Germany Sports Nutrition Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Sports Protein Products (Protein/Energy Bars, Sports Protein Powder, Sports Protein RTD), Sports Non-Protein Products), Sales Channel (Retail Offline, Retail Online), Ingredients (Vitamins and Minerals, Proteins and Amino Acids, Carbohydrates, Probiotics, Botanicals/Herbals, Others), Functionality (Energy, Muscle growth, Hydration, Weight Management, Others), End User (Bodybuilders, Athletes, Lifestyle Users)

- Food & Beverage

- Dec 2025

- VI0617

- 130

-

Germany Sports Nutrition Market Statistics and Insights, 2026

- Market Size Statistics

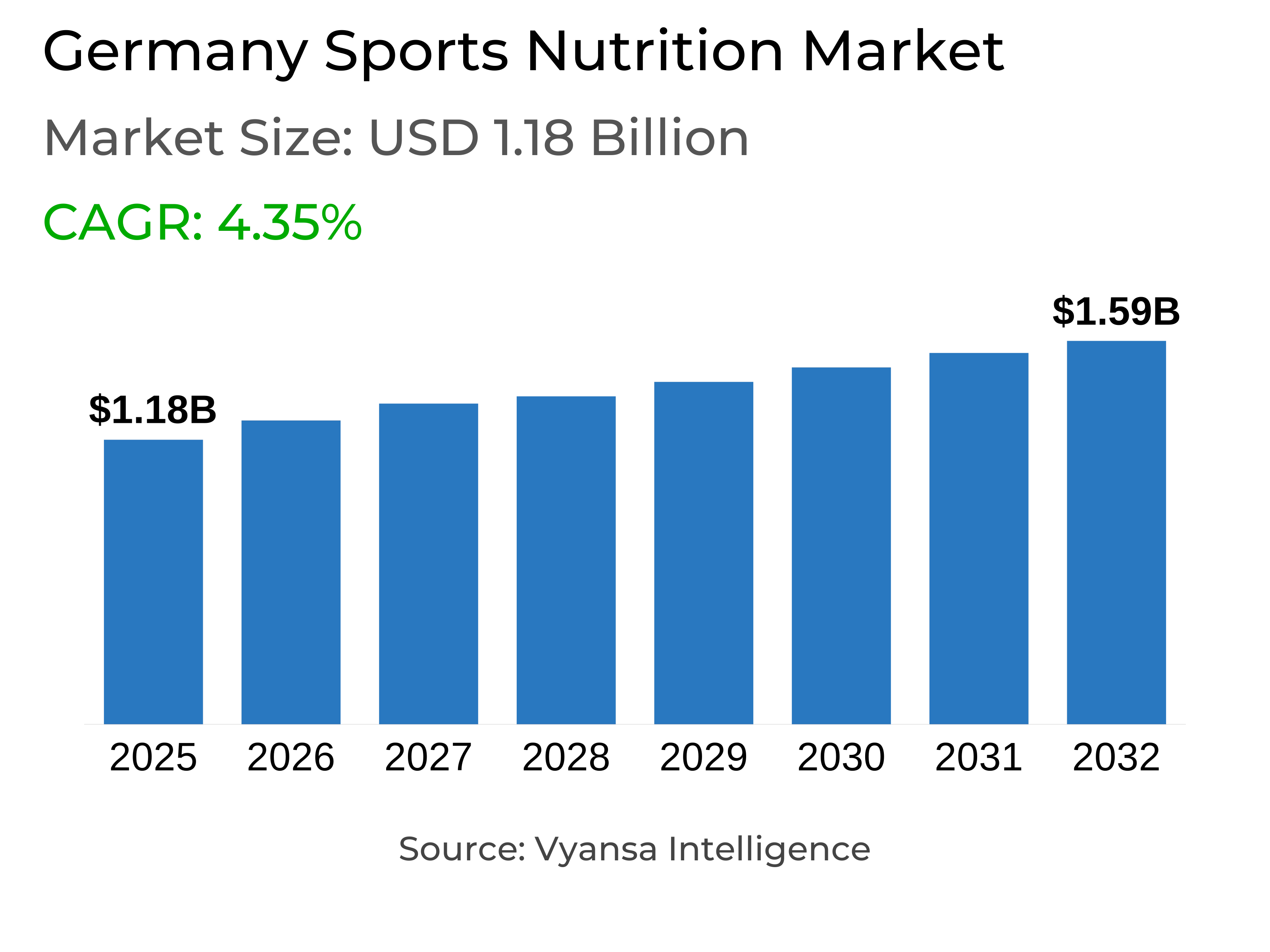

- Sports nutrition in germany is estimated at USD 1.18 billion.

- The market size is expected to grow to USD 1.59 billion by 2032.

- Market to register a cagr of around 4.35% during 2026-32.

- Product Type Shares

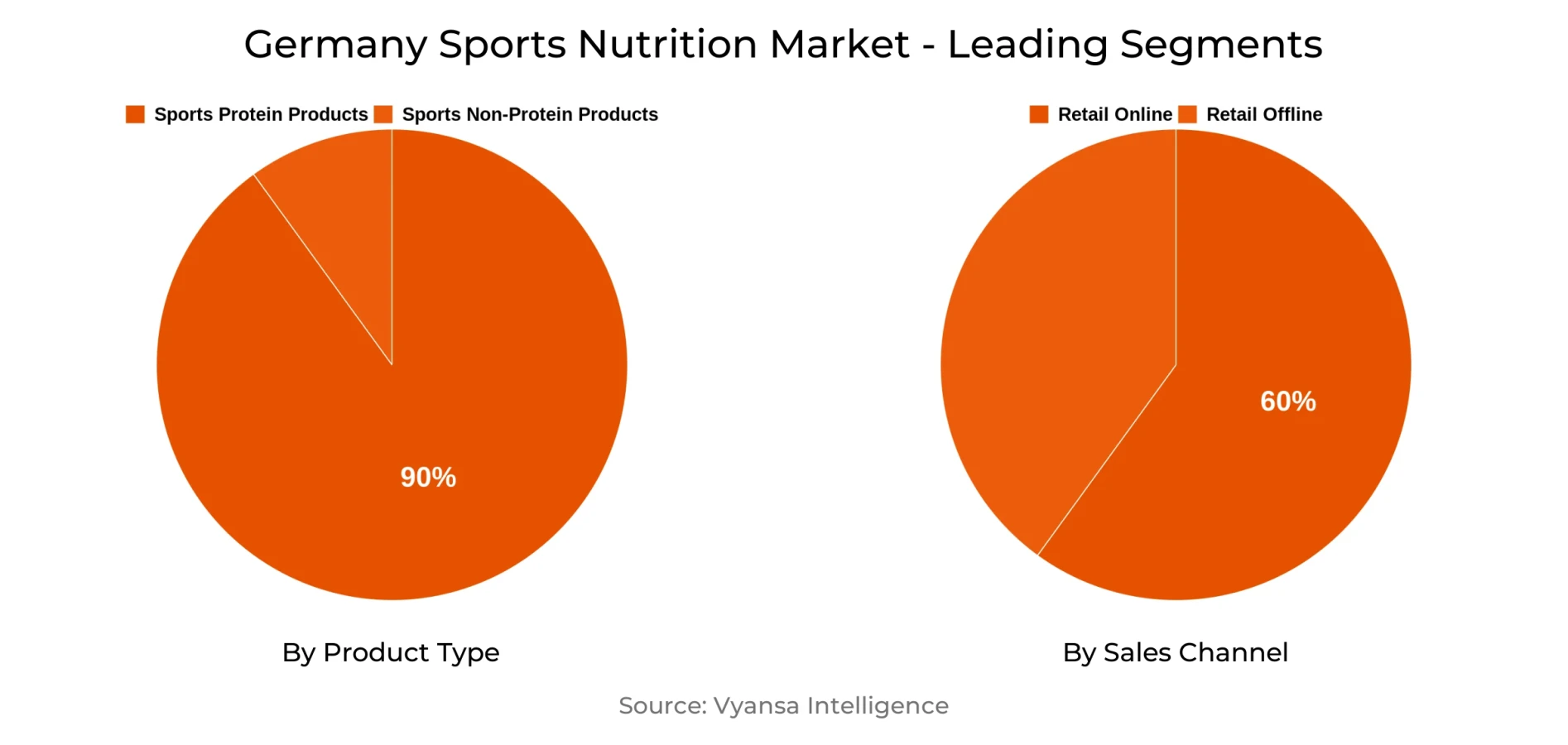

- Sports protein products grabbed market share of 90%.

- Competition

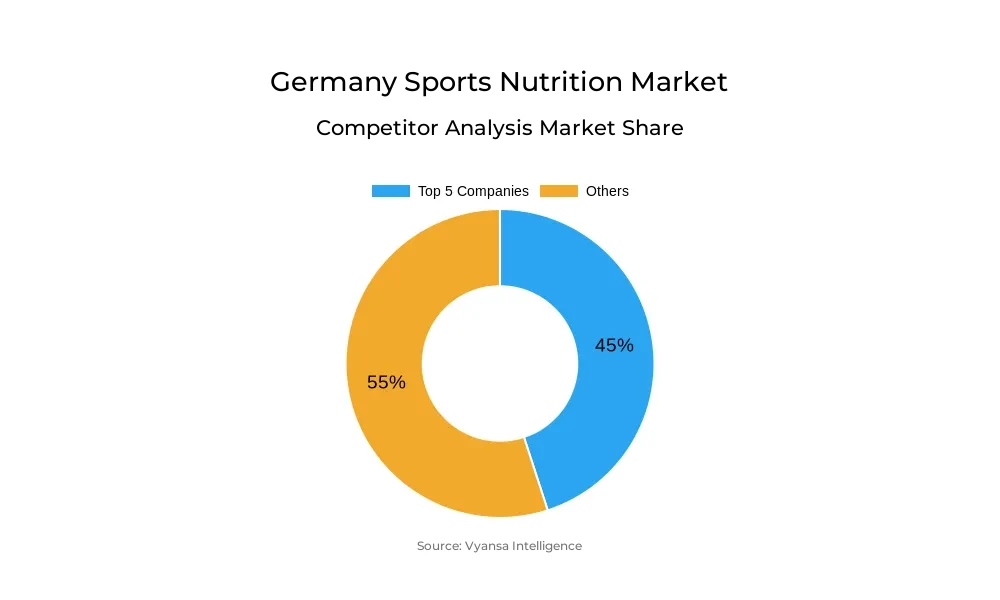

- More than 20 companies are actively engaged in producing sports nutrition in germany.

- Top 5 companies acquired around 45% of the market share.

- Weider Germany GmbH, Foodspring GmbH, Well Plus Trade Vertriebs GmbH & Co KG, Hut.com Ltd, Fitmart GmbH & Co KG etc., are few of the top companies.

- Sales Channel

- Retail online grabbed 60% of the market.

Germany Sports Nutrition Market Outlook

The sports nutrition market in Germany is valued at around $1.18 billion in 2025 and is likely to reach around $1.59 billion in 2032, with a CAGR of around 4.35% from 2026-32. The growth will be supported by growing focus on health, fitness, and preventive care awareness among the end users. Younger end users will remain the primary focus, with older end users interested in preserving muscle mass, controlling weight, and improving overall health through protein intake and other products.

Sports protein products lead the market, with a share of around 90% of total sales. These involve protein powders, protein/energy bars, and ready-to-drink protein products. End users are drawn to these products for their convenience, multiple formats, and effectiveness in supporting fitness goals. Sports non protein products hold a smaller share but continue to serve end users with specific recovery or targeted fitness needs.

Retail online dominates with around 60% market share. End users prefer retail online for easy access to diverse products, price comparisons, and promotions. Retail offline still remains popular with those who want purchases made physically or instant impulse purchases. Retail online will continue to dominate the market through end users familiarity with online shopping and the availability of products through multiple purchase channels.

Sports nutrition products are likely to see sustained growth as there will be a growing demand for convenient, innovative, and customized products. Ready to drink products and bars will still draw end users in search of a quick meal or snack, while customized formulations for weight management, muscle recovery, and general wellness will grow the category. Manufacturers, distributors, and retailers targeting innovative and customized products will be pivotal to the market's growth from 2026-2032.

Germany Sports Nutrition Market Growth DriverRising Popularity of Sports Nutrition Among Diverse Age Groups

Sports nutrition conitnues to maintain growth in 2025, fueled by growing demand throughout the category. While younger end users remain the core audience, older end users are showing greater awareness of the importance of adequate protein intake as they age. The expanding gym culture is supporting sales, as gyms acts not just as places for fitness activity but also as key points of purchase.

Post pandemic, greater numbers of end users visit gyms to control weight, enhance fitness, and maintain body shape, aligning with the wider preventative health focus. Protein and energy bars are now more widely consumed as convenient on the go meals and snacks due to their increased availability in convenience stores and food retailers. These shifts reflect the expanding end user base and changing usage patterns in the sports nutrition market.

Germany Sports Nutrition Market ChallengeRising Impact of Protein-Enriched Mainstream Foods

The expansion of packaged foods with higher protein content beyond the traditional sports nutrition is generating tremendous competition for the category. Foodstuffs like dairy products, biscuits, crackers, breakfast cereals, and other fortified snacks now present easy sources of protein, pulling end users wish to help maintain muscle, control weight, or enhance overall wellness. This growing presence of protein in mass foods is altering end user choice and minimizing the necessity to buy specialized sports nutrition products for a lot of end users.

Additionally, as more end users are adding protein into their everyday diets, certain end users might strongly prefer these enriched foods instead of sports nutrition products such as powders, RTDs, and bars. This change in consumption behavior would act to slow the growth of sports nutrition sales even as awareness of health and fitness grows. Brands will have to sharply differentiate their products, innovate, and create new formats so they remain player in a category where protein is becoming increasingly commoditized across various types of products.

Germany Sports Nutrition Market TrendShifts in Sports Nutrition Preferences and Convenience

Sports nutrition is changing with end users demanding convenient and flexible products that align with active lifestyles. Ready-to-drink (RTD) protein drinks and protein/energy bars are popular formats for on the go consumption. This is fueled by end users seeking simple, convenient solutions to support exercise, recovery, or overall health without devoting additional time in meal preparation.

Further, ingredients like creatine, BCAA amino acids, and CBD are increasingly being used in sports nutritionals, targeting a wider audience of end users who are not necessarily typical gym members. Older adult specific products are also expected to enjoy greater adoption,reflecting a shift toward products that focus on muscle vitality and general wellbeing. These shifts point toward greater emphasis on convenience, individualization, and ingredient creativity within the sport nutrition category.

Germany Sports Nutrition Market OpportunityGrowing Potential for Innovative and Tailored Products

Sports nutrition will expand robustly in the forecast period as end users increasingly prioritize health, fitness, and regular exercise. The increasing popularity of bars and ready to drink protein products options as quick meals or snacks will likely boost overall consumption across various groups. Increasing body awareness, coupled with social media impact on daily lifestyle and social relationships, will prompt end users to seek out new products and experiment with various formulations.

Moreover, in coming years, weight management, muscle recovery, and general fitness products will gain more popularity among end users. Manufacturers, distributors, and retailers will establish new and innovative formulations and product lines specifically designed to address these changing needs. New products and custom product development will be key to expanding the category and driving ongoing expansion.

Germany Sports Nutrition Market Segmentation Analysis

By Product Type

- Sports Protein Products

- Sports Non-Protein Products

The most prevalent segment in the sports nutrition industry is sports protein products, which represent around 90% of overall sales. These consist of protein powders, protein/energy bars, and ready-to-drink protein drinks. Protein based products are favored by end users as a way to develop muscle, maintain weight, and ensure general health. Convenience, variety of forms, and widespread availability across retail offline and retail online platforms have reinforced the dominance of this segment.

Additionally, non protein products account for a smaller segment of the market. They remain to appeal the end users interested in targeted fitness effects or recovery assistance. Sports protein products are forecasted to maintain their dominant share over the 2026–2032 period, supported by expanding health consciousness and ongoing end user demand for easy to consume, convenient protein solutions.

By Sales Channel

- Retail Offline

- Retail Online

The most dominating segment under Sales Channel is Retail Online, which captured around 60% of the market. Retail online is more popular among end users because browsing through a vast assortment of brands, comparing prices, and remaining updated on promotions and offers is easier and more convenient. Retail online offers end users an easy reach to variety of products, enabling them to have a smooth and customized shopping experience.

Retail offline continues to attract those who prefer in person purchases or quick impulse buys. Retail online will continue to be the leading channel, supported by end users growing comfort with retail online shopping, the increasing availability of sports nutrition products through retail online, and the shift toward multiple purchase channels.

Top Companies in Germany Sports Nutrition Market

The top companies operating in the market include Weider Germany GmbH, Foodspring GmbH, Well Plus Trade Vertriebs GmbH & Co KG, Hut.com Ltd, Fitmart GmbH & Co KG, Quality First GmbH, Tripoint GmbH, Barebells Functional Foods Deutschland GmbH, Active Nutrition International GmbH, Genuport Trade GmbH, etc., are the top players operating in the germany sports nutrition market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Germany Sports Nutrition Market Policies, Regulations, and Standards

4. Germany Sports Nutrition Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Germany Sports Nutrition Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Sports Protein Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Protein/Energy Bars- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Sports Protein Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Sports Protein RTD- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Sports Non-Protein Products- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Sales Channel

5.2.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Ingredients

5.2.3.1. Vitamins and Minerals- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Proteins and Amino Acids- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Carbohydrates- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Probiotics- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Botanicals/Herbals- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Functionality

5.2.4.1. Energy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Muscle growth- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Hydration- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Weight Management- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By End User

5.2.5.1. Bodybuilders- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Athletes- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Lifestyle Users- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. Germany Protein Products Sports Nutrition Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Ingredients- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Functionality- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Germany Non-Protein Products Sports Nutrition Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Ingredients- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Functionality- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Hut.com Ltd, The

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Fitmart GmbH & Co KG

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Quality First GmbH

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Tripoint GmbH

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Barebells Functional Foods Deutschland GmbH

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Weider Germany GmbH

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Foodspring GmbH

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Well Plus Trade Vertriebs GmbH & Co KG

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Active Nutrition International GmbH

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Genuport Trade GmbH

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Sales Channel |

|

| By Ingredients |

|

| By Functionality |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.