Czech Republic Leisure & Business Travel Booking Market Report: Trends, Growth and Forecast (2026-2032)

By Travel Sales Type (Leisure Travel, Business Travel), By Booking Channel (Offline Booking, Online Booking), By Booking Method (Travel Intermediaries, Direct Suppliers)

- ICT

- Nov 2025

- VI0387

- 125

-

Czech Republic Leisure & Business Travel Booking Market Statistics and Insights, 2026

- Market Size Statistics

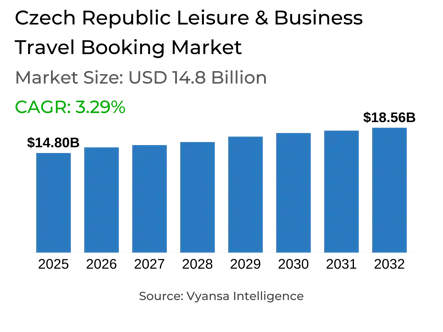

- Leisure & Business Travel Booking in Czech Republic is estimated at $ 14.8 Billion.

- The market size is expected to grow to $ 18.56 Billion by 2032.

- Market to register a CAGR of around 3.29% during 2026-32.

- Travel Sales Type Shares

- Leisure Travel grabbed market share of 85%.

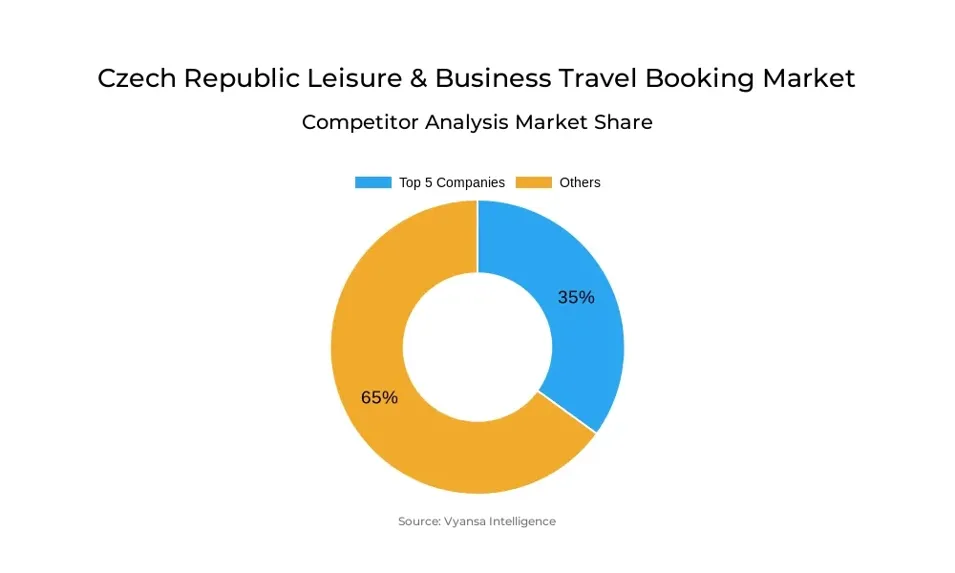

- Competition

- Czech Republic Leisure & Business Travel Booking Market is currently being catered to by more than 20 companies.

- Top 5 companies acquired 35% of the market share.

- Cedok as, Blue Style ks, Asiana spol sro, Booking.com (Czech Republic) sro, Invia.cz as etc., are few of the top companies.

- Booking Channel

- Online Booking grabbed 65% of the market.

Czech Republic Leisure & Business Travel Booking Market Outlook

The Czech Republic leisure and business travel book market was worth $14.8 billion in 2025 and is expected to grow to $18.56 billion by 2032, indicating consistent growth in demand. Following a year of economic strains , bookings recovered in 2025 as end users remained focused on summer vacations, underpinned by appealing packages, foreign destinations, and adaptable options from travel intermediaries. Czech tourists, though prudent with their expenditure, evidenced a robust appetite to sustain the quality experience, frequently opting for shorter trips in preference to lower-rated services.

Booking behaviour is changing as end users book their holidays increasingly in advance to take advantage of deals and prevent increasing costs. Travel intermediaries are responding with the push of advance booking, child-free holidays, and flexible bookings like date or destination changes. The market also became more competitive with the arrival of Coral Travel and TUI, which boosted choice of destinations and contributed to reducing package prices. Meanwhile, the agencies are venturing into shorter trips, cultural tours, and domestic packages in order to reach broader categories of tourists.

Digitalisation will define the future, with 65% of the market already covered through online bookings. Mobile travel is likely to fuel further growth as more end users, of all ages, rely on mobile phones and tablets to plan and book holidays. Providers are introducing mobile-only offers, while intermediaries are optimizing websites so that they can provide smooth booking experiences. This movement to mobile platforms will continue to be key to maintaining sales growth in the coming years.

In the future, travel intermediaries will maintain their importance despite shifts in end-user behavior. Increased demand from solo travelers, multi-generational families, and affluent pensioners will maintain bookings. Intermediaries also provide benefits like financial protection, insurance, and competitive prices through volume savings, which are attractive to end users with language barriers. Since Czechs more and more undertake brief but more regular trips, intermediaries offering adaptability, trustworthiness, and value will most likely gain a strong foothold in the market.

Czech Republic Leisure & Business Travel Booking Market Growth Driver

Strong Demand for Summer Holidays and Exotic Destinations

Czech Republic Leisure & Business Travel Bookings Market is boosted by the high demand for summer breaks, with seaside vacations remaining Czech holiday makers' first preference. Despite economic constraints on household budgets, end-users are not ready to settle for anything less than their primary break, creating consistent bookings. Summer breaks continue to be the priority, making the demand robust despite financial pressures.

Another driving factor behind growth is the rising availability of exotic holidays, further facilitated by direct charter flights. Such holidays appeal to new experience-seekers, while the ease of using charter services drives sales for intermediaries. Both factors combined in the strong demand for beach holidays and the rising availability of exotic holidays function as underlying forces driving momentum in the marketplace.

Czech Republic Leisure & Business Travel Booking Market Trend

Holiday Makers Booking Holidays Earlier in Order to Get Value

An emerging trend in the market is that travellers are planning and booking their holidays further in advance to better manage budgets and secure more favourable deals. Travelers are no longer waiting until the very end but are reserving as soon as they get offers they like. This is also attributed to not experiencing the effect of inflation on travel costs, so early planning is a favored option for most.

Travel intermediaries are buckling under this change by inducing advance sales and providing incentives for early reservation. Perks of kids travelling free or date and place changes closer to departure are now commonly utilized to entice end users. This new trend proves to illustrate that travellers are becoming more strategic in getting value, as well as how it is transforming the way intermediaries craft and promote their packages.

Czech Republic Leisure & Business Travel Booking Market Opportunity

Growing Potential for Mobile Travel

Mobile travel is set to become a significant opportunity, with end users increasingly turning to smartphones and tablets to support their day-to-day activities, from shopping to banking. This familiarity with mobile technology is then being converted to increased adoption in researching and booking vacations. What was previously the domain of young, technology-aware travellers is now starting to move into older audiences, who are also adopting tablets and smartphones for trip planning and booking.

To seize this opportunity, direct providers and intermediaries are optimizing their platforms to be more mobile, and introducing mobile-only exclusive offers. Even where bookings are not completed on mobile, the pre-search and planning is increasingly being initiated there, placing mobile at the heart of the end user experience. This increasing dependence on mobile devices opens new channels for travel providers to access end users and deliver stable growth in bookings.

Czech Republic Leisure & Business Travel Booking Market Segmentation Analysis

By Travel Sales Type

- Leisure Travel

- Business Travel

The segment with most market share under the Travel Sales is Leisure Travel, with a market capture of about 85%. The demand has been driven by high interest in summer vacations, with most Czechs preferring sea trips and foreign countries backed up by direct charter flights. Despite economic constraint, the end user has continued to regard holiday visits as an essential expenditure, cutting back on additional services or switching to less expensive locations instead of foregoing travel entirely. More frequent but shorter leisure holidays are also becoming popular, with early-autumn and early-spring breaks being favored.

Recreational travel is still the pillar of the Czech travel economy, with cultural visits, weekend escapes, and holidays with family all fueling expansion. Shoppers are booking earlier in order to get good deals and beat price increases, and intermediaries are increasing sales with flexible sales like child-travel-for-free and date changes.

By Booking Channel

- Offline Booking

- Online Booking

The segment that has the highest market share under the Booking Channel is Online Booking, which accounted for around 65% of the market. end users in the Czech Republic are increasingly using mobile devices to search and book holidays, with both younger and older demographics driving growth. Many now rely on smartphones and tablets for initial research, and some intermediaries have started offering mobile-only deals to encourage faster adoption of online channels.

Online booking has become a focal point for market growth, underpinned by easy-to-use websites and platforms by key players. Although travel intermediaries are still pertinent because of benefits such as end user protection and language assistance, online channels increasingly represent the preferred choice for convenience and cost economies. This continued transformation mirrors the increased digital ease of Czech travellers, so that online booking is a mainstream and growing channel.

Top Companies in Czech Republic Leisure & Business Travel Booking Market

The top companies operating in the market include Cedok as, Blue Style ks, Asiana spol sro, Booking.com (Czech Republic) sro, Invia.cz as, Exim Tours as, Cestovní kancelár FISCHER as, Student Agency ks, Alexandria spol sro, Kiwi.com sro, etc., are the top players operating in the Czech Republic Leisure & Business Travel Booking Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Czech Republic Leisure & Business Travel Booking Market Policies, Regulations, and Standards

4. Czech Republic Leisure & Business Travel Booking Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Czech Republic Leisure & Business Travel Booking Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Travel Sales Type

5.2.1.1. Leisure Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Business Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Booking Channel

5.2.2.1. Offline Booking- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Online Booking- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Booking Method

5.2.3.1. Travel Intermediaries- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Direct Suppliers- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Czech Republic Leisure Travel Booking Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Travel Sales Type- Market Insights and Forecast 2022-2032, USD Million

6.2.1.1. Leisure Air Travel- Market Insights and Forecast 2022-2032, USD Million

6.2.1.2. Leisure Car Rental- Market Insights and Forecast 2022-2032, USD Million

6.2.1.3. Leisure Cruise- Market Insights and Forecast 2022-2032, USD Million

6.2.1.4. Leisure Experiences and Attractions- Market Insights and Forecast 2022-2032, USD Million

6.2.1.5. Leisure Lodging- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Booking Method- Market Insights and Forecast 2022-2032, USD Million

7. Czech Republic Business Travel Booking Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Travel Sales Type- Market Insights and Forecast 2022-2032, USD Million

7.2.1.1. Business Air Travel- Market Insights and Forecast 2022-2032, USD Million

7.2.1.2. Business Car Rental- Market Insights and Forecast 2022-2032, USD Million

7.2.1.3. Business Lodging- Market Insights and Forecast 2022-2032, USD Million

7.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Booking Method- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1. Booking.com (Czech Republic) sro

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2. Invia.cz as

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3. Exim Tours as

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4. Cestovní kancelár FISCHER as

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5. Student Agency ks

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6. Cedok as

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7. Blue Style ks

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8. Asiana spol sro

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9. Alexandria spol sro

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Kiwi.com sro

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Travel Sales Type |

|

| By Booking Channel |

|

| By Booking Method |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.