Egypt Sports Nutrition Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Sports Protein Products (Protein/Energy Bars, Sports Protein Powder, Sports Protein RTD), Sports Non-Protein Products), Sales Channel (Retail Offline, Retail Online), Ingredients (Vitamins and Minerals, Proteins and Amino Acids, Carbohydrates, Probiotics, Botanicals/Herbals, Others), Functionality (Energy, Muscle growth, Hydration, Weight Management, Others), End User (Bodybuilders, Athletes, Lifestyle Users)

- Food & Beverage

- Dec 2025

- VI0616

- 115

-

Egypt Sports Nutrition Market Statistics and Insights, 2026

- Market Size Statistics

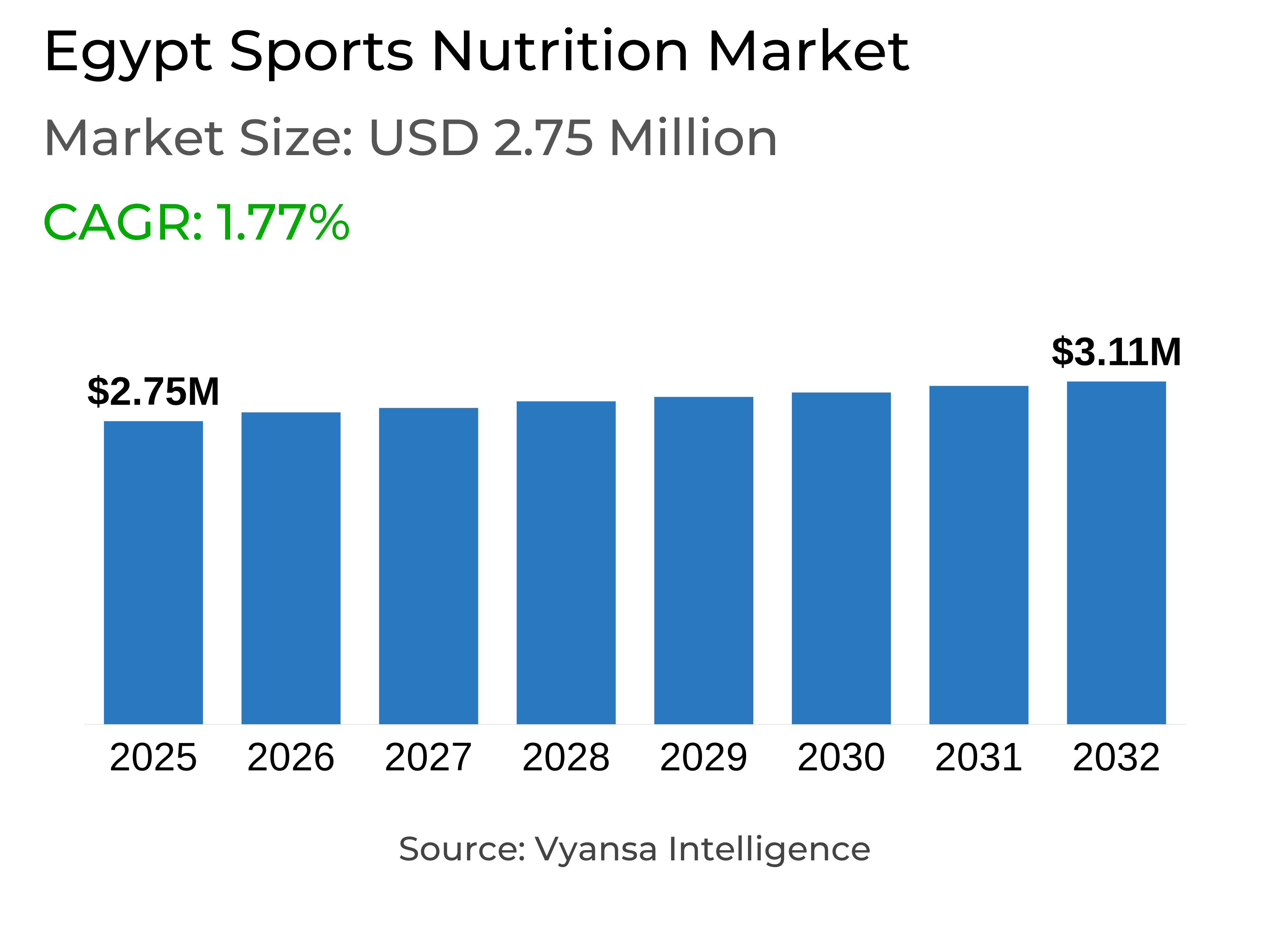

- Sports nutrition in egypt is estimated at USD 2.75 million.

- The market size is expected to grow to USD 3.11 million by 2032.

- Market to register a cagr of around 1.77% during 2026-32.

- Product Type Shares

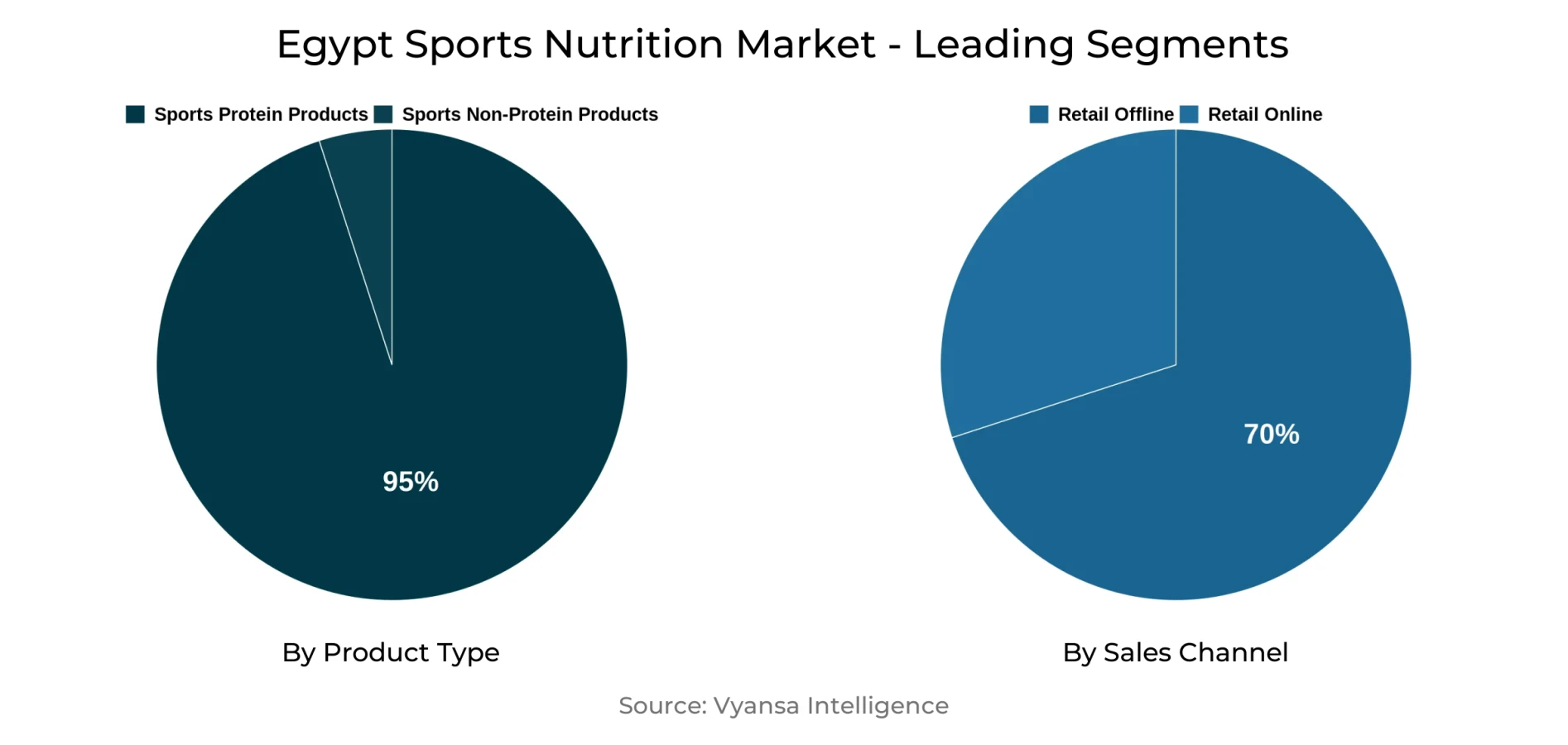

- Sports protein products grabbed market share of 95%.

- Competition

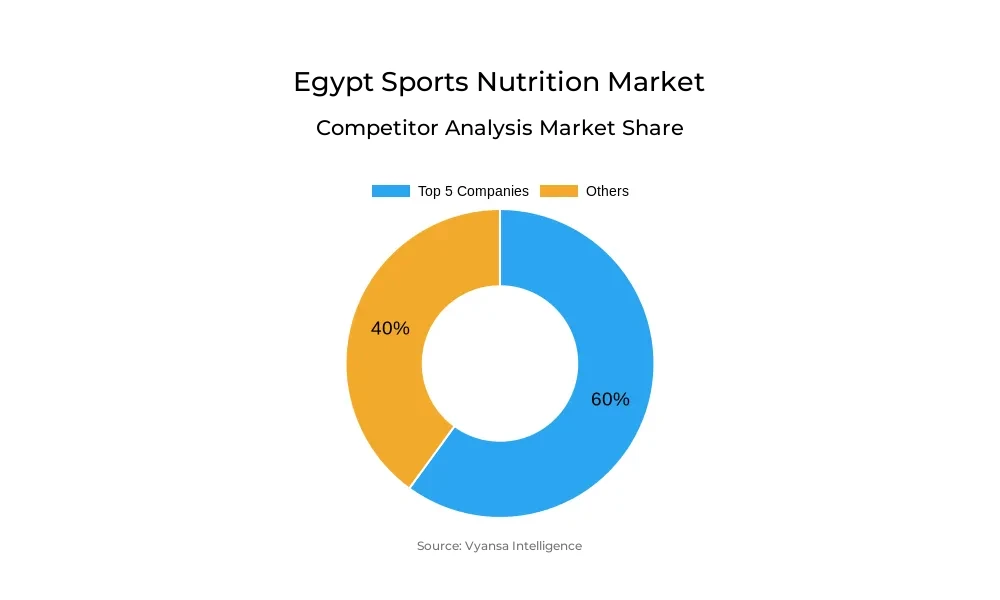

- More than 10 companies are actively engaged in producing sports nutrition in egypt.

- Top 5 companies acquired around 60% of the market share.

- Grain Labz Foods SAE, Les Laboratoires Biopharma SA, Dulex Lab Nutrition, Optimum Nutrition Inc, BPI Sports Holdings LCC etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 70% of the market.

Egypt Sports Nutrition Market Outlook

The sports nutrition market in Egypt is estimated at around $2.75 million in 2025 and is set to reach around $3.11 million by 2032, with a CAGR of around 1.77% between 2026–32. Expansion is driven by an increasing emphasis on wellbeing and wellness, with numerous end users embracing healty lifes and requiring products supporting fitness, recovery, and general wellbeing. Social media and various educational campaigns further shape decisions, making sports nutrition a part of daily lifestyles instead of being an exclusive part for athletes routine only.

Sports proteins products lead the market, with around 95% of total sales in 2025. End users favor protein powders and protein/energy bars for convenience, nutritional value, and strength and recovery benefits. These products appeal across a broad base of end users, from those occasionally engaged in physical fitness to competitive athletes, and continue to be at the heart of the market for their steady demand and ability to fulfill everyday needs for nutrition.

Retail offline is the dominant sales channel, with around 70% of total sales. Gyms, fitness centers, pharmacies, and specialty stores offer end users the opportunity to experience and try products, get expert advice from staff, and make informed decision on purchasing products. Retail online is slowly growing, but offline channels are still favored because of personal advice, convenience, and trust, holding their market stronghold.

The market is also moving towards sustainable and clean label products. End users are looking continuously for natural, unadulterated nutrition and environmentally friendly packaging. Brands will have to get creative with biodegradable inputs and responsibly sourced materials to cater to this requirement. The emphasis on sustainability, coupled with the ongoing popularity of protein products and offline retail dominance, is set to drive the sports nutrition market in 2026-32.

Egypt Sports Nutrition Market Growth DriverGrowing Focus on Health and Wellness

The rising interest in wellness and health continues to dominate end user behavior in market. Social media, has become a major platform for influence, as more young end users are following fitness professionals and lifestyle influencers who promote healthy diets, regular exercise, and nutrition awareness. This exposure pushes end users toward adopting healthier routines and inspires them to incorporate sports nutrition into their day to day lives as part of maintaining fitness and well-being.

Additionally, with more exposure to health information through various media campaigns and educational platforms is also strengthening awareness towards the conditions like obesity, heart disease, and stress. The more end users learn about the advantages of living an active life, the more they are opting for habits that enhance their quality of life. Sports nutrition products are now seen as essentials items for building up strength and recovery, not just as supplements for athletes.

Egypt Sports Nutrition Market ChallengeNavigating Food Safety Requirements

One of the biggest issues that the sports nutrition industry currently facing is, complying with strict food safety regulations set up by the Egyptian Food Safety Authority. These laws makes mandatory for the brands to meet quality and safety standards, which ends up delaying product approvals, launches and increases operational costs. It can be challenging for new brands to enter the market because of the complexity to meet these changing requirements.

Moreover, for established players in this segment, it is necessary for all products to pass regulatory requirements consistently to ensure end user trust and brand image. Compliance involves continuous testing, documentation, and adherence to ever changing regulations, which requires considerable resources. Brands have to manage these operations very carefully in order to avoid penalties or recalls. Meeting regulatory expectations is therefore a key factor influencing how companies plan their operations, launch new products, and maintain a strong position in the market.

Egypt Sports Nutrition Market TrendExpanding Variety of Products

Sports nutrition products are becoming more diverse to meet various end user requirements. Protein supplements such as whey protein powders, plant based powders, and protein bars are extremely popular among various end users such as athletes and fitness enthusiasts. These products offer a convenience mechanism to enhance protein consumption, which supports muscle recovery, development, and overall performance. Protein bars are also viewed as a healthy end user snack alternative for individuals with busy lifestyles.

Brands continue to launch new versions, such as introduction of new flavours, formulations, and blends with other ingredients. Pre workout supplements are also becoming popular, providing extra energy, concentration, and stamina during exercise. These tend to feature ingredients such as caffeine, amino acids, creatine, and vitamins, as manufacturers increasingly target the particular needs of active end users.

Egypt Sports Nutrition Market OpportunityGrowing Focus on Sustainable and Clean Products

The need for sustainable and clean label sports nutrition products is likely to grow largely over the next few years. Health conscious end users will be on look for natural and pure form of nutrition, and with rising awareness regarding environment and social responsibility will promote preference for products with natural packaging and ethically sourced material. This shift is likely to alter the purchasing decision for a wide range of sports nutrition products.

Brands will have to update their existing protein products by innovating them with biodegradable packaging and sourcing ingredients from suppliers that are dedicated to sustainability and ethical sourcing. Products that align health benefits with the environment will find themselves more appealing to aware end users. This transformation will open up new growth opportunities, enabling companies to reinforce their market position while addressing changing expectations of end users for both personal health and for the environment.

Egypt Sports Nutrition Market Segmentation Analysis

By Product Type

- Sports Protein Products

- Sports Non-Protein Products

Sports protein products represent around 95% of overall sports nutrition sales in 2025 and making it the largest segment in the market. End users predominantly use protein powders and protein/energy bars due to their ability to supply important nutrients that assist in muscle recovery, increase strength, and promote general athletic performance. The growing desire for active lifestyles and fitness consciousness among end users has also fueled demand for these products.

Sports Protein products are still the first choice for a wide group of end users, ranging from amateur fitness users to professional athletes. These products are convenient, have consistent quality, and provide guaranteed support for everyday nutritional requirements, making them an essential component for regular fitness routines. The high demand for sports protein products demonstrates end users concentration in supporting performance goals, energy level support, and overall health improvement, which ensures their leading position in the sports nutrition market.

By Sales Channel

- Retail Offline

- Retail Online

Retail offline controls the sports nutrition segment, with around 70% of overall sales. Specialty stores, fitness centers, gyms, and pharmacies are the primary points of purchase, providing end users with the opportunity to view and test sample before purchase. Personal contact with experienced staff assists end users in making informed decisions and builds confidence in the quality and performance of the products. This practical learning continues to be essential for individuals experimenting with new supplements or looking for advice on diet and workout routines.

Retail online is also gaining traction, offering convenience and exposure to a wider variety of products. Retail offline channels are still ahead because they are accessible, offer personal service, and establish trust among end users, making them the first choice for most end users.

Top Companies in Egypt Sports Nutrition Market

The top companies operating in the market include Grain Labz Foods SAE, Les Laboratoires Biopharma SA, Dulex Lab Nutrition, Optimum Nutrition Inc, BPI Sports Holdings LCC, Iovate Health Sciences, Advanced Sports Nutrition, Imtenan Corp, Samo Trading Co, DSN, etc., are the top players operating in the egypt sports nutrition market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Egypt Sports Nutrition Market Policies, Regulations, and Standards

4. Egypt Sports Nutrition Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Egypt Sports Nutrition Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Sports Protein Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Protein/Energy Bars- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Sports Protein Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Sports Protein RTD- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Sports Non-Protein Products- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Sales Channel

5.2.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Ingredients

5.2.3.1. Vitamins and Minerals- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Proteins and Amino Acids- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Carbohydrates- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Probiotics- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Botanicals/Herbals- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Functionality

5.2.4.1. Energy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Muscle growth- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Hydration- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Weight Management- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By End User

5.2.5.1. Bodybuilders- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Athletes- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Lifestyle Users- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. Egypt Protein Products Sports Nutrition Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Ingredients- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Functionality- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Egypt Non-Protein Products Sports Nutrition Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Ingredients- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Functionality- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Optimum Nutrition Inc

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.BPI Sports Holdings LCC

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Iovate Health Sciences International Inc

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Advanced Sports Nutrition

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Imtenan Corp

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Grain Labz Foods SAE

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Les Laboratoires Biopharma SA

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Dulex Lab Nutrition

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Samo Trading Co

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. DSN

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Sales Channel |

|

| By Ingredients |

|

| By Functionality |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.