Global Defense Cybersecurity Market Report: Trends, Growth and Forecast (2025-2030)

By Offering (Hardware, Software, Service), By Security Type (Network Security, Endpoint Security, Application Security, Cloud Security), By Deployment Mode (On-Premises, Cloud and Hybrid), By Application (Critical Infrastructure Protection, Data Protection and Encryption, Incident Response and Forensics, Identity and Access Management, Secure Communications System), By End User (Army, Navy, Air Force), By Region (North America, South America, Europe, The Middle East & Africa, Asia-Pacific)

- Aerospace & Defense

- Dec 2025

- VI0133

- 129

-

Global Defense Cybersecurity Market Statistics, 2025

- Market Size Statistics

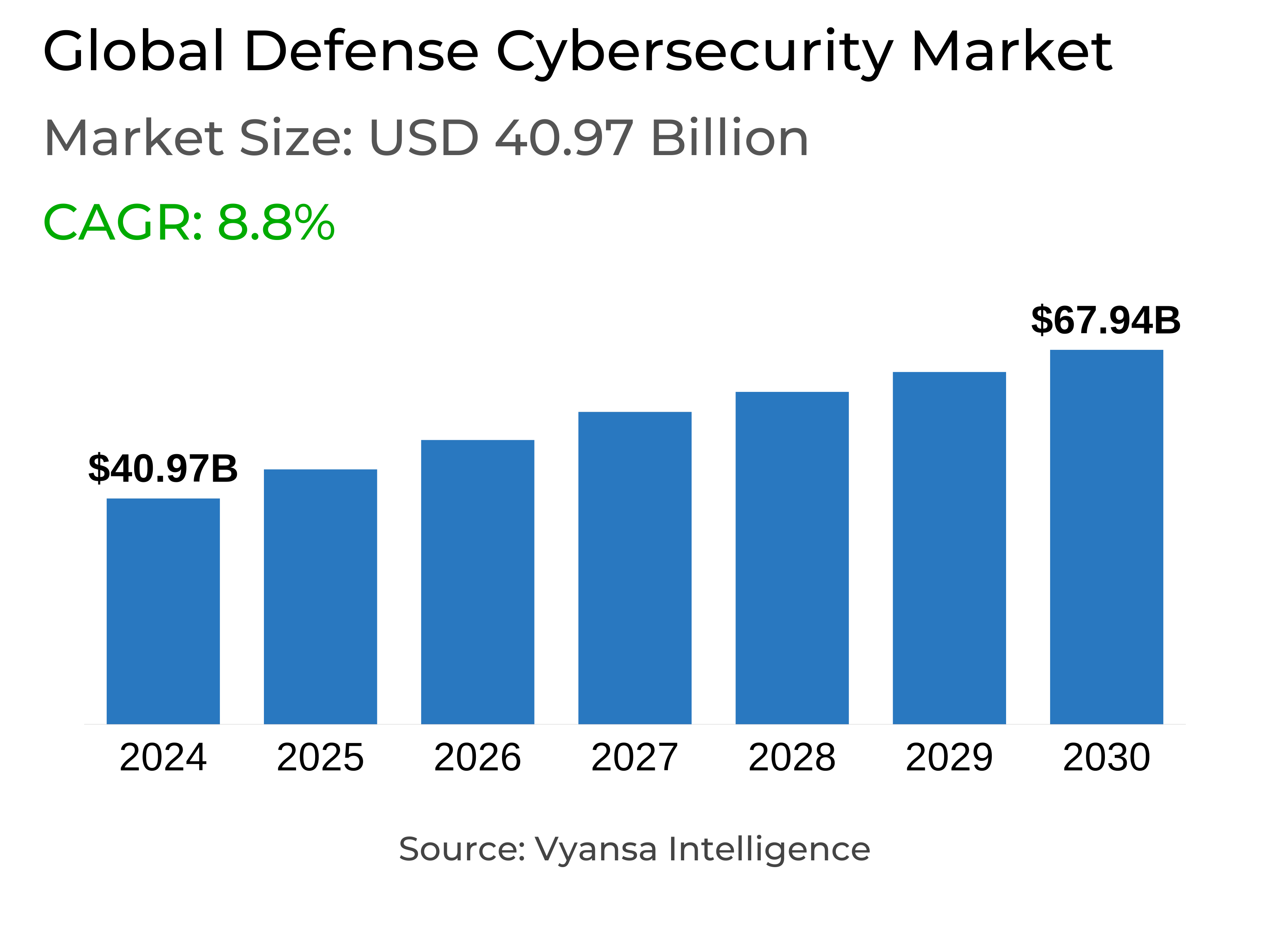

- Global Defense Cybersecurity Market is estimated at $ 40.97 Billion.

- The market size is expected to grow to $ 67.94 Billion by 2030.

- Market to register a CAGR of around 8.8% during 2025-30.

- Offering Segment

- Software & Services continues to dominate the market.

- Competition

- Global Defense Cybersecurity Market is currently being catered to by more than 25 companies.

- Top 10 companies acquired the maximum share of the market.

- IBM, Thales, Lockheed Martin Corporation, Booz Allen Hamilton Inc., General Dynamics Corporation etc., are few of the top companies.

- Security Analysis

- Network Security continues to dominate the market.

- Region

- North America emerges as the leading regional market.

Global Defense Cybersecurity Market Outlook

The worldwide defense cybersecurity industry is expected to register significant growth from 2025 to 2030, fueled by the increased frequency and complexity of cyberattacks against defense and military infrastructure. Recent attacks such as the Ultra Intelligence & Communications breach and attacks aimed at the Ukrainian Defense Forces have highlighted the necessity of improved cybersecurity. These threats, emanating from state and non-state actors, are compelling defense agencies globally to invest in sophisticated cyber defense systems to protect sensitive information and ensure operational security.

One of the issues in the market is integrating cybersecurity tools into legacy defense systems. Most organizations continue to operate on old systems, and it becomes challenging to implement new security models. Complexity and the cost of installing new technologies into old platforms slow down necessary upgrades and expose the vulnerabilities to attackers, compounding the risk to national security.

In spite of these obstacles, increasing digitization of military activities offers a huge opportunity. The convergence of cloud computing, IoT, and unmanned systems has lengthened the attack surface, and this has introduced AI-driven threat detection, zero-trust architecture, and quantum-resistant cryptography. These technologies allow defense forces to actively counter cyber threats and enhance digital resilience.

North America is expected to drive the global market both in growth and share, fueled by growing defense spending, high threat levels, and the presence of top contractors such as Lockheed Martin and Raytheon. The Software & Services segment is expected to lead by platform type, and Network Security will be the fastest-growing segment as digital infrastructure grows throughout the defense market.

Global Defense Cybersecurity Market Growth Driver

The increased frequency of cyberattacks over the past few years is compelling defense authorities to bolster their online security. The threats are increasingly frequent and sophisticated, carried out by state-sponsored organizations, criminal syndicates, and even insider threats. For example, in 2024, there was a cyberattack attributed to a Russian organization that hit Ultra Intelligence & Communications, an American company, impacting the Swiss Air Force. Approximately 30GB of sensitive information, including defense contracts and communications, was compromised. While Swiss operations were not affected, the hack revealed significant weaknesses and resulted in an official probe.

Later the same year, Ukraine's CERT-UA detected a cyberattack against its Defense Forces. The attackers presented themselves as a military comrade and sent a compromised Excel document that installed the COOKBOX malware when it was opened. Such events highlight the increasing threat to national security, prompting defense agencies to spend money on sophisticated cybersecurity technologies to protect infrastructure and be operationally ready.

Global Defense Cybersecurity Market Challenge

One of the most important challenges within the global defense space for cybersecurity is the extensive use of legacy infrastructure. Most defense agencies are still employing aged systems that are not designed to interface with contemporary cybersecurity systems. The aged systems are not equipped with the proper features to provide robust protection and are hard to modify.

Merger of such systems with contemporary high-level security technologies is a complicated, time-consuming, and expensive endeavor. It puts off necessary cybersecurity enhancements and raises the threat of cyberattacks. Since threats become increasingly advanced, these vulnerabilities can expose critical defense operations to danger, and it is becoming a serious threat for the industry in 2025–30.

Global Defense Cybersecurity Market Trend

Over the past few years, investments in defense cybersecurity have increased exponentially as a result of escalating geopolitical tensions and ever-advancing cyberattacks. Governments and organizations are increasingly investing money to safeguard vulnerable defense systems, particularly since allegations of state-sponsored cyber intrusions keep escalating.

To manage emerging threats, cyber defense needs to be autonomous and adaptive. These systems employ real-time assessments to dynamically configure cybersecurity controls so that it becomes more difficult and expensive for the attacker. Standard measures involve Moving Target Defense (MTD), artificial diversity, and bio-inspired measures. Adaptive multi-factor authentication and dynamic routing protocols are some of the latest developments advancing cyber resilience. MITER and UL Lafayette, for example, joined forces in March 2023 to create solutions intended to improve adaptive cybersecurity for the defense sector.

Global Defense Cybersecurity Market Opportunity

The swift digitalization of defense assets—fueled by the use of IoT platforms, unmanned systems, and cloud infrastructure—is drastically elevating the risks of cybersecurity threats. These digital enhancements, while enhancing organizational efficiency, create new vulnerabilities in defense networks that make them a prime target for cyberattacks.

To counter this escalating menace, defense organizations are now investing in AI-driven threat detection, zero-trust security frameworks, and quantum-resistant encryption. This shift is building a significant growth prospect for cybersecurity solutions. With militaries putting greater emphasis on more intelligent, quicker, and more robust cyber defense systems, demand for cutting-edge cybersecurity technologies is likely to increase exponentially over 2025–2030.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 40.97 Billion |

| USD Value 2030 | $ 67.94 Billion |

| CAGR 2025-2030 | 8.8% |

| Largest Category | Software & Services segment leads the market |

| Top Drivers | Rising Threat Landscape Driving Cybersecurity Investment |

| Top Challenges | Integration Issues with Legacy Infrastructure Hindering Market Growth |

| Top Trends | Rising Use of Adaptive Algorithms to Counter Dynamic Cyber Threats |

| Top Opportunities | Rising Tech Adoption Spurs Need for Advanced Cyber Defense |

| Key Players | IBM, Thales, Lockheed Martin Corporation, Booz Allen Hamilton Inc., General Dynamics Corporation, Cisco Systems Inc., Microsoft, Leidos, Northrop Grumman, Raytheon technologies, L3Harris Technologies, Inc., BAE Systems, ManTech International, Northrop Grumman, Saab and Others. |

Global Defense Cybersecurity Market Regional Analysis

North America leads the market and is expected to be the fastest-growing region in the global defense cybersecurity market from 2025 to 2030. This is fueled by heightened defense expenditure, heightened cyber threat levels, and the predominant presence of key defense contractors like Lockheed Martin, Northrop Grumman Corporation, and Raytheon. The region's sophisticated technological infrastructure and focus on safeguarding digital defense assets also further enhance its position in the market.

Moreover, constant defense modernization projects and strategic cybersecurity efforts are immensely enhancing demand throughout the region. Increasing military deals and requirements to safeguard vital national infrastructure are consistently driving the use of sophisticated cybersecurity solutions. Based on a survey, these elements together ensure North America holds both the largest market size and the fastest growth rate throughout the forecast period.

Global Defense Cybersecurity Market Segmentation Analysis

The most dominant segment under the Offering segment in terms of market share is the Software & Services segment. This domination is fueled by the growing demand for sophisticated threat detection systems, AI-based solution integration, and cloud-based secure environments in the global defense markets. With rapidly evolving cyber threats, the software capabilities that provide real-time threat management and response are the priorities for the defense agencies.

Further, as armed forces get digitized, there is an increasing need for scalable and flexible cybersecurity solutions. Software & Services are vital in enabling technologies such as machine learning and quantum-resistant encryption and therefore will be crucial in securing modern defense systems over the forecast period 2025–2030.

Top Companies in Global Defense Cybersecurity Market

The top companies operating in the market include IBM, Thales, Lockheed Martin Corporation, Booz Allen Hamilton Inc., General Dynamics Corporation, Cisco Systems Inc., Microsoft, Leidos, Northrop Grumman, Raytheon technologies, L3Harris Technologies, Inc., BAE Systems, ManTech International, Northrop Grumman, Saab, etc., are the top players operating in the Global Defense Cybersecurity Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Defense Cybersecurity Market Policies, Regulations, and Standards

4. Global Defense Cybersecurity Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Defense Cybersecurity Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Offering

5.2.1.1. Hardware- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Software- Market Insights and Forecast 2020-2030, USD Million

5.2.1.3. Service- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Security Type

5.2.2.1. Network Security- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Endpoint Security- Market Insights and Forecast 2020-2030, USD Million

5.2.2.3. Application Security- Market Insights and Forecast 2020-2030, USD Million

5.2.2.4. Cloud Security- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Deployment Mode

5.2.3.1. On-Premises- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Cloud and Hybrid- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By Application

5.2.4.1. Critical Infrastructure Protection- Market Insights and Forecast 2020-2030, USD Million

5.2.4.2. Data Protection and Encryption- Market Insights and Forecast 2020-2030, USD Million

5.2.4.3. Incident Response and Forensics- Market Insights and Forecast 2020-2030, USD Million

5.2.4.4. Identity and Access Management- Market Insights and Forecast 2020-2030, USD Million

5.2.4.5. Secure Communications System- Market Insights and Forecast 2020-2030, USD Million

5.2.5.By End User

5.2.5.1. Army- Market Insights and Forecast 2020-2030, USD Million

5.2.5.2. Navy- Market Insights and Forecast 2020-2030, USD Million

5.2.5.3. Air Force- Market Insights and Forecast 2020-2030, USD Million

5.2.6.By Region

5.2.6.1. North America

5.2.6.2. South America

5.2.6.3. Europe

5.2.6.4. The Middle East & Africa

5.2.6.5. Asia-Pacific

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. North America Defense Cybersecurity Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Offering- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By Security Type- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Deployment Mode- Market Insights and Forecast 2020-2030, USD Million

6.2.4.By Application- Market Insights and Forecast 2020-2030, USD Million

6.2.5.By End User- Market Insights and Forecast 2020-2030, USD Million

6.2.6.By Country

6.2.6.1. The US

6.2.6.2. Canada

6.2.6.3. Mexico

6.3. The US Defense Cybersecurity Market Statistics, 2020-2030F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in US$ Million

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Offering- Market Insights and Forecast 2020-2030, USD Million

6.3.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

6.4. Canada Defense Cybersecurity Market Statistics, 2020-2030F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in US$ Million

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Offering- Market Insights and Forecast 2020-2030, USD Million

6.4.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

6.5. Mexico Defense Cybersecurity Market Statistics, 2020-2030F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in US$ Million

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Offering- Market Insights and Forecast 2020-2030, USD Million

6.5.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

7. South America Defense Cybersecurity Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Offering- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Security Type- Market Insights and Forecast 2020-2030, USD Million

7.2.3.By Deployment Mode- Market Insights and Forecast 2020-2030, USD Million

7.2.4.By Application- Market Insights and Forecast 2020-2030, USD Million

7.2.5.By End User- Market Insights and Forecast 2020-2030, USD Million

7.2.6.By Country

7.2.6.1. Brazil

7.2.6.2. Argentina

7.2.6.3. Rest of South America

7.3. Brazil Defense Cybersecurity Market Statistics, 2020-2030F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in US$ Million

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Offering- Market Insights and Forecast 2020-2030, USD Million

7.3.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

7.4. Argentina Defense Cybersecurity Market Statistics, 2020-2030F

7.4.1.Market Size & Growth Outlook

7.4.1.1. By Revenues in US$ Million

7.4.2.Market Segmentation & Growth Outlook

7.4.2.1. By Offering- Market Insights and Forecast 2020-2030, USD Million

7.4.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

8. Europe Defense Cybersecurity Market Statistics, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Offering- Market Insights and Forecast 2020-2030, USD Million

8.2.2.By Security Type- Market Insights and Forecast 2020-2030, USD Million

8.2.3.By Deployment Mode- Market Insights and Forecast 2020-2030, USD Million

8.2.4.By Application- Market Insights and Forecast 2020-2030, USD Million

8.2.5.By End User- Market Insights and Forecast 2020-2030, USD Million

8.2.6.By Country

8.2.6.1. Germany

8.2.6.2. The UK

8.2.6.3. France

8.2.6.4. Spain

8.2.6.5. Italy

8.2.6.6. Rest of Europe

8.3. Germany Defense Cybersecurity Market Statistics, 2020-2030F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in US$ Million

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Offering- Market Insights and Forecast 2020-2030, USD Million

8.3.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

8.4. France Defense Cybersecurity Market Statistics, 2020-2030F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in US$ Million

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Offering- Market Insights and Forecast 2020-2030, USD Million

8.4.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

8.5. The UK Defense Cybersecurity Market Statistics, 2020-2030F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in US$ Million

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Offering- Market Insights and Forecast 2020-2030, USD Million

8.5.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

8.6. Spain Defense Cybersecurity Market Statistics, 2020-2030F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in US$ Million

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Offering- Market Insights and Forecast 2020-2030, USD Million

8.6.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

8.7. Italy Defense Cybersecurity Market Statistics, 2020-2030F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in US$ Million

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Offering- Market Insights and Forecast 2020-2030, USD Million

8.7.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

9. Middle East & Africa Defense Cybersecurity Market Statistics, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Offering- Market Insights and Forecast 2020-2030, USD Million

9.2.2.By Security Type- Market Insights and Forecast 2020-2030, USD Million

9.2.3.By Deployment Mode- Market Insights and Forecast 2020-2030, USD Million

9.2.4.By Application- Market Insights and Forecast 2020-2030, USD Million

9.2.5.By End User- Market Insights and Forecast 2020-2030, USD Million

9.2.6.By Country

9.2.6.1. The UAE

9.2.6.2. Saudi Arabia

9.2.6.3. South Africa

9.2.6.4. Rest of the Middle East & Africa

9.3. The UAE Defense Cybersecurity Market Statistics, 2020-2030F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in US$ Million

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Offering- Market Insights and Forecast 2020-2030, USD Million

9.3.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

9.4. Saudi Arabia Defense Cybersecurity Market Statistics, 2020-2030F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in US$ Million

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Offering- Market Insights and Forecast 2020-2030, USD Million

9.4.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

9.5. South Africa Defense Cybersecurity Market Statistics, 2020-2030F

9.5.1.Market Size & Growth Outlook

9.5.1.1. By Revenues in US$ Million

9.5.2.Market Segmentation & Growth Outlook

9.5.2.1. By Offering- Market Insights and Forecast 2020-2030, USD Million

9.5.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

10. Asia-Pacific Defense Cybersecurity Market Statistics, 2020-2030F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Offering- Market Insights and Forecast 2020-2030, USD Million

10.2.2. By Security Type- Market Insights and Forecast 2020-2030, USD Million

10.2.3. By Deployment Mode- Market Insights and Forecast 2020-2030, USD Million

10.2.4. By Application- Market Insights and Forecast 2020-2030, USD Million

10.2.5. By End User- Market Insights and Forecast 2020-2030, USD Million

10.2.6. By Country

10.2.6.1. China

10.2.6.2. India

10.2.6.3. Japan

10.2.6.4. South Korea

10.2.6.5. Australia

10.2.6.6. Rest of Asia-Pacific

10.3. China Defense Cybersecurity Market Statistics, 2020-2030F

10.3.1. Market Size & Growth Outlook

10.3.1.1. By Revenues in US$ Million

10.3.2. Market Segmentation & Growth Outlook

10.3.2.1. By Offering- Market Insights and Forecast 2020-2030, USD Million

10.3.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

10.4. India Defense Cybersecurity Market Statistics, 2020-2030F

10.4.1. Market Size & Growth Outlook

10.4.1.1. By Revenues in US$ Million

10.4.2. Market Segmentation & Growth Outlook

10.4.2.1. By Offering- Market Insights and Forecast 2020-2030, USD Million

10.4.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

10.5. Japan Defense Cybersecurity Market Statistics, 2020-2030F

10.5.1. Market Size & Growth Outlook

10.5.1.1. By Revenues in US$ Million

10.5.2. Market Segmentation & Growth Outlook

10.5.2.1. By Offering- Market Insights and Forecast 2020-2030, USD Million

10.5.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

10.6. South Korea Defense Cybersecurity Market Statistics, 2020-2030F

10.6.1. Market Size & Growth Outlook

10.6.1.1. By Revenues in US$ Million

10.6.2. Market Segmentation & Growth Outlook

10.6.2.1. By Offering- Market Insights and Forecast 2020-2030, USD Million

10.6.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

10.7. Australia Defense Cybersecurity Market Statistics, 2020-2030F

10.7.1. Market Size & Growth Outlook

10.7.1.1. By Revenues in US$ Million

10.7.2. Market Segmentation & Growth Outlook

10.7.2.1. By Offering- Market Insights and Forecast 2020-2030, USD Million

10.7.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Booz Allen Hamilton Inc.

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. General Dynamics Corporation

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Cisco Systems Inc.

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Microsoft

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Leidos

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. IBM

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Thales

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Lockheed Martin Corporation

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Northrop Grumman

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Raytheon Technologies

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

11.1.11. L3Harris Technologies, Inc.

11.1.11.1.Business Description

11.1.11.2.Product Portfolio

11.1.11.3.Collaborations & Alliances

11.1.11.4.Recent Developments

11.1.11.5.Financial Details

11.1.11.6.Others

11.1.12. BAE Systems

11.1.12.1.Business Description

11.1.12.2.Product Portfolio

11.1.12.3.Collaborations & Alliances

11.1.12.4.Recent Developments

11.1.12.5.Financial Details

11.1.12.6.Others

11.1.13. ManTech International

11.1.13.1.Business Description

11.1.13.2.Product Portfolio

11.1.13.3.Collaborations & Alliances

11.1.13.4.Recent Developments

11.1.13.5.Financial Details

11.1.13.6.Others

11.1.14. Northrop Grumman

11.1.14.1.Business Description

11.1.14.2.Product Portfolio

11.1.14.3.Collaborations & Alliances

11.1.14.4.Recent Developments

11.1.14.5.Financial Details

11.1.14.6.Others

11.1.15. Saab

11.1.15.1.Business Description

11.1.15.2.Product Portfolio

11.1.15.3.Collaborations & Alliances

11.1.15.4.Recent Developments

11.1.15.5.Financial Details

11.1.15.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Offering |

|

| By Security Type |

|

| By Deployment Mode |

|

| By Application |

|

| By End User |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.