France Childrenswear Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Apparel (Baby and Toddler Wear, Boys Apparel, Girls Apparel), Footwear (Boys Footwear, Girls Footwear), Accessories (Boys Accessories, Girls Accessories), Others), By Age Group (Infant/Toddler (Below 2 years), Kids/Children (2 - 14 years)), By Price Category (Mass, Premium), By Sales Channel (Retail Offline, Retail Online)

- FMCG

- Jan 2026

- VI0825

- 120

-

France Childrenswear Market Statistics and Insights, 2026

- Market Size Statistics

- Childrenswear in France is estimated at USD 3.43 billion in 2025.

- The market size is expected to grow to USD 3.75 billion by 2032.

- Market to register a cagr of around 1.28% during 2026-32.

- Product Type Shares

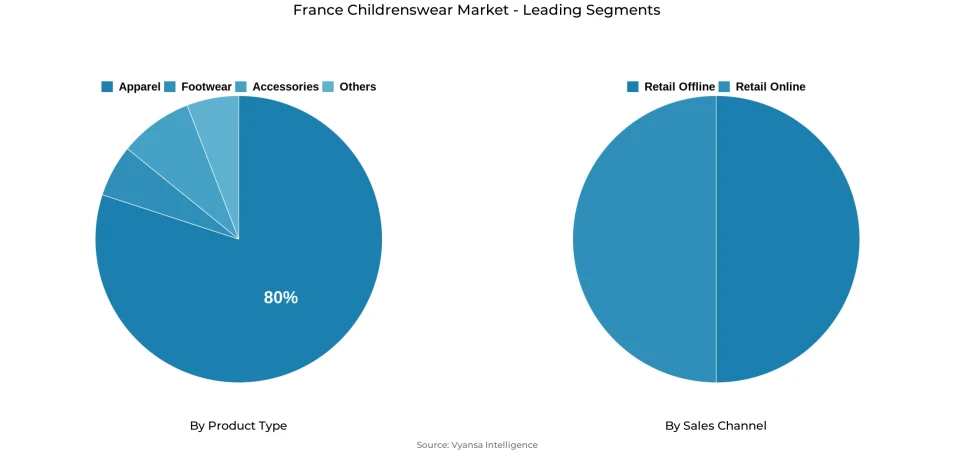

- Apparel grabbed market share of 80%.

- Competition

- Childrenswear in France is currently being catered to by more than 20 companies.

- Top 5 companies acquired around 45% of the market share.

- Galeries Lafayette SA; Primark France SAS; adidas Group; KIABI Europe SAS; Groupe Okaïdi etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 80% of the market.

France Childrenswear Market Outlook

France childrenswear market is expected to grow in the coming 2032 but at a low CAGR of approximately 1.28% in 2026-2032 because its current size is USD 3.43 billion in 2025 and the growth is expected to rise to USD 3.75 billion in 2032. The market is still in structural downturn despite its size, and maturity as the birth rates are decreasing, and more people prefer second-hand clothes. Apparel is the leader with almost 80% of the market value with the top five firms having around 45% share. Affordability and sustainability is what enduser and particularly parents are concerned with and second-hand apparel is becoming the new standard choice amongst most families due to the ongoing inflationary pressures.

Retail offline still takes approximately 80% of the sales with the value-based formats like the chained and variety stores performing well. Such brands as Kiabi and Okaidi still hold leading positions with the help of low prices and family-based product mix, but both brands have lost shares because of the active competition and the growing second-hand market. The newer in-store resale features added by Kiabi and the price freeze approach to business by Orchestra indicate the growing significance of affordability. In the meantime, low-price childrenswear collections are being offered by variety chains like Action and sports retailers like Intersport to win the low-end clientele in the market with their lower prices.

The market will still be adjusting to changing family set ups and consumer expectations during the forecast period. The emergence of mompreneur influencers and online narration is changing the way parents interact with brands and purchase behaviour is being influenced by social media such as Instagram and Tik Tok. Meanwhile, firms are adopting brand-to-brand partners and unisex fashion to appeal to the emerging gender-neutral audience. The collaboration with Lego and the AI-based shopping assistant by Zalando are examples of how brands are integrating technology, inclusivity and convenience to make the engagement with the rather dull market fresh.

The overall acceptance of second-hand clothing will continue to be one of the characteristics of the market until 2032. Older retailers and luxury brands like Cyrillus, Jacadi, and Bonton are branching to resale and consignment, and startups like Il Etait Plusieurs Fois are focused on sustainable childrenswear. The importance of sustainability will grow, and Kiabi will achieve 100% sustainable production by the year 2030. Altogether, structural challenges will continue to exist but the childrenswear market in France will stabilise based on innovation, affordability, and circleswearing.

France Childrenswear Market Growth DriverGrowing Acceptance of Affordable and Second-Hand Apparel

The childrenswear market in France is increasingly influenced by the growing popularity of low-cost and second-hand apparel, driven by mass-market adoption and rising awareness of sustainable consumption practices among parents. The families are also finding second hand to be affordable and convenient as their children grow very fast. A study conducted at the French Fashion Institute showed that more than forty % of parents in France purchase second hand clothing on behalf of their children and this trend shows the normalization of resale shopping.

Online resale websites are supporting this change by providing convenience and diversity. It has been possible to share and resell used garments or resell them by parents through websites and applications that encourage a circular culture of fashion. According to a report of ADEME (French Agency of Ecological Transition), the resale market of clothing in France increased almost by thirty % in 2024, with children apparel as the primary driver. This development makes price and sustainability to be the driving forces in the current buying behavior.

France Childrenswear Market ChallengeDeclining Birth Rate and Weak Consumer Spending

In France, the childrenswear market is experiencing a chronic problem owing to the declining birth rate and the decreased purchasing power of households. The natural customer pool of children apparel is decreasing, with a reduced number of babies born annually which will result in stagnation in volumes in the long term. In France, the fertility rate dropped to 1.68 births per woman in 2024, the lowest rate in almost 20 years according to INSEE. It is being compounded by inflation and high cost of living and many families are tightening their belts when buying clothes or opting to buy cheap clothes instead.

This economic pressure is further boosted by increased production and energy prices, which limit brand profitability as well as deterring new investment. Household purchasing power is down, according to a national survey conducted by the Banque de France, at -2.1 % in 2024, which decreased discretionary spending on clothing. The twofold effect of the demographic drop and economic strain still remains a challenge to both local and international players to have continued sales growth.

France Childrenswear Market TrendRise of Social Media-Driven Parenting and Influencer Culture

The increasing importance of social media in the purchasing behavior of parents is a trend that is dominant in the childrenswear market in France. Parents are now turning to digital communities, parenting blogs, and influencers who are lifestyle bloggers to make their children clothing choices. A survey by Mediametrie revealed that more than 70 % of parents in France rely on social media to inform their purchases, especially on such platforms as Instagram and Tik Tok. This proves the influence that digital narratives have on the choice of style and brand exposure.

The emergence of ompreneurs parents who make fashion content on the internet has also altered the way clothes are promoted and viewed. Their sincere interaction creates the sense of trust and relatability, and influencer collaboration is a useful instrument of brand promotion. According to a report by Kantar France, parenting influencers are 3x more effective in terms of rate of engagement when compared to conventional advertising. This change has brought to fore the role played by storytelling and emotional attachment in creating awareness and preference in the children fashion market.

France Childrenswear Market OpportunityExpansion of Sustainable and Gender-Neutral Apparel

Sustainability and inclusivity are some of the key opportunities that the future of the childrenswear market in France brings. With the increase in environmental awareness, parents are more and more attracted to environmentally friendly, sustainable, and socially responsible clothes. A study conducted by ADEME indicates that almost 65 % of French households put the concept of sustainability as a major precondition during the purchase of children clothes, which can be viewed as an indication of a significant shift in the direction of responsible consumption. The choice is in line with the national efforts to enforce circular fashion and less use of textile waste.

The other opportunity is the gender-neutral fashion, which is becoming increasingly popular among progressive parents who believe in individuality and diversity. In OpinionWay survey, 48 % of French parents agree gender-neutral clothes on their children, which demonstrates an increased tolerance to inclusive styles. Those brands that incorporate these values in their collections are well set to get the next wave of growth combining a social relevancy with environmental responsibility in the changing childrenswear market.

France Childrenswear Market Segmentation Analysis

By Product Type

- Apparel

- Baby and Toddler Wear

- Boys Apparel

- Girls Apparel

- Footwear

- Boys Footwear

- Girls Footwear

- Accessories

- Boys Accessories

- Girls Accessories

- Others

The segment with the highest share under the product type category in the France Childrenswear Market is Apparel, accounting for around 80% of the market. Apparel dominates as it remains the most essential and frequently purchased category for children. Parents consistently prioritise clothing for everyday wear, school, and seasonal needs, ensuring a stable baseline of demand even amid economic pressures. However, with rising inflation and declining birth rates, spending has shifted towards affordable and second-hand apparel, as families seek value and durability over premium fashion.

Major players such as Kiabi and Okaïdi continue to leverage their strong retail networks and low-cost strategies to maintain sales volume. The growing acceptance of sustainable and pre-owned apparel has also encouraged brands to introduce their own second-hand lines, allowing them to cater to price-sensitive parents while promoting circular fashion practices that align with evolving consumer values.

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share under the sales channel category in the France Childrenswear Market is Retail Offline, which holds around 80% of the market. Despite the rise of e-commerce, offline retail continues to dominate as French parents prefer to physically assess clothing quality, fit, and material before purchasing. Brick-and-mortar outlets such as Kiabi, Orchestra, and Primark remain highly popular for their wide product assortments, competitive pricing, and frequent in-store discounts, catering effectively to budget-conscious shoppers.

Moreover, department stores like Galeries Lafayette attract affluent buyers seeking premium childrenswear for special occasions, supported by inbound tourism. Retailers are also blending in-store and digital strategies, such as offering second-hand corners or AI-assisted services, to enhance convenience and engagement. The enduring trust in physical stores, combined with experiential shopping and instant product availability, secures retail offline as the leading sales channel in France’s childrenswear market.

List of Companies Covered in France Childrenswear Market

The companies listed below are highly influential in the France childrenswear market, with a significant market share and a strong impact on industry developments.

- Galeries Lafayette SA

- Primark France SAS

- adidas Group

- KIABI Europe SAS

- Groupe Okaïdi

- Orchestra SA

- Petit Bateau SAS

- Vertbaudet SAS

- Intersport France

- Jacadi SA

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. France Childrenswear Market Policies, Regulations, and Standards

4. France Childrenswear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. France Childrenswear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Baby and Toddler Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Boys Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Girls Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Boys Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Girls Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Boys Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Girls Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Age Group

5.2.2.1. Infant/Toddler (Below 2 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Kids/Children (2 - 14 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Category

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. France Apparel Childrenswear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. France Footwear Childrenswear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. France Accessories Childrenswear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.KIABI Europe SAS

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Okaïdi, Groupe

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Orchestra SA

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Petit Bateau SAS

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Vertbaudet SAS

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Galeries Lafayette SA

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Primark France SAS

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.adidas Group

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Intersport France

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Jacadi SA

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Age Group |

|

| By Price Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.