France Skin Care Market Report: Trends, Growth and Forecast (2025-2030)

By Product (Body Care, Facial Care, Hand Care, Skin Care Sets/Kits), By Category (Premium, Mass), By Gender (Men, Women, Unisex), By End User (Adults, Teenagers, Children), By Packaging (Tubes, Bottles, Jars, Others), By Sales Channel (Online, Offline)

- FMCG

- Dec 2025

- VI0110

- 122

-

France Skin Care Market Statistics, 2025

- Market Size Statistics

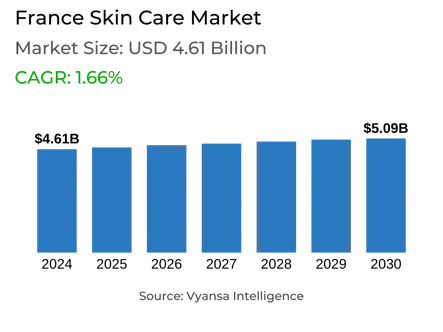

- Skin Care in France is estimated at $ 4.61 Billion.

- The market size is expected to grow to $ 5.09 Billion by 2030.

- Market to register a CAGR of around 1.66% during 2025-30.

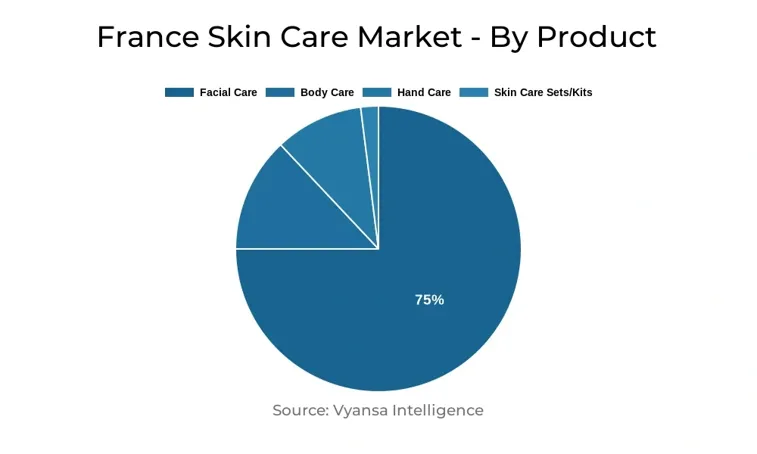

- Product Shares

- Facial Care grabbed market share of 75%.

- Competition

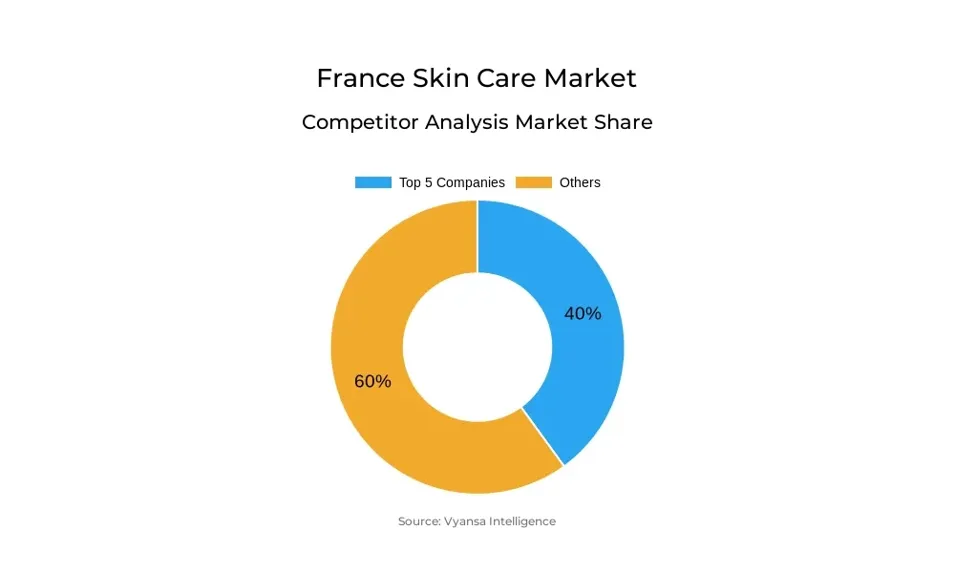

- More than 20 companies are actively engaged in producing Skin Care in France.

- Top 5 companies acquired 40% of the market share.

- Laboratoires NAOS SAS, Clarins SA, Caudalie Sarl, Cosmétique Active, International (CAI) L'Oréal SA etc., are few of the top companies.

- Sales Channel

- Retail Offline grabbed 85% of the market.

France Skin Care Market Outlook

France skin care market will experience consistent growth between 2025 and 2030 owing mainly to the growing demand for premium as well as dermocosmetic products. French shoppers continue to focus on skin care solutions that provide established outcomes, particularly those supported by scientific evidence or prescribed by pharmacists. Dermocosmetics, which are frequently retailed through pharmacies, will continue to experience robust growth since they provide medical-grade solutions with greater authenticity. This segment is gaining from the trend towards preventative and functional skincare, appealing both to younger and older consumers.

Premiumisation will continue to be a leading trend, with consumers prepared to pay more for effective moisturizing and anti-ageing products. The focus for brands is on clinical validation, active ingredients, and simplified but efficacious regimens, with peptides, niacinamide, and hyaluronic acid continuing in favor. Mass skin care participants are also launching performance-driven products to fight in this changing scenario. Distribution via pharmacies, beauty experts, and online platforms will increase, whereas sales in supermarkets and hypermarkets can continue to dwindle on account of consumer preference for expert advice in high-end purchases.

Natural skincare is also a principal mover, with increasingly products containing ingredients like lactobacilli and probiotics. Organic products still struggle because of certification charges and incursion by less expensive "natural" products. French ingredient manufacturers are working on their own eco-friendly, effective ingredients to drive the clean beauty movement.

Technological innovation will increasingly influence the market. Intelligent beauty devices, artificial intelligence-driven tailored routines, and partnerships with dermatologists are becoming the focal point of product development. Technologies like LED masks and in vivo skin analysis machines mirror increased consumer demand for scientific, at-home treatments and convenience.

France Skin Care Market Growth Driver

Demand for French skin care will continue to grow steadily, particularly for high-end products that provide tangible results and live up to their promises. People of all ages are more concerned about wellbeing as a whole and are increasingly turning towards global solutions. Personalization and technology are on the ascendancy, with companies embracing AI software to examine individual skin types and develop individualized routines. Natural ingredients such as probiotics and lactobacilli are also becoming increasingly popular because they assist in balancing the bacteria on the skin and enhancing resilience, with an emphasis on sustained repair rather than instant fixing.

Dermocosmetics should also experience strong growth as skin care increasingly becomes medicalised. Consumers are happy to pay more for products they can rely upon—frequently those supported by pharmacists or recommended by physicians. Even the growing popularity of retinal, a quicker-acting form of anti-ageing compound than retinol, adds fuel to this trend. Yet the line between authentic dermocosmetics and seeming medicalised products is increasingly blurring.

France Skin Care Market Trend

Over the next few years, natural ingredients in skin care will continue to increase gradually as more consumers associate personal health with environmental stewardship. The trend towards clean beauty is increasing, with companies emphasizing natural, sustainable ingredients and shunning toxic chemicals. Consumers are increasingly conscious and demand transparency regarding product composition and active ingredients. This is fueling demand for safe, green, and transparently labeled skin care solutions.

French ingredient players are at the forefront of this trend. Codif Technologie Naturelle is converting apple cider byproducts into functional ingredients that enhance skin barrier function and smoothness. Laboratories Expanscience has introduced Gaïaline, a linseed-derived ingredient, which protects and regenerates the skin and is cultivated using certified regenerative agriculture. Roquette Beaute has introduced Beaute by Roquette ST 730, a pea starch-derived, water-resistant filler with a clinically validated lifting effect for anti-aging cosmetics.

France Skin Care Market Opportunity

Beauty technology is emerging as a major trend with more skincare brands embracing new technologies to provide intelligent solutions. One of the most significant advancements is the introduction of internet-enabled skincare gadgets that examine the skin in real time and modulate treatments as per immediate feedback. An example of such is the My Blend mask, one of the earliest LED beauty masks to hit the consumer market, featuring 288 red and infrared LED lights to trigger collagen and diminish signs of aging. Top retailer Galeries Lafayette has even committed a specific Beauty Tech area in its health section, signifying strong commitment to this trend.

Brands such as Lancôme have been at the forefront of this for years, beginning with their Pro Radiance booster in 2009 and now having a third-generation ultrasound version. Lightinderm has partnered with the Cochin hospital in Paris to demonstrate the success of its photo modulation machine, treating wrinkles, redness, and blemishes with patented serums. More of the same can be anticipated in the future.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 4.61 Billion |

| USD Value 2030 | $ 5.09 Billion |

| CAGR 2025-2030 | 1.66% |

| Largest Category | Facial Care segment leads with 75% market share |

| Top Drivers | Growing Preference for Personalised, Premium & Holistic Solutions Driving Market Growth |

| Top Trends | Growing Shift Towards Natural & Sustainable Ingredients |

| Top Opportunities | Rising Adoption of Beauty Tech Devices Transforming Skincare Routines |

| Key Players | Laboratoires NAOS SAS, Clarins SA, Caudalie Sarl, Cosmétique Active, International (CAI) L'Oréal SA, Beiersdorf (France) SA, Yves Rocher SA, Pierre Fabre SA, Henkel France SA, Gemey Maybelline Garnier and Others. |

France Skin Care Market Segmentation Analysis

The most market share holding segment in the France Skin Care Market under the sales channel is Retail Offline. Pharmacies, parapharmacies, and beauty specialist stores continue to be the most sought-after channels for buying premium skin care. These stores experienced an upsurge in 2024, whereas supermarkets and hypermarkets experienced a drop in sales. Mass goods struggled in grocery-led retail formats with customers wanting to shop at specialist stores where there is access to expert advice and personal recommendations. Retailers such as Sephora countered by introducing parapharmacy departments in their stores and online sites to hold onto customers.

Dermocosmetics keep selling well because they have the clinical support and increasing consumer trust. Variety retailers also recorded the most rapid expansion in 2024 from a low starting point, as budget-conscious consumers hunted for deals. At the same time, online shopping is increasingly on the rise, with some accessing it for information first and then purchasing offline. Social networks and influencers are also having an effect, with robust online sales being recorded by beauty experts such as Sephora.

Top Companies in France Skin Care Market

The top companies operating in the market include Laboratoires NAOS SAS, Clarins SA, Caudalie Sarl, Cosmétique Active, International (CAI) L'Oréal SA, Beiersdorf (France) SA, Yves Rocher SA, Pierre Fabre SA, Henkel France SA, Gemey Maybelline Garnier, etc., are the top players operating in the France Skin Care Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. France Skin Care Market Policies, Regulations, and Standards

4. France Skin Care Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. France Skin Care Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Firming Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. General Purpose Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Facial Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.1. Acne Treatments- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.2. Face Masks- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3. Facial Cleansers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.1. Liquid- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.2. Cream- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.3. Gel- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.4. Bar Cleansers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.5. Facial Cleansing Wipes- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4. Moisturisers and Treatments- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4.1. Basic Moisturisers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4.2. Anti-Agers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.5. Lip Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.6. Toners- Market Insights and Forecast 2020-2030, USD Million

5.2.1.3. Hand Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.4. Skin Care Sets/Kits- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Category

5.2.2.1. Premium- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Women- Market Insights and Forecast 2020-2030, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By End User

5.2.4.1. Adults- Market Insights and Forecast 2020-2030, USD Million

5.2.4.2. Teenagers- Market Insights and Forecast 2020-2030, USD Million

5.2.4.3. Children- Market Insights and Forecast 2020-2030, USD Million

5.2.5.By Packaging

5.2.5.1. Tubes- Market Insights and Forecast 2020-2030, USD Million

5.2.5.2. Bottles- Market Insights and Forecast 2020-2030, USD Million

5.2.5.3. Jars- Market Insights and Forecast 2020-2030, USD Million

5.2.5.4. Others- Market Insights and Forecast 2020-2030, USD Million

5.2.6.By Sales Channel

5.2.6.1. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.6.2. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. France Body Care Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By Category- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Gender- Market Insights and Forecast 2020-2030, USD Million

6.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

6.2.5.By Packaging- Market Insights and Forecast 2020-2030, USD Million

6.2.6.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. France Facial Care Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Category- Market Insights and Forecast 2020-2030, USD Million

7.2.3.By Gender- Market Insights and Forecast 2020-2030, USD Million

7.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

7.2.5.By Packaging- Market Insights and Forecast 2020-2030, USD Million

7.2.6.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. France Hand Care Market Statistics, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2020-2030, USD Million

8.2.2.By Gender- Market Insights and Forecast 2020-2030, USD Million

8.2.3.By End User- Market Insights and Forecast 2020-2030, USD Million

8.2.4.By Packaging- Market Insights and Forecast 2020-2030, USD Million

8.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

9. France Skin Care Sets/Kits Market Statistics, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2020-2030, USD Million

9.2.2.By Gender- Market Insights and Forecast 2020-2030, USD Million

9.2.3.By End User- Market Insights and Forecast 2020-2030, USD Million

9.2.4.By Packaging- Market Insights and Forecast 2020-2030, USD Million

9.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Cosmétique Active

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. International (CAI) L'Oréal SA

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Beiersdorf (France) SA

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Yves Rocher SA

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Pierre Fabre SA

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Laboratoires NAOS SAS

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Clarins SA

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Caudalie Sarl

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Henkel France SA

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Gemey Maybelline Garnier

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Category |

|

| By Gender |

|

| By End User |

|

| By Packaging |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.