France Jewellery Market Report: Trends, Growth and Forecast (2026-2032)

Category (Costume Jewellery, Fine Jewellery), Type (Earrings, Neckwear, Rings, Wristwear, Other), Collection (Diamond, Non-Diamond), Material Type (Gold, Platinum, Metal Combination, Silver), Sales Channel (Retail Offline, Retail Online), End User (Men, Women)

- FMCG

- Dec 2025

- VI0620

- 130

-

France Jewellery Market Statistics and Insights, 2026

- Market Size Statistics

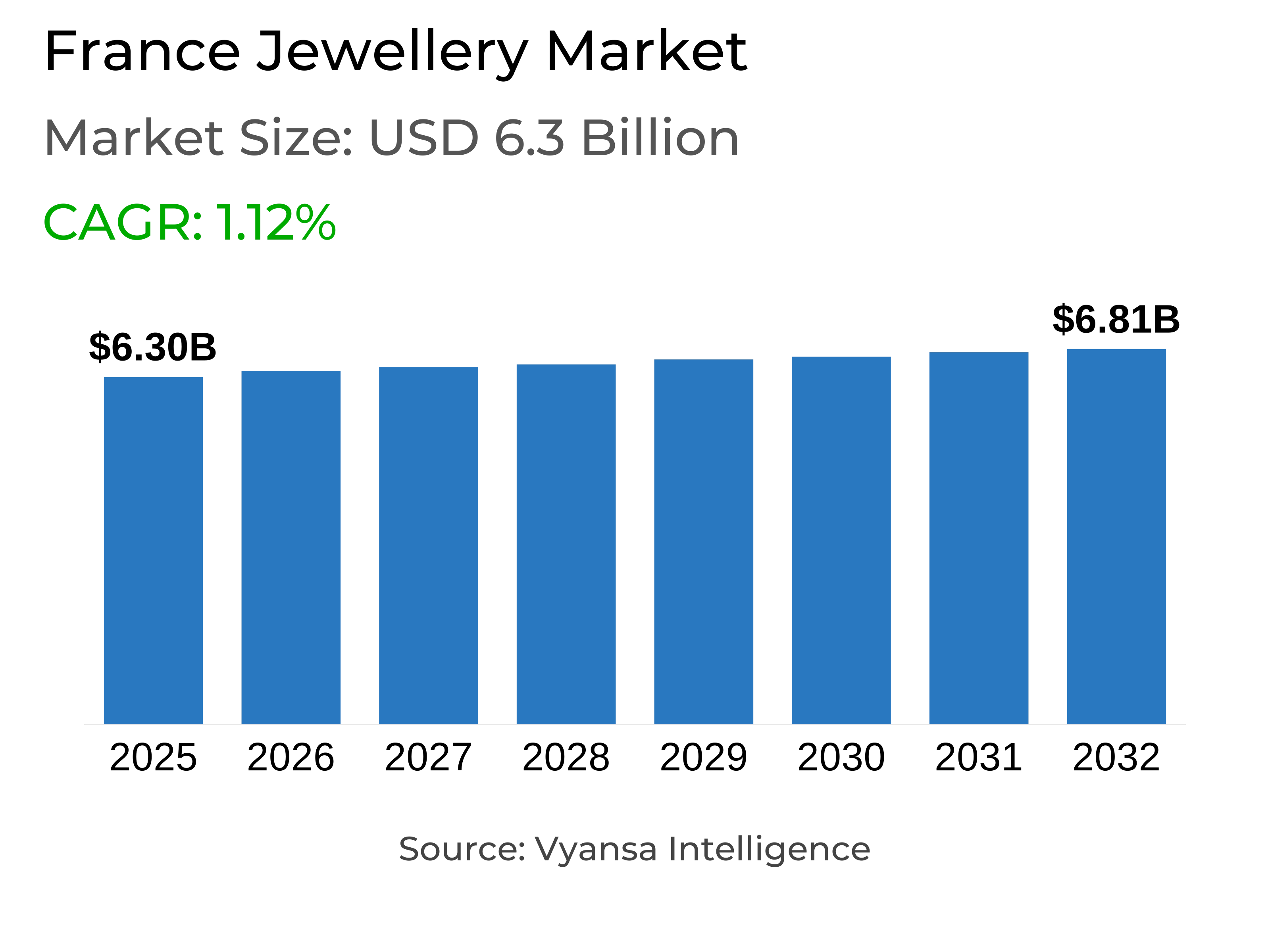

- Jewellery in france is estimated at USD 6.3 billion.

- The market size is expected to grow to USD 6.81 billion by 2032.

- Market to register a cagr of around 1.12% during 2026-32.

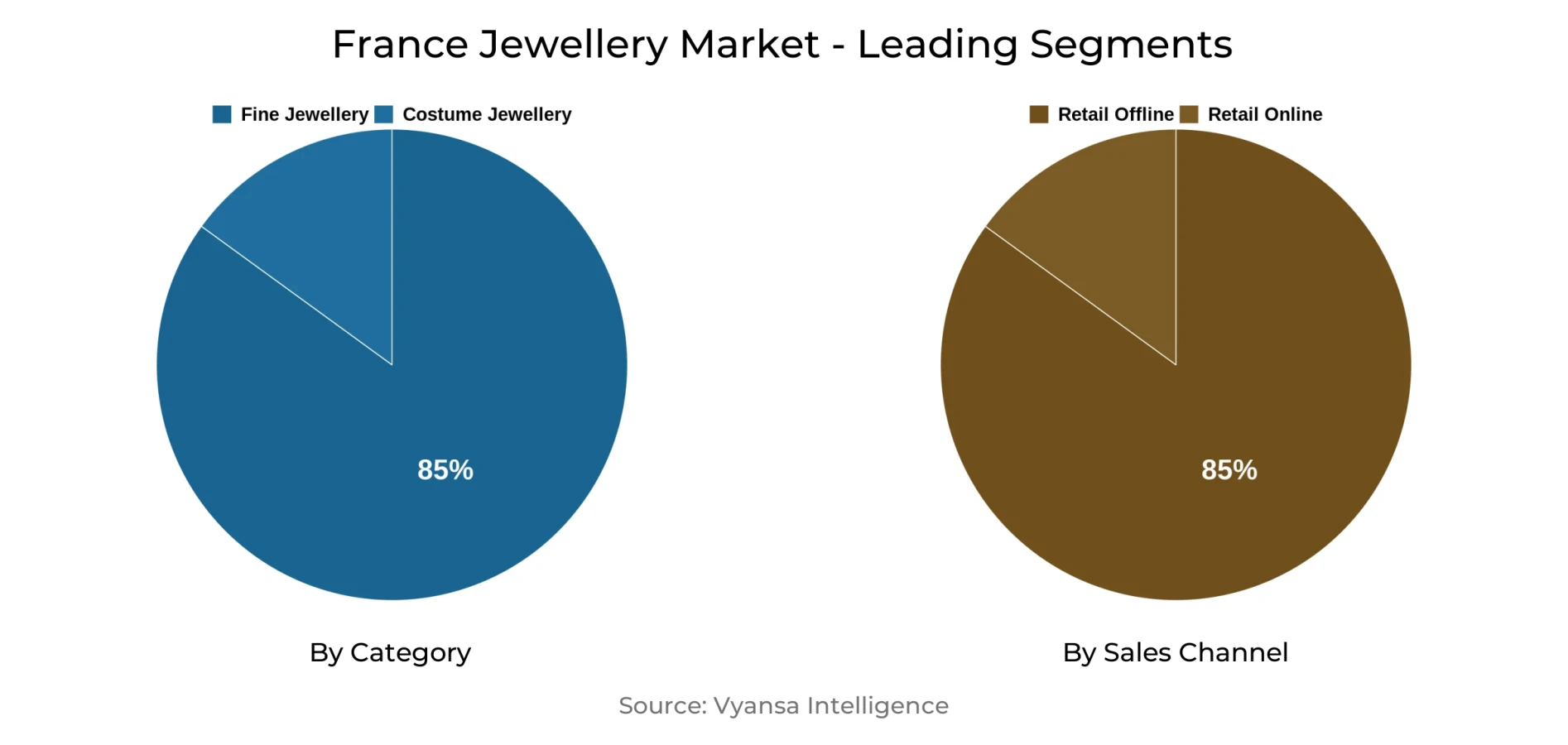

- Category Shares

- Fine jewellery grabbed market share of 85%.

- Competition

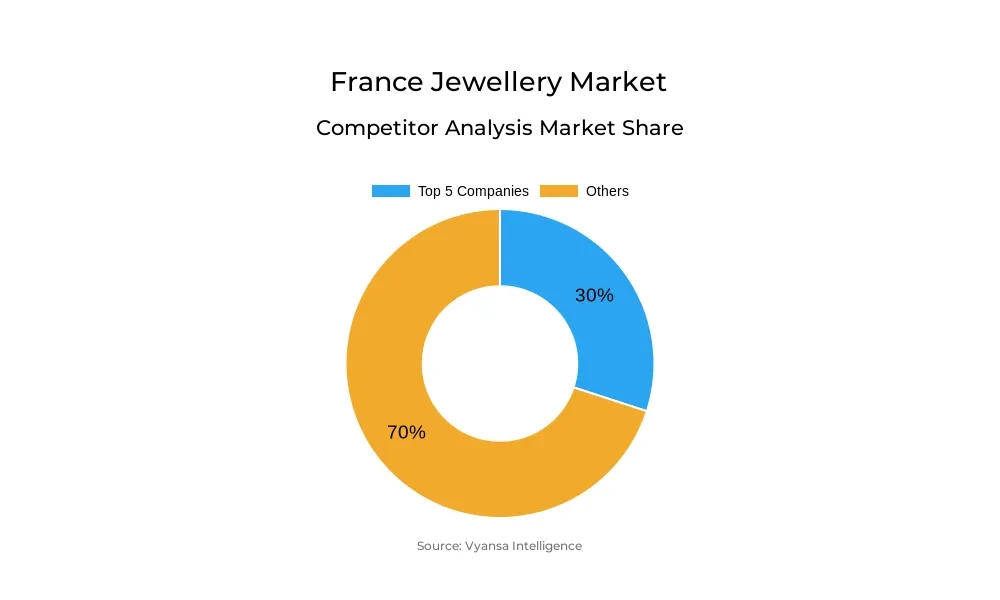

- More than 20 companies are actively engaged in producing jewellery in france.

- Top 5 companies acquired around 30% of the market share.

- Swarovski France SA, Orest Group SA, Dinh Van SAS, Cartier Joaillerie International SAS, Pandora France etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

France Jewellery Market Outlook

The jewellery market in France is estimated at around USD 6.3 billion in 2025 and is projected to reach around USD 6.81 billion by 2032, growing at a CAGR of around 1.12% during 2026-2032. Growth is primarily supported by increasing fine jewellery demand, as more end users perceive it as a symbol of value and long term stability. Gold and diamond jewellery remains at the forefront due to their combination of emotional and financial value. End users are opting more for elegant jewellery pieces that have lasting value, while the return of tourism and steady local spending also help the market maintain momentum.

Fine jewellery holds the highest market share of around 85%, reflecting strong end user trust in luxury and quality. It continues to be popular for personal use and as a gift, particularly among those who view it as an investment. This demand for high end and classic designs continues to drive market growth guide market expansion even though some end users reduce spending due to high costs and risk aversion.

Retail offline channels lead the sales with around 85% market share, as end user still prefer to see and try products before purchasing. Stores in luxury shopping areas continue to draw both local and international end users by offering unique designs and customized services. Even though retail online sites are expanding, retail offline stores continue to play a crucial role in establishing trust and providing a high end shopping experience.

The market is also witnessing increased demand for men's and unisex jewellery, as more end users express individuality through accessories. Top companies collectively hold around 30% of the market, but new brands are introducing diversity through minimal, gender neutral, and eco friendly designs. These developments reflect how the market is striking a balance between tradition and modernity while progressing steadily.

France Jewellery Market Growth DriverGrowing Preference for Fine Jewellery Boosts Market Growth

Growing interest in high end jewellery is supporting market expansion as more end users view it as a sign of value and stability. The increase in gold prices has increased its appeal as an investment, particularly among high net worth end users who are less concerned about inflation. The return of tourists and consistent demand from wealthy locals continues to boost sales. Fine jewellery made using gold and diamonds is contributing to the market growth by providing emotional as well as monetary value.

Additionally, growing confidence in fine jewellery is encouraging more end users to make purchase, despite of cautious spending behavior. They are selecting jewellery items for their long term value, whether in high end or mid range collections. The increasing interest from end users towards fashion and meaningful jewellery also helps support this momentum for the fine jewellery segment.

France Jewellery Market ChallengeSlowing Market Growth and Weak Tourist Spending

The market is slowing down as sales remains stagnant and growth is weaker than before. Although tourism is recovering, it has not provided the strong lift that brands expected. Big events such as the Paris Olympics have not helped to boost retail demand, and fewer international shoppers are purchasing jewellery in France. Most of the Chinese travelers, who were previously big spenders, tend to prefer buying luxury items in their native land. Consequently, domestic retailers are losing a major source of income which limits overall growth.

Besides, the rising price of gold is making jewellery more expensive, lowering new purchases among price conscious end users. Although some wealthy end users continue to view jewellery as an investment, many families are opting to save money or sell off old jewellery instead. Such cautious spending is slowing the growth of the market and impacting its performance in the future.

France Jewellery Market TrendLuxury Brands Embrace Storytelling and Lab Grown Diamonds

Luxury brands now narrate stories to make end users feel more attached to their products. They mention their long history, careful craftsmanship, and the meaning behind each jewellery piece. Certain brands also incorporate lab grown diamonds (LGDs) to appeal to youthful and environmentally conscious end users. A ring that cost EUR 4,800 became extremely popular after it was featured in a TV program for young people, making lab grown diamonds more noticeable in France and contributing to the brand's ethical reputation.

Most brands are also becoming transparent regarding the source of their diamonds. Some now have transparent systems in place to indicate that gems are selected in an fair and secure manner. The practice of using lab grown diamonds is gradually increasing as more end users prioritize sustainability and the wellbeing of the planet. Even traditional luxury brands are noticing this shift toward more mindful and responsible luxury.

France Jewellery Market OpportunityRising Demand for Men's and Unisex Jewellery

Men's and unisex jewellery is expected to see significant growth over the next few years as growing numbers of male end users become interested in accessories and personal style. The category, previously ignored, will continue to grow as brands focus on designs made from silver and natural gemstones, which are usually associated with emotional or energizing qualities. This demand will also be supported by the return of wedding jewellery and the rise of bold yet refined pieces, such as large rings and bracelets.

Luxury collections are most likely to feature more gender neutral designs that will appeal to a wide range of end users. Most designers are moving towards simple, refined, and retro style looks and focus on ethical sourcing. Retailers will also look to expand their portfolios to offer such designs, creating new opportunities for growth for the jewellery industry during the forecast period.

France Jewellery Market Segmentation Analysis

By Category

- Costume Jewellery

- Fine Jewellery

The segment with the highest share under the category is Fine Jewellery, holding around 85% of the total market. This indicates that the majority of end users opt for fine jewellery compared to other types. Fine jewellery is appreciated for its beauty, durability, and gold and diamond usage. It is frequently associated with luxury, heritage, and emotional value, thus being the best for gifts and personal use.

The market is primarily defined by keen interest in luxurious and sophisticated pieces. Most prominent brands adhere to detailed designs, superior materials, and master craftsmanship to satisfy increased demand. Fine jewellery remains dominant in the market since end users view it as a permanent investment and a signature of style. This high confidence in fine jewellery sustains its huge share and consistent growth in the market.

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share under the Sales Channel category is Retail Offline, holding around 85% of the total market. The majority of end users like to purchase jewellery from physical stores where they can touch and experience products before buying. Luxury shopping areas remain key locations for fine jewellery, as they offer a sense of trust and exclusivity. These regions assist in strengthening the reputation of high end jewellery and encourage increased attention from overseas investors, further reinforcing the development of the fine jewellery market.

Even though retail online is growing, but retail offline outlets still dominate the market. Most brands are combining in store and online experiences to target more end users.Luxury shopping areas remain key locations for fine jewellery, as they offer a sense of trust and exclusivity. are being used to promote collections and attract more end users to the stores. These activities keep retail offline strong and ensure it remains the most preferred sales channel.

Top Companies in France Jewellery Market

The top companies operating in the market include Swarovski France SA, Orest Group SA, Dinh Van SAS, Cartier Joaillerie International SAS, Pandora France, LVMH Moët Hennessy Louis Vuitton SA, Boucheron SA, Chaumet International SA, Tiffany & Co, Mauboussin SAS, etc., are the top players operating in the france jewellery market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. France Jewellery Market Policies, Regulations, and Standards

4. France Jewellery Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. France Jewellery Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Costume Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Fine Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Type

5.2.2.1. Earrings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Neckwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Rings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Wristwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Collection

5.2.3.1. Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Non-Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material Type

5.2.4.1. Gold- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Platinum- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Metal Combination- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Silver- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel

5.2.5.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. France Costume Jewellery Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7. France Fine Jewellery Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Cartier Joaillerie International SAS

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Pandora France

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.LVMH Moët Hennessy Louis Vuitton SA

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Boucheron SA

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Chaumet International SA

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Swarovski France SA

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Orest Group SA

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Dinh Van SAS

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Tiffany & Co

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Mauboussin SAS

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Type |

|

| By Collection |

|

| By Material Type |

|

| By Sales Channel |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.