Germany Industrial Gases Market Report: Trends, Growth and Forecast (2026-2032)

By Gas Type (Nitrogen Gas, Oxygen Gas, Carbon Dioxide Gas, Argon Gas, Helium Gas, Hydrogen Gas, Other), By Supply Mode (Cylinders, Bulk, On-Site Production, Captive, Other), By Application (Combustion and Process Oxygen, Welding and Metal Fabrication, Inerting Blanketing and Heat Treating, Cryogenics and liquefaction, Chemical Synthesis and Hydrogenation, Purging and Purifications, Analytical and Calibration), By End User Industry (General Manufacturing, Food, Metallurgy, Chemicals, Healthcare, Electronics, Refining & Energy, Glass, Pulp & Paper, Others)

|

Major Players

|

Germany Industrial Gases Market Statistics and Insights, 2026

- Market Size Statistics

- Industrial gases in Germany is estimated at USD 4.25 billion in 2025.

- The market size is expected to grow to USD 5.43 billion by 2032.

- Market to register a cagr of around 3.56% during 2026-32.

- Gas Type Shares

- Oxygen gas grabbed market share of 35%.

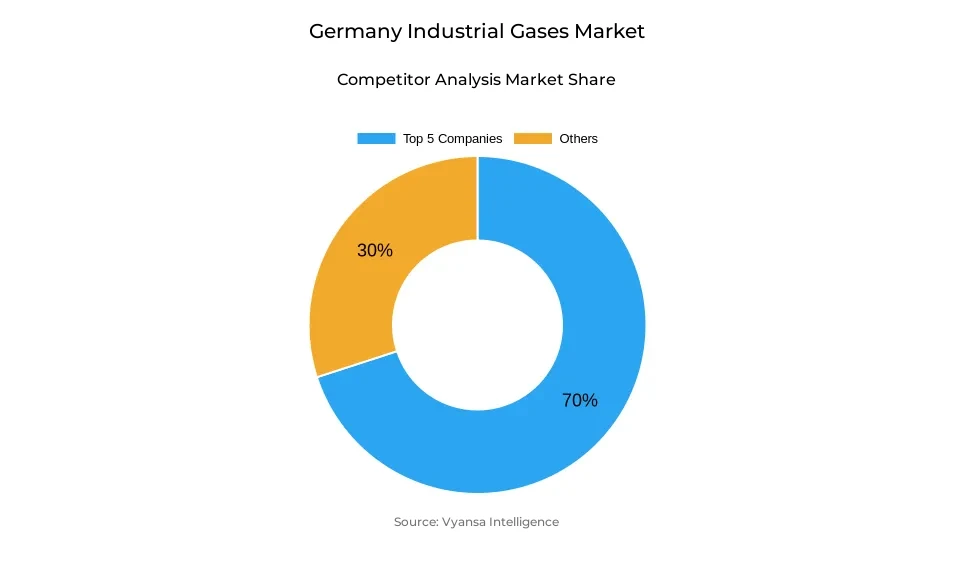

- Competition

- More than 10 companies are actively engaged in producing industrial gases in Germany.

- Top 5 companies acquired around 70% of the market share.

- SIAD Deutschland; Westfalen Group; Nippon Gases (Nippon Sanso); Linde; Air Liquide etc., are few of the top companies.

- Supply Mode

- Cylinders grabbed 45% of the market.

Germany Industrial Gases Market Outlook

The market for industrial gases in Germany will continue to expand at an average rate from 2026-2032. It will be driven by industrial transition and demand for oxygen, nitrogen, and hydrogen. The market, at a value of USD 4.25 billion in 2025, will expand and touch a value of USD 5.43 billion by 2032. It will maintain a CAGR of 3.56%.Industrial energy consumption, steel production, and solar energy will continue to promote oxygen and hydrogen consumption. A very significant player here is sustainable production and the adoption of low-carbon hydrogen production technologies by heavy industries.

Also enhancing demand for specialty gases in the Germany market are its efforts to build a hydrogen economy through the extension of electrolysers, subsequent hydrogen pipeline network implementation with a total length of 1,800 km, and its Power Plant Strategy. Demand drivers that also remain stable are needs related to healthcare, particularly medical oxygen. Nevertheless, growth is tempered by high energy costs, as well as less-than-robust production within some industry sectors.

Pressures on gas producers arise from high natural gas prices, decreases within the chemical industry, and slowdowns within the automotive production sector. Challenges to hydrogen production and decreases within energy-intensive facilities also limit consumption. Yet, modernization projects, foreign investment, and on-site production opportunities remain structural drivers for gas producers. By product type, oxygen continues to lead with a 35% market share.

Based on supply modes, cylinders again hold the prominent position with 45%, primarily due to end-use consumption. Germany continues on its decarbonized trajectory, market outlooks are set to be encouraging with ample opportunities on offer within hydrogen, specialty gases, and on-site technologies up to 2032.

Germany Industrial Gases Market Growth DriverProgressive Industrial Transition Supporting Market Expansion

Despite accelerated growth in industrial transition and sustainability, and with intensified decarbonization efforts among heavy industries, the demand for industrial gases still continues at an accelerated rate. Increased energy consumption in industrial production witnessed an escalation in industrial consumption from 688 GWh/d in 2023 to 737 GWh/d in 2024. A 37.23 million-ton steel production level achieved in 2024, aided by oxygen converters and electric arc melting furnaces requiring large volumes of gases, supports consumption. At the same time, enhancing solar and wind energy capacity extension at 20 GW in 2024 boosts clean hydrogen production based on paths determined by the National Hydrogen Strategy, with 10 GW electrolyzer capacity envisaged by 2030.

However, it is worth noting that industrial low-carbon projects are increasingly targeting sectors like chemicals, steel production, and healthcare, which remain fundamentally dependent on industrial gases as an integral business process. As an indication of national market size, BASF alone accounts for 13% of national gas consumption, and with its project launch of a 54 MW electrolyzer, low-carbon hydrogen production continues to enter mainstream industrial infrastructure. A third of Europe’s total production is occupied by the chemical industry, with a principle usage involving constant feedstocks. Medical oxygen demands remain a core area given Germany’s highly developed healthcare sector, with oxygen concentrators accounting for 25.1% market share within Europe.

Germany Industrial Gases Market ChallengeStructural Pressures from Energy Costs and Supply Limitations

The market for industrial gases in Germany is highly exposed to the challenge posed by continuously high energy costs, making production economics unfavorable for major gas suppliers. A price range for natural gas of between 30 and 60 euros per megawatt-hour in 2024 is significantly higher than traditional averages. Lower production within the chemical sector in Europe as well as an 18% reduction within Germany since 2019 impacts demands for oxygen, hydrogen, and nitrogen, which are consumed on a large scale in gas-based synthesis processes. Total industrial production also remained softer, with an 3.9% drop on a year-over-year basis in August 2025 and an 18.5% drop on a monthly basis in automotive production, thus making short-term demands for cutting and welding gases, traditionally associated with high production volumes, less demanding.

Hydrogen supply constraints also constrain growth, despite nation-wide commitment of policy goals. The 2024 Expert Commission pointed out that some structure-based supply constraints could be exposed because fulfillment of hydrogen goals would require almost three times more electricity than today’s production. Chemical industry producers are also reducing production at gas-demanding facilities, with plans from BASF to reduce gas demand permanently by 13% via fertilizer production shutdowns by 2026. All these factors have imposed strong constraints on feedstock-driven demands in very gas-demanding industries.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Germany Industrial Gases Market TrendAccelerating Shift Toward Hydrogen Integration and Specialized Gas Applications

The ever-developing German industry sector is gradually aligning itself with hydrogen-based applications and gas solutions that match clean energy strategies. The government’s intention to develop an 1,800 km backbone hydrogen pipeline network by 2027-2028 will encourage more use of hydrogen within steel, refinery, and chemical complexes. At a total hydrogen consumption level of 46 TWh within 2023, primarily with gray hydrogen, there are immediate opportunities for research and development within current infrastructure converted for low-carbon energy. Local extensions for air separation and on-site production plants have begun due to strong industry demands for location-centric and high-purity production.

The latest advancements in manufacturing technologies drive the need for advanced gas distribution and precision monitoring with controlled purity requirements. Industry 4.0 adoption and convergence enable real-time gas optimization for electronic, chemical, and premium manufacturing industries. The Germany Power Plant Strategy facilitating an additional 12.5 GW of hydrogen-ready gas-fired plants and continued growth in electrolyzer capacity will eventually introduce varied market demands. Large-scale industrial estates, including chemical parks, are adopting an oxygen-nitrogen-hydrogen solution for reduced process emissions, thus accentuating the shift towards pipeline and on-site production solutions for large-end market consumption.

Germany Industrial Gases Market OpportunityDecarbonization Pathways Creating Long-Term Supply

The multi-billion euro commitment made by Germany to hydrogen and industrial decarbonization presents enormous opportunities for industrial gas marketers. Government subsidies of €8-9 billion will fund the conversion challenge in hard-to-decarbonize industries, most notably steel and chemicals, where hydrogen will substitute for traditional, carbon-heavy processes. The conversion of the steel industry to 11.5 million tons per year of low-carbon DRI Steel production with hydrogen presents enormous offtake volumes with individual projects requiring 100,000 tons per annum of hydrogen supply for 15-year terms.

Foreign investment agreements worth €631 billion from 2028 onwards should improve market fundamentals due to efforts towards modernizing chemical plants, semiconductor materials production, and recycling batteries. The Ludwigshafen site, which is the biggest integrated industrial facility in Germany, ensures a stable market for specialty gases in specialty chemicals and materials. Other market drivers include government incentives, which include accelerated tax depreciation on equipment by 30% up to 2027, and enable more industries and factories to use oxygen injection and specialty gas production facilities.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Germany Industrial Gases Market Segmentation Analysis

By Gas Type

- Nitrogen Gas

- Oxygen Gas

- Carbon Dioxide Gas

- Argon Gas

- Helium Gas

- Hydrogen Gas

- Other

Oxygen gas holds the leading position in Germany’s industrial gases market, securing a 35% market share due to its critical role in steelmaking and healthcare applications. Steel production alone generated demand from oxygen converters producing 26.42 million tons of steel in 2024, supported by energy-intensive processes requiring continuous high-volume oxygen supply. Healthcare applications further reinforce oxygen’s prominence, driven by Germany’s advanced medical infrastructure where rising respiratory disease prevalence increases hospital and home-care usage while oxygen concentrators hold 25.1% of Europe’s share. These combined applications position oxygen as the backbone of industrial gas consumption nationwide.

Nitrogen and hydrogen form the complementary gas categories supporting diverse industrial and transition-aligned applications. Nitrogen remains essential for inerting, cooling, and safety operations across chemicals, food processing, and metal fabrication. Hydrogen’s rising significance reflects national decarbonization objectives, with Germany consuming 46 TWh of hydrogen in 2023—primarily from refineries and ammonia plants—laying the foundation for substitution with renewable hydrogen as electrolyzer capacity scales toward the 2030 target. Together, these gases underpin Germany’s shift toward cleaner, more efficient industrial systems.

By Supply Mode

- Cylinders

- Bulk

- On-Site Production

- Captive

- Other

Cylinder supply mode leads the Germany industrial gases market with a 45% share, reflecting broad adoption among small and medium-scale end users where on-site generation remains cost-prohibitive. Medical oxygen cylinders see strong utilization across hospitals, emergency response systems, and home-care environments, where portability and accessibility remain essential to critical-care delivery. Hospitals and standalone medical facilities also rely heavily on stationary oxygen cylinders for continuous treatment, reinforcing widespread use in decentralized healthcare settings.

Bulk and on-site supply modes complement cylinder distribution as large industrial facilities prioritize uninterrupted supply for steelmaking, chemical production, and energy-intensive processes. Integrated supply networks operated by Linde plc, Air Liquide Industriegase GmbH & Co. KG, and Messer Group GmbH support pipeline, on-site, and bulk transport solutions across Germany. These diversified supply mechanisms allow large-scale end users to maintain operational reliability while enabling smaller dispersed operations to access cost-effective industrial gas supplies through cylinders, ensuring comprehensive market coverage.

List of Companies Covered in Germany Industrial Gases Market

The companies listed below are highly influential in the Germany industrial gases market, with a significant market share and a strong impact on industry developments.

- SIAD Deutschland

- Westfalen Group

- Nippon Gases (Nippon Sanso)

- Linde

- Air Liquide

- Air Product

- Messer Group GmbH

- SOL Deutschland (SOL Group)

- Abello Linde S.A.

Market News & Updates

- Air Liquide, 2025:

Investing €250 million to build three air separation units, two hydrogen production units, and infrastructure in Dresden's "Silicon Saxony," operational by 2027 using 100% renewable electricity.

- Messer Group GmbH, 2024:

€4.5B consolidated sales (+2% YoY), €1.4B EBITDA (+10%), €0.9B invested in green hydrogen, semiconductors, aerospace, medical industries, and plant expansion across Germany and Europe.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Germany Industrial Gases Market Policies, Regulations, and Standards

4. Germany Industrial Gases Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Germany Industrial Gases Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Quantity Sold in Tons

5.2. Market Segmentation & Growth Outlook

5.2.1.By Gas Type

5.2.1.1. Nitrogen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.2. Oxygen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.3. Carbon Dioxide Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.4. Argon Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.5. Helium Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.6. Hydrogen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.7. Other- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.By Supply Mode

5.2.2.1. Cylinders- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.2. Bulk- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.3. On-Site Production- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.4. Captive- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.By Application

5.2.3.1. Combustion and Process Oxygen- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.2. Welding and Metal Fabrication- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.3. Inerting Blanketing and Heat Treating- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.4. Cryogenics and liquefaction- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.5. Chemical Synthesis and Hydrogenation- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.6. Purging and Purifications- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.7. Analytical and Calibration- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.By End User Industry

5.2.4.1. General Manufacturing- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.2. Food- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.3. Metallurgy- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.4. Chemicals- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.5. Healthcare- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.6. Electronics- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.7. Refining & Energy- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.8. Glass- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.9. Pulp & Paper- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.10. Others- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Germany Nitrogen Gas Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Quantity Sold in Tons

6.2. Market Segmentation & Growth Outlook

6.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

6.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7. Germany Oxygen Gas Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Quantity Sold in Tons

7.2. Market Segmentation & Growth Outlook

7.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8. Germany Carbon Dioxide Gas Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Quantity Sold in Tons

8.2. Market Segmentation & Growth Outlook

8.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9. Germany Argon Gas Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Quantity Sold in Tons

9.2. Market Segmentation & Growth Outlook

9.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10. Germany Helium Gas Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.1.2. By Quantity Sold in Tons

10.2. Market Segmentation & Growth Outlook

10.2.1. By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10.2.3. By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11. Germany Hydrogen Gas Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.1.2. By Quantity Sold in Tons

11.2. Market Segmentation & Growth Outlook

11.2.1. By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11.2.3. By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Linde

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Air Liquide

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Air Product

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Messer Group GmbH

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. SOL Deutschland (SOL Group)

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. SIAD Deutschland

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Westfalen Group

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Nippon Gases (Nippon Sanso)

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Abello Linde S.A.

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Gas Type |

|

| By Supply Mode |

|

| By Application |

|

| By End User Industry |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.