Hungary Sports Nutrition Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Sports Protein Products (Protein/Energy Bars, Sports Protein Powder, Sports Protein RTD), Sports Non-Protein Products), Sales Channel (Retail Offline, Retail Online), Ingredients (Vitamins and Minerals, Proteins and Amino Acids, Carbohydrates, Probiotics, Botanicals/Herbals, Others), Functionality (Energy, Muscle growth, Hydration, Weight Management, Others), End User (Bodybuilders, Athletes, Lifestyle Users)

- Food & Beverage

- Jan 2026

- VI0623

- 125

-

Hungary Sports Nutrition Market Statistics and Insights, 2026

- Market Size Statistics

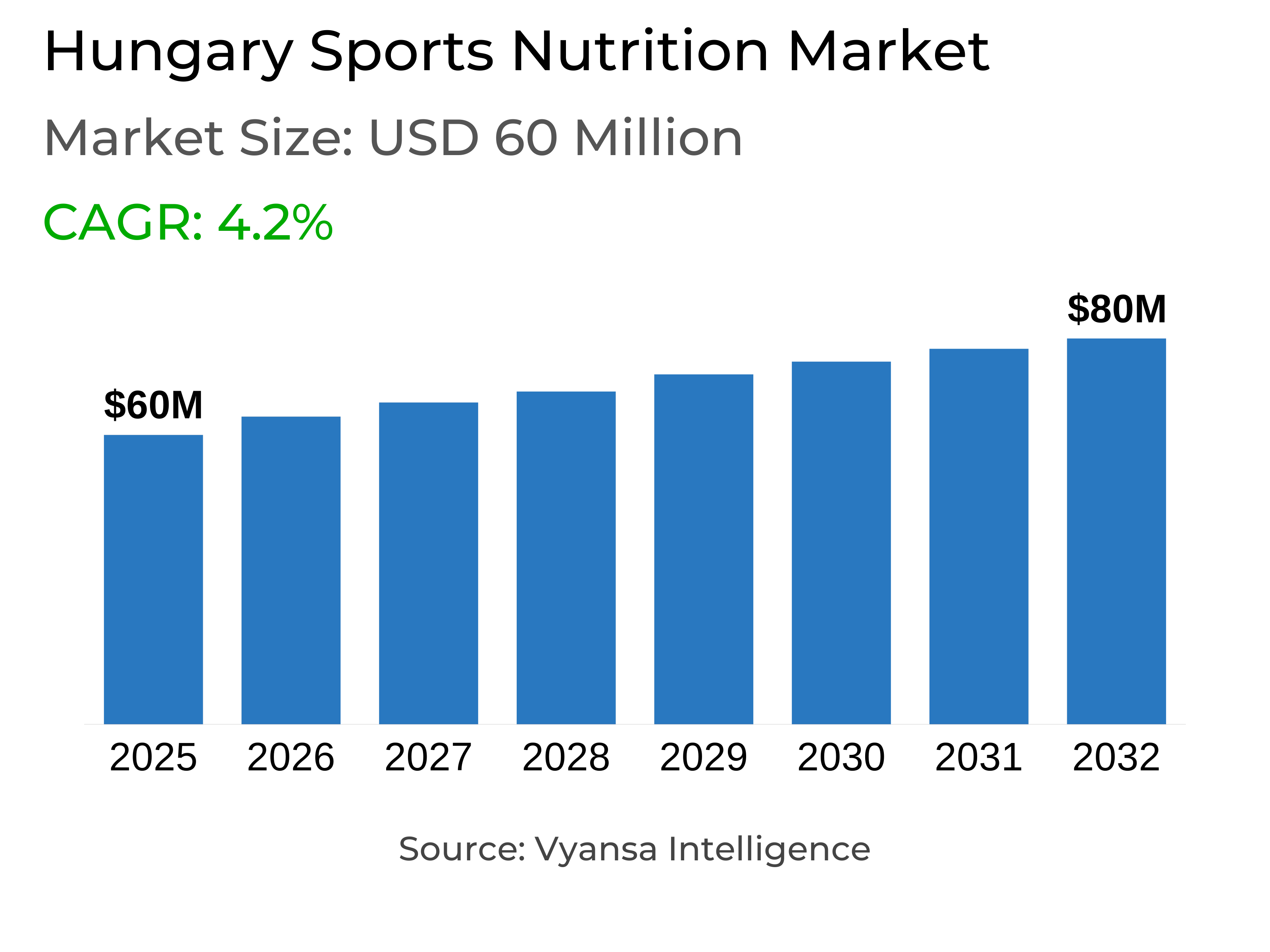

- Sports nutrition in Hungary is estimated at USD 60 million.

- The market size is expected to grow to USD 80 million by 2032.

- Market to register a cagr of around 4.2% during 2026-32.

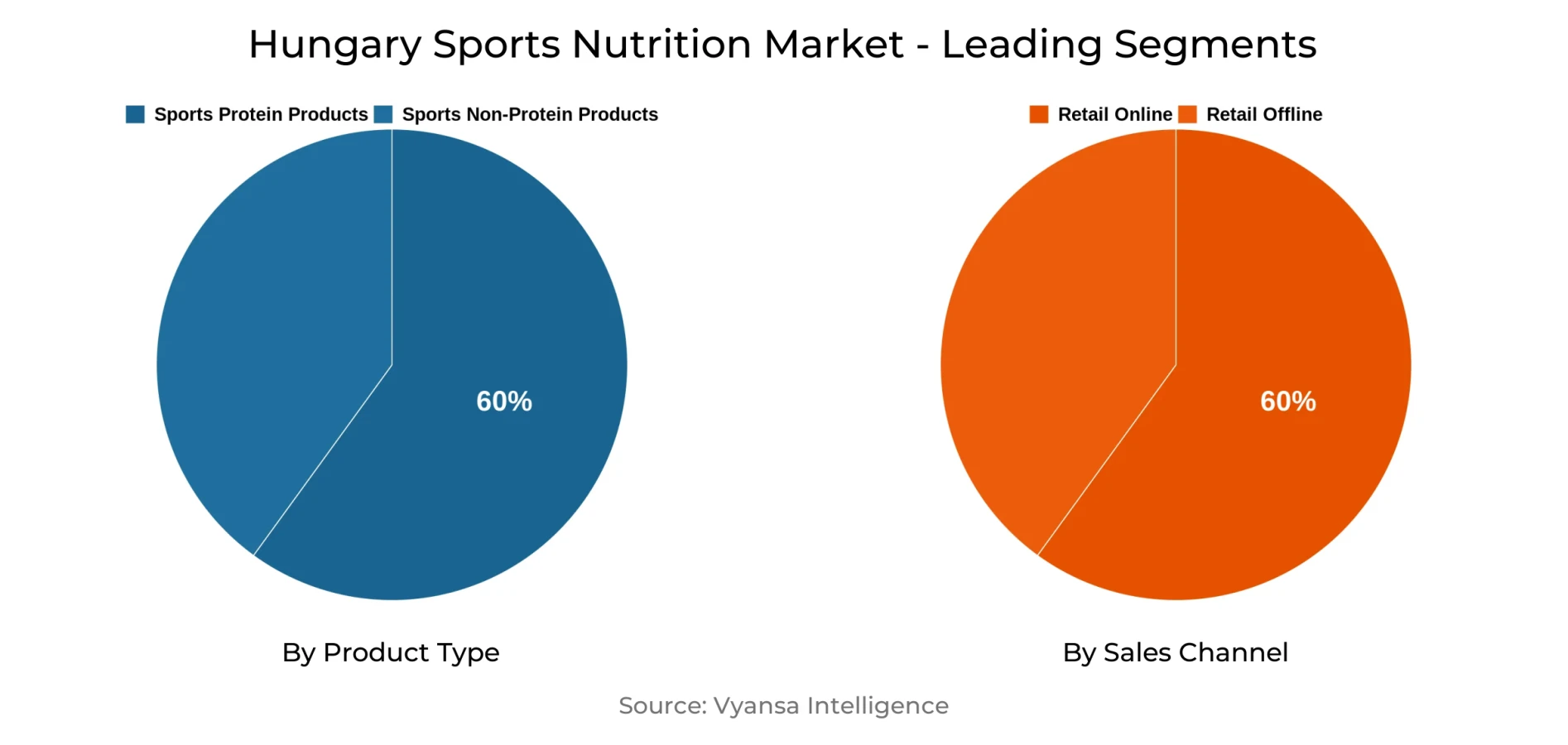

- Product Type Shares

- Sports protein products grabbed market share of 60%.

- Competition

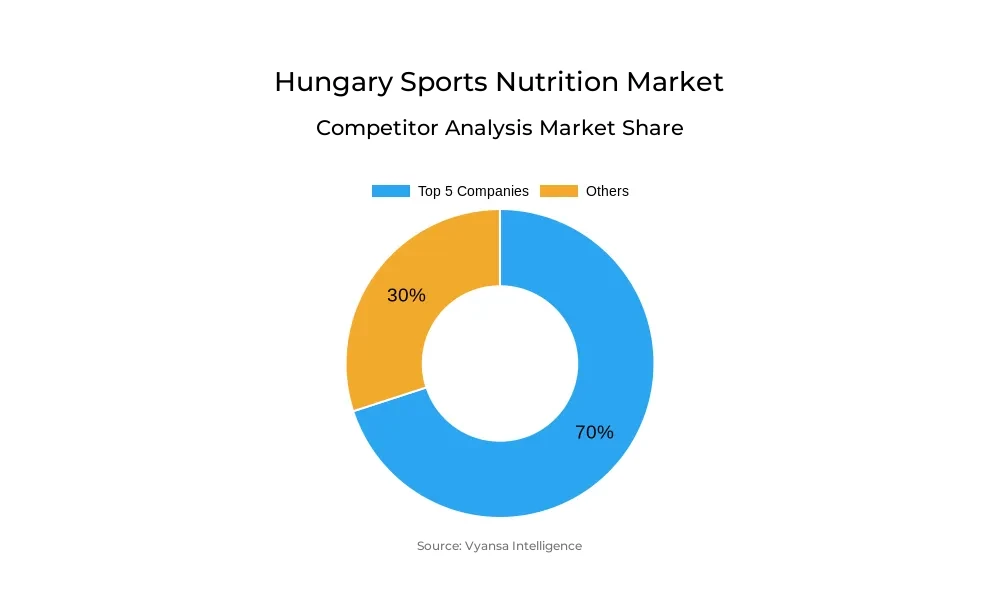

- More than 15 companies are actively engaged in producing sports nutrition in Hungary.

- Top 5 companies acquired around 70% of the market share.

- Glanbia Plc, Olimp Laboratories Sp zoo, Weider Global Nutrition LLC, Scitec Kft, BioTech USA Kft etc., are few of the top companies.

- Sales Channel

- Retail online grabbed 60% of the market.

Hungary Sports Nutrition Market Outlook

The sports nutrition market in Hungary is growing fast, with an estimated value of around USD 60 million in 2025. It is expected to reach around USD 80 million by 2032, showing a steady CAGR of around 4.2% during 2026-32. Growth is supported by rising health awareness and more people joining gyms and fitness activities. End users are now focusing more on healthy living, which continues to drive steady demand for sports nutrition products.

Sports protein products have the biggest market share of around 60%. They are used for enhancing strength and post exercise recovery. They are convenient to use and are available in variety of flavors, making them the most popular choice among frequent gym goers. Protein and energy bars are also gaining popularity as quick, nutritious snacks that cater to busy lifestyles.

Retail online channels dominate the sales channel with around 60% of the overall market. The growth of retail online sites and simplicity in accessing fitness products online has made it easy for end users to purchase from home. Retail online stores provide wider variety, promotions, and shipping options, which encourages more end users to shop online rather than going to physical stores.

Market competition is intense, with the top five players holding around 70% of overall sales. They possess strong brand image, reputable products, and large retail offline and retail online networks. Small brands are also entering the market by providing clean, vegan, and plant based solutions to attract new end users. This blend of strong competition and increasing health consciousness will continue to influence market growth in the future.

Hungary Sports Nutrition Market Growth Driver

Rising Health Awareness Boosts Demand for Sports Nutrition

With increasing focus on health and wellness is generating strong demand for sports nutrition. With time more numbers of end users are opting for these products as part of a healthy lifestyle. Many end users are now more active, joining fitness programs or exercising regularly to improve both physical and mental wellbeing. This habit has become stronger after the pandemic, as end users continue to prioritise health and immunity.

Additionally, with improving purchasing power and improved economic conditions has supported the increased expenditures on sports nutrition products. End users are becoming more aware of the benefits of sports nutrition, that it is not only for athletes or bodybuilders but also for anyone seeking better fitness and energy in daily life. Such increased awareness keeps expanding the end users base and facilitates consistent market growth.

Hungary Sports Nutrition Market Challenge

Rising Concern Over Product Safety and Quality

There are increasing concerns regarding the safety and proper labeling of sports nutrition products. Certain products contain banned chemicals or inaccurate descriptions of what they consist of, as mentioned in the Council of Europe report. This leaves most end users unsure about which products are safe to use. It also damages the reputations of respected brands that attempt to offer quality and safe products. When end user lose confidence, it becomes harder for good companies to grow.

Moreover, this problem puts additional pressure on government authorities to inspect and regulate these products. Companies also have to invest additional funds and time to adhere to safety regulations and ensure their products meet all the quality benchmarks. Due to this, market growth slows down, and fair competition becomes challenging for responsible and sincere brands.

Hungary Sports Nutrition Market Trend

Shift Towards Clean and Healthy Formulations

Sports nutrition brands are evolving as end user seeks healthier and more natural products. Many companies are channeling their focus on offering sugar free, lactose free, and gluten free items, along with vegan and plant based choices. Such products are more easily digestible and are perceived as cleaner and safer. This shift makes end user feel more confident about what they are putting in their bodies support their fitness objectives without unwanted additives.

Additionally, manufacturers are including additional nutrients such as probiotics and fibre to increase the utility of products for everyday wellbeing. These shifts also differentiate brands from vitamins and dietary supplements. With increased health consciousness among end users, clean label and plant based products are becoming a regular choice for active lifestyles. This gradual shift indicates the direction that the market is heading towards natural and wellness oriented nutrition.

Hungary Sports Nutrition Market Opportunity

Increasing Focus on Women and Younger End Users

Sports nutrition currently has a strong and growing base of end users, yet its application will increase further among women and youth. More women andteenagers around the age of 16 are showing interest in spending time in gyms and fitness centres as part of a healthy and active lifestyle. This increased desire for fitness will create increased demand for products which enhance strength, energy, and overall health.

Moreover, in coming years, more products are likely to be made for these groups. They will target their particular health requirements and simple taste preferences. As more women and younger people start using sports nutrition, it will become a regular part of daily fitness routines and help the market grow steadily in the future.

Hungary Sports Nutrition Market Segmentation Analysis

By Product Type

- Sports Protein Products

- Sports Non-Protein Products

The most dominated segment in terms of market share is sports protein products, holding around 60% of the market. These products are most commonly used to enhance strength and post workout recovery. Powders and ready to drink formats are convenient to consume and provide quick results, popular among end users pursuing fitness. There are wide variety of flavours available and growing brands image further supports their strong position in the market

Energy and protein bars are also gaining attention as an easy and healthy snack.Many people eat them before or after workouts, or as a quick meal during busy days. Their ease of use, affordability, and availability in stores is helping this segment grow steadily, even though it currently holds a smaller share compared to other protein products.

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share under the sales channel is retail online, which holds around 60% of the total market. The rapid growth of retail online channels, fitness websites, and online sites has facilitated easy purchase of sports nutrition products by end users at home.Retail online platforms are preferred more by end users because they offer wider products variety, frequent discounts, and convenient delivery. Retail online channels also enable small and new brands to access larger audiences at lower costs.

This growth is also backed by growing internet usage and the popularity of digital payments. It is easy for end users to compare prices and read reviews before making a purchase. The wide product line, ranging from protein powder to energy bars, and simple subscription plans make online purchasing more appealing. This consistent shift in end user behavior continues to push retail online ahead of retail offline stores.

Top Companies in Hungary Sports Nutrition Market

The top companies operating in the market include Glanbia Plc, Olimp Laboratories Sp zoo, Weider Global Nutrition LLC, Scitec Kft, BioTech USA Kft, Hut.com Ltd, MHN Sport Kft, Nutrend DS as, Muscle Tech Inc, Cerbona Élelmiszergyártó Kft, etc., are the top players operating in the Hungary sports nutrition market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Hungary Sports Nutrition Market Policies, Regulations, and Standards

4. Hungary Sports Nutrition Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Hungary Sports Nutrition Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Sports Protein Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Protein/Energy Bars- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Sports Protein Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Sports Protein RTD- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Sports Non-Protein Products- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Sales Channel

5.2.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Ingredients

5.2.3.1. Vitamins and Minerals- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Proteins and Amino Acids- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Carbohydrates- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Probiotics- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Botanicals/Herbals- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Functionality

5.2.4.1. Energy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Muscle growth- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Hydration- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Weight Management- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By End User

5.2.5.1. Bodybuilders- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Athletes- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Lifestyle Users- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. Hungary Protein Products Sports Nutrition Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Ingredients- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Functionality- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Hungary Non-Protein Products Sports Nutrition Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Ingredients- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Functionality- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Scitec Kft

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.BioTech USA Kft

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Hut.com Ltd, The

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.MHN Sport Kft

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Nutrend DS as

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Glanbia Plc

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Olimp Laboratories Sp zoo

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Weider Global Nutrition LLC

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Muscle Tech Inc

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Cerbona Élelmiszergyártó Kft

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Sales Channel |

|

| By Ingredients |

|

| By Functionality |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.