France Premium Beauty and Personal Care Market Report: Trends, Growth and Forecast (2025-2030)

By Product (Colour Cosmetics, Fragrances, Deodorants, Hair Care, Skin Care, Bath and Shower, Baby and Child-specific Products), By End User (Men’s, Women’s, Unisex), By Sales Channel (Online, Offline)

- FMCG

- Dec 2025

- VI0031

- 121

-

France Premium Beauty and Personal Care Market Statistics, 2025

- Market Size Statistics

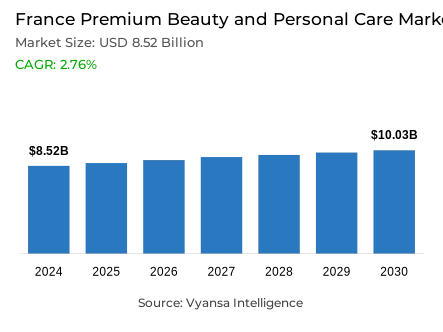

- Premium Beauty and Personal Care in France is estimated at $ 8.52 Billion.

- The market size is expected to grow to $ 10.03 Billion by 2030.

- Market to register a CAGR of around 2.76% during 2025-30.

- Product Shares

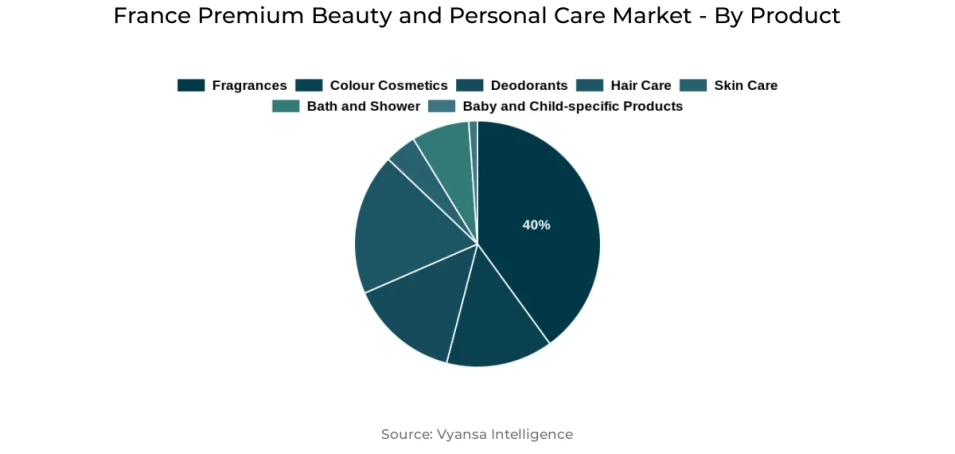

- Premium Fragrances grabbed market share of 40%.

- Competition

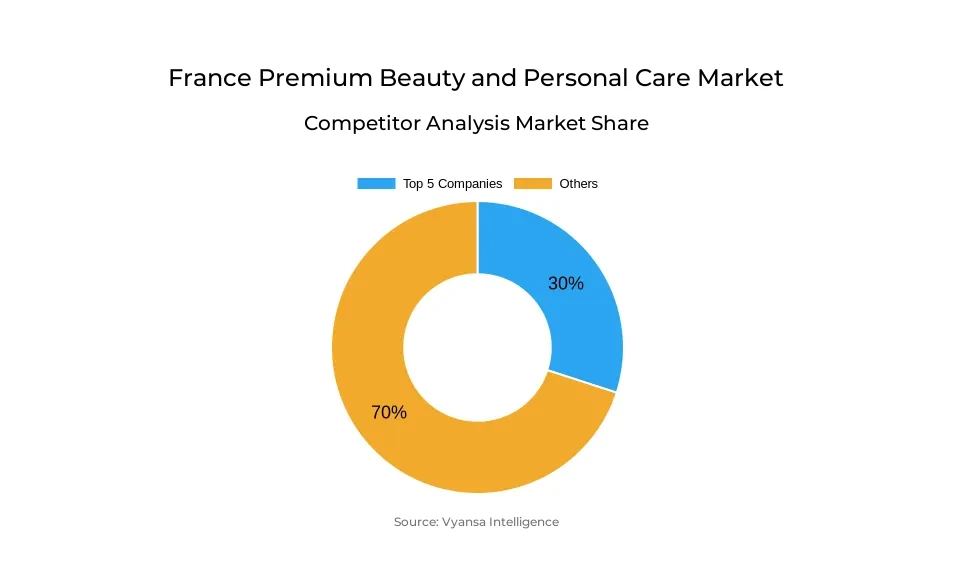

- More than 20 companies are actively engaged in producing Premium Beauty and Personal Care in France.

- Top 5 companies acquired 30% of the market share.

- Clarins SA, NAOS SAS, L'Oréal SA, Cosmétique Active, Pierre Fabre SA etc., are few of the top companies.

France Premium Beauty and Personal Care Market Outlook

France premium beauty and personal care market will be in continued strong growth through 2025 to 2030 as a result of continued premiumisation and the preferences of consumers for quality rather than quantity. Consumers in France are willing to spend more on products that prove to work effectively, particularly in sectors such as fragrances, skincare, and hair care. Luxury perfumes continue to dominate as the biggest segment, driven by legend france brands and increasing demand for niche and customized fragrances. Consumers remain resilient despite adverse economic conditions, opting to purchase their preferred premium brands, reflecting the deep emotional attachment these brands have established.

Market leaders such as L'Oréal Groupe and Inter Parfums will continue to hold their market share through the use of omnichannel strategies, innovation, and successful social media marketing. L'Oréal's emphasis on dermocosmetics and sustainability, for example through refillable perfume bottles, is meeting increasing consumer demand for ethical yet effective products. Brands such as Lacoste are meanwhile reaching younger consumers through celebrity endorsements and new product releases, which are driving them to grow.

In-store has a part to play as well, with premium dedicated areas in stores such as Marionnaud serving to increase customer interaction through customised services and VIP programmes. These serve to confirm the luxury status and loyalty. Sub-segments like premium body mists and sun protection creams meanwhile are set to ride high on growth, backed by constant use throughout the year and recommendations by dermatologists, and the pharmacy as the favorite purchase destination.

Lastly, the personalisation trend, further boosted by AI technology and skin analysers, will continue to propel the premium market. People are seeking tailored beauty regimens that meet their individual requirements, which premium companies are equipped to deliver. Overall, the france premium personal care and beauty market will be active and resilient in 2025-30.

France Premium Beauty and Personal Care Market Growth Driver

The increasing desire for quality over quantity is compelling france consumers to opt for premium beauty and personal care brands. Although masstige products are gaining by releasing new products regularly, france shoppers continue to prefer the efficacy and genuineness of high-end brands. Yet, dupes are gaining popularity as they provide similar benefits at lower costs. Despite this, premiumisation continues to be strong as customers across generations are willing to buy less frequently if it will deliver superior quality.

Of all the segments, premium body mists and sun protection should develop most during the forecast period. In 2024, sun care remained in robust form even against a disappointing summer thanks to growing year-round usage. While mass sun creams purchased largely for holidays, premium offerings from La Roche-Posay, Uriage, and Avène are widely prescribed by dermatologists. Pharmacists continue to be the leader, providing trusted medical counsel valued by france shoppers.

France Premium Beauty and Personal Care Market Trend

The increasing skinification trend in hair care will also witness premium hair care sales rise significantly. france consumers increasingly follow hair care regimens with a focus on scalp health and personalized treatments, and these products become an integral part of their beauty routine. This is evident from the consistent launch of new, innovative products in the market that are specifically designed to target scalp care and hair well-being.

Moreover, professional hair care at salons is witnessing significant growth, with all brands falling in the premium segment. The proliferation of specialized hair care stores such as Blue Libulle and La Boutique de Coiffeur has made salon products more widely available outside hairdressers. Luxury and premium brands are concentrating on creating more customized, scalp-focused products, further stimulating growth and consumer demand in this space.

France Premium Beauty and Personal Care Market Opportunity

Personalisation in beauty and personal care will be a significant growth opportunity in 2025-30. The premium segment, too, has remained robust even in challenging times, and personalisation is now going to be the major driver for further advancement. Increasingly, consumers are looking for products that are specific to their individual needs, and technology is facilitating this process.

Skin analysis products, including Derma Expert and L'Oréal's Skin Genius, powered by AI are informing consumers about their skin condition. This enables them to adjust their routines as well as select the right products depending on their individual needs. Consequently, the use of AI is likely to propel growth and make the premium beauty and personal care market more robust.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 8.52 Billion |

| USD Value 2030 | $ 10.03 Billion |

| CAGR 2025-2030 | 2.76% |

| Largest Category | Premium Fragrances segment leads with 40% market share |

| Top Drivers | Rising Demand for Body Mists and Premium Sun Protection Products |

| Top Trends | Traction Towards Skinification Driving Market Growth |

| Top Opportunities | Growing Potential in Personalisation Driven by AI Technology |

| Key Players | Clarins SA, NAOS SAS, L'Oréal SA, Cosmétique Active, Pierre Fabre SA, Laboratoires Christian Dior SA, Parfums, Chanel SA, Guerlain SAS, Paco Rabanne - Groupe Puig SA, Estée Lauder (France) SA and Others. |

France Premium Beauty and Personal Care Market Segmentation

The category with the largest market share of the France Premium Beauty and Personal Care Market 2025-30 is Premium Fragrances. The category remains the biggest, fueled by good value growth in both women's and men's products. Premium fragrances contain some of France's best-known beauty products, with consumers increasingly interested in niche and personal fragrances. france consumers are ready to pay for such perfumes, with the tendency of opting for products of famous france fashion brands. The segment enjoys innovations, personalization, and a transition towards sustainability, which assist in preserving its high standing.

Luxury fragrances have remained stable despite economic downturns, with customers continuing to purchase their favorite perfumes because of the emotional attachment and lifestyle they signify. Most customers prefer to spend money on premium fragrances over several low-cost brands. Buyers are also trying out various fragrances for the day and night, based on the mood each scent creates, further driving the segment's growth.

Top Companies in France Premium Beauty and Personal Care Market

The top companies operating in the market include Clarins SA, NAOS SAS, L'Oréal SA, Cosmétique Active, Pierre Fabre SA, Laboratoires Christian Dior SA, Parfums, Chanel SA, Guerlain SAS, Paco Rabanne - Groupe Puig SA, Estée Lauder (France) SA, etc., are the top players operating in the France Premium Beauty and Personal Care Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. France Premium Beauty and Personal Care Market Policies, Regulations, and Standards

4. France Premium Beauty and Personal Care Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. France Premium Beauty and Personal Care Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Colour Cosmetics- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Eye Make-Up- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. Facial Make-Up- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.3. Lip Products- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.4. Nail Products- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.5. Colour Cosmetics Sets/Kits- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Fragrances- Market Insights and Forecast 2020-2030, USD Million

5.2.1.3. Deodorants- Market Insights and Forecast 2020-2030, USD Million

5.2.1.4. Hair Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5. Skin Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5.1. Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5.2. Facial Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5.3. Hand Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5.4. Skin Care Sets/Kits- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5.5. Sun Protection- Market Insights and Forecast 2020-2030, USD Million

5.2.1.6. Bath and Shower- Market Insights and Forecast 2020-2030, USD Million

5.2.1.7. Baby and Child-specific Products- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By End User

5.2.2.1. Men’s- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Women’s- Market Insights and Forecast 2020-2030, USD Million

5.2.2.3. Unisex- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Sales Channel

5.2.3.1. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. France Premium Colour Cosmetics Market Outlook, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By End User- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. France Premium Fragrances Market Outlook, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By End User- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. France Premium Deodorants Market Outlook, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By End User- Market Insights and Forecast 2020-2030, USD Million

8.2.2.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

9. France Premium Hair Care Market Outlook, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By End User- Market Insights and Forecast 2020-2030, USD Million

9.2.2.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

10. France Premium Skin Care Market Outlook, 2020-2030F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Product- Market Insights and Forecast 2020-2030, USD Million

10.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

11. France Premium Bath and Shower Market Outlook, 2020-2030F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By End User- Market Insights and Forecast 2020-2030, USD Million

11.2.2. By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

12. France Premium Baby and Child-specific Products Market Outlook, 2020-2030F

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in US$ Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

13. Competitive Outlook

13.1. Company Profiles

13.1.1. Cosmétique Active International (CAI)

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. Pierre Fabre SA, Laboratoires

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Christian Dior SA

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. Chanel SA

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. Guerlain SAS

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. Clarins SA

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. NAOS SAS

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. L'Oréal SA

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. Paco Rabanne - Groupe Puig SA

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

13.1.10. Estée Lauder (France) SA

13.1.10.1. Business Description

13.1.10.2. Product Portfolio

13.1.10.3. Collaborations & Alliances

13.1.10.4. Recent Developments

13.1.10.5. Financial Details

13.1.10.6. Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.