Global Cellulose Fiber Market Report: Trends, Growth and Forecast (2026-2032)

Grade (Natural Fiber, Synthetic Fiber), Application (Textiles, Paper, Composites), Region (North America, South America, Europe, Asia Pacific)

- Chemical

- Dec 2025

- VI0713

- 220

-

Global Cellulose Fiber Market Statistics and Insights, 2026

- Market Size Statistics

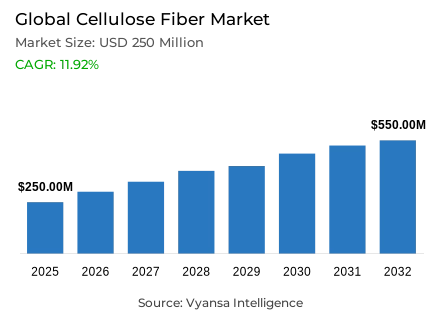

- Global cellulose fiber market is estimated at USD 250 million in 2025.

- The market size is expected to grow to USD 550 million by 2032.

- Market to register a CAGR of around 11.92% during 2026-32.

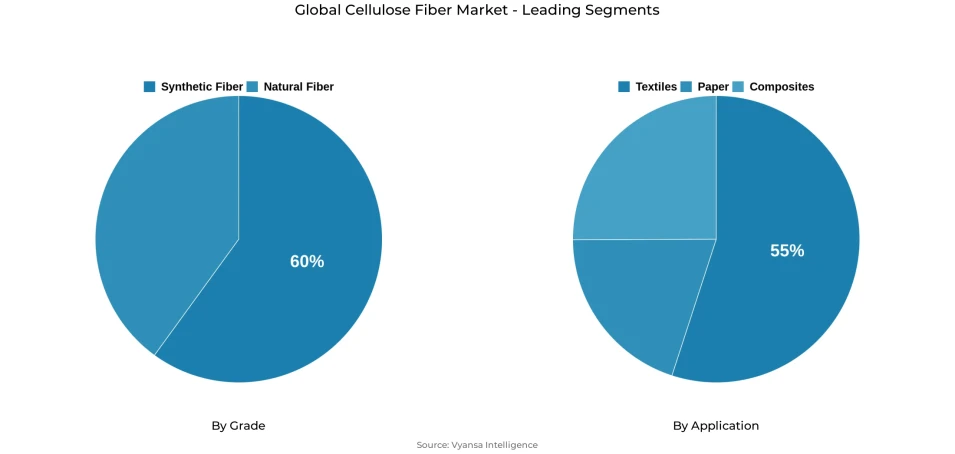

- Grade Shares

- Synthetic fiber grabbed market share of 60%.

- Competition

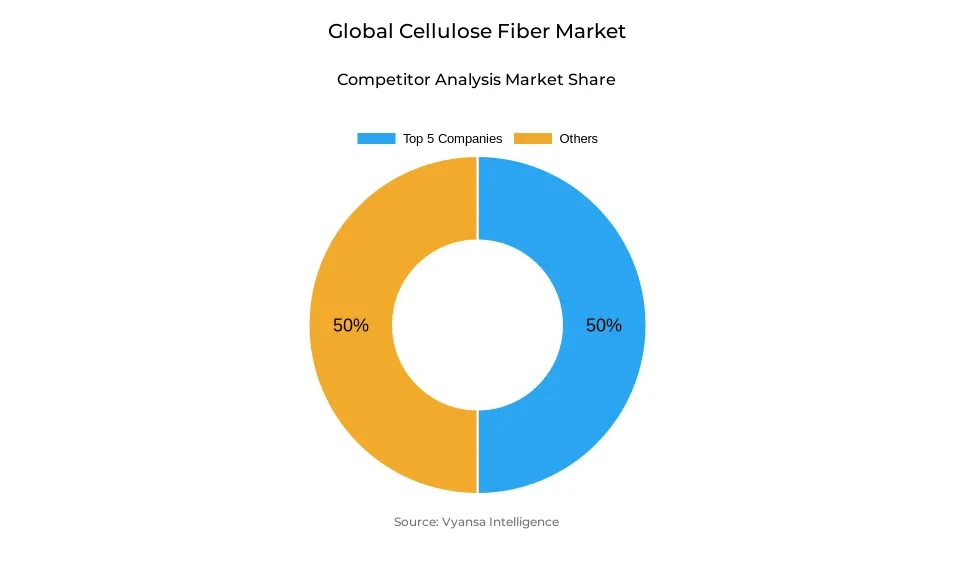

- More than 20 companies are actively engaged in producing cellulose fiber.

- Top 5 companies acquired around 50% of the market share.

- West Fraser Timber Co.; Suzano; Stora Enso; UPM-Kymmene Corporation; Domtar Corporation etc., are few of the top companies.

- Application

- Textiles grabbed 55% of the market.

- Region

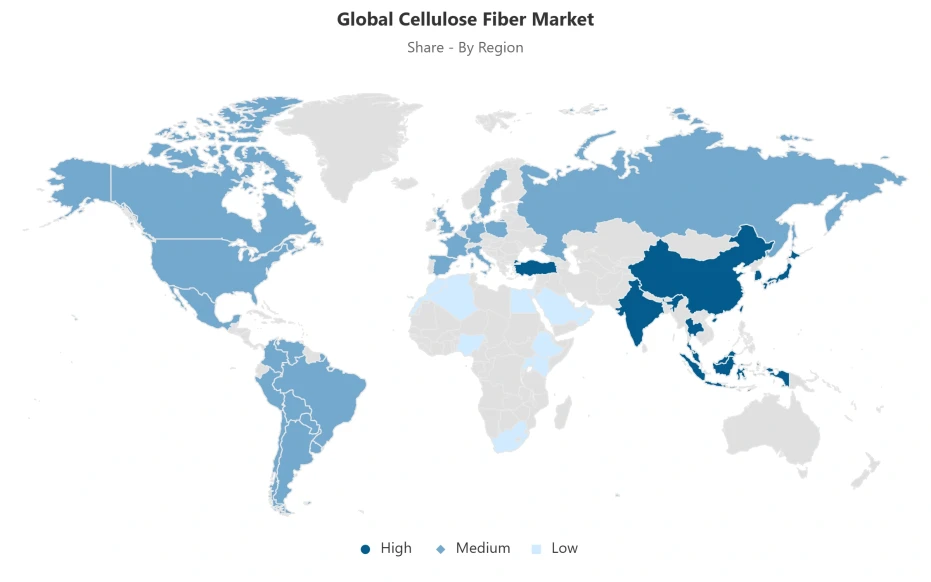

- Asia Pacific leads with a 40% share of the global market.

Global Cellulose Fiber Market Outlook

In 2025 the global market for cellulos fibre is projected to grow from an estimated $250 million to approximately $550 million by 2032 at a CAGR of 11.92% over the 2026-2032 forecast period. The key drivers contributing to this growth include the rise in producing sustainably using closed-loop systems for viscose production and the recovery of 60%-70% of the chemicals used in production and about one-third less water than current operations. Current estimated market share of synthetic fibre is about 60%, but stricter environmental regulations will increase consumers' interest in biodegradable alternatives resulting in cellulose fibre being much more popular than synthetic fibre is likely to be in the future.

Many of the major Man-Made Cellulosic Fibre producers have been developing sustainable methods, especially in the Asia Pacific, which will make up about 40% of the world total of MMCF manufactured globally. In India and China, the rapid growth in production growth is being driven by the very large textile manufacturing systems and the increase in quantities of certified Forestry and Agricultural Products (through both FSC and PEFC Certification) and the greater adoption of green manufacturing technologies into the production processes. When these advancements are combined, they provide greater traceability for raw materials, greater efficiency in resource use, and align the MMCF manufacturers with the commercial supply chains. Cellulose fibre will also have the ability to compete with polyester products due to the improvements made by manufacturers of MMCF.

The advancements being made in sustainable fibre production are significant, but there remain challenges related to proper management of environmental practices during viscose production. The excessive usage of chemicals, the concerns about the discharge of wastewater and the lack of consistent enforcement of environmental regulations are all barriers smaller companies have to overcome before they can be in full compliance with the requirements to operate as an environmentally responsible manufacturer. In addition, the existence of forest-sourced raw materials and the associated issues related to transparency in developing nations will also pose challenges to the transition of cellulose fibre to a fully sustainable supply chain. The ability to address these barriers is critical to the credibility of this supply chain in light of the potential effects of stricter regulation of international trade.

In addition to the aforementioned challenges, there are emerging new uses for cellulose fibres beyond the traditional textile applications (approximately 55% of total demand currently). The growth of textile-to-textile recycling technology will support further advancing circularity within the cellulose fibre industry as well as reducing reliance on virgin hardwood fibre. Future growth opportunities for cellulose fibre will also be realised in non-apparel textile applications (i.e., hygiene products, automotive, medical devices, building materials, etc.) and will be supported by the increasing emphasis placed on sustainability initiatives by governments within the Asia Pacific region.

Global Cellulose Fiber Market Growth Driver

Expanding Sustainable Production Capabilities

Sustainability is becoming increasingly important as the global market grows for cellulose fibre.The ability of manufacturers to utilise more efficient methods of producing MMCF (man-made cellulose fibre) will drive demand for products made through closed loop viscose production systems. Closed loop viscose production systems can enable approximately 60-70% of certain chemicals to be reused and can also reduce water consumption by approximately one-third, depending upon the technology of the mill, resulting in a greater level of sustainability for the mill. Asia Pacific is expected to remain the largest region for cellulose fibre consumption due to the rapidly growing textile supply chain in India, which is focused on integrating cellulosic fibres into both high-value apparel and the technical textile sectors. The steadily advancing recognition of the benefits of certified wood for making cellulose products will also support the continued growth of sustainably produced cellulose products.

China has an increasing emphasis on developing "green" manufacturing and provides additional support for these trends through technological advances in the production of viscose, acetate and lyocell. As a result of the increasing adoption of sustainable fibre systems by all parties in the regional value chain, improved environmental alignment and resource efficiency are occurring across the industry. Increased investment in circularity and closed-loop processes by many large manufacturers will further facilitate the transition of the global textile industry toward cleaner input materials along with enhanced traceability for cellulose products in apparel, home textiles, and technical textile applications.

Global Cellulose Fiber Market Challenge

Environmental and Resource Management Barriers

Viscose production has made some strides in environmental management, but the industry remains burdened with numerous challenges regarding environmental practices. Due to the high chemical usage still associated with viscose manufacturing processes, large amounts of wastewater containing contaminants like zinc (Zn²⁺) have the potential to negatively affect aquatic environments. Many of the smaller facilities in the emerging production hubs do not have advanced treatment solutions for their effluent, creating additional barriers for compliance as the global community continues to raise the bar when it comes to environmental stewardship. These operational obstacles create added financial pressure on the producers, thus limiting the ability of smaller mills to fulfil certification obligations that end-users around the world have established.

Sources from forest products are still influencing brand scrutiny and government regulations related to the viscose industry. Currently, most viscose supply is considered low risk; however, some viscose supply still comes from forests that may be classified as at-risk. Difficulty obtaining full supply chain verification due to the limited amount of transparency from some developing countries continues to impede the ability to pursue full supply chain verification for viscose. Furthermore, there is also considerable variability in the enforcement standards associated with environmental and labour practices, further impeding the widespread implementation of best practices. The continuous existence of these obstacles has delayed the progress of building a completely compliant, low-impact cellulose fibre ecosystem.

Global Cellulose Fiber Market Trend

Advancements in Circular Manufacturing Models

As circularity becomes more prevalent, textile-to-textile recycling has developed into a realistic alternative to traditional cellulose feedstock. Enzymatic separation systems provide manufacturers with a means to reclaim cellulose from mixed textile waste materials that have been separated from the original source. The use of these systems will help to alleviate the pressure on virgin pulp and improve the ability to manage waste. In addition, manufacturers who use these systems will have more choices for feedstock sources than before and will have less exposure to fluctuations in the price of raw materials. Therefore, these technologies create optimal conditions for manufacturers to align themselves with sustainable practices over the long term. As a result, customers will be able to take advantage of lower carbon footprints and more uniform quality of recycled materials due to the use of advanced recycling technology.

Asia-Pacific is leading the way with regard to these new developments. The majority of Multinational Consumer Goods Firms (MMCF) are located in China, while India and Indonesia are increasingly using recycled and/or sustainably sourced feedstocks for their respective lyocell and modal fibre products. As advanced recycling technologies become economically viable, producers are integrating recycling into their core businesses processes across all regions. This will improve the resiliency of supply chains, enhance the sustainability performance of manufacturers, and increase the ability of manufacturers to comply with the growing global market standards.

Global Cellulose Fiber Market Opportunity

Expanding Potential Across High-Value Applications

Cellulose fibers are expanding their use into new areas outside of textiles which will create a variety of new markets. The combustibility, moisture absorption, and superior performance characteristics of biodegradable cellulose products has caused a growing increase of nonwoven materials used in various industries that directly impact the production and distribution of personal hygiene and medical products, automotive parts, and Building & Construction. The increasing amount of prepared medical products (i.e. Bandages, surgical drapes, etc.) being produced from cellulosic materials provide an ideal synergy with the progressive environmental goals of the healthcare industry, and also because cellulosic materials are considered to be more biocompatible than synthetic materials. Automobile manufacturers are utilizing cellulose fibres in their vehicles' components, such as: light weight interior components (e.g. seat backs), filtration systems, noise-reducing systems that meet the new economy standards for fuel efficiency.

Government sponsored programs, particularly in the Asia Pacific area, will support future demand for specialty cellulose products. The present focus on technical textiles, protective apparel and material engineering encourages manufacturers to design products made of cellulosic fibres for high performance driven applications. The building and construction sector are also utilizing cellulosic insulation materials to satisfy increasing sustainability and energy performance requirements established by current building codes. As cellulose fibre use continues to increase within these sectors, cellulose becomes more attractive as a renewable, environmentally-friendly material across all sectors.

Global Cellulose Fiber Market Regional Analysis

By Region

- North America

- South America

- Europe

- Asia Pacific

Asia Pacific remains the dominant regional market for cellulose fibers, accounting for over 40% of global production and consumption, making it the largest regional segment by a substantial margin. China’s scale in viscose and cellulose acetate production, along with growing adoption of greener process technologies, firmly anchors regional supply strength. India and Bangladesh have emerged as major textile hubs incorporating cellulose fibers across multiple apparel categories, benefiting from favorable labor structures and strong export-oriented ecosystems. These dynamics reinforce Asia Pacific’s position as the global center for cellulose fiber processing and downstream textile manufacturing.

The region’s competitive advantages include access to cost-effective raw materials, expanding technical-textile capabilities, and government initiatives aimed at lowering environmental impact. Southeast Asian economies such as Vietnam, Thailand, and Indonesia continue investing in modern MMCF facilities, diversifying supply and bolstering regional textile value chains. This expansion improves global sourcing flexibility while enabling end users to transition toward more traceable, sustainable cellulose-based materials.

Global Cellulose Fiber Market Segmentation Analysis

By Grade

- Natural Fiber

- Synthetic Fiber

The market continues to operate within an ecosystem dominated by synthetic grades, with polyester serving as the leading material and accounting for over 60% of market share. Although cellulosic fibers are gaining traction due to rising sustainability requirements, synthetics continue to anchor the competitive landscape. Polyester remains the primary synthetic category, but growing environmental scrutiny and tightening regulations are shifting preference toward biodegradable and renewable alternatives. MMCFs are benefiting from this shift, supported by performance enhancements and narrowing cost differentials achieved through closed-loop viscose systems. End users increasingly evaluate full lifecycle impacts, positioning cellulose as an attractive substitute for petrochemical-based options.

India’s expanding role as a leading MMF producer reinforces this competitive transition. Growing domestic manufacturing capability supports greater availability of cellulosic fibers suited for premium apparel, home textiles, and technical fabrics. The material’s superior moisture management, breathability, and biodegradability continue to validate its value proposition across higher-end applications. As environmental expectations strengthen globally, cellulose fibers are positioned to capture incremental share from conventional synthetic grades.

By Application

- Textiles

- Paper

- Composites

India’s apparel manufacturing sector significantly shapes this landscape, supporting widespread integration of cellulosic fibers across spinning, weaving, processing, and garment-making operations. The country’s integrated textile ecosystem leverages cellulose in both domestic and export-oriented value chains. Beyond apparel, cellulose fibers continue to support industrial fabrics, home textiles, and non-apparel categories requiring durable, breathable, and biodegradable materials, which collectively reinforce long-term demand stability.

Market Players in Global Cellulose Fiber Market

These market players maintain a significant presence in the Global cellulose fiber market sector and contribute to its ongoing evolution.

- West Fraser Timber Co.

- Suzano

- Stora Enso

- UPM-Kymmene Corporation

- Domtar Corporation

- Sappi Limited

- International Paper Company

- Daicel Corporation

- Rayonier Advanced Materials

- Georgia-Pacific

- Nippon Paper Industries

- Oji Holdings Corporation

- Mercer International Inc.

- Södra

- Metsä Group

Market News & Updates

- Domtar Corporation, 2025:

Domtar Corporation published its inaugural 2025 Sustainability Report following the October 2024 integration of legacy Domtar, Resolute Forest Products, and Paper Excellence Group operations, establishing a North American forest products sector leader. The company invested $57 million in the Hawesville Mill’s Energetec™ paper technology, introducing stretchable paper innovation as part of a strategic portfolio diversification beyond commodity communications papers. Advanced cellulose filaments (nanofibrillated cellulose/NFC) commercialization at the Kénogami mill demonstrated 100% natural biomaterial performance enhancements in concrete and plastic applications. Additionally, the company evaluated translucent cellulose film products as replacements for clear plastic packaging, receiving positive stakeholder feedback. These initiatives highlight Domtar’s commitment to sustainable innovation, advanced cellulose technologies, and natural biomaterial solutions to meet rising global demand for environmentally friendly and high-performance fiber applications.

- Suzano, 2025:

Suzano expanded its Eucafluff® fluff pulp capacity through a R$490 million investment, increasing annual production from 100,000 to 440,000 tons, with commercial operations commencing in Q4 2025. Eucafluff® is the world’s first bleached kraft fluff pulp made entirely from planted eucalyptus, offering superior liquid retention, comfort, and discretion for personal hygiene products such as diapers, feminine hygiene products, and pet pads. The product has been authorized for EU Ecolabel and Nordic Swan certifications, demonstrating reduced fossil energy consumption, carbon emissions, water usage, and land requirements compared to alternatives. Suzano also announced cellulose price increases of €50/ton for Europe/US and €20/ton for Asia, reflecting rising market demand. Additionally, the company invested in Simplifyber’s Series A round to commercialize a 3D-molding process using moldable cellulose for soft goods manufacturing, targeting synthetic fiber replacement and sustainable innovation in advanced cellulose applications.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Cellulose Fiber Market Policies, Regulations, and Standards

4. Global Cellulose Fiber Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Cellulose Fiber Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Grade

5.2.1.1. Natural Fiber- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Synthetic Fiber- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Textiles- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Paper- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Composites- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Region

5.2.3.1. North America

5.2.3.2. South America

5.2.3.3. Europe

5.2.3.4. Asia Pacific

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. North America Cellulose Fiber Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Grade- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Country

6.2.3.1. US

6.2.3.2. Canada

6.2.3.3. Mexico

6.2.3.4. Rest of North America

6.3. US Cellulose Fiber Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in USD Million

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Cellulose Fiber Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in USD Million

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Cellulose Fiber Market Statistics, 2022-2032F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in USD Million

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

7. South America Cellulose Fiber Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Grade- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Country

7.2.3.1. Brazil

7.2.3.2. Rest of South America

7.3. Brazil Cellulose Fiber Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in USD Million

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8. Europe Cellulose Fiber Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Grade- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Country

8.2.3.1. Germany

8.2.3.2. France

8.2.3.3. UK

8.2.3.4. Italy

8.2.3.5. Spain

8.2.3.6. Netherlands

8.2.3.7. Belgium

8.2.3.8. Russia

8.2.3.9. Poland

8.2.3.10. Turkey

8.2.3.11. Rest of Europe

8.3. Germany Cellulose Fiber Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in USD Million

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.4. France Cellulose Fiber Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in USD Million

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.5. UK Cellulose Fiber Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in USD Million

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.6. Italy Cellulose Fiber Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in USD Million

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.7. Spain Cellulose Fiber Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in USD Million

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.8. Netherlands Cellulose Fiber Market Statistics, 2022-2032F

8.8.1.Market Size & Growth Outlook

8.8.1.1. By Revenues in USD Million

8.8.2.Market Segmentation & Growth Outlook

8.8.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.9. Belgium Cellulose Fiber Market Statistics, 2022-2032F

8.9.1.Market Size & Growth Outlook

8.9.1.1. By Revenues in USD Million

8.9.2.Market Segmentation & Growth Outlook

8.9.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.9.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.10. Russia Cellulose Fiber Market Statistics, 2022-2032F

8.10.1. Market Size & Growth Outlook

8.10.1.1. By Revenues in USD Million

8.10.2. Market Segmentation & Growth Outlook

8.10.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.11. Poland Cellulose Fiber Market Statistics, 2022-2032F

8.11.1. Market Size & Growth Outlook

8.11.1.1. By Revenues in USD Million

8.11.2. Market Segmentation & Growth Outlook

8.11.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.11.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.12. Turkey Cellulose Fiber Market Statistics, 2022-2032F

8.12.1. Market Size & Growth Outlook

8.12.1.1. By Revenues in USD Million

8.12.2. Market Segmentation & Growth Outlook

8.12.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.12.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9. Asia Pacific Cellulose Fiber Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Grade- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Country

9.2.3.1. China

9.2.3.2. India

9.2.3.3. Japan

9.2.3.4. South Korea

9.2.3.5. Australia

9.2.3.6. Thailand

9.2.3.7. Rest of Asia Pacific

9.3. China Cellulose Fiber Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in USD Million

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.4. India Cellulose Fiber Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in USD Million

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.5. Japan Cellulose Fiber Market Statistics, 2022-2032F

9.5.1.Market Size & Growth Outlook

9.5.1.1. By Revenues in USD Million

9.5.2.Market Segmentation & Growth Outlook

9.5.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.6. South Korea Cellulose Fiber Market Statistics, 2022-2032F

9.6.1.Market Size & Growth Outlook

9.6.1.1. By Revenues in USD Million

9.6.2.Market Segmentation & Growth Outlook

9.6.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.7. Australia Cellulose Fiber Market Statistics, 2022-2032F

9.7.1.Market Size & Growth Outlook

9.7.1.1. By Revenues in USD Million

9.7.2.Market Segmentation & Growth Outlook

9.7.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.8. Thailand Cellulose Fiber Market Statistics, 2022-2032F

9.8.1.Market Size & Growth Outlook

9.8.1.1. By Revenues in USD Million

9.8.2.Market Segmentation & Growth Outlook

9.8.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. UPM-Kymmene Corporation

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Domtar Corporation

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Sappi Limited

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. International Paper Company

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Daicel Corporation

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. West Fraser Timber Co.

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Suzano

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Stora Enso

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Rayonier Advanced Materials

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Georgia-Pacific

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

10.1.11. Nippon Paper Industries

10.1.11.1.Business Description

10.1.11.2.Product Portfolio

10.1.11.3.Collaborations & Alliances

10.1.11.4.Recent Developments

10.1.11.5.Financial Details

10.1.11.6.Others

10.1.12. Oji Holdings Corporation

10.1.12.1.Business Description

10.1.12.2.Product Portfolio

10.1.12.3.Collaborations & Alliances

10.1.12.4.Recent Developments

10.1.12.5.Financial Details

10.1.12.6.Others

10.1.13. Mercer International Inc.

10.1.13.1.Business Description

10.1.13.2.Product Portfolio

10.1.13.3.Collaborations & Alliances

10.1.13.4.Recent Developments

10.1.13.5.Financial Details

10.1.13.6.Others

10.1.14. Södra

10.1.14.1.Business Description

10.1.14.2.Product Portfolio

10.1.14.3.Collaborations & Alliances

10.1.14.4.Recent Developments

10.1.14.5.Financial Details

10.1.14.6.Others

10.1.15. Metsä Group

10.1.15.1.Business Description

10.1.15.2.Product Portfolio

10.1.15.3.Collaborations & Alliances

10.1.15.4.Recent Developments

10.1.15.5.Financial Details

10.1.15.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Grade |

|

| By Application |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.