Ecuador Bath & Shower Products Market Report: Trends, Growth and Forecast (2025-2030)

By Product (Bath Soaps, Body Wash/Shower Gels, Bath Additives, Body Powder, Hand Sanitisers, Intimate Hygiene), By Product Form (Solid, Gels & Jellies, Liquid, Powder), By Ingredient (Conventional/Synthetic, Natural/Organic), By Price Point (Premium, Mass), By End User (Women, Men, Kids/Children), By Sales Channel (Online, Offline)

- FMCG

- Dec 2025

- VI0051

- 110

-

Ecuador Bath & Shower Products Market Statistics, 2025

- Market Size Statistics

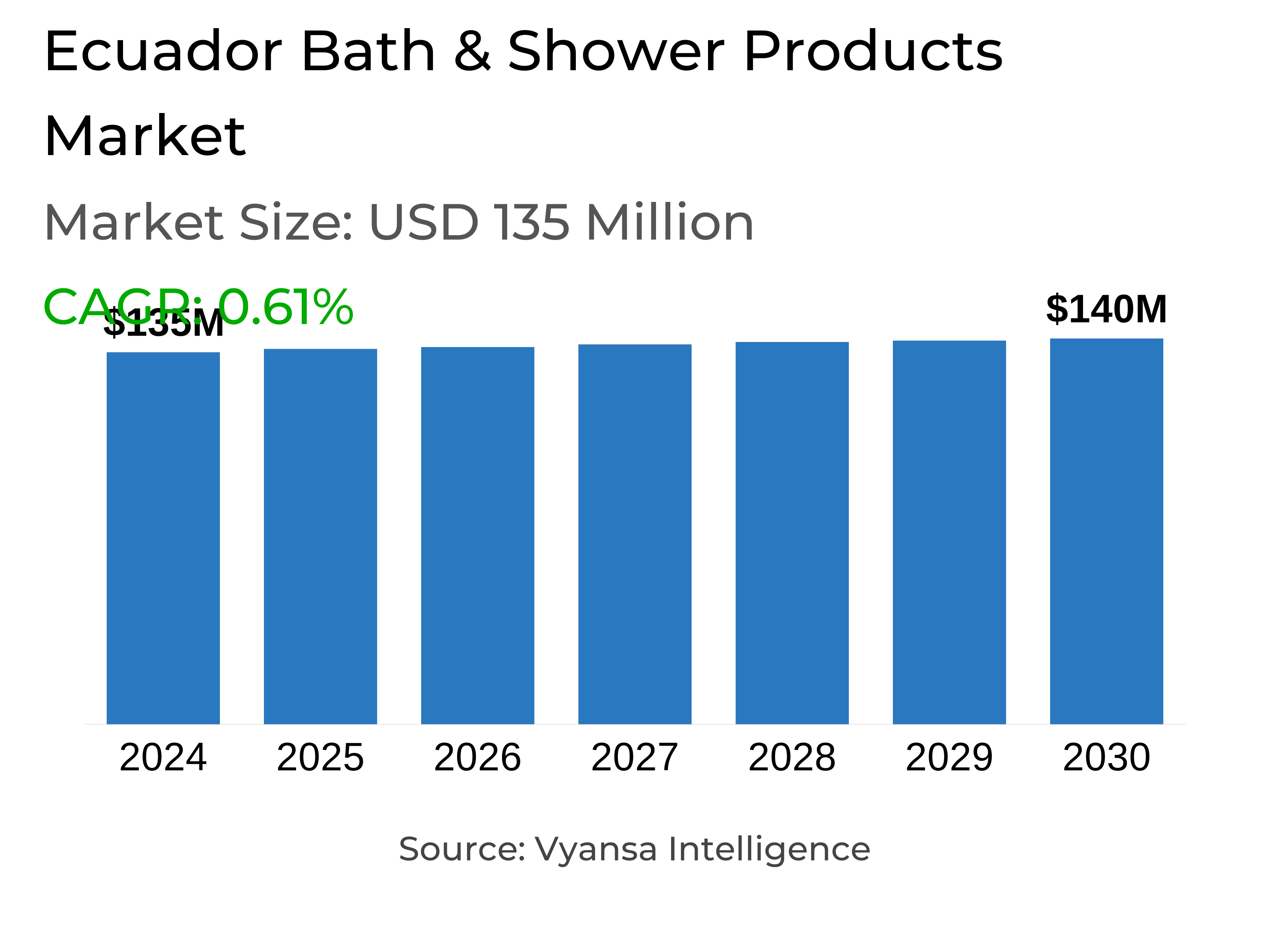

- Bath & Shower Products in Ecuador is estimated at $ 135 Million.

- The market size is expected to grow to $ 140 Million by 2030.

- Market to register a CAGR of around 0.61% during 2025-30.

- Product Shares

- Bath Soaps grabbed market share of 70%.

- Competition

- More than 15 companies are actively engaged in producing Bath & Shower Products in Ecuador.

- Top 5 companies acquired 65% of the market share.

- Ecuador Brands SA, Johnson & Johnson del Ecuador SA, Yanbal Ecuador SA, Colgate-Palmolive de Ecuador SA, La Fabril SA etc., are few of the top companies.

Ecuador Bath & Shower Products Market Outlook

The Ecuador bath and shower care market will record moderate value growth in 2025–2030. Although the category benefitted hugely from hygiene awareness during the COVID-19 pandemic, consumer behavior has reverted back to pre-pandemic times. Consequently, categories such as intimate washes and specialist cleansers are recording declining relevance, particularly with consumers now focusing on must-haves. Nevertheless, population growth will continue to underpin total demand.

Bath Soaps will continue to be the largest segment as a result of its low cost, ubiquity, and popularity among price-conscious consumers. It is a mainstay in urban and rural markets alike and can be conveniently accessed by way of local food stores, informal outlets, and drugstores. Yet, the most rapidly expanding unit will be shower gel/body wash due to urban consumers and companies such as Bath & Body Works, providing their customers with scent-heavy, high-quality products that appeal to shifting tastes toward a more luxurious bathing experience.

Distribution channels will still be dominated by small neighborhood grocers, providing day-to-day shopping needs for consumers with low incomes. Nonetheless, discounters like Tiendas Tuti are becoming good performers with branded and private label offerings at competitive prices. Their capacity to draw brand-consumers and build in-store exclusive private labels like Plie is molding future retail fortunes.

In the future, national brands and international brands will have to invest in quality and innovation to compete with increasing private label competition. Shoppers are increasingly attracted to products with benefits added, e.g., skin care benefits, attractive scents, and environmentally friendly packaging. This premiumisation and value creation trend will be a driver of continued relevance and future growth in the Ecuador bath and shower market.

Ecuador Bath & Shower Products Market Growth Driver

The Ecuador bath and shower goods market is anticipated to see moderate value growth in 2025-30, led by a growing population. While more entrants into the market will boost demand for basic hygiene products like bar soaps and shower gels, the scope for major growth in wider acceptance is restricted since a majority of households in the country already employ these basic products.

Rather, the market will experience growth via premiumisation, new product development, and shifting consumer tastes. Manufacturers can try to launch new, innovative, and value-added variants to win consumer attention. Consequently, though the market will continue to move ahead, the tempo will be continuous and moderate instead of fast, determined more by alterations in purchasing habits than an increase in new users.

Ecuador Bath & Shower Products Market Trend

In Ecuador, private labels are taking on a brand-like look to compete more successfully in the bath and shower market. Hard discounter Tuti has a soap brand named Plie, which has a stand-alone brand look and feel unlike most private labels. Though its distribution remains limited to Tuti, consumers tend to perceive it as a distinct brand, making it even more difficult to differentiate from national brands. This move is beneficial in establishing trust, giving the feel of exclusivity, and even enhancing loyalty among Tuti's clientele.

For instance, Corporación Favorita's La Original is a cheap private label that does not obviously stand out as a store brand. It competes with the other private labels, particularly those bearing the Supermaxi label, in the same store. This enables Corporación Favorita to serve different groups of consumers and dominate various price levels, further solidifying its market position.

Ecuador Bath & Shower Products Market Opportunity

As private label and value brands increase their presence in Ecuador, major bath and shower product manufacturers can defend and build market share by emphasizing product quality and innovation. Instead of depending on price reduction, brands can stand out through improved formulations, new scents, and additional skin benefits. Shoppers are increasingly drawn to moisturizing ingredients, dermatologically tested products, and long-lasting fragrances—particularly in competitive segments such as liquid soap.

To keep ahead, businesses are putting money into strong fragrances, visible labels, and sustainable packaging. Sensitive skin-friendly products or antibacterial and dermocosmetic-inspired solutions are becoming popular. This change in consumer behavior is an open opportunity for brands to increase loyalty and differentiate themselves in a competitive landscape by providing high-end experiences that transcend fundamental hygiene requirements.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 135 Million |

| USD Value 2030 | $ 140 Million |

| CAGR 2025-2030 | 0.61% |

| Largest Category | Bar Soap segment leads with 70% market share |

| Top Drivers | Rising Population and Product Premiumisation to Sustain Market Momentum |

| Top Trends | Private Labels Adopting Brand-Like Appeal to Attract Consumers |

| Top Opportunities | Rising Focus on Innovation & Quality to Counter Private Label Growth |

| Key Players | Ecuador Brands SA, Johnson & Johnson del Ecuador SA, Yanbal Ecuador SA, Colgate-Palmolive de Ecuador SA, La Fabril SA, Unilever Andina Ecuador SA, Laboratorios Siegfried SAS, Jabonería Wilson SA, Oriflame del Ecuador SA, Productos Familia Sancela SA and Others. |

Ecuador Bath & Shower Products Market Segmentation

The most market-share holding segment in the Ecuador Bath & Shower Products Market is bar soap. It holds sway primarily because it is inexpensive, conveniently available, and used on multiple parts of the body. Bar soaps are much less expensive than liquid body wash or specialty cleansers and thus are the first choice of price-sensitive consumers. Their availability in malls, drugstores, neighborhood shops, and street markets makes them easily accessible to all segments of consumers, particularly during periods of economic strain.

Conversely, body wash/shower gel is the most rapidly growing segment, while still capturing a lower proportion of the total market. Its growth is being driven by younger, urban consumers seeking a convenience, variety in scent, and more luxurious bathing experience. The category was given a boost by the introduction of Bath & Body Works (Ecuador Brands SA), creating awareness and inducing additional competition in the segment, driving continued growth beyond economic restrictions.

Top Companies in Ecuador Bath & Shower Products Market

The top companies operating in the market include Ecuador Brands SA, Johnson & Johnson del Ecuador SA, Yanbal Ecuador SA, Colgate-Palmolive de Ecuador SA, La Fabril SA, Unilever Andina Ecuador SA, Laboratorios Siegfried SAS, Jabonería Wilson SA, Oriflame del Ecuador SA, Productos Familia Sancela SA, etc., are the top players operating in the Ecuador Bath & Shower Products Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Ecuador Bath and Shower Product Market Policies, Regulations, and Standards

4. Ecuador Bath and Shower Product Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Ecuador Bath and Shower Product Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Bath Soaps- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Body Wash/Shower Gels- Market Insights and Forecast 2020-2030, USD Million

5.2.1.3. Bath Additives- Market Insights and Forecast 2020-2030, USD Million

5.2.1.4. Body Powder- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5. Hand Sanitisers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.6. Intimate Hygiene- Market Insights and Forecast 2020-2030, USD Million

5.2.1.6.1. Intimate Washes- Market Insights and Forecast 2020-2030, USD Million

5.2.1.6.2. Intimate Wipes- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Product Form

5.2.2.1. Solid- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Gels & Jellies- Market Insights and Forecast 2020-2030, USD Million

5.2.2.3. Liquid- Market Insights and Forecast 2020-2030, USD Million

5.2.2.4. Powder- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Ingredient

5.2.3.1. Conventional/Synthetic- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Natural/Organic- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By Price Point

5.2.4.1. Premium- Market Insights and Forecast 2020-2030, USD Million

5.2.4.2. Mass- Market Insights and Forecast 2020-2030, USD Million

5.2.5.By End User

5.2.5.1. Women- Market Insights and Forecast 2020-2030, USD Million

5.2.5.2. Men- Market Insights and Forecast 2020-2030, USD Million

5.2.5.3. Kids/Children- Market Insights and Forecast 2020-2030, USD Million

5.2.6.By Sales Channel

5.2.6.1. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.6.2. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Ecuador Bath Soaps Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product Form- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By Ingredient- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Price Point- Market Insights and Forecast 2020-2030, USD Million

6.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

6.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. Ecuador Body Wash/Shower Gels Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Form- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Ingredient- Market Insights and Forecast 2020-2030, USD Million

7.2.3.By Price Point- Market Insights and Forecast 2020-2030, USD Million

7.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

7.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. Ecuador Bath Additives Market Statistics, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Form- Market Insights and Forecast 2020-2030, USD Million

8.2.2.By Ingredient- Market Insights and Forecast 2020-2030, USD Million

8.2.3.By Price Point- Market Insights and Forecast 2020-2030, USD Million

8.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

8.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

9. Ecuador Body Powder Market Statistics, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Product Form- Market Insights and Forecast 2020-2030, USD Million

9.2.2.By Ingredient- Market Insights and Forecast 2020-2030, USD Million

9.2.3.By Price Point- Market Insights and Forecast 2020-2030, USD Million

9.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

9.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

10. Ecuador Hand Sanitisers Market Statistics, 2020-2030F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Product Form- Market Insights and Forecast 2020-2030, USD Million

10.2.2. By Ingredient- Market Insights and Forecast 2020-2030, USD Million

10.2.3. By Price Point- Market Insights and Forecast 2020-2030, USD Million

10.2.4. By End User- Market Insights and Forecast 2020-2030, USD Million

10.2.5. By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

11. Ecuador Intimate Hygiene Market Statistics, 2020-2030F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Product- Market Insights and Forecast 2020-2030, USD Million

11.2.2. By Product Form- Market Insights and Forecast 2020-2030, USD Million

11.2.3. By Ingredient- Market Insights and Forecast 2020-2030, USD Million

11.2.4. By Price Point- Market Insights and Forecast 2020-2030, USD Million

11.2.5. By End User- Market Insights and Forecast 2020-2030, USD Million

11.2.6. By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Colgate-Palmolive de

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Ecuador SA La Fabril SA

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Unilever Andina Ecuador SA

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Laboratorios Siegfried SAS

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Jabonería Wilson SA

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Ecuador Brands SA

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Johnson & Johnson del Ecuador SA

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Yanbal Ecuador SA

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Oriflame del Ecuador SA

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Productos Familia Sancela SA

12.1.10.1.Business Description

12.1.10.2.Product Portfolio

12.1.10.3.Collaborations & Alliances

12.1.10.4.Recent Developments

12.1.10.5.Financial Details

12.1.10.6.Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Product Form |

|

| By Ingredient |

|

| By Price Point |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.