated at USD 9.72 billion in 2025.

- The market size is expected to grow to USD 13.21 billion by 2032.

- Market to register a cagr of around 4.48% during 2026-32.

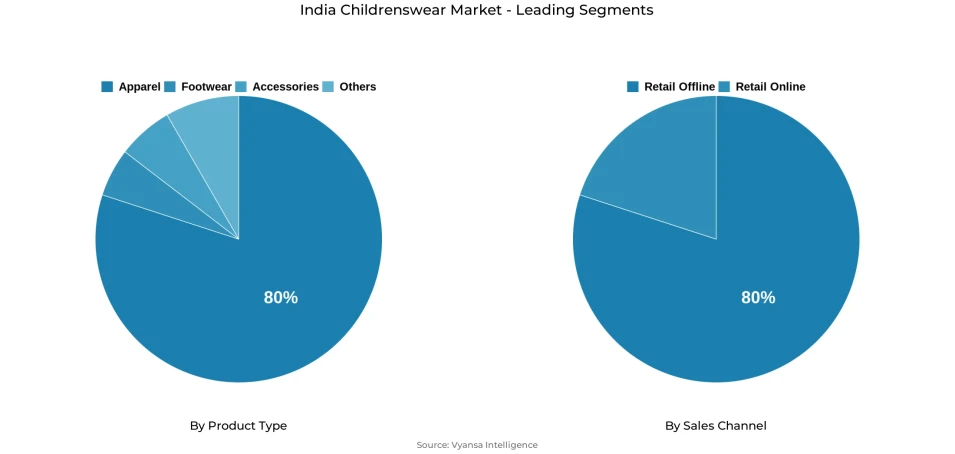

- Product Type Shares

- Apparel grabbed market share of 80%.

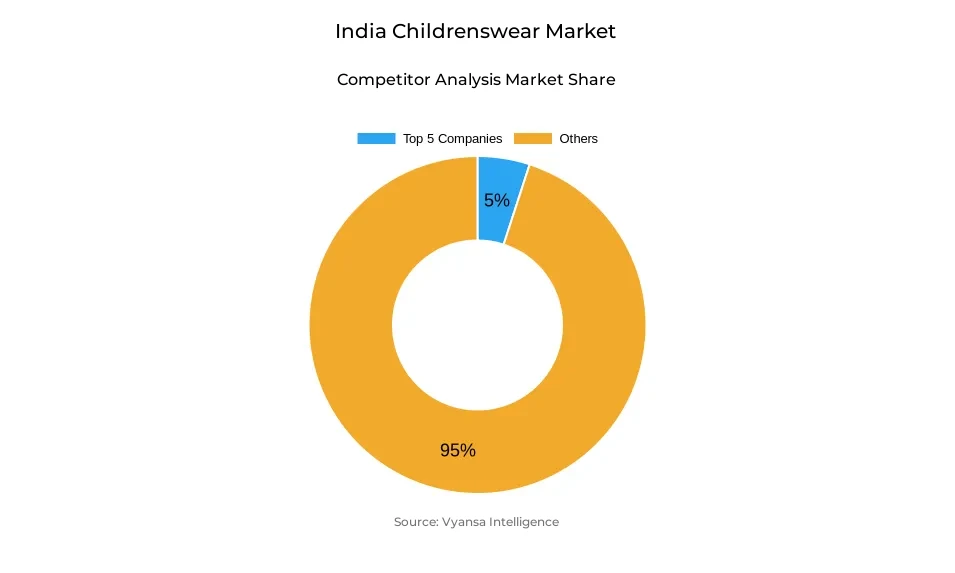

- Competition

- More than 15 companies are actively engaged in producing childrenswear in India.

- The market is highly fragmented, with top 5 companiesholding 5% market share.

- H & M Hennes & Mauritz India Pvt Ltd; Benetton India Pvt Ltd; Tommy Hilfiger Arvind Fashion Pvt Ltd; Lifestyle International Pvt Ltd; Arvind Lifestyle Brands Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 80% of the market.

India Childrenswear Market Outlook

The India childrenswear market is valued at USD 9.72 billion in 2025 and is projected to reach nearly USD 13.21 billion by 2032, registering a compound annual growth rate (CAGR) of about 4.48% during 2026–2032. It remains a robust segment despite the economic conditions that have prevailed, and it performs better compared to other types of garments due to parental spending priorities. Parents now lean towards better, more comfortable, and quality clothes, and this trend has prevailed due to the growing affluence and middle-class families in the urban areas. The most consumed product segment includes garments, contributing about 80% of the market sales.

The market is experiencing the trend of premiumisation. Parents in the city prefer to opt for safe and properly designed clothing made from organic fabrics. Sustainability is also on the rise; direct-to-end user brands such as Kidbea and Greendigo by local brands are promoting environmentally and sustainably manufactured products that are more durable and environmentally friendly too. This change in conscious spending habits displays that India parents are gradually becoming quality-oriented with their spending habits.

Retail offline is leading the sales market with almost 80% market share because parents want to touch and feel the quality and fit of the fabric themselves. But there is also a predicted rise in omnichannel growth because online-first brands such as Ed-a-Mamma and First Cry are launching offline stores. The offline stores act as contact points and facilitate trust with convenience in online shopping and are definitely a sign of moving to a phygital approach for brands.

In the future, the role played by children in the fashion market demand is projected to be more influential. This is because they are or have been exposed to digital technology. Their demand for fashion and character-driven designs is likely to increase. However, a balance would be created in the fashion market demand as parents would demand their own fashion designs, hence influencing the high growth potential exhibited by the childrenswear market in India through to 2032.

India Childrenswear Market Growth Driver

Premiumization and Deliberate Quality Choice

The India childrenswear market is being driven by increasing disposable incomes and changing parental priorities. The young urban families are becoming more and more inclined to high-quality, durable, and safe clothes, focusing on quality and sustainability. Parents are demanding clothes that are made of organic materials and certified materials, and they are shifting their attention to simple multipacks to high-value designs. The World Bank states that India has a GDP per capita growth of 6.5% in 2023, which indicates greater purchasing power of middle-income households.

Also, according to UNICEF, children constitute more than 30% of the total population of India, which supports the existence of a stable long-term demand in childrenswear. This end user power, combined with the increasing wealth, brings about an evident change in the buying behaviour that is no longer price-based but value-driven. The emphasis on safety, sustainability, and design-led apparel by parents, backed by increasing incomes and a high number of children, drives ongoing premiumisation throughout the segment.

India Childrenswear Market Challenge

Balancing Affordability with Quality amid Cost Pressures

Affordability and the need to satisfy the increasing demand of high-quality and certified apparel is a challenge to the players in the market. Discretionary spending is limited by inflation and reserved end user behavior, which forces brands to be more creative with smaller price ranges. MOSPI (2024) reports that the average retail inflation in India was 5.4% in FY 2023-24, which restricts the purchasing power of most households. In the meantime, the IMF (2024) states that the growth in household consumption expenditure decreased to 4.2%, which indicates the pressure on family budgets.

As a result, parents are more concerned with safer and sustainable materials, but the problem is to offer this quality at a reasonable price. Manufacturers have to strike a balance between sourcing, production and design to remain profitable and meet the increasing expectations. The low consumption and inflation are forcing brands to balance high quality with low prices, and strategic cost management and portfolio diversification are required.

India Childrenswear Market Trend

Mini-Me Styling and Emotion-Led Fashion Choices

Growing interest in coordinated “mini-me” styling is shaping childrenswear design, as apparel increasingly serves as a medium for emotional connection and shared family identity. This tendency runs through casual, festal, and daily clothing, which is affected by social media and the presence of celebrities. UNICEF (2024) reports that urban families spend more of their discretionary income on lifestyle and appearance-related categories due to aspirational behaviour among younger parents.

In addition, the World Bank (2024) reports that the urbanisation rate in India was 36% and increased the exposure to digital trends and family-oriented marketing of lifestyles. As a result, the interplay of emotional narratives, sustainability, and design-based purchases transforms brand strategies and product introductions. Mini-me styling is a cultural phenomenon in which fashion is used to show emotional attachment, sustainability, and identity, redefining design decisions in the market.

India Childrenswear Market Opportunity

Child-Led Preferences and Personalized Product Design

Future growth will increasingly be shaped by the rising influence of children in shaping apparel choices, as their preferences play a more decisive role in household clothing purchases. As children become more digitally exposed, they will actively influence the preferences in purchases, requiring trend-driven, colourful, and character-based clothing. The World Bank estimates that the working-age population in India will keep growing until 2040, which will guarantee a steady household purchasing power. Also, according to UNICEF, more than 250 million children in India are below 14 years old, which is a solid foundation of developing fashion sub-segments.

With the increase in digital fluency, children aged 6-12 will affect brand choice via platforms like YouTube and Instagram, and brands will need to create expressive, safe, and personalised products. The increasing digital awareness of children will provide a brand with a chance to co-produce expressive, personalised, and safe clothes that will be attractive to both parents and young influencers.

India Childrenswear Market Segmentation Analysis

By Product Type

- Apparel

- Footwear

- Accessories

- Others

The segment with the highest share under the product type category in the India Childrenswear Market is Apparel, which holds around 80% of the market. Apparel continues to dominate due to strong parental spending priorities and the growing cultural emphasis on well-dressed children across income levels. Categories such as everyday wear, ethnic wear, and festive outfits remain central to purchases, driven by India diverse cultural calendar and family-centric celebrations. The trend of “mini-me” dressing—where parents and children wear matching outfits—has also enhanced the appeal of apparel across both casual and festive segments.

Additionally, rising disposable incomes and growing awareness around sustainability are shaping the apparel segment’s future growth. Parents increasingly seek high-quality, durable, and eco-friendly fabrics from brands like Ed-a-Mamma, Kidbea, and Greendigo. The shift toward premiumisation and functional designs—such as organic cotton and gender-neutral styles—will ensure apparel continues to lead the childrenswear market through the forecast period.

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share under the sales channel category in the India Childrenswear Market is Retail Offline, accounting for around 80% of the market. Physical retail continues to dominate as parents prefer visiting stores to assess the fit, feel, and fabric quality of childrenswear before purchasing. The ability to physically examine garments, seek advice from in-store staff, and access exclusive promotions makes offline channels a trusted and convenient option for families.

Major retail outlets such as FirstCry, Lifestyle, and Shoppers Stop, along with supermarkets and departmental stores, play a key role in this segment’s strength. Seasonal collections, festive discounts, and broad product assortments across price ranges have made these stores the go-to destinations for India parents. Retail Offline is expected to maintain its dominance, as in-person shopping remains deeply rooted in family purchasing behaviour for childrenswear.

List of Companies Covered in India Childrenswear Market

The companies listed below are highly influential in the India childrenswear market, with a significant market share and a strong impact on industry developments.

- H & M Hennes & Mauritz India Pvt Ltd

- Benetton India Pvt Ltd

- Tommy Hilfiger Arvind Fashion Pvt Ltd

- Lifestyle International Pvt Ltd

- Arvind Lifestyle Brands Ltd

- Trent Ltd

- Pantaloons Fashion & Retail Ltd

- Shoppers Stop Ltd

- Marks & Spencer Reliance India Pvt Ltd

- Aditya Birla Fashion & Retail Ltd

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. India Childrenswear Market Policies, Regulations, and Standards

4. India Childrenswear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. India Childrenswear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Baby and Toddler Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Boys Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Girls Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Boys Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Girls Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Boys Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Girls Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Age Group

5.2.2.1. Infant/Toddler (Below 2 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Kids/Children (2 - 14 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Category

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. India Apparel Childrenswear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. India Footwear Childrenswear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. India Accessories Childrenswear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Lifestyle International Pvt Ltd

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Arvind Lifestyle Brands Ltd

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Trent Ltd

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Pantaloons Fashion & Retail Ltd

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Shoppers Stop Ltd

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.H & M Hennes & Mauritz India Pvt Ltd

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Benetton India Pvt Ltd

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Tommy Hilfiger Arvind Fashion Pvt Ltd

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Marks & Spencer Reliance India Pvt Ltd

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Aditya Birla Fashion & Retail Ltd

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Age Group |

|

| By Price Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.