Germany Bottled Water Market Report: Trends, Growth and Forecast (2026-2032)

By Type of Water (Carbonated Bottled Water, Flavoured Bottled Water, Functional Bottled Water, Still Bottled Water (Purified Water, Mineral Water, Spring Water, Plain Water)), By Packaging Material (Plastic Bottles, Glass Bottles, Metal Cans, Others (Tetra Pack Cartons, Bioplastics, etc.)), By Price Point (Mass, Premium), By Sales Channel (On Trade, Off Trade (Retail Offline, Retail Online))

- FMCG

- Feb 2026

- VI0896

- 125

-

Germany Bottled Water Market Statistics and Insights, 2026

- Market Size Statistics

- Bottled water in Germany is estimated at USD 7.51 billion in 2025.

- The market size is expected to grow to USD 8.4 billion by 2032.

- Market to register a cagr of around 1.61% during 2026-32.

- Type of Water Shares

- Carbonated bottled water grabbed market share of 53%.

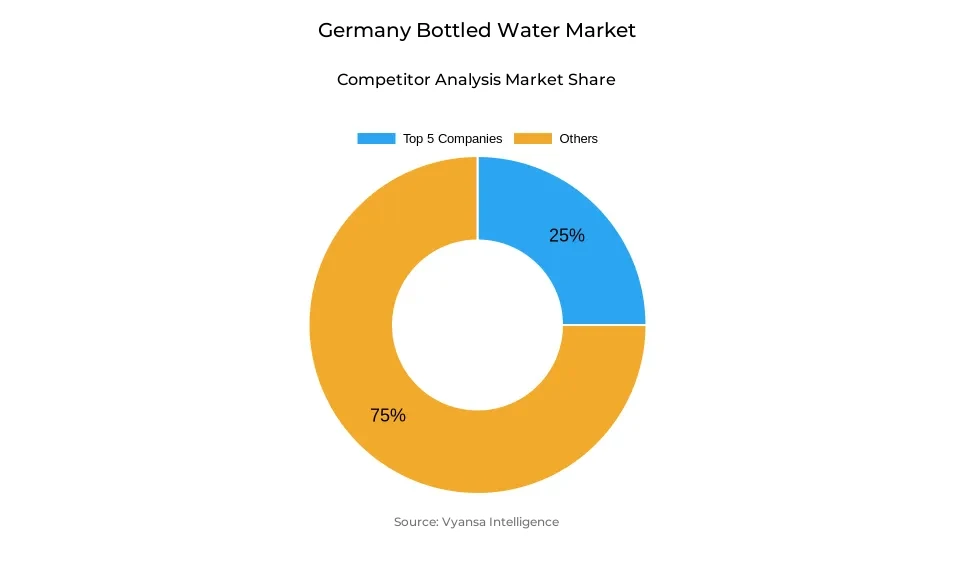

- Competition

- Bottled water in Germany is currently being catered to by more than 20 companies.

- Top 5 companies acquired around 25% of the market share.

- Adelholzener Alpenquellen GmbH; Vilsa-Brunnen O Rodekohr GmbH & Co; Franken Brunnen GmbH & Co KG; Gerolsteiner Brunnen GmbH & Co KG; Danone Waters Deutschland GmbH etc., are few of the top companies.

- Sales Channel

- Off trade grabbed 80% of the market.

Germany Bottled Water Market Outlook

The German bottled water market is estimated at around USD 7.51 billion in 2025 and is expected to reach USD 8.40 billion by 2032 with a CAGR of 1.61% in 2026-32. This stable growth perspective is a sign of a market that is more structural than volume-driven. The need-based demand of bottled water is still limited by high confidence in the quality of municipal drinking water, which is backed by strict federal monitoring in the German Drinking Water Ordinance and the updated EU Drinking Water Directive. As a result, the growth of the market is slow and is mostly based on product differentiation as opposed to fundamental hydration requirements.

Good public confidence in tap water has a direct impact on the purchasing behaviour of end-users. Statistics provided by the Federal Environment Agency continuously support the argument that tap water is at or above EU quality standards, thus promoting daily use in homes and offices. This trust, coupled with cost consciousness and sustainability, moderates the demand of the baseline bottled water. Bottled water is also facing a highly plausible, low-cost, and environmentally responsible substitute that is influencing the wary yet predictable demand trends over the forecast period.

Environmental scrutiny is one of the characteristic limitations that affect the market perspective. The focus of policy in Germany by the Circular Economy Act and the EU Single-Use Plastics Directive has increased the awareness of packaging waste, especially in high-volume beverage categories. The end-users are increasingly concerned with the environmental impact in their purchasing decisions, with the safe tap water readily available. This dynamic continues to put pressure on bottled water suppliers to protect relevance in a sustainability-oriented policy and social environment.

In this context, the market structure is well defined. The type-of-water category is still dominated by carbonated bottled water, which has a 53% market share, and is backed by the strong cultural inclination towards sparkling water as a unique sensory experience. Distribution is dominated by off-trade channels, which represent about 80% of sales, anchored by the strong retail infrastructure and efficient deposit-return systems in Germany. These segments combined will offer stability and continuity to the German bottled water market up to 2026-32.

Germany Bottled Water Market Growth DriverStrong Public Trust in Municipal Drinking Water Quality

The confidence in the quality of municipal drinking water is also high, which is one of the main factors that influence the market of the German bottled-water. Federal monitoring in accordance with the German Drinking Water Ordinance, which is consistent with the 2020 amendment of the EU Drinking Water Directive, presupposes regular evaluation of microbiological, chemical, and sensory parameters, which strengthens the confidence of the population in its safety and consistency. Statistics of the Federal Environment Agency indicate that tap water always meets or exceeds EU limits, which confirms its position as a safe source of daily fluid. This institutional confidence has been reflected in the general acceptance of behaviour, with national health and environmental authorities repeatedly confirming that tap water is safe to be consumed by all age groups on a regular basis.

This confidence has a direct impact on the buying behavior of end users because it diminishes the perceived necessity of packaged alternatives. This trend is supported by economic factors and the growing sustainability consciousness, with end users becoming more and more convinced that tap water is affordable and sustainable. The combination of regulatory credibility and communication to the people still moderates the baseline demand of bottled water, thus defining the competitive environment of the market.

Germany Bottled Water Market ChallengeSustainability Pressure and Plastic Reduction Imperatives

The German bottled-water market is subjected to environmental scrutiny as a structural constraint, which is motivated by the national and EU-level policy focus on plastic waste reduction. The Circular Economy Act of Germany and the EU Single-Use Plastics Directive have made the issue of packaging waste a more pressing topic, and bottled water is under specific pressure because of its connection to high-volume plastic consumption. The Federal Environment Agency states that packaging is one of the biggest contributors to the generation of plastic waste in Germany, which supports the negative attitudes to single-use beverage containers. This policy environment increases reputational and compliance risks to bottled-water suppliers.

To end users, the environmental impact is becoming a determining factor in purchasing behaviour, particularly in situations where high-quality tap water is easily accessible. The bottled-water manufacturers have the challenge of making a case of justification of packaging, logistics and lifecycle emissions against municipal supply. In the absence of plausible sustainability enhancements, brands face the risk of losing credibility and becoming less relevant to environmentally conscious end users who are actively seeking waste-reducing options.

Germany Bottled Water Market TrendRegulatory Assurance Strengthening Tap Water Adoption

The continuous strengthening of drinking water standards is influencing the long-term consumption trends in Germany. The updated EU Drinking Water Directive, which comes into force in 2021, requires member states to enhance access to safe water and increase the level of transparency regarding quality indicators. The implementation in Germany involves increased monitoring requirements and disclosure requirements, which enhance visibility of water safety performance. These actions strengthen the idea of tap water as a reliable, high-quality source of daily hydration, supported by objective compliance instead of advertising statements.

This regulatory transparency affects end users by making tap water use a default option in households and workplaces. Regular testing and disclosure make the uncertainty and perceived risk lower, making municipal water appear credible and sustainable. With the growing regulatory confidence, bottled water is competing more on differentiation than necessity, and this is redefining the demand in the German bottled-water market.

Germany Bottled Water Market OpportunitySustainability-Led Differentiation Pathways for Brands

In spite of the structural pressures, sustainability alignment offers a distinct strategic route to bottled-water suppliers in Germany. With the EU Drinking Water Directive framework encouraging safe tap water use, the bottled-water brands can rebrand around the value of complement instead of substitution. The focus on recycled materials, light packaging, and reduced transport emissions are consistent with the product stories and national environmental priorities as defined by the Federal Environment Agency. Authenticated sustainability assertions can be used to overcome doubt and remain relevant in the eyes of environmentally conscious customers.

There are also opportunities that arise with the involvement in circular systems, such as deposit-return optimisation and refill-compatible packaging formats. The confidence in bottled products can be restored by transparent reporting of environmental performance, which is backed by third-party certification. With the brand identity aligned with the wider sustainability and health goals of Germany, suppliers can protect premium segments and maintain contact with end users who value both quality and environmental responsibility.

Germany Bottled Water Market Segmentation Analysis

By Type of Water

- Carbonated Bottled Water

- Flavoured Bottled Water

- Functional Bottled Water

- Still Bottled Water

- Purified Water

- Mineral Water

- Spring Water

- Plain Water

Carbonated Bottled Water holds the largest share within the Type of Water segmentation, accounting for approximately 53% of the Germany Bottled Water Market. This dominance reflects deeply embedded cultural preferences for sparkling water, which is widely consumed during meals and social occasions. End users often associate carbonation with refreshment and digestive comfort, supporting frequent, habitual consumption. The segment benefits from a broad portfolio of mineral-rich and lightly carbonated options that align with taste expectations across age groups.

The sustained leadership of carbonated bottled water is also supported by its positioning as a distinct sensory experience rather than a basic hydration substitute. While tap water quality is high, many end users continue to value effervescence as a differentiating attribute. This preference anchors demand stability for carbonated varieties, ensuring their continued contribution to overall market volume and value despite structural headwinds affecting packaged water consumption.

By Sales Channel

- On Trade

- Off Trade

- Retail Offline

- Retail Online

Off-Trade distribution dominates the Sales Channel segmentation, representing around 80% of bottled water sales in Germany. Supermarkets, discount retailers, and convenience formats remain the primary purchasing points, reflecting end users’ preference for integrating bottled water purchases into routine grocery shopping. High shelf visibility, bulk packaging options, and price-led promotions reinforce the importance of off-trade channels in sustaining market reach.

The strength of off-trade channels is further supported by Germany’s well-developed retail infrastructure and efficient deposit-return systems, which facilitate large-volume purchases and returns. For end users, off-trade outlets offer convenience and cost efficiency, particularly for multi-pack formats. While on-trade consumption supports brand exposure, off-trade channels continue to anchor sales volumes and remain central to distribution strategies within the Germany Bottled Water Market.

List of Companies Covered in Germany Bottled Water Market

The companies listed below are highly influential in the Germany bottled water market, with a significant market share and a strong impact on industry developments.

- Adelholzener Alpenquellen GmbH

- Vilsa-Brunnen O Rodekohr GmbH & Co

- Franken Brunnen GmbH & Co KG

- Gerolsteiner Brunnen GmbH & Co KG

- Danone Waters Deutschland GmbH

- Aldi Einkauf GmbH & Co oHG

- Lidl & Schwarz Stiftung & Co KG

- Rewe Markt GmbH

- Hansa Heemann AG

- Rheinfelsquelle H Hövelmann GmbH & Co KG

Competitive Landscape

Germany’s bottled water market is becoming increasingly competitive as traditional brands, private labels, and alternative hydration solutions vie for relevance in a changing consumer environment. Established bottled water brands face pressure from rising sustainability concerns and price sensitivity, forcing them to invest in recycled PET packaging, functional and flavoured variants, and stronger transparency around environmental claims. At the same time, private label players such as Lidl and Aldi are gaining influence by combining low prices with brand-building efforts and visible sustainability initiatives, including rPET usage and sports partnerships. Competition is also intensifying from home carbonation systems like SodaStream and powder concentrates that use tap water, while functional bottled water remains a small but growing niche led by brands such as Eckes-Granini’s Hohes C Functional Water.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Germany Bottled Water Market Policies, Regulations, and Standards

4. Germany Bottled Water Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Germany Bottled Water Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Volume (Million Litres)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Type of Water

5.2.1.1. Carbonated Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Flavoured Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Functional Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Still Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Purified Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Mineral Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Spring Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Plain Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Packaging Material

5.2.2.1. Plastic Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Glass Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Metal Cans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Others (Tetra Pack Cartons, Bioplastics, etc.)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Point

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. On Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Off Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Germany Carbonated Bottled Water Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Volume (Million Litres)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Germany Flavoured Bottled Water Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Volume (Million Litres)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Germany Functional Bottled Water Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Volume (Million Litres)

8.2. Market Segmentation & Growth Outlook

8.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Germany Still Bottled Water Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Volume (Million Litres)

9.2. Market Segmentation & Growth Outlook

9.2.1.By Type of Water- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Price Point- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Gerolsteiner Brunnen GmbH & Co KG

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Danone Waters Deutschland GmbH

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Aldi Einkauf GmbH & Co oHG

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Lidl & Schwarz Stiftung & Co KG

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Rewe Markt GmbH

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Adelholzener Alpenquellen GmbH

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Vilsa-Brunnen O Rodekohr GmbH & Co

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Franken Brunnen GmbH & Co KG

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Hansa Heemann AG

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Rheinfelsquelle H Hövelmann GmbH & Co KG

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Type of Water |

|

| By Packaging Material |

|

| By Price Point |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.