Denmark Healthy Snacks Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Low/No Fat & Salt Snacks (Low Fat Snacks, No Fat Snacks, Low Salt Snacks, No Salt Snacks), Low/No Sugar & Caffeine Snacks (Low Sugar Snacks, No Sugar Snacks, No Added Sugar Snacks, No Caffeine Snacks), Allergy / Free-from / Specialized Diet Snacks (Gluten-Free Snacks, Dairy-Free Snacks, Lactose-Free Snacks, Hypoallergenic Snacks, Keto Snacks, Meat-Free Snacks, No Allergens Snacks, Plant-Based Snacks, Vegan Snacks, Vegetarian Snacks, Weight Management Snacks), Fortified / Nutrient-Enhanced Snacks (Good Source of Antioxidants Snacks, Good Source of Minerals Snacks, Good Source of Omega-3s Snacks, Good Source of Vitamins Snacks, High Fibre Snacks, High Protein Snacks, Probiotic Snacks, Superfruit Snacks), Health & Wellness-Oriented Snacks (Bone and Joint Health Snacks, Brain Health and Memory Snacks, Cardiovascular Health Snacks, Digestive Health Snacks, Energy Boosting Snacks, Immune Support Snacks, Skin Health Snacks, Vision Health Snacks), Natural Snacks, Organic Snacks), By Product Type (Meat Snacks, Nuts, Seeds & Trail Mixes, Dried Fruit Snacks, Cereal & Granola Bars, Others), By Packaging (Bag & Pouches, Boxes, Cans, Jars, Others), By Sales Channel (Retail Offline, Retail Online)

- Food & Beverage

- Jan 2026

- VI0743

- 110

-

Denmark Healthy Snacks Market Statistics and Insights, 2026

- Market Size Statistics

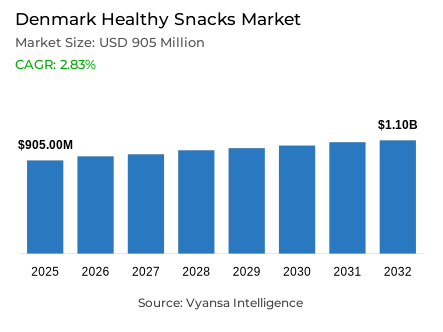

- Healthy snacks in Denmark is estimated at USD 905 million in 2025.

- The market size is expected to grow to USD 1.1 billion by 2032.

- Market to register a cagr of around 2.83% during 2026-32.

- Category Shares

- Allergy / free-from / specialized diet snacks grabbed market share of 25%.

- Competition

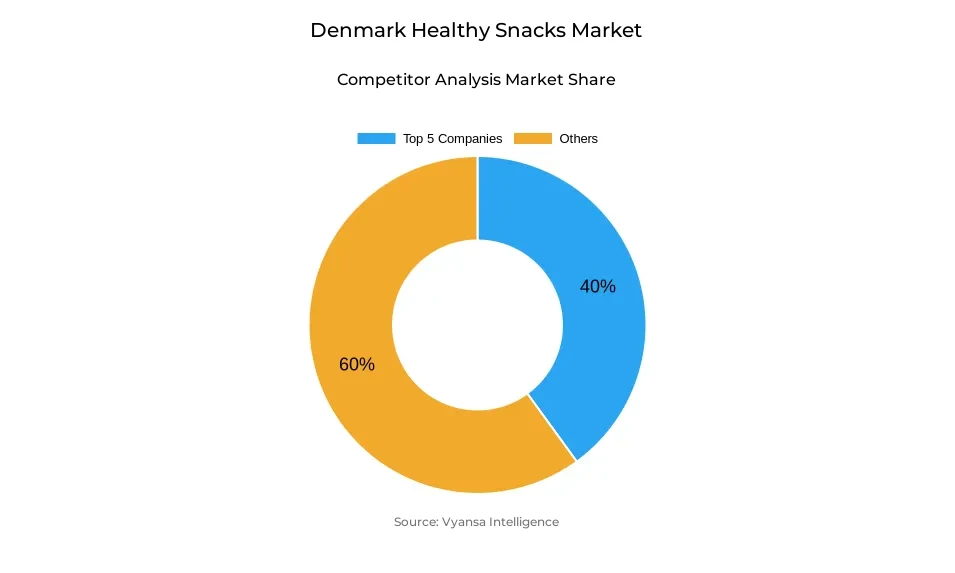

- More than 10 companies are actively engaged in producing healthy snacks in Denmark.

- Top 5 companies acquired around 40% of the market share.

- FDB Group; Unilever Group; Dmhermes Trade sro; Paulig Ab; Chocoladefabriken Lindt & Sprüngli AG etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

Denmark Healthy Snacks Market Outlook

The Denmark healthy snacks market is currently estimated at USD 905 million in 2025 and is set to reach approximately USD 1.1 billion by 2032, growing with a CAGR of 2.83% during the forcast period. Although the demand for organic snacks had shown a slow growth rate owing to its premium pricing, the affinity of the denmark end users towards sustainable, ethical, and health-driven end users goods ensures a robust base for the market to recover and perform well in the forcast periods.

Organics and plant-based categories are expected to continue being important growth drivers. Today, health- and environment-conscious individuals are linking such alternatives and making efforts towards veganism, plant-based, and local diner options. This is also being aided by official government health recommendations by the denmark government, asking them to limit their consumption of meat and dairy products in order to decrease their carbon footprints. Innovations like Hansen Balance's hybrid ice-cream and BareBells' vegan protein bars show how companies are working under the pressure to offer healthful indulgence options.

Protein-rich and low-sugar snacks are also set to become popular, catering to the needs of end end users looking for functional nutrition. Food products made from pulses, lentils, and even insects are set to trend, signaling the openness of the denmark market towards alternative protein-rich food. Companies, including Orkla's Kims and Naturli', are at the forefront of the market, introducing low-fat and plant-based crisp breads.

Allergy/Free From/ Specialized Dietary Snack Sales are still dominated, with growing end users awareness regarding gluten intolerance and clean-label trends. Sales Channels retail offline remains in the lead, with supermarkets and convenience stores still very visible in promoting sales through Organics and Functional Snacks. Nonetheless, retail online are also gradually emerging because they provide end users with easier accessibility to innovative, natural, and protein-enriched Snack products.

Denmark Healthy Snacks Market Growth DriverRising Health and Environmental Consciousness

The main driver in the Denmark Health and Wellness Snacks Market is the increasing orientation between health and wellness and sustainability in the country. denmark end users tend to rely more on organic, vegetarian, or vegan snacks due to the health and sustainability merits they carry. According to Statistics Denmark, 11.6% of the denmark food market is derived from organic food in 2024, and 65.5% of denmark citizens regularly purchase organic food, showing the high sustainability orientation in the country. The denmark Climate Plan initiated by the denmark Government advocates for the reduction of meat and dairy consumption to cut CO2 emissions, indirectly fueling the demand for vegetarian or vegan health and wellness snacks.

Increasing awareness regarding the benefits of organic agriculture and plant-based alternatives has helped support ever-escalating demands in natural snack products. Studies have shown that plant-based diets can lower emissions by 20-50% against traditional diets; this serves to support merging end users behaviors based on ethical and health-centric reasons, which act as prime drivers for this segment.

Denmark Healthy Snacks Market ChallengeEconomic Pressures and Price Sensitivity

Rising living costs and sustained inflationary pressures are increasingly limiting end users willingness to pay premium prices for organic snacking brands. Acc to EU prediction a 1.3% inflation rate for Denmark in 2024, pushing towards a 1.6% inflation rate in 2025, leading to a residual effect of decreased affordability, thereby making end users in Denmark opt for a less expensive option, such as private labels, over premium brands such as organic brands.

Moreover, due to the higher price of raw materials for organic products and the rise in operating costs related to food production, the level of afford ability has been restricting the growth rate. Therefore, the growth in the super premium segment for organic snacks is being affected because end userss feel the need for the basic food categories in times of economic downturn.

Denmark Healthy Snacks Market TrendGrowth of Plant-Based and Local Snack Products

Growing demand for plant-based, vegan, and locally produced snacks is emerging as a key trend shaping the denmark snack market.The Food Strategy 2030 of the denmark Government promotes the inclusion of more plant-based diets by denmark end users. Not only does the denmark government indicate end users interest in the demand for more plant-based snacks, but more than half of the denmark end users also aim to lower their meat consumption.

Such a trend triggers innovation, with new products emerging in the marketplace, such as chickpea snacks, combined dairy and plant-based products, and vegan biodegradable products. The integration of local sourcing and vegetarian product lines inspired by sustainability will also continue as end users in the denmark market opt for green lifestyles.

Denmark Healthy Snacks Market OpportunityProtein-Enriched and Functional Snack Expansion

The emergence of a growing market for functional and high-protein snacks is a significant opportunity for market expansion. The Green Protein Strategy for sustainable protein diversification launched by Denmark encourages a shift from focusing on traditional sources of protein, like meat and dairy, to diversified and sustainable sources of protein, such as legumes, grass protein, and insects. The demand for functional, nutritious, or healthy snacks, like protein bars or legume chips, is a reflection of this shift.

Local businesses are taking advantage of such a trend with regard to such products as insect-based and protein from legumes. The government support for sustainable sources of protein in their climate and food policies provides a rich basis for development in the emerging market such as this one in denmark.

Denmark Healthy Snacks Market Segmentation Analysis

By Category

- Low/No Fat & Salt Snacks

- Low Fat Snacks

- No Fat Snacks

- Low Salt Snacks

- No Salt Snacks

- Low/No Sugar & Caffeine Snacks

- Low Sugar Snacks

- No Sugar Snacks

- No Added Sugar Snacks

- No Caffeine Snacks

- Allergy / Free-from / Specialized Diet Snacks

- Gluten-Free Snacks

- Dairy-Free Snacks

- Lactose-Free Snacks

- Hypoallergenic Snacks

- Keto Snacks

- Meat-Free Snacks

- No Allergens Snacks

- Plant-Based Snacks

- Vegan Snacks

- Vegetarian Snacks

- Weight Management Snacks

- Fortified / Nutrient-Enhanced Snacks

- Good Source of Antioxidants Snacks

- Good Source of Minerals Snacks

- Good Source of Omega-3s Snacks

- Good Source of Vitamins Snacks

- High Fibre Snacks

- High Protein Snacks

- Probiotic Snacks

- Superfruit Snacks

- Health & Wellness-Oriented Snacks

- Bone and Joint Health Snacks

- Brain Health and Memory Snacks

- Cardiovascular Health Snacks

- Digestive Health Snacks

- Energy Boosting Snacks

- Immune Support Snacks

- Skin Health Snacks

- Vision Health Snacks

- Natural Snacks

- Organic Snacks

The segment has the highest share around the category, and the highest market share is held by Allergy / Free-from / Specialized Diet Snacks, accounting around 25% of the Denmark healthy snacks market share. This segment benefits from strong awareness around food sensitivities, lifestyle-driven dietary choices, and health-focused eating habits among Danish end users. Products that are gluten-free, lactose-free, vegan, or free from artificial additives align well with the country emphasis on clean labels, natural ingredients, and transparent sourcing.

The segment continues to gain traction as end users seek snacks that balance indulgence with perceived health benefits. Rising interest in plant-based diets, lower sugar intake, and minimally processed foods further supports demand for specialised diet snacks. Innovation in flavour, texture, and protein enrichment has also improved product appeal, allowing this segment to remain relevant even during periods of price sensitivity, when consumers prioritise value but are reluctant to compromise on dietary requirements.

By Sales Channel

- Retail Offline

- Retail Online

The segment has the highest share under sales channel, is retail offline, contributing around 75% of the Denmark healthy snacks market. Supermarkets, hypermarkets, discounters, and convenience stores remain the primary purchase points for healthy snacks due to their wide product assortment, strong private label presence, and frequent promotional activity. These outlets allow end users to compare prices easily while accessing both branded and affordable healthy snack options.

Retail offline continues to benefit from impulse purchases and routine grocery shopping habits, particularly for snacks consumed between meals. Discounters and private label ranges play a critical role in supporting volume sales by offering healthier alternatives at lower price points. While online channels are expanding, physical retail remains central to distribution, as end users prefer immediate availability, familiar brands, and the ability to assess product claims and packaging directly at the point of purchase.

List of Companies Covered in Denmark Healthy Snacks Market

The companies listed below are highly influential in the Denmark healthy snacks market, with a significant market share and a strong impact on industry developments.

- FDB Group

- Unilever Group

- Dmhermes Trade sro

- Paulig Ab

- Chocoladefabriken Lindt & Sprüngli AG

- Koff A/S

- Katjes Group

- Midsona AB

- Intersnack Group GmbH & Co KG

Competitive Landscape

The competitive landscape for health and wellness snacks in Denmark reflected a clear shift driven by pricing pressures and evolving consumer priorities. While organic snacks remained the largest claim, rising costs weakened branded organic offerings, creating growing opportunities for private label players, particularly within discounters and major retailers. Private labels increasingly matched branded products through claims such as no sugar, high fibre, gluten free, and no palm oil, with ranges like Salling gaining traction. At the same time, brands positioned around plant-based, vegan, and sustainable credentials strengthened their presence, supported by innovation from players such as Bælg, Hansen’s, Barebells, and True Gum, which appealed to health-, ethics-, and environment-conscious consumers. Protein-focused brands, including Barebells, Nick’s, Hey Planet, and Enorm, also gained visibility as demand shifted towards functional and sustainable snack solutions.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Denmark Healthy Snacks Market Policies, Regulations, and Standards

4. Denmark Healthy Snacks Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Denmark Healthy Snacks Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Low/No Fat & Salt Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Low Fat Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. No Fat Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Low Salt Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. No Salt Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Low/No Sugar & Caffeine Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Low Sugar Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. No Sugar Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. No Added Sugar Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. No Caffeine Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Allergy / Free-from / Specialized Diet Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Gluten-Free Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Dairy-Free Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lactose-Free Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Hypoallergenic Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.5. Keto Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.6. Meat-Free Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.7. No Allergens Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.8. Plant-Based Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.9. Vegan Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.10. Vegetarian Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.11. Weight Management Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Fortified / Nutrient-Enhanced Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Good Source of Antioxidants Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Good Source of Minerals Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Good Source of Omega-3s Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Good Source of Vitamins Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.5. High Fibre Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.6. High Protein Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.7. Probiotic Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.8. Superfruit Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Health & Wellness-Oriented Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.1. Bone and Joint Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.2. Brain Health and Memory Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.3. Cardiovascular Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.4. Digestive Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.5. Energy Boosting Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.6. Immune Support Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.7. Skin Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.8. Vision Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Natural Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Organic Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Product Type

5.2.2.1. Meat Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Nuts, Seeds & Trail Mixes- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Dried Fruit Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Cereal & Granola Bars- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Packaging

5.2.3.1. Bag & Pouches- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Boxes- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Cans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Jars- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Denmark Low/No Fat & Salt Snacks Healthy Snacks Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Packaging- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Denmark Low/No Sugar & Caffeine Snacks Healthy Snacks Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Packaging- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Denmark Allergy / Free-from / Specialized Diet Snacks Healthy Snacks Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Packaging- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Denmark Fortified / Nutrient-Enhanced Snacks Healthy Snacks Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Packaging- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Denmark Health & Wellness-Oriented Snacks Healthy Snacks Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Packaging- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Denmark Natural Snacks Healthy Snacks Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Packaging- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Denmark Organic Snacks Healthy Snacks Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Packaging- Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Competitive Outlook

13.1. Company Profiles

13.1.1. Paulig Ab

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. Chocoladefabriken Lindt & Sprüngli AG

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Koff A/S

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. Katjes Group

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. Midsona AB

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. FDB Group

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. Unilever Group

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. Dmhermes Trade sro

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. Intersnack Group GmbH & Co KG

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Product Type |

|

| By Packaging |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.