France Leisure & Business Travel Booking Market Report: Trends, Growth and Forecast (2026-2032)

By Travel Sales Type (Leisure Travel, Business Travel), By Booking Channel (Offline Booking, Online Booking), By Booking Method (Travel Intermediaries, Direct Suppliers)

- ICT

- Nov 2025

- VI0389

- 115

-

France Leisure & Business Travel Booking Market Statistics and Insights, 2026

- Market Size Statistics

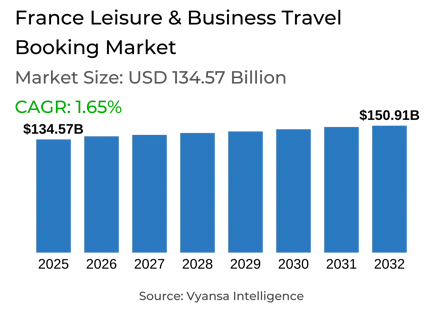

- Leisure & Business Travel Booking in France is estimated at $ 134.57 Billion.

- The market size is expected to grow to $ 150.91 Billion by 2032.

- Market to register a CAGR of around 1.65% during 2026-32.

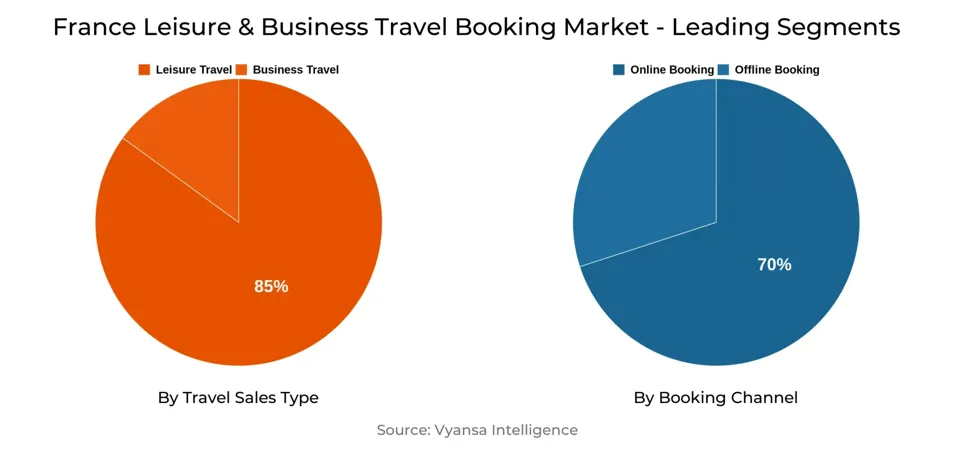

- Travel Sales Type Shares

- Leisure Travel grabbed market share of 85%.

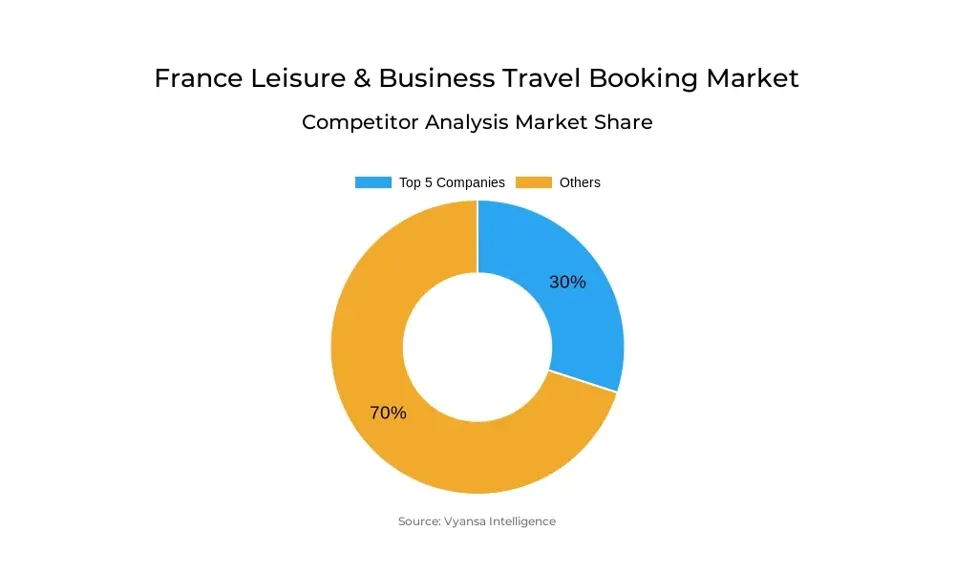

- Competition

- France Leisure & Business Travel Booking Market is currently being catered to by more than 20 companies.

- Top 5 companies acquired 30% of the market share.

- Groupe Voyageurs SA, Lastminute SAS, Leclerc Voyages SA, Booking.com BV, Selectour Afat Entreprise SA etc., are few of the top companies.

- Booking Channel

- Online Booking grabbed 70% of the market.

France Leisure & Business Travel Booking Market Outlook

The French leisure and business travel booking market is recording robust growth, with the market valued at $134.57 billion in 2025 and poised to grow to $150.91 billion by 2032. Travel intermediaries such as traditional agencies, online, and tour operators are gaining from the post-COVID pick-up as more French end users book domestic and international vacations. In spite of economic pressures, travel expenditure continues to increase, driven by long-haul, medium-haul, and domestic leisure bookings driven by increasing end user and business confidence.

Internet booking still leads the market, accounting for approximately 70% of revenues. end customers increasingly favor the convenience, effectiveness, and value of digital platforms, with mobile applications leading dynamic growth with last-minute book services, loyalty schemes, and easy-to-use interfaces. Players like Booking.com, Lastminute.com, and Voyage-prive.com continue to dominate, providing integrated travel solutions such as accommodations, flights, transportation, and activities.

Travel intermediary competition is growing, with the likes of TUI Group, Club Méditerranée SA, and Selectour Afat Entreprise SA having a dynamic growth rate. Firms are putting money into omnichannel, dynamic packaging, and new-generation services in response to increasing demand and the requirement for younger end users to have more customized holiday experiences. Offline players such as grocery stores are moving into holiday booking too, displaying resilience within a competitive market.

In the future, travel inspiration and planning is becoming a more significant function of social media, especially among millennials. French travelers have a proclivity for novel, environmentally friendly, and sustainable experiences, and countries of North Africa, the Mediterranean, Scandinavia, Mauritius, and North America are likely to experience high growth. Whereas lower-income end users will curb demand for conventional travel agencies, upper-end and luxury segments will enjoy increased per-trip spending, bolstering overall market growth through 2032.

France Leisure & Business Travel Booking Market Growth Driver

Increased Demand for Long-Haul and Business Travel

Long-haul destinations and business travel bookings are a key driver of growth for France Leisure & Business Travel Booking Market. Increasing confidence in organizing international travel means that visitors are increasingly eager to visit destinations not only within Europe but also abroad. Bookings for business tourism and MICE tourism are especially on the increase, sustained by the popularity of green destinations such as Scandinavian nations.

This increase in business and long-distance travel leads to greater booking values, as these journeys tend to involve greater expenditure. Operators and travel intermediaries gain from this trend as they process more sophisticated bookings and provide customized services to cater to varied travellers' needs. The continued demand for international and business travel remains a strong growth force within the market.

France Leisure & Business Travel Booking Market Challenge

Increasing Burden of Affordability on Travelers

The France Leisure & Business Travel Booking Market is under pressure as lower and middle-income end users are finding it difficult to maintain pace with increasing travel prices. Inflation and diminished purchasing power compel individuals to find value for money alternatives, including staying with friends or relatives or comparing fares on deal websites. This reduces the level of demand for conventional travel agency services and presents an obstacle for expansion in the broader booking market.

As luxury and high-end travel keeps growing, the expansion is primarily fueled by upper and certain middle-class travelers. Smaller agencies are especially exposed to the situation, as the diminishing customer base among price-conscious end users poses a threat to their long-term existence. The gap between value and premium travel makes it challenging for the market to achieve stable growth.

France Leisure & Business Travel Booking Market Trend

Increased Demand for Online and Mobile Reservations

French end users are also more often opting to plan their vacations online and on mobile applications compared to offline. Mobile booking is also expanding rapidly due to last-minute bookings and convenient applications. Such websites offer unique offers, convenience, and loyalty benefits like discounts and upgrades, which attract repeat business.

This trend indicates how convenience and digital interaction increasingly dominate travel planning. With online and mobile channels providing instant access and value-added services, travellers are developing habits that work best for digital interfaces. As the trend gathers momentum, the old methods of booking lose momentum, determining the future course of the market.

France Leisure & Business Travel Booking Market Opportunity

Expansion of Services by New and Non-Traditional Players

The France Leisure & Business Travel Booking Market has solid prospects with emerging forms of players entering the market. Air carriers and hotel companies are expanding their offerings to car rentals, concert tickets, and sports event reservations, which provide new streams of revenue. Meanwhile, banks and even supermarket chains are venturing into travel booking, reflecting the industry's broad attractiveness.

This growth presents new opportunities to capture and attract travellers in innovative ways, providing end users with more convenient and integrated booking channels. By providing bundled products beyond flights and hotels, these new entrants have the potential to tap into demand from a larger segment. The involvement of non-traditional players will bring forth more competitive and innovative solutions and propel further expansion for the market.

France Leisure & Business Travel Booking Market Segmentation Analysis

By Travel Sales Type

- Leisure Travel

- Business Travel

The segment with the highest market share under the Travel Sales Type is Leisure Travel, which took 85% of the market. Leisure tourism continued to dominate as more French citizens kept approaching travel agents and tour operators in 2023 and 2024. Top destinations in this period were Spain, Italy, urban France, Morocco, Egypt, Thailand, Mexico, Finland, and Mauritius.

Home leisure bookings remained stable, while outbound leisure travel enhanced the overall performance. With this broad choice of both nearby and foreign destinations, leisure trips continued to be the dominant segment, propelling most of the booking volumes in France.

By Booking Channel

- Offline Booking

- Online Booking

The segment with the highest market share under Booking Channel is Online Booking, which took a 70% market share. Online booking had already bounced back to pre-pandemic sales levels in 2023 and grew even more in 2024. end users grew accustomed and familiar with online channels, fuelling the robust growth of this segment.

In addition to this, mobile booking also exhibited dynamic growth during 2023 and 2024, facilitated by better apps and user-friendly interfaces. With online platforms having a distinct advantage over offline channels, online booking emerged as the most popular channel in the travel market of France.

Top Companies in France Leisure & Business Travel Booking Market

The top companies operating in the market include Groupe Voyageurs SA, Lastminute SAS, Leclerc Voyages SA, Booking.com BV, Selectour Afat Entreprise SA, Marietton Développement SAS, TUI Group, Club Méditerranée SA, Expedia Group Inc, VPG SA, etc., are the top players operating in the France Leisure & Business Travel Booking Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. France Leisure & Business Travel Booking Market Policies, Regulations, and Standards

4. France Leisure & Business Travel Booking Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. France Leisure & Business Travel Booking Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Travel Sales Type

5.2.1.1. Leisure Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Business Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Booking Channel

5.2.2.1. Offline Booking- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Online Booking- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Booking Method

5.2.3.1. Travel Intermediaries- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Direct Suppliers- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. France Leisure Travel Booking Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Travel Sales Type- Market Insights and Forecast 2022-2032, USD Million

6.2.1.1. Leisure Air Travel- Market Insights and Forecast 2022-2032, USD Million

6.2.1.2. Leisure Car Rental- Market Insights and Forecast 2022-2032, USD Million

6.2.1.3. Leisure Cruise- Market Insights and Forecast 2022-2032, USD Million

6.2.1.4. Leisure Experiences and Attractions- Market Insights and Forecast 2022-2032, USD Million

6.2.1.5. Leisure Lodging- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Booking Method- Market Insights and Forecast 2022-2032, USD Million

7. France Business Travel Booking Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Travel Sales Type- Market Insights and Forecast 2022-2032, USD Million

7.2.1.1. Business Air Travel- Market Insights and Forecast 2022-2032, USD Million

7.2.1.2. Business Car Rental- Market Insights and Forecast 2022-2032, USD Million

7.2.1.3. Business Lodging- Market Insights and Forecast 2022-2032, USD Million

7.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Booking Method- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1. Booking.com BV

8.1.1.1. Business Description

8.1.1.2. Service Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2. Selectour Afat Entreprise SA

8.1.2.1. Business Description

8.1.2.2. Service Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3. Marietton Développement SAS

8.1.3.1. Business Description

8.1.3.2. Service Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4. TUI Group

8.1.4.1. Business Description

8.1.4.2. Service Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5. Club Méditerranée SA

8.1.5.1. Business Description

8.1.5.2. Service Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6. Groupe Voyageurs SA

8.1.6.1. Business Description

8.1.6.2. Service Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7. Lastminute SAS

8.1.7.1. Business Description

8.1.7.2. Service Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8. Leclerc Voyages SA

8.1.8.1. Business Description

8.1.8.2. Service Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9. Expedia Group Inc

8.1.9.1. Business Description

8.1.9.2. Service Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. VPG SA

8.1.10.1. Business Description

8.1.10.2. Service Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Travel Sales Type |

|

| By Booking Channel |

|

| By Booking Method |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.