Egypt Bottled Water Market Report: Trends, Growth and Forecast (2026-2032)

By Type of Water (Carbonated Bottled Water, Flavoured Bottled Water, Functional Bottled Water, Still Bottled Water (Purified Water, Mineral Water, Spring Water, Plain Water)), By Packaging Material (Plastic Bottles, Glass Bottles, Metal Cans, Others (Tetra Pack Cartons, Bioplastics, etc.)), By Price Point (Mass, Premium), By Sales Channel (On Trade, Off Trade (Retail Offline, Retail Online)), By Region (Cairo, Alexandria, Others)

- FMCG

- Feb 2026

- VI0895

- 125

-

Egypt Bottled Water Market Statistics and Insights, 2026

- Market Size Statistics

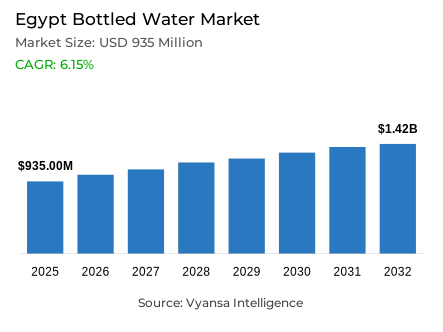

- Bottled water in Egypt is estimated at USD 935 million in 2025.

- The market size is expected to grow to USD 1.42 billion by 2032.

- Market to register a cagr of around 6.15% during 2026-32.

- Type of Water Shares

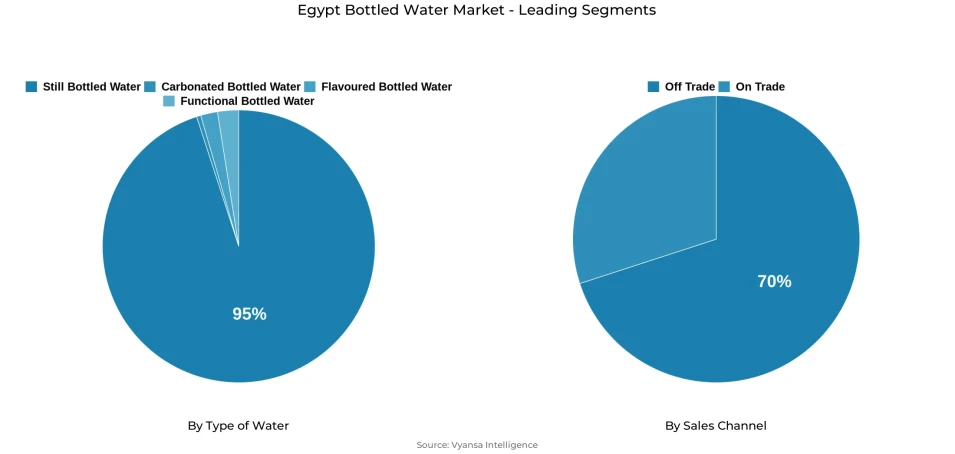

- Still bottled water grabbed market share of 95%.

- Competition

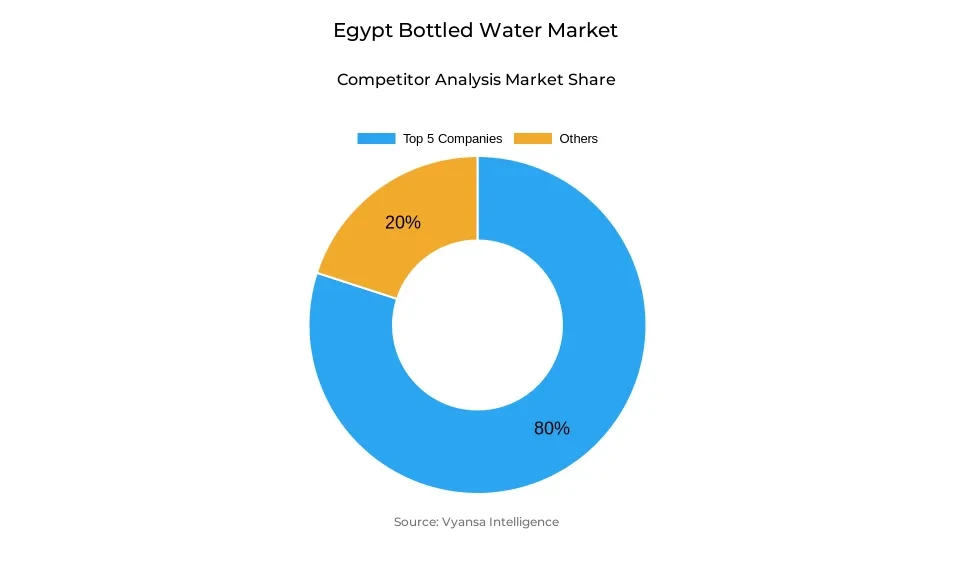

- Bottled water in Egypt is currently being catered to by more than 15 companies.

- Top 5 companies acquired around 80% of the market share.

- Global Industrial & Development LLC; Danone Egypt; Al Hayat Development & Industrialization Co SAE; Société des Eaux Minérales Vittor SAE; Coca-Cola Egypt etc., are few of the top companies.

- Sales Channel

- Off trade grabbed 70% of the market.

Egypt Bottled Water Market Outlook

The Egypt bottled water market is estimated at USD 935 million in 2025 and will grow to about USD 1.42 billion in 2032 with a CAGR of about 6.15% in the period 2026-32. This consistent growth perspective indicates the position of bottled water as a need product and not a luxury drink, which is backed by the high consumption rates in the household, work, and social environments. Repeat purchase behaviour and similar usage occasions across income groups form the basis of the category resilience.

The fundamentals of long-term demand remain rooted in population growth and the rapid urbanisation. As the population of Egypt is projected to reach over 116 million by 2024, growing urban centres create a continuous baseline demand of convenient and perceived-safe drinking water. The higher the number of people in the household and the high population density in the city, the more frequent the consumption on a daily basis, and the more the urban lifestyle supports the habitual buying behavior due to the presence of numerous retail stores. This population trend helps to sustain the volume growth instead of temporary demand peaks.

The market perspective is also enhanced by health consciousness since bottled water enjoys the advantage of being linked to calorie-free hydration in the face of increased awareness regarding sugar reduction. Still bottled water is the most popular product in the product mix with an estimated market share of 95%, which is a sign of its universal applicability in daily home, meal, and work hydration. Although alternative formats are gaining niche appeal, they do not replace the fundamental purpose of still water.

Market stability is also supported by sales channel dynamics, with off-trade channels contributing about 70% of the total sales. The conventional grocery stores, neighbourhood stores, supermarkets, and convenience stores continue to be at the centre of accessibility, especially outside the major cities. With the growing environmental awareness, sustainability-oriented packaging and recycling programs provide another differentiation opportunity, which helps to maintain its relevance in the long term without changing the fundamental everyday role of bottled water.

Egypt Bottled Water Market Growth DriverDemographic Expansion and Urban Living Driving Daily Hydration Demand

The Egypt bottled water market has been driven by population growth and the pace of urbanisation, which continues to provide a consistent base demand of safe and convenient drinking water in the growing urban populations. The World Bank data shows that the population of Egypt exceeded 116 million people in the 2024 period, which supports its position as the most populous state in the Middle East and North Africa. The high population density and larger families contribute to the increased rate of daily water usage in households, workplaces, and public areas, which is structurally conducive to the volumes of bottled water.

In the urban consumer market, convenience, portability, and perceived reliability of packaged drinking water are usually given higher value, especially in the fast-paced urban lifestyles. With internal migration still concentrating populations in urban centres, bottled water enjoys the advantages of high-density retail networks and routine buying patterns. This population trend creates consistent, repeat consumption, thus establishing a long-term volume stability of the Egypt bottled water market among all income groups and usage events.

Egypt Bottled Water Market ChallengePublic Water Confidence Gaps and Cost Sensitivity Pressures

The attitudes towards the quality of municipal water remain one of the key limitations that influence the Egypt bottled water market and have a stronger impact on purchasing behaviour than the official infrastructure indicators. Although the availability of better water sources has increased in the country, the WHO and UNICEF Joint Monitoring Programme data show that access to safely managed drinking water is still disproportionate, which strengthens the unresolved concerns of end users about the potability of tap water. These images perpetuate the bottled water dependency but also make the category vulnerable in times of economic strain.

Increased living expenses can cause end users to down-trade to less expensive bottled water brands or decrease the frequency of purchase, especially of large-pack formats consumed at home. Without well-established, credible social guarantees on the safety of drinking water, consumption choices will be motivated by trust and not by objective system performance. This dynamic restricts premiumisation and the capacity of the Egypt bottled water market to decouple growth entirely with the overall household budget pressures.

Egypt Bottled Water Market TrendHealth-Oriented Beverage Choices Reshaping Consumption Patterns

Health awareness is becoming a key factor in the choice of beverages, which supports the position of bottled water as a fundamental daily beverage. Since 2020, WHO advice on the need to reduce sugar consumption to tackle non-communicable diseases has impacted regional behaviour, hastening the move towards non-sugary drinks. In this context, bottled water enjoys the benefits of being associated with calorie-free hydration and perceived wellness benefits.

A slow but steady shift towards carbonated bottled water as an alternative to traditional sodas is also being supported by end users who want variety without added sugar. Even though volumes are dominated by still water, this trend promotes portfolio diversification and small-scale innovation, especially in lightly carbonated forms. The outcome is not a shift in the fundamental role of the category, but an expansion of the occasions of use, which reinforces the defensive role of bottled water in the changing non-alcoholic beverage environment in Egypt.

Egypt Bottled Water Market OpportunitySustainable Packaging as a Differentiation Lever

Sustainability programs are an emerging market in the Egypt bottled water industry, as more end users and policymakers become environmentally conscious. The issue of plastic waste and recycling has become increasingly acute in the world since 2020, and it influences the perception of purchases even in price-sensitive markets. Brands that actively minimize material consumption, enhance recyclability, or facilitate collection efforts can increase trust and long-term relevance. Brand equity outside price competition can also be supported by alignment with public-sector environmental goals and visible sustainability commitments.

Although cost is still important, responsible packaging is becoming a product quality aspect that is being appreciated by end users. This provides room to the producers to differentiate based on the practice of operations and not just formulation. With environmental regulation and awareness slowly gaining strength, sustainable packaging strategies provide a way through which bottled water companies can future-proof their operations without losing social and regulatory alignment.

Egypt Bottled Water Market Segmentation Analysis

By Type of Water

- Carbonated Bottled Water

- Flavoured Bottled Water

- Functional Bottled Water

- Still Bottled Water

- Purified Water

- Mineral Water

- Spring Water

- Plain Water

Still Bottled Water represents the dominant segment within the Egypt bottled water market, accounting for approximately 95% of total market share. Its leadership reflects broad daily functionality, neutral taste, and universal suitability across hydration occasions, including home consumption, meals, workplaces, and schools. End users consistently view still water as the default choice for routine hydration, reinforcing its structural dominance.

Extensive availability across traditional retail, supermarkets, kiosks, and forecourt outlets further strengthens still water’s position. While carbonated and specialty waters are gaining visibility, particularly among younger and health-oriented end users, they remain complementary rather than substitutive. The sheer scale of everyday demand ensures that still bottled water continues to anchor both volume and value, making it the core revenue driver within Egypt’s bottled water category.

By Sales Channel

- On Trade

- Off Trade

- Retail Offline

- Retail Online

Off-trade retail channels dominate bottled water sales channel in Egypt, capturing roughly 70% of total market sales. Traditional grocery stores, neighborhood shops, supermarkets, and convenience outlets form the backbone of access, enabling frequent, small-basket purchases aligned with daily consumption habits. These channels benefit from proximity, high footfall, and the ability to offer chilled products for immediate use.

Offline retail also provides extensive geographic reach, including secondary cities and semi-urban areas where digital commerce penetration remains limited. Although online grocery and delivery platforms are expanding, particularly in major cities, they currently supplement rather than replace physical retail. The entrenched role of offline channels ensures that off-trade sales channel remains central to volume stability and accessibility within the Egypt bottled water market.

List of Companies Covered in Egypt Bottled Water Market

The companies listed below are highly influential in the Egypt bottled water market, with a significant market share and a strong impact on industry developments.

- Global Industrial & Development LLC

- Danone Egypt

- Al Hayat Development & Industrialization Co SAE

- Société des Eaux Minérales Vittor SAE

- Coca-Cola Egypt

- Pepsi-Cola Egypt / Alkan Bugshan

- Egyptian Saudi Company For Natural Water & Food Industries (ESC)

- National Co for Natural Water in Siwa

- Wadi El-Gadid Natural Water

- Siwa SAE for Industrialisation & Development

Competitive Landscape

Competition in Egypt’s bottled water market remains intense, led by Nestlé SA, which held over half of volume share in 2025 through subsidiaries Société des Eaux Minérales Vittor SAE and Nestlé Egypt SAE. Its brands, including Nestlé Pure Life, Baraka, Nestlé Pure Fizz, and S Pellegrino, benefit from strong manufacturing capacity, nationwide distribution, and heavy promotion in modern trade, with smaller, affordable pack sizes driving mass appeal. Global Industrial & Development LLC emerged as the most dynamic player, with Puvana gaining share in sparkling water through light and medium sparkling variants. The launch of flavoured sparkling brand F2O further strengthened competition, attracting consumers seeking healthier carbonated options.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Egypt Bottled Water Market Policies, Regulations, and Standards

4. Egypt Bottled Water Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Egypt Bottled Water Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Volume (Million Litres)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Type of Water

5.2.1.1. Carbonated Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Flavoured Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Functional Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Still Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Purified Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Mineral Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Spring Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Plain Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Packaging Material

5.2.2.1. Plastic Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Glass Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Metal Cans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Others (Tetra Pack Cartons, Bioplastics, etc.)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Point

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. On Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Off Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Region

5.2.5.1. Cairo

5.2.5.2. Alexandria

5.2.5.3. Others

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. Egypt Carbonated Bottled Water Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Volume (Million Litres)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Region- Market Insights and Forecast 2022-2032, USD Million

7. Egypt Flavoured Bottled Water Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Volume (Million Litres)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Region- Market Insights and Forecast 2022-2032, USD Million

8. Egypt Functional Bottled Water Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Volume (Million Litres)

8.2. Market Segmentation & Growth Outlook

8.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Region- Market Insights and Forecast 2022-2032, USD Million

9. Egypt Still Bottled Water Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Volume (Million Litres)

9.2. Market Segmentation & Growth Outlook

9.2.1.By Type of Water- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Price Point- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Region- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Société des Eaux Minérales Vittor SAE

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Coca-Cola Egypt

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Pepsi-Cola Egypt / Alkan Bugshan

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Egyptian Saudi Company For Natural Water & Food Industries (ESC)

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. National Co for Natural Water in Siwa

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Global Industrial & Development LLC

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Danone Egypt

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Al Hayat Development & Industrialization Co SAE

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Wadi El-Gadid Natural Water

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Siwa SAE for Industrialisation & Development

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Type of Water |

|

| By Packaging Material |

|

| By Price Point |

|

| By Sales Channel |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.