Denmark Colour Cosmetics Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Eye Make-Up (Eye Liner/Pencil, Eye Shadow, Mascara, Others), Facial Make-Up (BB/CC Creams, Blusher/Bronzer/Highlighter, Foundation/Concealer, Powder, Others), Lip Products (Lip Gloss, Lip Liner/Pencil, Lipstick, Others), Nail Products (Nail Polish, Nail Treatments/Strengthener, Polish Remover, Others), Colour Cosmetics Sets/Kits), By Price (Premium, Mass), By Gender (Men, Women, Unisex), By Packaging Type (Travel/Mini Size, Standard Size, Professional/Salon Size), By Form (Creams/Gels, Lotions, Sprays, Solid, Others), By Nature (Organic, Inorganic), By Sales Channel (Retail Offline, Retail Online)

- FMCG

- Feb 2026

- VI0954

- 110

-

Denmark Colour Cosmetics Market Statistics and Insights, 2026

- Market Size Statistics

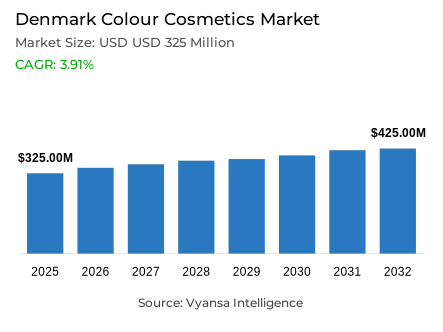

- Colour cosmetics in Denmark is estimated at USD 325 million in 2025.

- The market size is expected to grow to USD 425 million by 2032.

- Market to register a cagr of around 3.91% during 2026-32.

- Category Shares

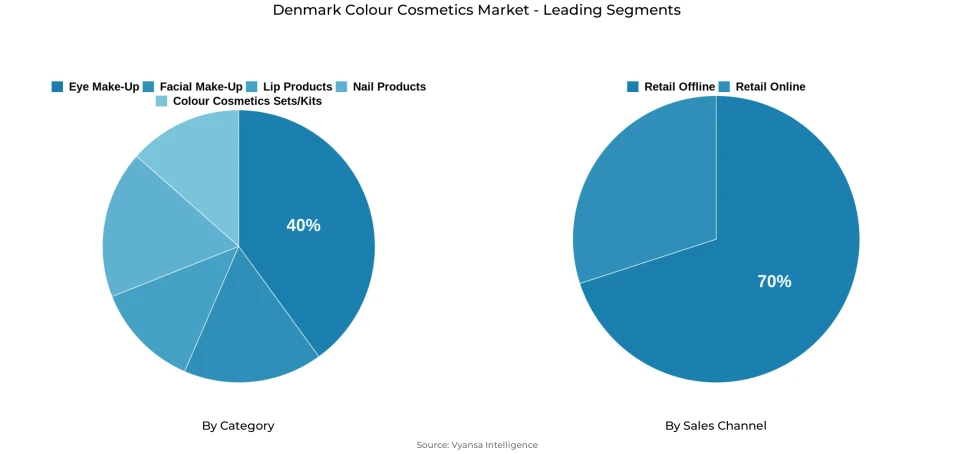

- Eye make-up grabbed market share of 40%.

- Competition

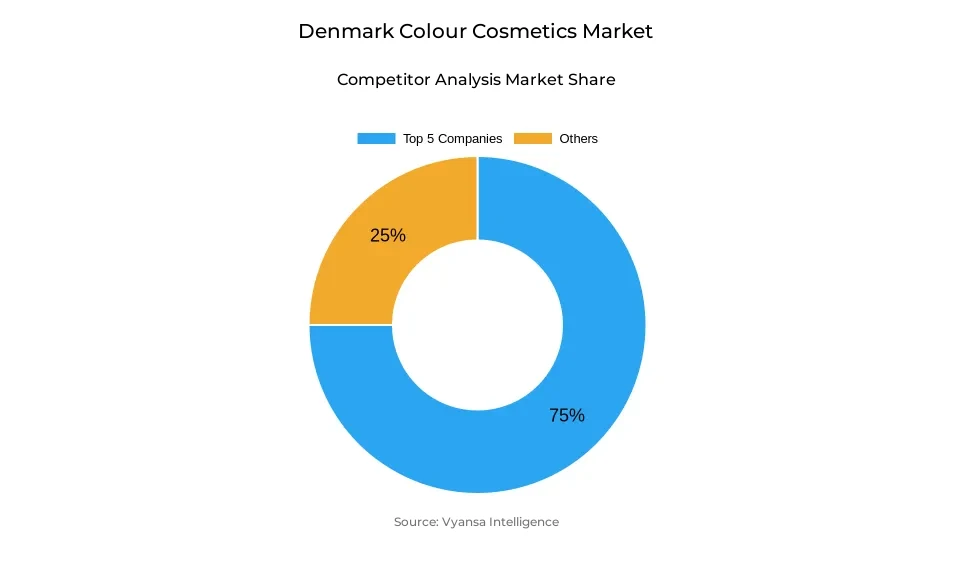

- More than 20 companies are actively engaged in producing colour cosmetics in Denmark.

- Top 5 companies acquired around 75% of the market share.

- Christian Dior A/S Denmark; Cosnova GmbH; Oriflame International ApS; Estée Lauder Cosmetics A/S; Sæther A/S etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 70% of the market.

Denmark Colour Cosmetics Market Outlook

Denmark Colour Cosmetics Market is estimated to realise a stable growth with an increase in market value of USD 325 million in the year 2025 and USD 425 million in the year 2032, which depicts a compound annual growth rate of 3.91%. The expansion of the markets will be supported by the macroeconomic environment being improved, an increase in the real wage growth, and the end user confidence level being improved. With a soaring 40% category share, eye makeup will continue to be the biggest market share due to its frequency of use as compared to other categories of makeup. Highluster, bronzer and premium blusher product lines are expected to have a tremendous momentum as end users will soon revert to high-end beauty category consumption.

The competitive forces will be vigorous and the main global brand portfolios including Estee Lauder and Chanel will enjoy the advantage of high brand awareness and broad retail distribution channels. They will have a strategic emphasis on high-end innovation which will lead to their continued growth in the market. At the same time, the trend trajectory of natural beauty will determine new requirements in the development of the product range, in the future, the brands will offer more, but with vegan formulations, a lack of cruelty and sustainable packaging solutions. These changing end user demands will strengthen expansion of the mass-market and high end markets.

The central role will remain played by retail offline channels, which have 70% of market distribution with the support of the large market share of Matas and Normal drugstore chain operators. The retail formats come with the convenience of shopping, a wide array of products and competitive prices structures that appeal to the shopper traffic. Nevertheless, the retail retail online will continue to be the most rapidly expanding distribution channel. The convenience, availability of product range, and possible savings on costs become the primary concerns of Danish end users, which stimulates the further shift towards online shopping platforms.

The digital platforms will become more strategically important through the 2032 forecast horizon as brands and retailers invest more in faster delivery services, easier returns procedures, and improved online shopping experiences. Having favourable macroeconomic factors, premiumization trends and increased focus on natural beauty positioning, the colour cosmetics market of Denmark is poised to keep delivering good performance of growth.

Denmark Colour Cosmetics Market Growth DriverImproving Economic Conditions Strengthen Beauty Spending

The macroeconomic environment in Denmark is still improving, which is still positively affecting the long-term demand of colour cosmetics since the inflationary pressures are projected to be reduced and end user confidence shows signs of recovery. The International Monetary Fund and European Commission analytical data show that the inflation rate in Denmark has reached peak levels of 8.5% in 2022, the highest rate since the early 1980s, and has since declined to close to 4.3% in 2023, after the energy price pressures were released, and monetary policy tightening policies began to have the desired effect, thus regaining the level of real wage growth and driving the level of household disposable income. As the financial stability environment improves and the cost-of-living pressures drop, the Danish end users are showing greater susceptibility to resume and increase the spending on the discretionary segments, which include premium colour cosmetics and specialty segments of formulations.

This enhanced end user confidence in economic mood inspires greater end user interaction with superior quality formulation qualities, seasonal product introduction and superior application of cosmetic finish in a variety of products. Real wage growth and lower purchasing power also facilitate the growth in the number of purchases made by end users of daily products such as eye makeup that continues to be one of the most frequently used and purchased categories of beauty product in Denmark. In totality, improved household buying power offers an effective basis of further category growth and contributes to the trends of upward trading in the mass-market, prestige, and luxury cosmetics market.

Denmark Colour Cosmetics Market ChallengePrice Sensitivity Persists Amid High Living Costs

Although macroeconomic recovery is taking place and the rate of inflation is on a downward trend, the high cost of living is still part of the pressure that is facing the Danish end users, posing continuous challenge to the colour cosmetics category. Denmark continues to be among the highest cost end user markets in Europe with high prices in personal care industries and discretionary industries that limit the buying power especially in younger end user segments and lower income demographic groups that are highly price sensitive and price differentials between the mass-market and premium brands.

Such continued pressure on costs develops austerity in spending behavior patterns, with many end users postponing the non-essential purchase, or planning to move strategically towards discount retailing, or towards the use of value-based product options. Although the general state of the economy suggests an upward trend and a decrease in inflation, the residual effects of structurally high cost of living diminishes the end user propensity to trade to higher levels of products and inhibits the process of experimenting with newly introduced products. Such perennial price elasticity despite wider economic recovery constrains the rate at which premiumization has been occurring in the market and constitutes a significant obstacle to brands who rely on product expansion strategies at a higher premium and positioning in the premium market.

Denmark Colour Cosmetics Market TrendNatural and Sustainable Beauty Gains Strong Momentum

The trends transforming the Denmark colour cosmetics market is the rapid and prolonged shift by end users to natural, vegan, and sustainably packaged beauty products, which is the result of extremely high end user sustainability awareness. The sustainability awareness level among the Danish end users is one of the highest in the world and this is evident through the high Denmark environmental performance indicators. The European Environment Agency states that, as of 2022, Denmark had a municipal waste recycling and preparation to reuse rate of 50% which is among the highest of all European markets, whereas the rate has been at 53.9% in 2020 with the previous calculation methodologies. This high level of environmental awareness indicates strong and entrenched end user demands on environmentally friendly product offerings such as minimised use of plastic packaging, clean formulations no controversial chemical compounds, and disclosure of ingredient sourcing and manufacturing procedures.

As these non-financial environmental and ethical value regimes are becoming more and more prominent among end users, especially younger population groups, brands are progressively giving greater emphasis to the development of natural and non-cruelty product lines, the integration of certified organic ingredient formulations, and reduced-impact packaging measures. Danish beauty end users (in particular, the segments of Generation Z and younger adults) tend to shift towards colour cosmetic products with very specific references to ethical adherence, environmental sustainability aspects, and open sourcing statements. This movement is not only radically transforming product development lines and formulations strategies across the category but also positions sustainability and clean beauty as a highly effective brand differentiation tool, with the demand of truly clean beauty, and ethically sourced cosmetics constantly growing across the Danish colour cosmetics marketplace.

Denmark Colour Cosmetics Market OpportunityRapid Expansion of E-Commerce Enhances Category Reach

Retail online represents a substantial and accelerating opportunity as Danish end users increasingly transition toward online platforms for beauty purchasing, supported by exceptionally developed digital infrastructure and connectivity levels. According to DataReportal analytical data, Denmark has achieved among the world's highest internet penetration rates at 99% of the population as of 2024–2025, reflecting near-universal digital access and connectivity across all demographic segments. This comprehensive and widespread connectivity accelerates retail online platform adoption, enabling brands to reach end users through convenience-driven, promotion-optimized, and increasingly personalized online experiences that complement traditional retail channel operations.

As colour cosmetics end users embrace digital browsing behaviors, virtual try-on technology applications, and accelerated delivery service options, the category benefits from significantly improved product discovery mechanisms and broader assortment availability across retail and direct-to-end user platform formats. Retailers and brands that systematically refine logistics infrastructure, enhance user interface and mobile experience quality, and integrate loyalty program frameworks and personalization feature capabilities are strategically positioned to capture disproportionate market share gains from this retail online growth opportunity. The continued expansion of Retail online not only broadens brand exposure and geographic market reach across Denmark but additionally substantially enhances accessibility for niche, independent, and premium beauty labels that may lack physical retail presence, fundamentally transforming the competitive landscape dynamics and end user purchasing behavior patterns.

Denmark Colour Cosmetics Market Segmentation Analysis

By Category

- Eye Make-Up

- Eye Liner/Pencil

- Eye Shadow

- Mascara

- Others

- Facial Make-Up

- BB/CC Creams

- Blusher/Bronzer/Highlighter

- Foundation/Concealer

- Powder

- Others

- Lip Products

- Lip Gloss

- Lip Liner/Pencil

- Lipstick

- Others

- Nail Products

- Nail Polish

- Nail Treatments/Strengthener

- Polish Remover

- Others

- Colour Cosmetics Sets/Kits

The dominant segment within category classification is eye makeup, which commands 40% of the Denmark colour cosmetics market. Its market leadership is sustained by frequent, everyday usage patterns as end users continue prioritizing expressive facial feature enhancement even within broader minimalist beauty trend contexts. Eye product categories including mascara and eyeliner remain central to Danish beauty routines, benefiting from elevated product turnover rates and steady innovation momentum. Category growth derives additional reinforcement from robust engagement with social media platforms that amplify application techniques and stimulate product experimentation.

Throughout the forecast period, eye makeup is projected to retain segment leadership as brands introduce lighter-texture formulations, more natural finish aesthetics, and multifunctional formula architectures aligned with Denmark's increasing preference for clean and sustainable beauty positioning. Expanded availability across both premium and mass-market product lines will contribute to sustained category penetration, while premium eye product offerings are positioned to gain traction as improving economic conditions encourage greater end user willingness to allocate expenditure toward higher-value, extended-wear product variants.

By Sales Channel

- Retail Offline

- Retail Online

The dominant segment within Sales Channel classification is retail offline, which commands 70% of the Denmark colour cosmetics market. Health and beauty specialty retailers—particularly dominant chain operators including Matas and Normal—anchor this leadership position by offering comprehensive product assortments, frequent promotional activities, and strong brand accessibility. Their nationwide physical retail presence supports impulse purchase behavior and enables end users to compare shade options and texture characteristics in person, representing a particularly important factor for foundation and eye product selection decisions.

Throughout the forecast period, retail offline is expected to maintain channel leadership as experiential in-store browsing experiences, immediate product availability, and established retailer relationship trust continue influencing purchase decisions. Although retail online will demonstrate rapid expansion, particularly among convenience-oriented shopper segments, the tactile evaluation characteristics inherent to colour cosmetics maintain Retail offline formats as central distribution mechanisms. Retail offline operators' growing investment in curated product display presentations, sustainable packaging merchandising sections, and premium product assortments will further strengthen the channel's market position dominance.

List of Companies Covered in Denmark Colour Cosmetics Market

The companies listed below are highly influential in the Denmark colour cosmetics market, with a significant market share and a strong impact on industry developments.

- Christian Dior A/S Denmark

- Cosnova GmbH

- Oriflame International ApS

- Estée Lauder Cosmetics A/S

- Sæther A/S

- L'Oréal Danmark A/S

- Matas A/S

- Gosh Cosmetics A/S

- Scandinavian Cosmetics Denmark ApS

- H&M Hennes & Mauritz A/S

Competitive Landscape

Denmark colour cosmetics market remained competitive, led by Estée Lauder, which continued to dominate through strong consumer loyalty to major brands such as Clinique, Estée Lauder and MAC, supported by their wide presence across retail and reatil online. Chanel emerged as one of the most dynamic performers, achieving notable gains across eye, facial and lip make-up as improving economic conditions encouraged a return to premium products. The competitive environment was further shaped by the strength of major health and beauty specialists, particularly Matas and Normal, whose nationwide reach and contrasting value propositions intensified price competition and reinforced brand visibility. Alongside this, rising digital engagement enabled both established players and smaller entrants to leverage expanding reatil online platforms to reach consumers seeking convenience, competitive pricing and broader product assortments.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Denmark Colour Cosmetics Market Policies, Regulations, and Standards

4. Denmark Colour Cosmetics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Denmark Colour Cosmetics Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Eye Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Eye Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Eye Shadow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Mascara- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Facial Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. BB/CC Creams- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Blusher/Bronzer/Highlighter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Foundation/Concealer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Lip Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Lip Gloss- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Lip Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lipstick- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Nail Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Nail Polish- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Nail Treatments/Strengthener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Polish Remover- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Colour Cosmetics Sets/Kits- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Price

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Packaging Type

5.2.4.1. Travel/Mini Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Standard Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Professional/Salon Size- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Form

5.2.5.1. Creams/Gels- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Lotions- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Sprays- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Solid- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Nature

5.2.6.1. Organic- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Inorganic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Denmark Eye Make-Up Colour Cosmetics Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Denmark Facial Make-Up Colour Cosmetics Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Denmark Lip Products Colour Cosmetics Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Denmark Nail Products Colour Cosmetics Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Denmark Colour Cosmetics Sets/Kits Colour Cosmetics Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Price- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Gender- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Estée Lauder Cosmetics A/S

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Sæther A/S

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. L'Oréal Danmark A/S

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Matas A/S

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Gosh Cosmetics A/S

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Christian Dior A/S, Denmark, Parfums

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Cosnova GmbH

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Oriflame International ApS

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Scandinavian Cosmetics Denmark ApS

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. H&M Hennes & Mauritz A/S

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Price |

|

| By Gender |

|

| By Packaging Type |

|

| By Form |

|

| By Nature |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.