Europe Water & Wastewater Pump Market Report: Trends, Growth and Forecast (2026-2032)

Pump Type (Centrifugal Pumps (End Suction, Split Case, Vertical (Turbine, Axial Pump, Mixed Flow Pump), Submersible Pump), Positive Displacement Pumps (Progressing Cavity, Diaphragm, Gear Pump, Others)), Application (Water, Wastewater), End User (Industrial Water & Wastewater, Municipal Water & Wastewater), Country (Germany, France, Italy, Spain, The UK, Poland, Benelux, Rest of Europe)

- Energy & Power

- Dec 2025

- VI0692

- 170

-

Europe Water & Wastewater Pump Market Statistics and Insights, 2026

- Market Size Statistics

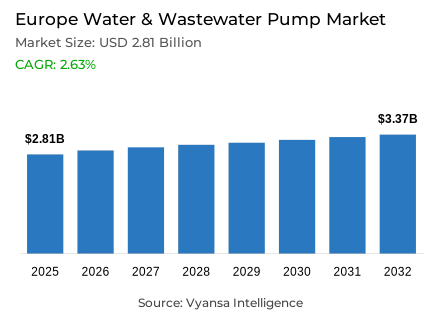

- Europe water & wastewater pump market is estimated at USD 2.81 billion in 2025.

- The market size is expected to grow to USD 3.37 billion by 2032.

- Market to register a cagr of around 2.63% during 2026-32.

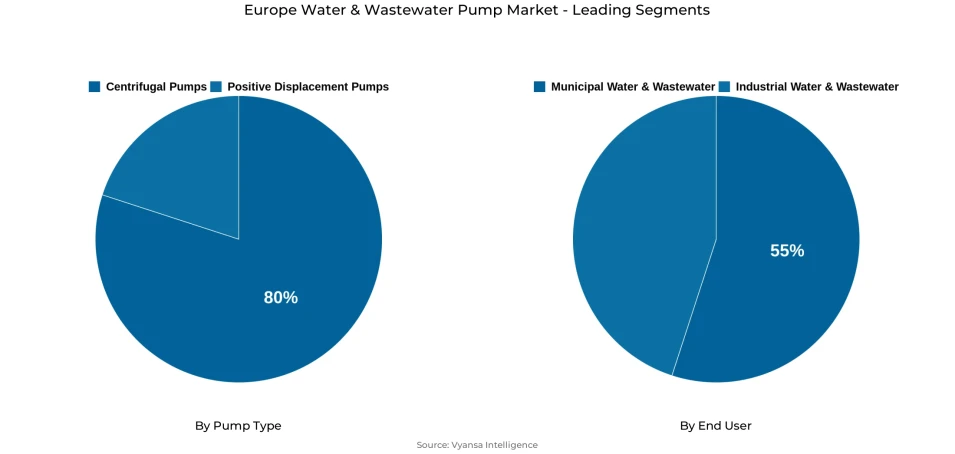

- Pump Type Shares

- Centrifugal pumps grabbed market share of 80%.

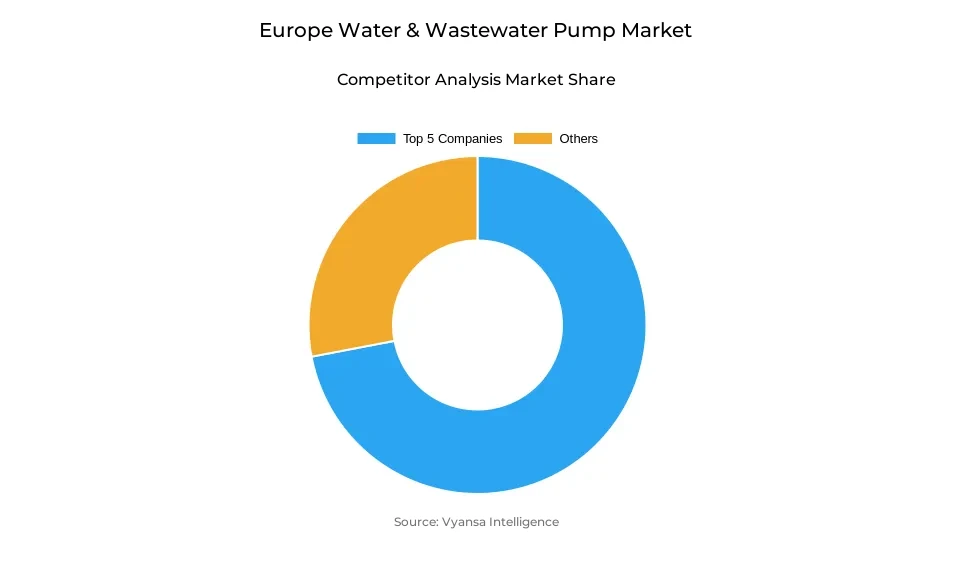

- Competition

- More than 10 companies are actively engaged in producing water & wastewater pump in Europe.

- Top 5 companies acquired the maximum share of the market.

- Xylem Inc.; KSB SE & Co. KGaA; Kirloskar Brothers Limited (KBL); Flowserve Corporation; Ebara Corporation etc., are few of the top companies.

- End User

- Municipal Water & Wastewater grabbed 55% of the market.

- Country

- Germany leads with a 30% share of the Europe market.

Europe Water & Wastewater Pump Market Outlook

Europe Water & Wastewater Pump Market, which is worth USD 2.81 billion in 2025, is anticipated to reach nearly USD 3.37 billion by 2032, growing at a CAGR of approximately 2.63% during the years 2026-2032. Replacement of aging water infrastructure in major European cities is fueling widespread replacement of old pumps with energy-efficient pumps. The European Commission's investment of close to €3 billion under the Emissions Trading System helped finance modernization initiatives, which have allowed over 65% of treatment plants to fit IE4-rated motors that reduce energy consumption by as much as 20%. Compliance with the EU Urban Wastewater Treatment Directive has further increased the installation of smart pumps, reducing unscheduled downtime and enhancing lifecycle efficiency.

Aging infrastructure continues to be a worry, with nearly 23% of Europe's water pipes having exceeded their design lifespan, resulting in elevated maintenance costs of more than €5 billion yearly. Southern and Eastern Europe endure the largest breakdown rates, which raise the cost of operation and put pressure on utilities to balance upkeep with EU efficiency regulations.

Additionally, the use of IoT and digital twin technologies has become increasingly popular, with close to half of municipal utilities incorporating real-time monitoring systems for lessened maintenance requirements and increased asset lifespan.

Centrifugal pumps are the market leaders, with 80% of all installations in 2025 because of their efficiency, energy use, and compatibility with intelligent control systems. Municipal water and sewer authorities are still the main end users, with 55% of the market share since public spending on modernization and compliance with regulations continues. The regional market is led by Germany with a 30% share, driven by stringent environmental regulation, well-developed industrial infrastructure, and ongoing investment in high-efficiency and digital pump technology.

Europe Water & Wastewater Pump Market Growth Driver

Infrastructure Modernization Accelerates Pump Replacement Initiatives

European cities are quickly replacing aging water infrastructure, driving massive replacement of legacy pumps with energy-efficient substitutes. The European Commission invests approximately €3 billion of Emissions Trading System funds in building water resilience, allowing utilities to retrofit more than 65% of treatment plants with high-efficiency IE4-rated motors in 2024. The upgrades enhance operating efficiency, saving up to 20% energy use per pumping station while increasing performance reliability throughout the network.

Concurrently, regulatory needs under the EU's Urban Wastewater Treatment Directive have spurred more than 90% compliance across member states. Utilities are installing smart pumps that are part of real-time monitoring systems, lowering unplanned downtime by 15% and maximizing total lifecycle cost. This wave of modernization not only increases pump sales but also positions regional utilities in line with EU energy and sustainability targets.

Europe Water & Wastewater Pump Market Challenge

Aging Infrastructure Elevates Operational and Maintenance Pressures

Europe's large and aging network of water pipes still causes pumping difficulties, boosting both maintenance rates and system inefficacies. According to the European Environment Agency, 23% of Europe's pipes are either below standard or beyond their designed lifespan, causing frequent pump failure and elevating maintenance levels above €5 billion per year. These aging pipes require constant maintenance, especially in older cities with original infrastructure.

Investment imbalances between areas exacerbate the issue. Southern and Eastern Europe suffer from breakdown rates almost 30% above the EU average, forcing utilities to spend as much as 40% more of their budgets on urgent pump repairs. Balancing EU efficiency rules with aging infrastructure remains a key challenge for operators and pump makers seeking long-term system reliability.

Europe Water & Wastewater Pump Market Trend

Digital Transformation Redefines Pump Monitoring and Management

The convergence of digital technologies is transforming Europe's water and wastewater pump market, helping utilities optimize operational intelligence and asset lifespan. By the close of 2024, some 50% of municipal utilities implemented IoT-based monitoring systems, compared to 28% in 2020, under the EU Smart Water Initiative. Such connected solutions provide early fault detection, reducing maintenance requirements by 18% and facilitating proactive management of pumping assets.

The use of digital twin models is also transforming infrastructure planning. Nearly 35% of major wastewater treatment plants currently employ virtual simulations to simulate pump performance and optimize energy usage. This increasing use of predictive analytics and digital modeling not only enhances regulatory compliance but also speeds the shift toward more intelligent, data-driven water management systems throughout Europe.

Europe Water & Wastewater Pump Market Opportunity

Sustainability Incentives Drive Adoption of Eco-Efficient Pump Solutions

The financing instruments of the EU Green Deal have opened wide doors of opportunity for the adoption of environmentally friendly pumping equipment. Member states in 2024 obtained €1.8 billion in grant funding to cover the costs of installing IE4-rated and hybrid pumps with Germany and France financing up to 40% of total project expenses. Utilities are assisted by these programs in meeting the EU's 2030 goal of reducing greenhouse gas emissions by 30% from water services, further fueling market demand for high-efficiency equipment.

While that's happening, renewable integration is becoming increasingly prominent in pumping operations. Solar-powered pump systems now account for 22% of remote treatment plants' energy needs, marking a transition toward hybrid and off-grid solutions. The trend widens growth opportunities for manufacturers creating systems in line with Europe's decarbonization and energy independence targets.

Europe Water & Wastewater Pump Market Country Analysis

By Country

- Germany

- France

- Italy

- Spain

- The UK

- Poland

- Benelux

- Rest of Europe

Germany dominates the Europe Water & Wastewater Pump Market with 30% market share, led by steady investment in infrastructure and tight environmental regulation. The Federal Environment Agency calculates yearly investments over €2.1 billion since 2022 to upgrade old equipment with high-efficiency, digitally controlled pumping systems. These actions align national utilities with EU-wide energy and sustainability objectives.

The nation's robust industrial economy and sophisticated regulatory environment further drive adoption of next-generation pump technology. Across wastewater treatment through to process industries, German end users place greater value on performance improvement and emission reduction, establishing regional benchmark levels that set procurement standards in neighboring EU countries.

Europe Water & Wastewater Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- Positive Displacement Pumps

Centrifugal pumps have the largest share, around 80% of all installations in 2025, highlighting their unparalleled flexibility in both water and wastewater applications. Their rugged construction accommodates low-pressure distribution and high-pressure treatment duties, making them an essential part of municipal and industrial operations. Easy maintenance processes and conformability with smart monitoring platforms provide further evidence of their status as the go-to technology for regional utilities.

Continuous innovation fuels their competitive advantage. European utilities more and more replace old units with IE4-rated centrifugal types, making up to 15% energy savings while satisfying tough EU performance requirements. The trade-off among efficiency, reliability, and regulatory requirements keeps centrifugal pumps as the market leader and most cost-effective choice in the Europe Water & Wastewater Pump Market.

By End User

- Industrial Water & Wastewater

- Municipal Water & Wastewater

Industrial usage, nevertheless, is recording appreciable growth momentum, growing at a CAGR of 3.92%. Increasing enforcement of discharge standards and process-specific pump configurations demand are driving adoption by manufacturers and power-intensive industries. This concomitant demand pattern—stellar municipal investment combined with increasing industrial upgrades—remains defining the competitive dynamics of Europe's water and wastewater pump market.

Various Market Players in Europe Water & Wastewater Pump Market

The companies mentioned below are highly active in the Europe water & wastewater pump market, occupying a considerable portion of the market and shaping industry progress.

- Xylem Inc.

- KSB SE & Co. KGaA

- Kirloskar Brothers Limited (KBL)

- Flowserve Corporation

- Ebara Corporation

- WILO SE

- Sulzer Limited

- Grundfos Holding A/S

- Franklin Electric

- Pentair PLC

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Europe Water & Wastewater Pump Market Policies, Regulations, and Standards

4. Europe Water & Wastewater Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Europe Water & Wastewater Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Vertical- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. Axial Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. Mixed Flow Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Submersible Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Progressing Cavity- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Diaphragm- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Gear Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End User

5.2.3.1. Industrial Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Municipal Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Country

5.2.4.1. Germany

5.2.4.2. France

5.2.4.3. Italy

5.2.4.4. Spain

5.2.4.5. The UK

5.2.4.6. Poland

5.2.4.7. Benelux

5.2.4.8. Rest of Europe

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Germany Water & Wastewater Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

7. France Water & Wastewater Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Italy Water & Wastewater Pump Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

9. Spain Water & Wastewater Pump Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

10. The UK Water & Wastewater Pump Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By End User- Market Insights and Forecast 2022-2032, USD Million

11. Poland Water & Wastewater Pump Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By End User- Market Insights and Forecast 2022-2032, USD Million

12. Benelux Water & Wastewater Pump Market Statistics, 2022-2032F

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in US$ Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

12.2.3. By End User- Market Insights and Forecast 2022-2032, USD Million

13. Competitive Outlook

13.1. Company Profiles

13.1.1. Flowserve Corporation

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. Ebara Corporation

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. WILO SE

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. Sulzer Limited

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. Grundfos Holding A/S

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. Xylem Inc.

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. KSB SE & Co. KGaA

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. Kirloskar Brothers Limited (KBL)

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. Franklin Electric

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

13.1.10. Pentair PLC

13.1.10.1.Business Description

13.1.10.2.Product Portfolio

13.1.10.3.Collaborations & Alliances

13.1.10.4.Recent Developments

13.1.10.5.Financial Details

13.1.10.6.Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Application |

|

| By End User |

|

| By Country |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.