Hong Kong Leisure & Business Travel Booking Market Report: Trends, Growth and Forecast (2026-2032)

By Travel Sales Type (Leisure Travel, Business Travel), By Booking Channel (Offline Booking, Online Booking), By Booking Method (Travel Intermediaries, Direct Suppliers)

- ICT

- Nov 2025

- VI0391

- 120

-

Hong Kong Leisure & Business Travel Booking Market Statistics and Insights, 2026

- Market Size Statistics

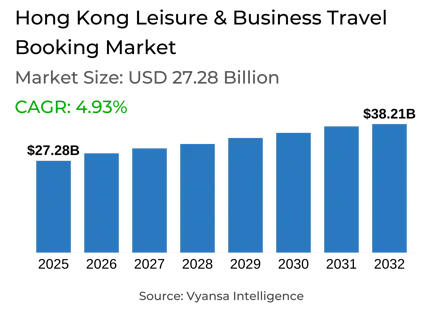

- Hong Kong Leisure & Business Travel Booking in is estimated at $ 27.28 Billion.

- The market size is expected to grow to $ 38.21 Billion by 2032.

- Market to register a CAGR of around 4.93% during 2026-32.

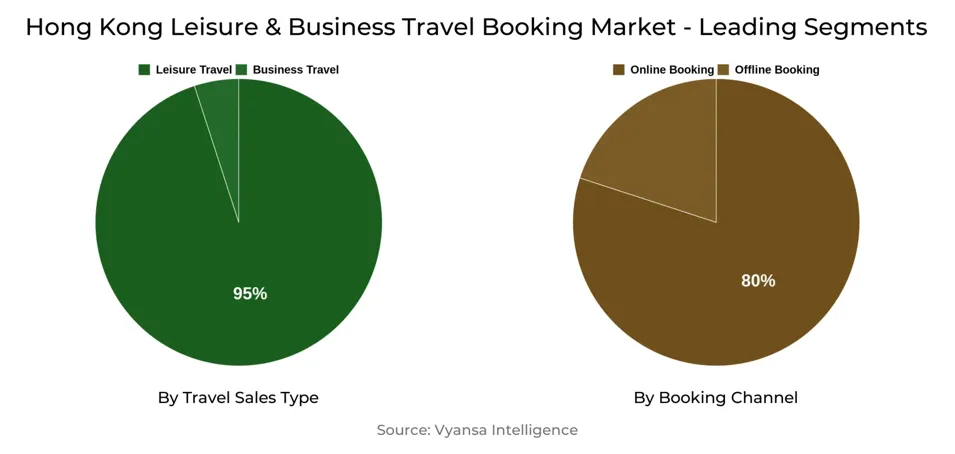

- Travel Sales Type Shares

- Hong Kong Leisure Travel grabbed market share of 95%.

- Competition

- Hong Kong Leisure & Business Travel Booking Market is currently being catered to by more than 10 companies.

- Top 5 companies acquired 10% of the market share.

- Miramar Hotel & Investment Co Ltd, Sunflower Travel Service Ltd, China Travel Service (HK) Ltd, Booking.com BV, Ctrip.com International Ltd etc., are few of the top companies.

- Booking Channel

- Online Booking grabbed 80% of the market.

Hong Kong Leisure & Business Travel Booking Market Outlook

The Hong Kong leisure and business travel bookings market is worth $27.28 billion in 2025 and will reach $38.21 billion by 2032 as a result of the amalgamation of technophile end users, changing travel trends, and growing digital platforms. Online bookings already represent 80% of the market, indicating the broad take-up of digital platforms for planning and booking travel. Conventional offline intermediaries are under pressure, while digitally sophisticated players such as EGL Tours and Wing On Travel are taking advantage of changing end user trends and continuing to grow within a highly competitive market.

Hong Kong tourists are more looking for experiential and culturally rich holidays. Their travel choices are guided by good dining, cultural participation, wellness, and local experience. This interest in individualized travel has contributed to high demand for attractions and experiential booking segments, which will continue to expand at a higher rate than customary air or accommodation bookings. Online portals and travel operators serving these needs are in an excellent position to gain sustained market growth.

The Greater Bay Area is a large potential for weekend and short-haul travel. Better connectivity and infrastructure links drive northbound trips to cities like Shenzhen, Dongguan, and Guangzhou. Operators are providing one-stop packages, combining accommodation, transportation, and carefully selected experiences, enabling travelers to have value-for-money and affordable trips while visiting cultural and recreational destinations. Sites such as Kolok are also bringing in special experiential activities, such as adventure- and wellness-driven activities.

Surface transport options like car hire and leisure cruises are becoming increasingly popular among Hong Kong tourists who desire flexibility and customized travel plans. More convenient access to international driving licenses and growing interest in cruise and self-drive holidays are opening new opportunities for expansion. Businesses that provide authentic, convenient, and bespoke travel experiences will remain at the core of the market's development to 2032.

Hong Kong Leisure & Business Travel Booking Market Growth Driver

Growing Demand for Experiential and Cultural Tourism

Hong Kong travelers increasingly demand more than traditional sightseeing, influencing the manner in which travel products are selected. They appreciate first-class gastronomic experiences and want to indulge in local cuisine, sample gourmet delights, and discover the distinctive culinary culture of the place. Their refined palate and love for real experiences fuel the demand for travel opportunities that can provide these experiences.

Moreover, tourists in Hong Kong are concerned with experiential cultural experiences that reveal local customs, heritage, and community living. They seek out genuine experiences, cultural immersion, and encounters that enhance their affinity for the destinations they travel to. This demand for rich and memorable travel experiences drives the market, shaping packages, tours, and services to conform to their upscale and experience-centric anticipations.

Hong Kong Leisure & Business Travel Booking Market Trend

Rising Popularity of Northbound Weekend Travel

Increasing numbers of Hong Kong visitors prefer weekend staycations in the Greater Bay Area, pointing towards a change in travel patterns from short regional breaks to proximate mainland stops. Enhanced connectivity and infrastructure links expand cities such as Shenzhen, Guangzhou, and Dongguan within reach, compelling locals to seek new experiences while reducing travel time. This represents an increasing appetite for short, value-for-money breaks that marry convenience with cultural and entertainment options.

Tourists are drawn to the varied experiences throughout the Greater Bay Area, such as cultural outings, indigenous food, and recreation. Companies react with packaged offerings and customized experiences that match these changing interests. Northbound travel trend reflects an unmistakable trend toward proximate destinations that yield a combination of convenience, immersion in local culture, and experience, shaping the nature of travel products and services in demand among Hong Kong tourists.

Hong Kong Leisure & Business Travel Booking Market Opportunity

Building Potential in Surface Travel Experiences

The increased popularity of surface modes of travel, including car rentals and recreational cruises, is a major opportunity for Hong Kong leisure and business travel bookings market. Travelers prefer more independent discovery of destinations at their own speed, designing their own customized itineraries, and searching for extraordinary experiences. Car rentals enable residents to reach remote or off-the-beaten-track sites, providing freedom and independence for day trips and drive excursions in the likes of Japan, Taiwan, Australia, and the Greater Bay Area.

Leisure cruises similarly draw tourists, particularly families, who prioritize convenience, comfort, and the ability to experience many places during one trip. Through bespoke packages and experiences for such surface modes of travel, players can leverage the appeal of flexible, engaging, and customised travel. This potential offers businesses the room to be creative and diversify products, accommodating changing tastes in Hong Kong travelers for freedom, ease, and unforgettable experiences.

Leisure & Business Travel Booking Market Segmentation Analysis

By Travel Sales Type

- Leisure Travel

- Business Travel

The category that holds the largest market share in the Travel Sales Type is Leisure Travel, which captured 95% of the market. Leisure travel is dominant since Hong Kong residents still crave experiential and authentic experiences. Top choices are weekend breaks to the Greater Bay Area, Japan, Taiwan, and other mainland destinations. Travellers strongly prefer cultural immersion, local food, wellness, and relaxation and thus leisure bookings are the largest contributor to total travel sales.

In this segment, surface travel modes like car hire and vacation cruises are becoming popular, providing flexibility as well as bespoke experiences. The allure of exploring hidden treasures, experiencing gastronomic cuisine, and participating in true local experiences ensures leisure tourism to be the leading force in the Hong Kong booking market.

By Booking Channel

- Offline Booking

- Online Booking

The most dominant segment under the Booking Channel is Online Booking, which held 80% of the market. Online channels have surpassed others as a leading channel since Hong Kong travellers now book and plan their trips online. Klook, Wing On Travel, and EGL Tours, among others, are reaping the rewards of robust demand for convenience, tailored experiences, and bundled packages for domestic and overseas trips.

Mobile and internet reservations have experienced lively growth, especially for experience and surface travel products like cruises and car rentals. Offline intermediaries are threatened with closures and consolidation, yet digital media are still the travel arrangement preference, further cementing online booking as the top channel in Hong Kong's business and leisure travel market.

Top Companies in Leisure & Business Travel Booking Market

The top companies operating in the market include Miramar Hotel & Investment Co Ltd, Sunflower Travel Service Ltd, China Travel Service (HK) Ltd, Booking.com BV, Ctrip.com International Ltd, Expedia Asia Pacific Ltd, Klook Travel Technology Ltd, EGL Tours Co Ltd, Hong Kong Student Travel Ltd, Travel Expert (Asia) Enterprises Ltd, etc., are the top players operating in the Leisure & Business Travel Booking Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Hong Kong Leisure & Business Travel Booking Market Policies, Regulations, and Standards

4. Hong Kong Leisure & Business Travel Booking Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Hong Kong Leisure & Business Travel Booking Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Travel Sales Type

5.2.1.1. Leisure Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Business Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Booking Channel

5.2.2.1. Offline Booking- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Online Booking- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Booking Method

5.2.3.1. Travel Intermediaries- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Direct Suppliers- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Hong Kong Leisure Travel Booking Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Travel Sales Type- Market Insights and Forecast 2022-2032, USD Million

6.2.1.1. Leisure Air Travel- Market Insights and Forecast 2022-2032, USD Million

6.2.1.2. Leisure Car Rental- Market Insights and Forecast 2022-2032, USD Million

6.2.1.3. Leisure Cruise- Market Insights and Forecast 2022-2032, USD Million

6.2.1.4. Leisure Experiences and Attractions- Market Insights and Forecast 2022-2032, USD Million

6.2.1.5. Leisure Lodging- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Booking Method- Market Insights and Forecast 2022-2032, USD Million

7. Hong Kong Business Travel Booking Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Travel Sales Type- Market Insights and Forecast 2022-2032, USD Million

7.2.1.1. Business Air Travel- Market Insights and Forecast 2022-2032, USD Million

7.2.1.2. Business Car Rental- Market Insights and Forecast 2022-2032, USD Million

7.2.1.3. Business Lodging- Market Insights and Forecast 2022-2032, USD Million

7.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Booking Method- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1. Booking.com BV

8.1.1.1. Business Description

8.1.1.2. Service Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2. Ctrip.com International Ltd

8.1.2.1. Business Description

8.1.2.2. Service Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3. Expedia Asia Pacific Ltd

8.1.3.1. Business Description

8.1.3.2. Service Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4. Klook Travel Technology Ltd

8.1.4.1. Business Description

8.1.4.2. Service Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5. EGL Tours Co Ltd

8.1.5.1. Business Description

8.1.5.2. Service Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6. Miramar Hotel & Investment Co Ltd

8.1.6.1. Business Description

8.1.6.2. Service Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7. Sunflower Travel Service Ltd

8.1.7.1. Business Description

8.1.7.2. Service Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8. China Travel Service (HK) Ltd

8.1.8.1. Business Description

8.1.8.2. Service Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9. Hong Kong Student Travel Ltd

8.1.9.1. Business Description

8.1.9.2. Service Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Travel Expert (Asia) Enterprises Ltd

8.1.10.1. Business Description

8.1.10.2. Service Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Travel Sales Type |

|

| By Booking Channel |

|

| By Booking Method |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.