Egypt Leisure & Business Travel Booking Market Report: Trends, Growth and Forecast (2026-2032)

By Travel Sales Type (Leisure Travel, Business Travel), By Booking Channel (Offline Booking, Online Booking), By Booking Method (Travel Intermediaries, Direct Suppliers)

- ICT

- Nov 2025

- VI0388

- 120

-

Egypt Leisure & Business Travel Booking Market Statistics and Insights, 2026

- Market Size Statistics

- Leisure & Business Travel Booking in Egypt is estimated at $ 2.91 Billion.

- The market size is expected to grow to $ 3.56 Billion by 2032.

- Market to register a CAGR of around 2.92% during 2026-32.

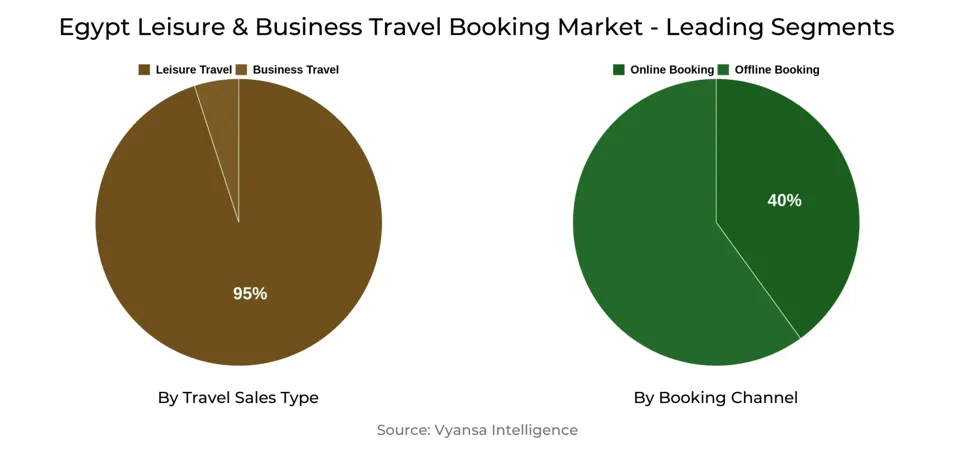

- Travel Sales Type Shares

- Leisure Travel grabbed market share of 95%.

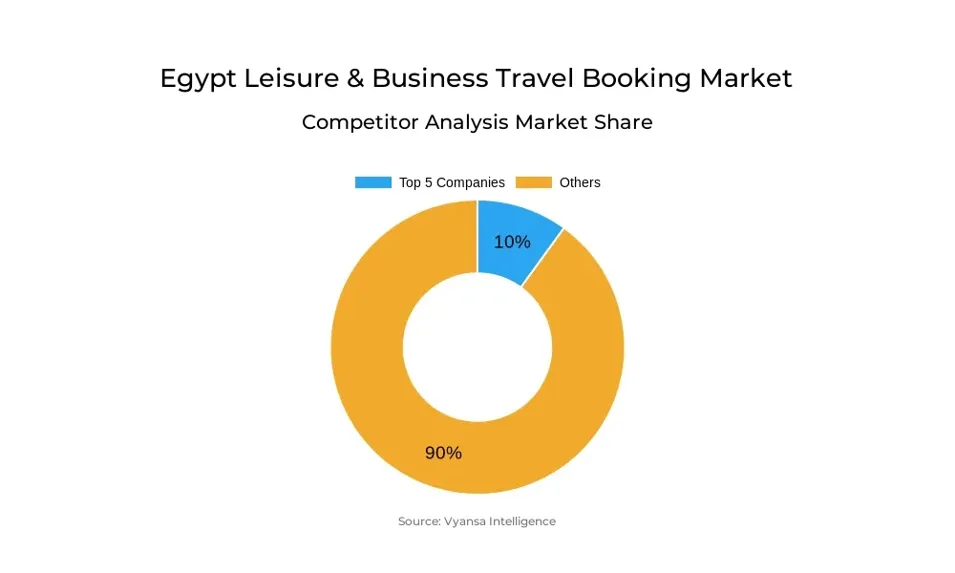

- Competition

- Egypt Leisure & Business Travel Booking Market is currently being catered to by more than 20 companies.

- Top 5 companies acquired 10% of the market share.

- Gazef, AboSamra Travel, Expedia Group Inc, Travco Group Holding SAE, Blue Sky Travel Ltd etc., are few of the top companies.

- Booking Channel

- Online Booking grabbed 40% of the market.

Egypt Leisure & Business Travel Booking Market Outlook

The Egypt leisure and business travel booking market stands at $2.91 billion as of 2025 and is set to reach $3.56 billion by 2032. Trade participation and government marketing campaigns form the core in bolstering such growth. The Ministry of Tourism is energetically presenting Egypt at key international exhibitions like WTM London and ITB Berlin, as well as on campaigns like the Cairo City Break, which markets the capital as a break away weekend destination. These campaigns are supported by digital campaigns via short films and endorsements to keep Egypt top of mind in competitive tourism streams.

Egypt is also consolidating relations with source markets of strategic importance. A recent B2B promotional mission focused on the French tourism market, bringing 200 French agencies and companies to visit Luxor, Aswan, and Abu Simbel. This effort showcases Egypt's Nile and cultural tourism potential as well as fortifying trade ties. These efforts are positioning Egypt as a multifaceted destination beyond its long-standing strengths.

Foreign investment also helps fuel growth, especially in cultural heritage tourism. Collaboration with USAID and local institutions is leading the conservation initiatives like the Red Sea initiative, which conserves coral reefs and involves communities in climate action. Renovation in cities such as Esna is also being done, with initiatives to enhance infrastructure and market it as a cultural destination, while empowering SMEs in tourism.

Looking forward, Egypt is broadening its product base to entice international tourists. In addition to culture and beach tourism, the nation is marketing retreats, eco-tourism, trekking, and adventure travel. Tour operators are broadening their offers with packages that feature eco-lodges, tours to natural and historical attractions, and activities that benefit the local economy. With online bookings already making up 40% of sales, digital channels are poised to have an increasingly significant contribution to serving international travelers, holding steady momentum for the market over to 2032.

Egypt Leisure & Business Travel Booking Market Growth Driver

Government-Led Marketing Improving Tourism Visibility

Government-led marketing campaigns and active trade participation are driving the market by strongly positioning Egypt as a leading travel destination. The Ministry of Tourism is making high-profile appearances like WTM London and ITB Berlin, where airlines, hotels, and regional officials are being brought together under one roof. Promotions like Cairo City Break are also being rolled out to establish Cairo as an energetic long weekend break destination and highlight its cultural and archaeological pull. These initiatives put Egypt's varied offerings in front of a broad audience of potential travelers.

Alongside end user-oriented campaigns, the trade sector is also being targeted by the government. Efforts like welcoming 200 French tourism businesses on an invitation trip to Luxor, Aswan, and Abu Simbel are actually building bridges with one of Egypt's most important source markets. These efforts do more than raise visibility; they create direct relationships with overseas travel agencies as well, creating a consistent supply of demand and solidifying Egypt's place in international tourism.

Egypt Leisure & Business Travel Booking Market Trend

Increasing Demand for Varied Tourism Experience

End users in Egypt are increasingly seeking experiences different from the conventional emphasis on cultural heritage and beach holidays. The nation is presently marketed for retreats, eco-tourism, trekking, and adventure travel. This change is a result of the increasing desire of tourists who seek differentiated and real experiences rather than typical all-inclusive resort holidays.

Operators are responding by providing an expanded array of packages, such as visits to the White Desert or the Graeco-Roman Museum, as well as ecotourism accommodations in major eco-lodges. Other travelers also express interest in benefiting local businesses and experiencing Egyptian culture in a more substantial way. Government officials and market players are reacting to this demand, which is driving Egypt's tourism appeal further and underpinning the ongoing growth of the market.

Egypt Leisure & Business Travel Booking Market Opportunity

Foreign Investment Spurring Cultural and Eco-Tourism

Egypt Leisure & Business Travel Booking Market is experiencing robust foreign investment support that is designed to protect cultural heritage sites and pursue sustainable tourism. Investment undertakings like USAID work towards safeguarding historic sites, rehabilitating infrastructure, and enhancing Egyptian positioning as a cultural tourism center. This Red Sea undertaking further emphasizes these efforts by protecting coral reefs and initiating local and climate-related action, which will ensure long-term ecological equilibrium.

In Esna, a culturally vibrant city, joint efforts by USAID, Takween, and the Egyptian government are restoring sites of history and marketing the city as a top destination for tourists. To complement this, tour operators and investors are offering help to SMEs, enabling them to diversify cultural tourism offerings. These efforts not only increase Egypt's attractiveness on the world stage but also provide sustainable avenues for the development of the tourism market.

Egypt Leisure & Business Travel Booking Market Segmentation Analysis

By Travel Sales Type

- Leisure Travel

- Business Travel

The segment with the largest market share under the Travel Sales Type is Leisure Travel, which accounted for about 95% of the market. Egypt remains to entice tourists with its rich cultural and historical heritage, in addition to its favorite beach resort areas. Marketing promotions like the Cairo City Break initiative and attendance at international events like WTM London and ITB Berlin are placing the country on the list of top leisure destinations to visit. Demand is further supplemented by B2B activity in key markets like France, where tourism bureaux are presented first-hand to Egypt's cultural and Nile experiences.

Leisure Travel leads the market because of the extensive product range being offered. Aside from traditional resorts, Egypt increasingly markets eco-tourism, trekking, retreats, and adventure tourism. Tourists are now looking for combinations of culture, heritage, and sustainability-based experiences in the form of eco-lodge stays and community-based activities. These changing preferences make leisure tourism the key growth driver.

By Booking Channel

- Offline Booking

- Online Booking

The largest market segment under the Booking Channel is Online Booking, with a market share of approximately 40%. The government and tourism sector stakeholders are contributing to contemporary promotion methods to drive this channel, including short films, digital recommendations, and online marketing that focus on Egypt's multi-facet ed attractions. end users tend to research and reserve through electronic means, aided by international events and promotional activities that make Egypt's destinations accessible to global travelers.

Bookings online keep growing as Egypt diversifies its tourism product beyond beach and cultural vacations. Packages now feature adventure travel, ecotourism, and local community experiences that are attractive to digital travelers who value the convenience of booking online. The synergy of focused government marketing and expanding options for experiences means that online booking is an ever-growing aspect of Egypt's tourist market.

Top Companies in Egypt Leisure & Business Travel Booking Market

The top companies operating in the market include Gazef, AboSamra Travel, Expedia Group Inc, Travco Group Holding SAE, Blue Sky Travel Ltd, Kanoo Group, Misr Travel Co, American Express (Middle East) EC, Al Tayyar Travel Group Holding Co, Carlson Wagonlit Travel Inc, etc., are the top players operating in the Egypt Leisure & Business Travel Booking Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Egypt Leisure & Business Travel Booking Market Policies, Regulations, and Standards

4. Egypt Leisure & Business Travel Booking Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Egypt Leisure & Business Travel Booking Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Travel Sales Type

5.2.1.1. Leisure Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Business Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Booking Channel

5.2.2.1. Offline Booking- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Online Booking- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Booking Method

5.2.3.1. Travel Intermediaries- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Direct Suppliers- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Egypt Leisure Travel Booking Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Travel Sales Type- Market Insights and Forecast 2022-2032, USD Million

6.2.1.1. Leisure Air Travel- Market Insights and Forecast 2022-2032, USD Million

6.2.1.2. Leisure Car Rental- Market Insights and Forecast 2022-2032, USD Million

6.2.1.3. Leisure Cruise- Market Insights and Forecast 2022-2032, USD Million

6.2.1.4. Leisure Experiences and Attractions- Market Insights and Forecast 2022-2032, USD Million

6.2.1.5. Leisure Lodging- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Booking Method- Market Insights and Forecast 2022-2032, USD Million

7. Egypt Business Travel Booking Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Travel Sales Type- Market Insights and Forecast 2022-2032, USD Million

7.2.1.1. Business Air Travel- Market Insights and Forecast 2022-2032, USD Million

7.2.1.2. Business Car Rental- Market Insights and Forecast 2022-2032, USD Million

7.2.1.3. Business Lodging- Market Insights and Forecast 2022-2032, USD Million

7.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Booking Method- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1. Travco Group Holding SAE

8.1.1.1. Business Description

8.1.1.2. Service Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2. Blue Sky Travel Ltd

8.1.2.1. Business Description

8.1.2.2. Service Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3. Kanoo Group

8.1.3.1. Business Description

8.1.3.2. Service Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4. Misr Travel Co

8.1.4.1. Business Description

8.1.4.2. Service Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5. American Express (Middle East) EC

8.1.5.1. Business Description

8.1.5.2. Service Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6. Gazef

8.1.6.1. Business Description

8.1.6.2. Service Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7. AboSamra Travel

8.1.7.1. Business Description

8.1.7.2. Service Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8. Expedia Group Inc

8.1.8.1. Business Description

8.1.8.2. Service Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9. Al Tayyar Travel Group Holding Co

8.1.9.1. Business Description

8.1.9.2. Service Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Carlson Wagonlit Travel Inc

8.1.10.1. Business Description

8.1.10.2. Service Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Travel Sales Type |

|

| By Booking Channel |

|

| By Booking Method |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.