Global Copper Sulfate (Battery/Metallurgical Grade) Market Report: Trends, Growth and Forecast (2026-2032)

By Grade (Battery Grade, Metallurgical Grade, Technical Grade, Agricultural Grade), By Application (Batteries (Lead-Acid Batteries), Agriculture (Fungicide), Electroplating, Animal Feed, Pigments), By Region (North America, South America, Europe, Middle East & Africa, Asia Pacific)

- Chemical

- Jan 2026

- VI0758

- 215

-

Global Copper Sulfate (Battery/Metallurgical Grade) Market Statistics and Insights, 2026

- Market Size Statistics

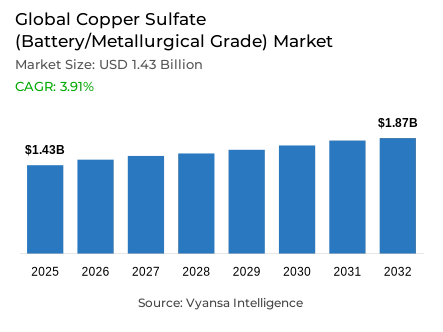

- Global copper sulfate (battery/metallurgical grade) market is estimated at USD 1.43 billion in 2025.

- The market size is expected to grow to USD 1.87 billion by 2032.

- Market to register a CAGR of around 3.91% during 2026-32.

- Grade Shares

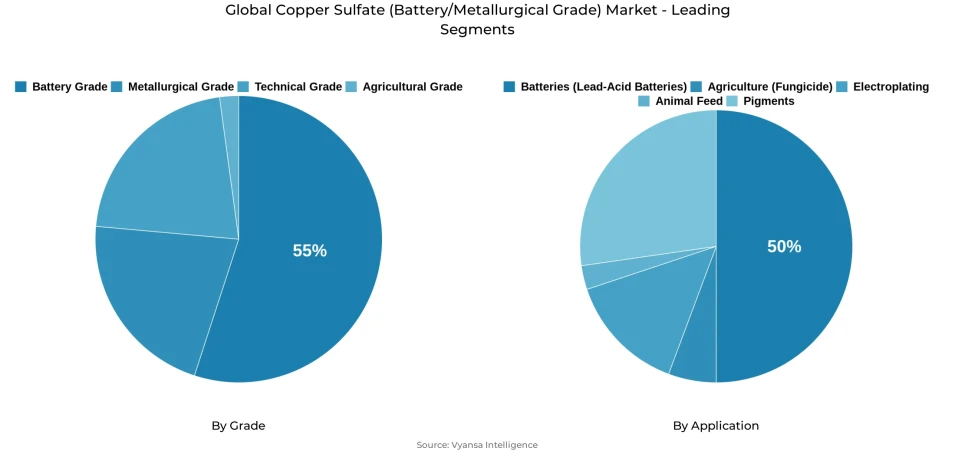

- Battery grade grabbed market share of 55%.

- Competition

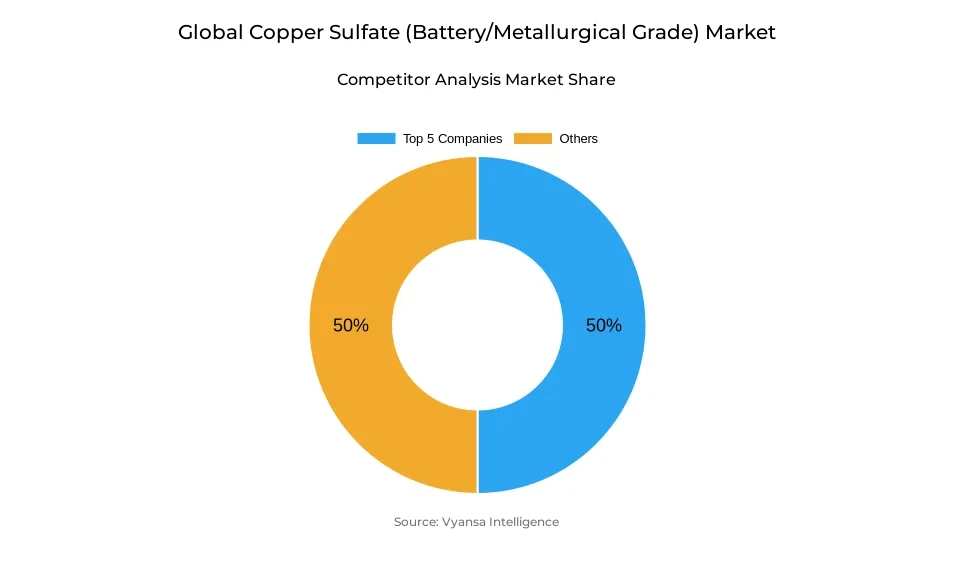

- More than 25 companies are actively engaged in producing copper sulfate (battery/metallurgical grade).

- Top 5 companies acquired around 50% of the market share.

- Norkem Limited; Old Bridge Chemicals; ProChem, Inc.; Sumitomo Metal Mining; Acuro Organics etc., are few of the top companies.

- Application

- Batteries (lead-acid batteries) grabbed 50% of the market.

- Region

- Asia Pacific leads with a 65% share of the global market.

Global Copper Sulfate (Battery/Metallurgical Grade) Market Outlook

The Global Copper Sulfate (Battery/Metallurgical) market is projected to reach around 1.87 Billion USD through 2032 which is about a 3.91% Annual Growth Rate (CAGR) from an estimated 1.43 Billion USD in 2025. The projected growth is due to the increasing demand for copper sulfate due to the increase in Electric Vehicle (EV) production (53-75 kg of copper in each battery system/electrical components). Due to this increase in copper sulfate needed, higher purity Copper Sulfate is being consumed for battery electrodes and current collectors. Other factors driving the demand for high purity copper sulfate are Enhanced renewable energy capacity & Persistent demand for Lead-acid batteries; therefore maintaining the continued Robust demand from the Automotive, Energy Storage and Industrial sectors.

Battery grade Copper Sulfate comprises about 55% of the Global Copper sulfate market; therefore, Contract Manufacturers will be producing Battery Grade Copper Sulfate for High Purity Applications (i.e., Lithium-ion Batteries and Lead-acid Batteries). The Metallurgical grade Copper Sulfate represents the other 45% of the Copper Sulfate market as it supports the conventional Industrial markets, such as Electroplating, Water Treatment, Agriculture, and Mineral Processing. Due to the Pure requirements for Battery Grade, therefore, the Higher Specification Battery Products are being provided at a Higher Price; meanwhile, the Manufacturer of the Metallurgical Grade Products produce those for Lower Cost Product for use in the Industrial Market, therefore producing an adequate balance in the market structure.

Approximately 50% of the total consumption of Copper Sulfate is used in Battery Applications, with Lead-acid batteries being the Leading Battery Application. In Emerging Market Countries, Lead-acid Batteries are widely deployed as Starting-light-ignition applications, Back-up Power, Telecom, and Renewable Energy Storage, while usage of Lithium-ion Batteries is increasing due to the growth of Electric Vehicle (EV) Production, but currently total Lithium-ion Demand is significantly less than Lead-acid Demand, therefore the demand for both technologies remains stable for growth as battery production continues.

By Region, Asia-Pacific represents the largest amount of global Copper Sulfate Consumption at approximately 65% owing to the scale of Battery Manufacturing in the Asia-Pacific region, Industrial Chemical Manufacturing, and Agricultural Activity. China and India will be the Leading Growth areas driven by Government incentives and the Large Investments in Renewable Energy Production and the growth of Electric Vehicle Infrastructure. Due to this scale, as well as industrial scale and technological capability, the Asia-Pacific region will be the Major area of consumption and innovation for Copper Sulfate from 2026 to 2032.

Global Copper Sulfate (Battery/Metallurgical Grade) Market Growth Driver

Electric Vehicle Growth Boosts Copper Sulfate Consumption

More and more people are adopting mobility around the world which has had a huge impact on the demand for copper sulfate, mainly because of the growing number of electric vehicles. Approximately 17 million electric vehicles sold worldwide by the end of 2024 and the estimated 20 million plus in 2025 an estimated increase of 25% year over the previous year. Electro-Magnetic vehicles have a range of 53 to 75 kilograms of copper used for wiring of the batteries and other components and are much higher than their Internal combustion vehicle counterparts. The need to consume large quantities of copper translates directly to increased consumption of Copper Sulfate, which is an important component in the manufacture of lithium-ion battery anode and current collector coatings. Copper sulfate has become the go-to product for battery manufacturers who require high purity Copper Sulfate in order to support electric vehicle electrification and consistent battery operation performance.

In the International Energy Agency's projections of global copper demand for re- refining will increase from approximately 27 million metric tons in 2024 to approximately 33 million metric tons by 2035. The increase in renewable energy infrastructure and the increased deployment of electric vehicles are driving a sustained and significant demand for battery-grade copper sulfate on an ongoing basis. Those manufacturers that supply high-specification formulations of each component will be well-positioned to take advantage of the long-term growth opportunities that will arise as the energy transition causes a dramatic increase in both volume and pricing for those products used in all end-use sectors globally.

Global Copper Sulfate (Battery/Metallurgical Grade) Market Challenge

Constraints from Declining Copper Ore Grades Impact Production Capacity

Due to declining ore grades, the future growth of copper sulfate production capacity is limited by structural issues. Mined output reached approximately 22-23 million tons in 2024 but will reach an estimated peak of slightly above 24 million tons in the late 2020s before declining below 19 million tons between 2035 due to a combination of depletion of required reserves (including current mining operations). Declining ore quality, and depletion of reserves means that lower-grade ores will require more extensive processing, resulting in a more significantly complex and costly operations, thus directly limiting the overall supply of copper sulfate at a time when battery and industrial uses require increasing quantities.

The International Energy Agency has stated there could be a potential copper supply shortage of up to 30% by 2035 because production will fall short of meeting increasing end-use demand. These limitations will result in significantly increased capital needs, increased regulatory compliance burden on producers, and increased technical challenges with refining and converting chemicals into copper sulfate. The increased geopolitical vulnerability of supply chains further compounds production challenges, especially for battery-grade copper sulfate, where end-users (e.g., electric vehicles, renewable energy, industrial) demand increased purity and consistent supply.

Global Copper Sulfate (Battery/Metallurgical Grade) Market Trend

Sustainability Shift Accelerates Circular Economy Practices and Eco-Friendly Production

Concerns for the sustainability and increasing focus on resume circular economic principles have resulted in the copper sulfate industry, and growers alike, to adopt environmentally responsible manufacturing processes. With increasing frequency, many manufacturers are adding recycled copper to their manufacturing processes, which will result in decreased reliance upon mining new copper as well as ensuring that all product produced meets the strictest purity requirements for battery, agriculture, and industrial uses. This shift to using guaranteed recycled input has expanded to other industries including semiconductor companies, where they are recovering and reusing copper from the waste stream. Companies throughout the industry are implementing new closed-loop methods of sourcing copper sulfate.

At the same time, developments in production technology within the copper sulfate industry have also contributed to this trend. For instance, while the old-school methods used to produce copper sulfate produced the most possible residue, today’s methods contain low residues through the use of new formulation techniques, more effective chelation to avoid using most or all of the raw material, and better technology systems for accurate and precise application for producing minimal residue. While these technologies offer improved production processes that will reduce emissions and waste, they also differentiate the production practices of copper sulfate manufacturers, establishing the basis for how a manufacturer operates and how it will compete.

Global Copper Sulfate (Battery/Metallurgical Grade) Market Opportunity

Advanced Lithium-Ion Batteries Spur Demand for High-Purity Copper Sulfate

The lithium-ion batteries continue to grow in number and use, the need for specialized copper sulfate formulations has grown significantly. In 2023, the world's lithium-ion battery production capacity was about 2,000 GWh per year, with the growth projections exceeding 7,300 GWh by 2030, with the development of more than 430 gigafactories worldwide. A significant amount of high-purity copper sulfate is going to be required now and in the future to meet the technical requirements of advanced designs including solid-state. The advanced battery chemistry and solid-state technology markets are currently the highest segments, yielding the greatest profitability on sales to the proper suppliers.

The global energy transition has resulted in strict requirements for sourcing critical materials for the production of batteries; therefore, working with suppliers that have certified quality assurance, and a transparent supply chain has become an important differentiator to advanced battery manufacturers beyond price point competition. Copper sulfate producers that establish technical partnerships, fulfill quality infrastructure, and commit to adhering to the most stringent requirements can develop a sustainable market share in the high-specification battery market through the forecast period of 2026–2032 while capitalizing on the additional growth potential that these higher specifications offer globally.

Global Copper Sulfate (Battery/Metallurgical Grade) Market Regional Analysis

By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia Pacific

Copper sulfate (Battery/Metallurgical) has become the largest regional market in the Asia-Pacific, accounting for around 65% regional share. The development of this area is attributable to the many different types of industrial chemicals and batteries that it manufactures, along with its extensive use of agricultural products. The fastest-growing copper sulfate markets are in China and India; China manufactures a significant portion of the world's batteries, while India is rapidly increasing its production capacity as a result of strong government support. Additionally, the large-scale production of agricultural products in this region supports demand for copper sulfate in its fungicide applications, and the mining, electroplating, and water treatment industries also help to provide a steady source of copper sulfate demand.

With continued growth in renewable energy infrastructure and electric vehicle (EV) charging networks, as well as modernization of farming methods, demand for copper sulfate will remain strong in the Asia-Pacific region. The combination of industrial output, advanced technology, and increased variety of end use in the Asia-Pacific will allow it to be a central hub for picking up new markets as well as a significant contributor to the global consumption of copper sulfate between 2026 and 2032.

Global Copper Sulfate (Battery/Metallurgical Grade) Market Segmentation Analysis

By Grade

- Battery Grade

- Metallurgical Grade

- Technical Grade

- Agricultural Grade

Battery-grade copper sulfate represents 55% of the market, reflecting Copper Sulphate's strategic role for a company's energy transition products or components to support energy transition to electric vehicles. The growth of electric vehicles is expected to exceed 20 million units by 2025, while lead-acid battery consumption is expected to continue its use in the automotive, telecommunications and backup power industries for some time into the future, creating continued high demand for high-purity copper sulphate formulations. The battery-grade copper sulphate segment is supported by its very high performance and purity that end-users must meet for the energy storage and electric mobility markets.

The metallurgical segment represents 45% of the market and remains the main support for traditional industrial applications (electroplating, water treatment & agriculture) and mineral processing. Although the total volume of metallurgical-grade copper sulphate formulations is smaller than battery-grade copper sulphate, the metallurgical-grade formulations are of significant importance to cost-sensitive industrial users. The continuing imbalance of 55:45 on the ratio of battery-grade to metallurgical-grade copper sulphate represents an ongoing structural transition from conventional industrial uses to electric vehicle use. The continued growth of electric vehicles, coupled with the continuing use of lead-acid batteries by end-users will provide stability on both sides throughout the forecast time period.

By Application

- Batteries (Lead-Acid Batteries)

- Agriculture (Fungicide)

- Electroplating

- Animal Feed

- Pigments

All other applications of copper sulfate account for the other 50% of total global demand. This demand includes lithium-ion batteries, agricultural fungicides, electroplating, water treatment and mineral processing. Lithium-ion battery applications have grown at a rapid pace, with global electric vehicle (EV) battery deployments increasing at a rate of approximately twenty-five percent annually. However, as of the end of 2026, total consumption of copper sulfate from lithium-ion batteries remains significantly lower than that of lead-acid batteries. The dual structure of demand between these two applications highlights the balance in the market between established, stable, low-growth applications and new high-growth applications creating a major impact on global demand for copper sulfate.

Market Players in Global Copper Sulfate (Battery/Metallurgical Grade) Market

These market players maintain a significant presence in the Global copper sulfate (battery/metallurgical grade) market sector and contribute to its ongoing evolution.

- Norkem Limited

- Old Bridge Chemicals

- ProChem, Inc.

- Sumitomo Metal Mining

- Acuro Organics

- Allan Chemical Corporation

- JX Advanced Metals

- Noah Chemicals

- Merck KGaA

- Beneut Enterprise

- NOAH Technologies

- Atotech

- Blue Line Corp.

- Changsha Haolin Chemicals

- Highnic Group

Market News & Updates

- Sumitomo Metal Mining, 2025:

Announced a 2.6% production cut for fiscal 2025-26 due to planned maintenance at Toyo Smelter & Refinery and nickel plant turnarounds.

- JX Advanced Metals, 2025:

Plans to cut refined copper production by several tens of thousands of tonnes due to inability to procure copper concentrates, while investing 7 billion yen in recycled material processing.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Copper Sulfate (Battery/Metallurgical Grade) Market Policies, Regulations, and Standards

4. Global Copper Sulfate (Battery/Metallurgical Grade) Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Grade

5.2.1.1. Battery Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Metallurgical Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Technical Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Agricultural Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Batteries (Lead-Acid Batteries)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Agriculture (Fungicide)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Electroplating- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Animal Feed- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Pigments- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Region

5.2.3.1. North America

5.2.3.2. South America

5.2.3.3. Europe

5.2.3.4. Middle East & Africa

5.2.3.5. Asia Pacific

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. North America Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Grade- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Country

6.2.3.1. Canada

6.2.3.2. Mexico

6.2.3.3. USA

6.2.3.4. Rest of North America

6.3. Canada Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in USD Million

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.4. Mexico Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in USD Million

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.5. USA Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in USD Million

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

7. South America Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Grade- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Country

7.2.3.1. Argentina

7.2.3.2. Brazil

7.2.3.3. Chile

7.2.3.4. Peru

7.2.3.5. Rest of South America

7.3. Argentina Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in USD Million

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

7.4. Brazil Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

7.4.1.Market Size & Growth Outlook

7.4.1.1. By Revenues in USD Million

7.4.2.Market Segmentation & Growth Outlook

7.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

7.5. Chile Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

7.5.1.Market Size & Growth Outlook

7.5.1.1. By Revenues in USD Million

7.5.2.Market Segmentation & Growth Outlook

7.5.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

7.6. Peru Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

7.6.1.Market Size & Growth Outlook

7.6.1.1. By Revenues in USD Million

7.6.2.Market Segmentation & Growth Outlook

7.6.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8. Europe Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Grade- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Country

8.2.3.1. Belgium

8.2.3.2. Benelux

8.2.3.3. France

8.2.3.4. Germany

8.2.3.5. Italy

8.2.3.6. Netherlands

8.2.3.7. Poland

8.2.3.8. Spain

8.2.3.9. UK

8.2.3.10. Rest of Europe

8.3. Belgium Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in USD Million

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.4. Benelux Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in USD Million

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.5. France Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in USD Million

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.6. Germany Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in USD Million

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.7. Italy Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in USD Million

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.8. Netherlands Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

8.8.1.Market Size & Growth Outlook

8.8.1.1. By Revenues in USD Million

8.8.2.Market Segmentation & Growth Outlook

8.8.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.9. Poland Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

8.9.1.Market Size & Growth Outlook

8.9.1.1. By Revenues in USD Million

8.9.2.Market Segmentation & Growth Outlook

8.9.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.9.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.10. Spain Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

8.10.1. Market Size & Growth Outlook

8.10.1.1. By Revenues in USD Million

8.10.2. Market Segmentation & Growth Outlook

8.10.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.11. UK Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

8.11.1. Market Size & Growth Outlook

8.11.1.1. By Revenues in USD Million

8.11.2. Market Segmentation & Growth Outlook

8.11.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.11.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9. Middle East & Africa Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Grade- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Country

9.2.3.1. Qatar

9.2.3.2. Russia

9.2.3.3. Saudi Arabia

9.2.3.4. South Africa

9.2.3.5. Turkey

9.2.3.6. UAE

9.2.3.7. Rest of Middle East & Africa

9.3. Qatar Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in USD Million

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.4. Russia Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in USD Million

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.5. Saudi Arabia Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

9.5.1.Market Size & Growth Outlook

9.5.1.1. By Revenues in USD Million

9.5.2.Market Segmentation & Growth Outlook

9.5.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.6. South Africa Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

9.6.1.Market Size & Growth Outlook

9.6.1.1. By Revenues in USD Million

9.6.2.Market Segmentation & Growth Outlook

9.6.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.7. Turkey Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

9.7.1.Market Size & Growth Outlook

9.7.1.1. By Revenues in USD Million

9.7.2.Market Segmentation & Growth Outlook

9.7.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.8. UAE Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

9.8.1.Market Size & Growth Outlook

9.8.1.1. By Revenues in USD Million

9.8.2.Market Segmentation & Growth Outlook

9.8.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10. Asia Pacific Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Country

10.2.3.1. Australia

10.2.3.2. China

10.2.3.3. India

10.2.3.4. Japan

10.2.3.5. South Korea

10.2.3.6. Thailand

10.2.3.7. Rest of Asia Pacific

10.3. Australia Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

10.3.1. Market Size & Growth Outlook

10.3.1.1. By Revenues in USD Million

10.3.2. Market Segmentation & Growth Outlook

10.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

10.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.4. China Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

10.4.1. Market Size & Growth Outlook

10.4.1.1. By Revenues in USD Million

10.4.2. Market Segmentation & Growth Outlook

10.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

10.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.5. India Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

10.5.1. Market Size & Growth Outlook

10.5.1.1. By Revenues in USD Million

10.5.2. Market Segmentation & Growth Outlook

10.5.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

10.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.6. Japan Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

10.6.1. Market Size & Growth Outlook

10.6.1.1. By Revenues in USD Million

10.6.2. Market Segmentation & Growth Outlook

10.6.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

10.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.7. South Korea Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

10.7.1. Market Size & Growth Outlook

10.7.1.1. By Revenues in USD Million

10.7.2. Market Segmentation & Growth Outlook

10.7.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

10.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.8. Thailand Copper Sulfate (Battery/Metallurgical Grade) Market Statistics, 2022-2032F

10.8.1. Market Size & Growth Outlook

10.8.1.1. By Revenues in USD Million

10.8.2. Market Segmentation & Growth Outlook

10.8.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

10.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Sumitomo Metal Mining

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Acuro Organics

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Allan Chemical Corporation

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. JX Advanced Metals

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Noah Chemicals

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Norkem Limited

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Old Bridge Chemicals

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. ProChem, Inc.

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Merck KGaA

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Beneut Enterprise

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

11.1.11. NOAH Technologies

11.1.11.1.Business Description

11.1.11.2.Product Portfolio

11.1.11.3.Collaborations & Alliances

11.1.11.4.Recent Developments

11.1.11.5.Financial Details

11.1.11.6.Others

11.1.12. Atotech

11.1.12.1.Business Description

11.1.12.2.Product Portfolio

11.1.12.3.Collaborations & Alliances

11.1.12.4.Recent Developments

11.1.12.5.Financial Details

11.1.12.6.Others

11.1.13. Blue Line Corp.

11.1.13.1.Business Description

11.1.13.2.Product Portfolio

11.1.13.3.Collaborations & Alliances

11.1.13.4.Recent Developments

11.1.13.5.Financial Details

11.1.13.6.Others

11.1.14. Changsha Haolin Chemicals

11.1.14.1.Business Description

11.1.14.2.Product Portfolio

11.1.14.3.Collaborations & Alliances

11.1.14.4.Recent Developments

11.1.14.5.Financial Details

11.1.14.6.Others

11.1.15. Highnic Group

11.1.15.1.Business Description

11.1.15.2.Product Portfolio

11.1.15.3.Collaborations & Alliances

11.1.15.4.Recent Developments

11.1.15.5.Financial Details

11.1.15.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Grade |

|

| By Application |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.