Egypt Wearable Electronics Market Report: Trends, Growth and Forecast (2025-2030)

By Product (Activity Wearables, Smart Wearables), By Application (Healthcare, Entertainment, Industrial, Others), By Sales Channel (Offline, Online)

- FMCG

- Dec 2025

- VI0064

- 110

-

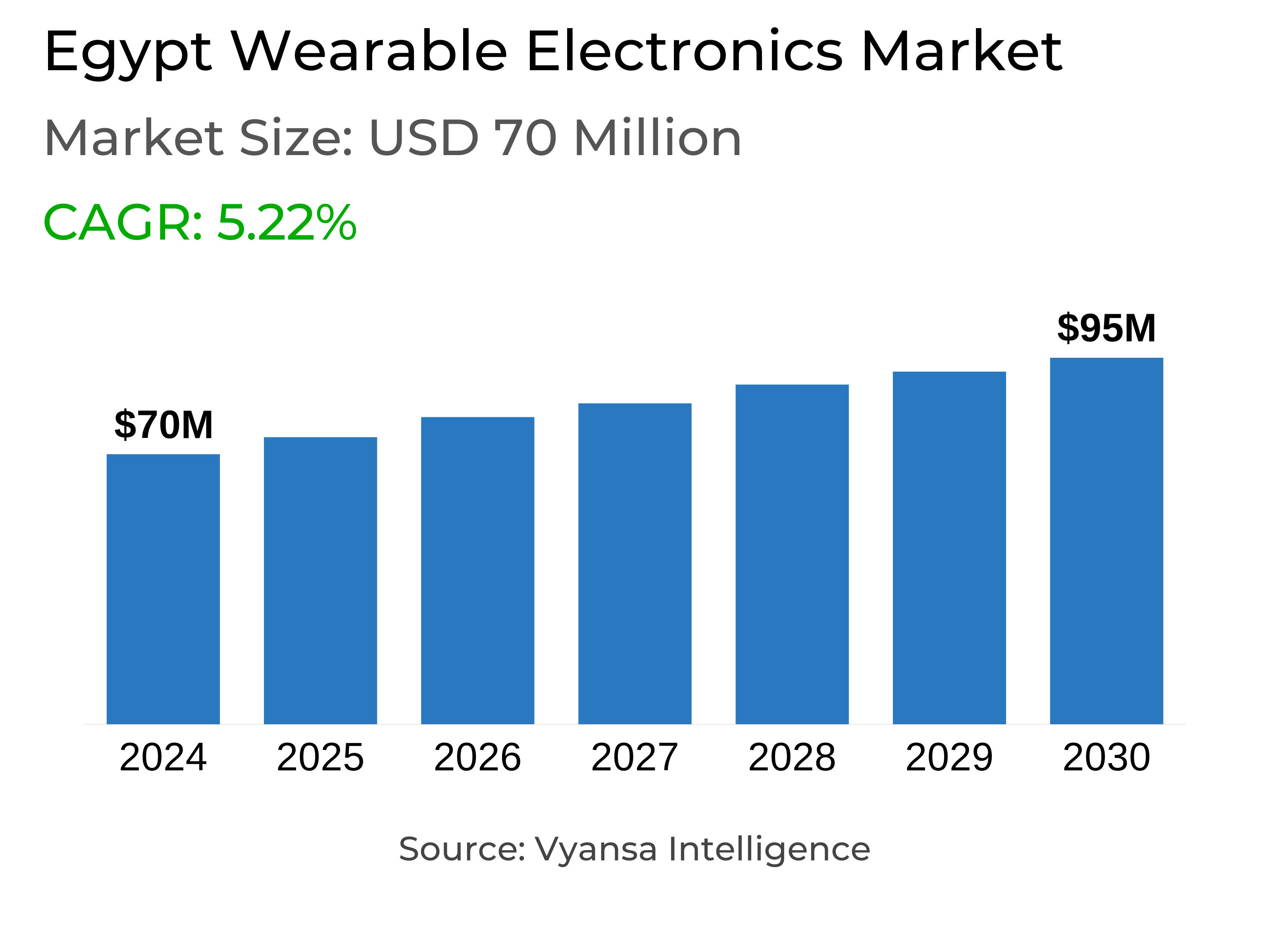

Egypt Wearable Electronics Market Statistics, 2025

- Market Size Statistics

- Wearable Electronics in Egypt is estimated at $ 70 Million.

- The market size is expected to grow to $ 95 Million by 2030.

- Market to register a CAGR of around 5.22% during 2025-30.

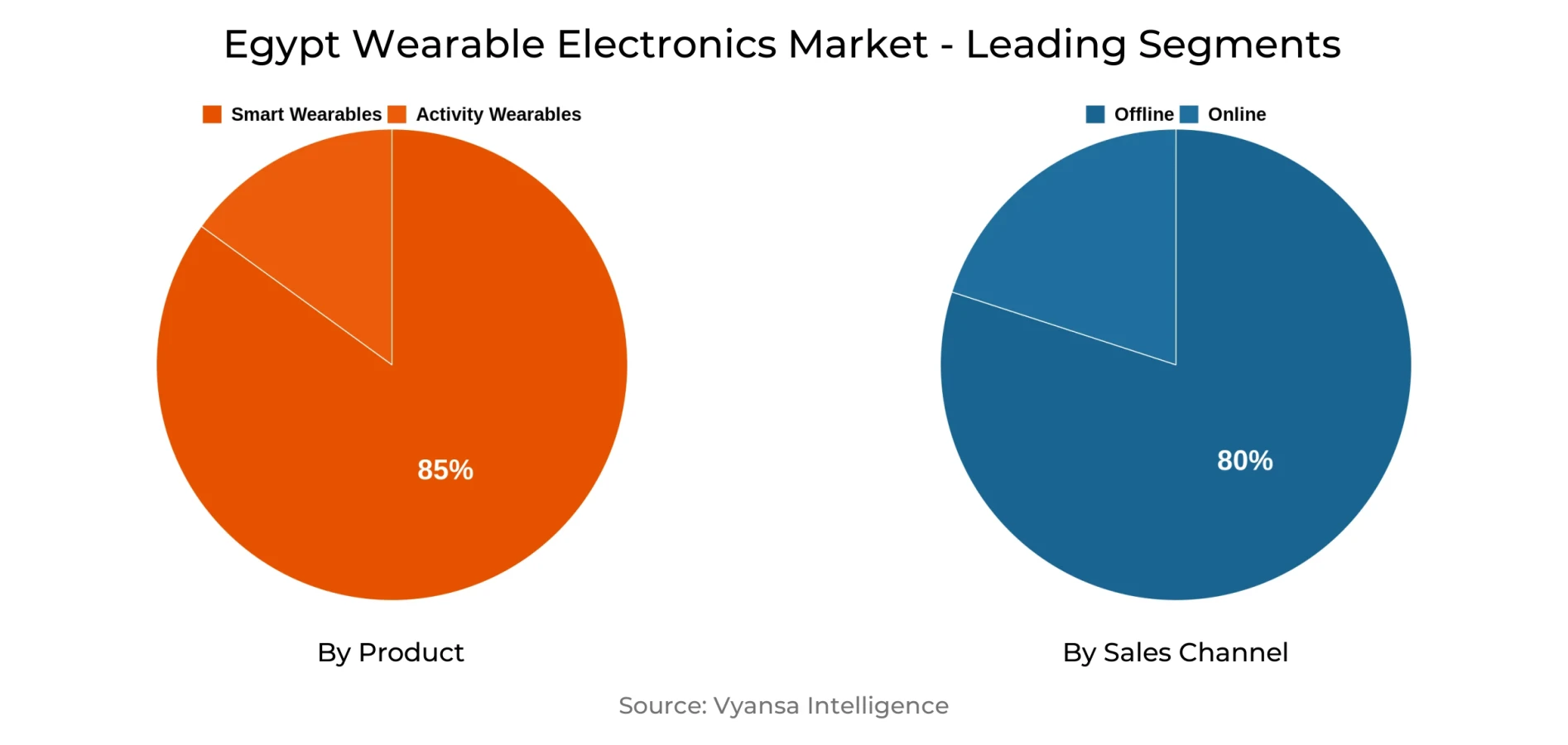

- Product Shares

- Smart Wearables grabbed market share of 85%.

- Smart Wearables to witness a volume CAGR of around 5.31%.

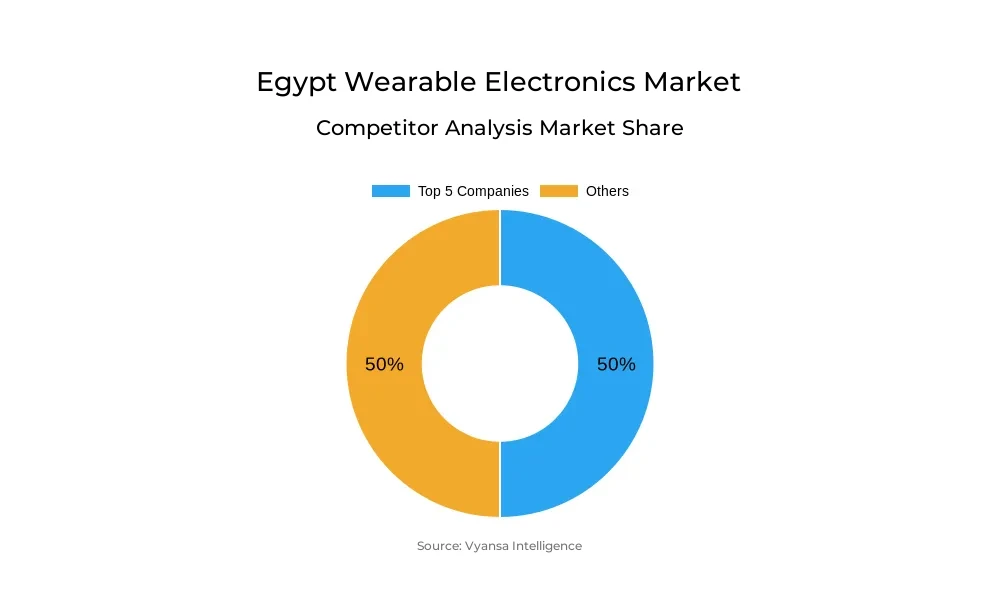

- Competition

- More than 10 companies are actively engaged in producing Wearable Electronics in Egypt.

- Top 5 companies acquired 50% of the market share.

- Honor Device Co Ltd, Shanghai Kieslect Technology Co Ltd, Guangdong OPPO Mobile Telecommunications Corp Ltd, Xiaomi Corp, Huawei Technologies Co Ltd etc., are few of the top companies.

- Sales Channel

- Retail Offline grabbed 80% of the market.

Egypt Wearable Electronics Market Outlook

The Egypt wearable electronics market is predicted to register steady growth from 2025 to 2030, primarily driven by increasing health awareness, particularly among young consumers. While the market continues to recover from disruptions posed by high inflation and currency devaluation, demand is predicted to increase as consumers continue to prioritize their wellness and health. Wearables providing health monitoring and fitness capabilities are expected to remain in favor, especially among Millennials and Generation Z consumers.

Intelligent wearables will dominate market growth on account of their improved features and broader consumer acceptance. Further budget-friendly and feature-packed smart wearables from new brands such as Oraimo will remain to challenge established players like Xiaomi and Samsung. Domestic production by Oraimo, especially at its Ain Sokhna plant, will help drive its market position further and enhance availability. The waning popularity of online activity watches can persist, particularly since such bands present limited innovation and are prone to the impact of price hikes and bans on import.

While economic pressure persists, price-conscious consumers will tend to turn towards affordable wearables, copy versions, or those providing greater value for money. E-commerce should continue to be the leading retailing channel through improved prices, quick availability of new models, and ease. Its appeal is consistent with the priorities of the young, technologically adept Egyptian consumer.

Overall, though there will be challenges along the way, the Egypt wearable electronics market will expand steadily over 2025–30. The expansion will be spurred on by increased health awareness, the availability of locally cheap brands, and the growing importance of e-commerce in effectively reaching the target customer base.

Egypt Wearable Electronics Market Growth Driver

In spite of the continued financial pressures in Egyptian homes, consumers are increasingly health and fitness conscious, driving demand for wearable electronics. The trend is particularly high among younger generations, who continue to prioritize expenditure on goods that promote their health. Although the effects of the pandemic have been dampened, health-conscious behavior continues to be an integral part of daily living, guaranteeing constant demand for wearable products.

Besides this, many companies are also gearing up to introduce new brands and increase their product range. This broader portfolio is anticipated to generate increased consumer interest and stimulate deeper adoption of wearables. Due to this, the category can expect to see stable and continued growth over the forecast period, with health and wellness continuing to be a major driver.

Egypt Wearable Electronics Market Trend

The market dynamics are being rewritten by the entry of multiple low-cost brands and the expansion of domestic production. These changes are bringing smart wearables within the reach of more consumers by providing a quality-price mix that is improved. Consequently, consumers now have more options than poor-quality generic ones.

This trend is contributing to a more competitive market where value-for-money products are becoming popular. Consumers are being attracted more towards smart wearables that provide consistent features at discounted prices. With improved options being available at reasonable prices, the use of smart wearables is likely to increase further in the next few years.

Egypt Wearable Electronics Market Opportunity

Growing emphasis on well-being and health will create solid opportunities for wearable electronics in the future years. Although volume sales during 2024 are unlikely to approach 2021 highs, the market holds up well. Egyptian consumers continue to spend on these devices to monitor health parameters and assist in fitness aspirations, irrespective of persistent economic pressures like inflation and the decline of the Egyptian pound against the US dollar.

One of the key trends that will aid future development is the growing demand for cheap or replica wearable electronics, particularly among young people and teenagers. Fashion is also one of the purchase drivers that create demand among younger shoppers such as Generation Z and millennials. With 10–12% of Egyptian smartphone owners already utilizing wearables, there is evident room for growth within this category in 2025–30.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 70 Million |

| USD Value 2030 | $ 95 Million |

| CAGR 2025-2030 | 5.22% |

| Largest Category | Smart Wearables segment leads with 85% market share |

| Top Drivers | Rising Focus on Health and Wellness to Support Market Growth |

| Top Trends | Rise of Affordable and Feature-Rich Wearables |

| Top Opportunities | Rising Health Consciousness to Accelerate Demand for Affordable Wearables |

| Key Players | Honor Device Co Ltd, Shanghai Kieslect Technology Co Ltd, Guangdong OPPO Mobile Telecommunications Corp Ltd, Xiaomi Corp, Huawei Technologies Co Ltd, Samsung Corp, Zepp Health Corp, Oraimo Technology Ltd, Zhenshi Information Technology (Shanghai) Co Ltd, Shenzhen Kospet Technology Co Ltd and Others. |

Egypt Wearable Electronics Market Segmentation Analysis

The most dominant segment in the Egypt Wearable Electronics Market in 2025–30 is smart wearables. Even with difficulties like inflation and import bans, smart wearables are continuing to show strong sales volume growth. This is primarily attributed to the entry of cheaper brands, which contained the average unit price increase. Consumers, particularly young consumers, were drawn to smart wearables due to the extra functionalities offered beyond digital activity bands, such as fashion, health, and telecommunication requirements.

Middle- to upper-income families, less affected by economic stress, were still principal consumers. The higher end helped make these products the target for black market importers, who imported them in small lots as personal use products. Xiaomi surpassed Samsung as the top brand, though both suffered sales declines due to new budget-friendly competitors. Oraimo, started local production in September 2023, became popular with models such as the Oraimo Watch R2.

Top Companies in Egypt Wearable Electronics Market

The top companies operating in the market include Honor Device Co Ltd, Shanghai Kieslect Technology Co Ltd, Guangdong OPPO Mobile Telecommunications Corp Ltd, Xiaomi Corp, Huawei Technologies Co Ltd, Samsung Corp, Zepp Health Corp, Oraimo Technology Ltd, Zhenshi Information Technology (Shanghai) Co Ltd, Shenzhen Kospet Technology Co Ltd, etc., are the top players operating in the Egypt Wearable Electronics Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Egypt Wearable Electronics Market Policies, Regulations, and Standards

4. Egypt Wearable Electronics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Egypt Wearable Electronics Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.1.2.By Unit Sold (Thousand Units)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Activity Wearables- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Activity Bands- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. Activity Watch- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2.1. Analogue- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2.2. Digital- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Smart Wearables- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.1. Eye Wear- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.2. Body Wear- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Application

5.2.2.1. Healthcare- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Entertainment- Market Insights and Forecast 2020-2030, USD Million

5.2.2.3. Industrial- Market Insights and Forecast 2020-2030, USD Million

5.2.2.4. Others- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Sales Channel

5.2.3.1. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Egypt Activity Wearable Electronics Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.1.2.By Unit Sold (Thousand Units)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By Application- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. Egypt Smart Wearable Electronics Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.1.2.By Unit Sold (Thousand Units)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Application- Market Insights and Forecast 2020-2030, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Xiaomi Corp

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Huawei Technologies Co Ltd

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Samsung Corp

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Zepp Health Corp

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Oraimo Technology Ltd

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Honor Device Co Ltd

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Shanghai Kieslect Technology Co Ltd

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Guangdong OPPO Mobile Telecommunications Corp Ltd

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Zhenshi Information Technology (Shanghai) Co Ltd

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Shenzhen Kospet Technology Co Ltd

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Application |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.