Colombia Premium Wine Market Report: Trends, Growth and Forecast (2026-2032)

By Product Category (Fortified Wine & Vermouth (Port, Sherry, Other Fortified Wine, Vermouth), Sparkling Wine (Champagne, Other Sparkling Wine), Still Light Grape Wine (Still Red Wine, Still Rosé Wine, Still White Wine)), By Sales Channel (On Trade, Off Trade)

- Food & Beverage

- Dec 2025

- VI0651

- 115

-

Colombia Premium Wine Market Statistics and Insights, 2026

- Market Size Statistics

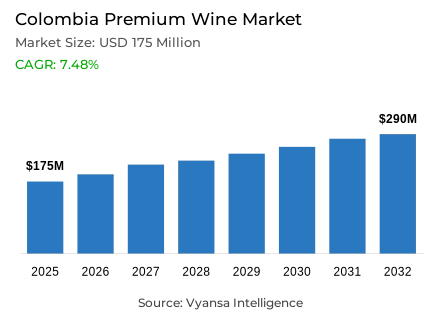

- Premium wine in Colombia is estimated at USD 175 million.

- The market size is expected to grow to USD 290 million by 2032.

- Market to register a cagr of around 7.48% during 2026-32.

- Product Category Shares

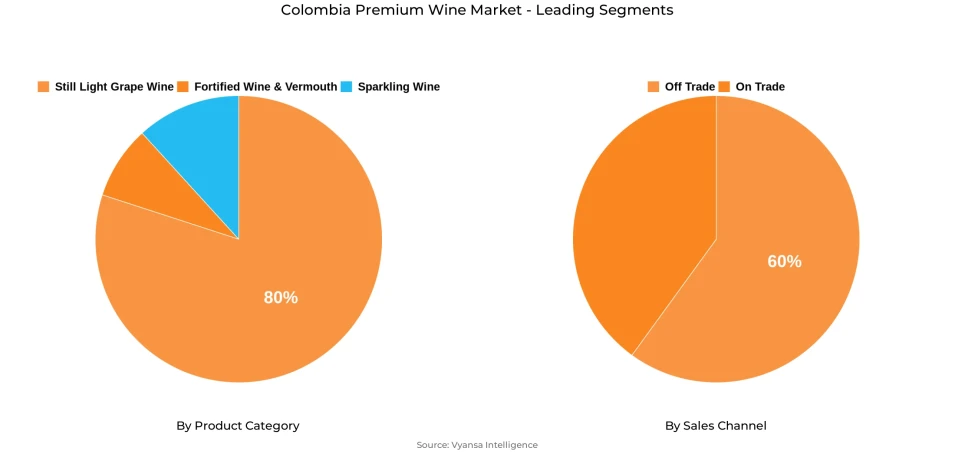

- Still light grape wine grabbed market share of 80%.

- Competition

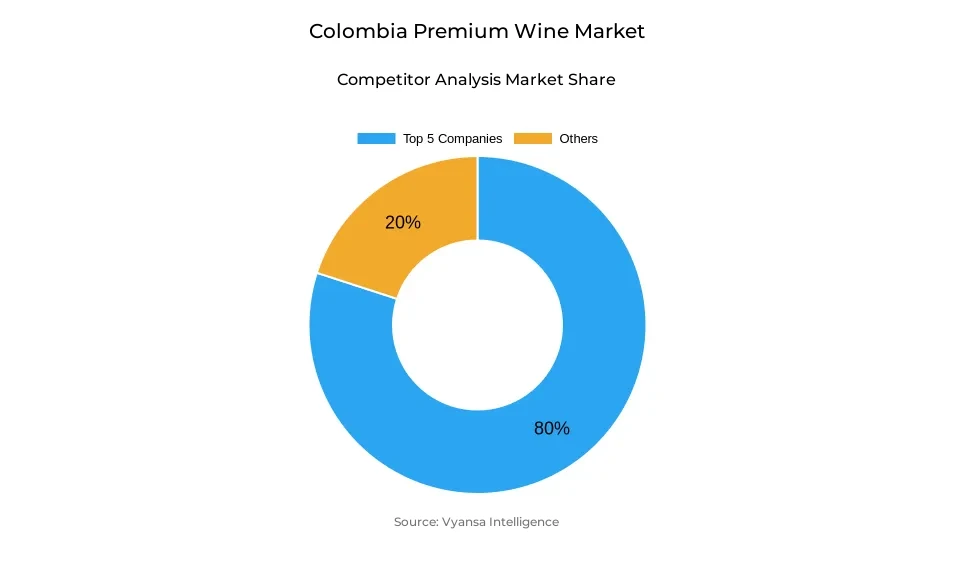

- More than 10 companies are actively engaged in producing premium wine in Colombia.

- Top 5 companies acquired around 80% of the market share.

- Viña La Rosa S.A.; E&J Gallo Winery Inc; Casa Vinícola Los Frailes; LVMH Moët Hennessy; Viña Concha y Toro S.A. etc., are few of the top companies.

- Sales Channel

- Off trade grabbed 60% of the market.

Colombia Premium Wine Market Outlook

Due to a combination of increased disposable income and urban development, Colombia's premium wine sector will continue to grow in a consistent manner. The projected growth is attributed to the GDP forecasted per capita income of USD 7,914 in 2024, will result in an increase in people buying premium alcoholic beverages across all parts of Colombia. This is especially true in urban centres such as Bogota and Medellin where access to retail locations, stable cold chain delivery processes, and the ability of retailers to display premium wines is best developed. Based on this trend, the value of the premium wine market is expected to be USD 175 million in 2025 and is also expected to increase to USD 290 million by 2032 at an approximate Compound Annual Growth Rate (CAGR) of 7.48% during the period from 2026 to 2032.

The increase in interest in high-quality wines is due to the fact that Colombia is completely dependent on importing all of its premium wine from Chile, Argentina, Spain, France, and Italy. While this increases the likelihood of Colombia having challenges related to logistics and regulations, the opportunity for the Colombian consumer to experience a wider variety of products from many international markets that are in line with the changing preferences of these consumers is an advantage. As a result, the majority of informed consumers prefer to buy premium red still wines, which is one of the primary reasons that Still Light Grape Wine represents 80% of the premium wine market.

Further to the growing interest in premium wines, the use of digital technology to contact and engage premium wine consumers has been, and continues to be, an important factor in this trend. The implementation of digital technology has facilitated e-commerce growth, and provides information on, access to, and comparison of premium wines, especially in smaller Colombian cities. Through digital channels, premium wine consumers can now identify European wines more easily and benefit from temperature-controlled fulfilment for their fragile premium SKUs.

Sales continue to be driven by the off-trade channel, which accounts for 60% of all wine distribution. Supermarkets, specialty stores, and online retail together provide the convenience and assortment depth valued by most end users. As digital integration strengthens within this channel, premium brands gain improved visibility and opportunities to capture rising interest in authentic, narrative-driven wine experiences.

Colombia Premium Wine Market Growth Driver

Rising Disposable Income and Expanding Urban Lifestyles

The expansion of Colombia's growing middle class and rapid urban expansion will enhance the ability to adopt more premium wines within major metropolitan locations or hubs. In 2024, when GDP is approximately USD 7,914, this situation creates greater purchasing power and translates into a greater willingness among end users to trade-up and to purchase more premium and sophisticated alcoholic beverages. Additionally, the concentration of people in urban areas has improved the access and availability of premium retail formats which allows for more readily available access to premium wines at retailers that carry high-quality selections of wine. Another area that is promoting growth for premium wines is that women are becoming a larger and more significant purchasing demographic, as many women are looking for organic-certified wines and other wellness-oriented products within this category and thus, are further contributing to growth in premium wines.

The improvements in disposable income along with the demographic trends are creating a marketplace that favours more differentiated wines that have a higher-priced proposition. Major city markets such as Bogotá and Medellín also afford efficient distribution, premium brand can be seen throughout the city, and the maintaining of cold-chain stability for premium wines. Hence, as end-users continue to shift to drinkable, aspirational products, both still and premium wine selections, both will experience strong growth as end-users become more familiar with and appreciative of the beauty of craftsmanship and provenance in wine-making techniques, as well as the narrative-driven aspects of each wine brand.

Colombia Premium Wine Market Challenge

Structural Import Dependence and Regulatory Complexities

Due to unfavorable climatic conditions for grape growing, the Colombian wine industry is completely reliant on imports. Inconsistent weather cycles limit the feasibility of local vinification. As a result, the only option for Consumers to access premium wines is through imported wines. However, the processes associated with importing products can present logistical and regulatory difficulties that are not present with domestically produced wines. For example, temperature-controlled shipments require stringent protocols for handling as well as increased costs associated with these shipments.

Tariffs and related administrative services associated with various agreements also create problems for the premium wine category's pricing structures, thereby affecting competitiveness. Consequently, this entrenched reliance upon external suppliers exposes the market to upstream risks related to disruptions from key exporting countries such as Chile and Argentina (for bulk) as well as Spain and France. In addition, the regulatory documentation and customs processes associated with importing products add indirect costs resulting from increased transaction costs for the end-users. Without a domestic production capacity to produce premium wines, the market's ability to adapt quickly to changes in the demand from consumers will be limited, and therefore, will be more vulnerable to fluctuations in international freight and global economic shocks affecting the availability of the product and the price stability at retail.

Colombia Premium Wine Market Trend

Increasing Preference for Premium and Imported Wine Profiles

In the Colombian wine market, there is a clear upward trend in consumers gravitating to premium wines as consumers focus increasingly on purchasing top-quality products across all beverage categories. There is considerable importation of wine into Colombia from European countries, with Spain importing USD 10.3 million, France importing USD 9.78 million and Italy importing USD 8.66 million in wine in 2023 alone. In addition to the growing trend for premium wines among the discerning buyer population, there is a significant attraction to still-light grape wines, especially premium red wine. Continued growth in online wine purchases (36% average YOY growth from 2019-2023; 15% increase forecasted for 2024) has allowed Colombian wine consumers access to an even broader selection of wines from around the world via digital sales channels.

The increase in online wine purchasing and the opportunity to access greater wine knowledge and discover premium wines has lead to increased exploration for wine consumers to discover new flavours, regions, etc. As a result, the way wine consumers select what they purchase is becoming increasingly driven by their ability to compare product offerings from reputable brands across all channels available (online and in-person). Online shopping provides direct interaction with Colombian consumers who desire premium wine and may no longer have access to premium products locally through brick and mortar retailers. This increased online shopping access to premium wine is paving the way for a direct relationship between premium wineries and sophisticated Colombian consumers looking for an elevated wine experience.

Colombia Premium Wine Market Opportunity

Expanding Digital Commerce and Premium Accessibility

E-commerce has rapidly transformed Colombia's premium wine market and has also created better access to many international brands. The way that customers will research, learn about, and buy premium wines, particularly in the smaller cities, is being changed by the use of online platforms. Many of the smaller urban centers had never had access to premium wine selections as they only existed in the larger metropolitan areas. Digital platforms assist in providing product education, product reviews, and pricing transparency which help customers make informed buying decisions based upon their unique characteristics as well as where they live.

There are many new opportunities for premium wine suppliers via e-commerce to connect with engaged customers directly; therefore, as e-commerce becomes more popularized, suppliers will be incentivized to implement advanced logistics, optimized last-mile delivery, and temperature-controlled distribution, enabling suppliers to ship fragile premium products safely. There will be marked competitive advantages for suppliers that are able to develop high-quality content, employ data-driven marketing strategies, and implement efficient order fulfillment processes in a marketplace that continues to trend towards greater convenience and discovery as the purchasing service level differentiator.

Colombia Premium Wine Market Segmentation Analysis

By Product Category

- Fortified Wine & Vermouth

- Port

- Sherry

- Other Fortified Wine

- Vermouth

- Sparkling Wine

- Champagne

- Other Sparkling Wine

- Still Light Grape Wine

- Still Red Wine

- Still Rosé Wine

- Still White Wine

Still light grape wine accounts for around 80% of Colombia’s total wine market, firmly establishing it as the leading product category. Strong familiarity with still wine profiles-especially red wine-supports its dominance among premium-seeking end users. The category benefits from a well-developed retail presence, consistent import flows, and a broad range of European and Latin American supply options that reinforce reliability. Limited adoption of sparkling, fortified, or alternative wine types further elevates the position of still grape wine within premium purchasing dynamics.

This concentration provides advantageous conditions for premium still wine producers, as the segment enjoys mature demand and low entry barriers related to product understanding. Established retail shelf space, distribution coverage, and consumption patterns help streamline premium positioning efforts. End users accustomed to still wine formats exhibit higher readiness to explore elevated quality tiers, enabling premium brands to leverage existing awareness and channel infrastructure to strengthen market presence.

By Sales Channel

- On Trade

- Off Trade

Off-trade retail accounts for around 60% of total wine distribution in Colombia, making it the dominant sales channel for premium wine purchases. This segment includes supermarkets, hypermarkets, specialty stores, and rapidly expanding online platforms. End users prefer the convenience, pricing transparency, and assortment depth offered by these outlets, which accommodate home-based consumption patterns that characterize Colombian wine usage. Growing digital integration within off-trade channels further accelerates adoption, enabling smooth browsing, secure payments, and efficient order fulfillment.

Off-trade channel strength has strategic implications for premium wine suppliers seeking visibility and competitive differentiation. Securing placement in high-traffic retail networks remains essential, while expanded online retail within the off-trade ecosystem provides direct-to-end-user opportunities for premium brands. Digital shelf optimization, targeted promotions, and curated premium assortments allow producers to communicate value and product heritage more effectively. As online components strengthen within off-trade, premium suppliers gain additional leverage to capture rising interest in sophisticated wine experiences.

List of Companies Covered in Colombia Premium Wine Market

The companies listed below are highly influential in the Colombia premium wine market, with a significant market share and a strong impact on industry developments.

- Viña La Rosa S.A.

- E&J Gallo Winery Inc

- Casa Vinícola Los Frailes

- LVMH Moët Hennessy

- Viña Concha y Toro S.A.

- Viña Santa Rita S.A.

- Viña Santa Carolina S.A.

- VSPT Wine Group

- Pernod Ricard Groupe

- Hijos de Antonio Barceló SA

Market News & Updates

- Pernod Ricard Groupe, 2025:

Achieved historic milestone with Olmeca Tequila surpassing one million cases sold globally for the first time (October 2025), with exceptional growth in emerging markets including Colombia where the brand's "bold positioning and vibrant spirit" are resonating with next-generation spirits consumers; portfolio includes Olmeca Silver, Gold, Reposado, and Chocolate variants alongside limited-edition bottles inspired by traditional Zapotec art. Additionally, Pernod Ricard maintains majority stake in Colombian rum brand La Hechicera (acquired 2021) producing premium rum portfolio including La Hechicera Reserva Familiar aged in ex-Bourbon barrels, Serie Experimental #1 finished in Muscat casks, and organic banana-infused Serie Experimental #2, distributed across Europe, US, and global travel retail sector with Colombian terroir heritage.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Colombia Premium Wine Market Policies, Regulations, and Standards

4. Colombia Premium Wine Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Colombia Premium Wine Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Quantity Sold (Million Liters)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Category

5.2.1.1. Fortified Wine & Vermouth- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Port- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Sherry- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Other Fortified Wine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Vermouth- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Sparkling Wine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Champagne- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Other Sparkling Wine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Still Light Grape Wine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Still Red Wine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Still Rosé Wine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Still White Wine- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Sales Channel

5.2.2.1. On Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Off Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Competitors

5.2.3.1. Competition Characteristics

5.2.3.2. Market Share & Analysis

6. Colombia Fortified Wine & Vermouth Premium Wine Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Quantity Sold (Million Liters)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Colombia Sparkling Premium Wine Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Quantity Sold (Million Liters)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Colombia Still Light Grape Premium Wine Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Quantity Sold (Million Liters)

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.LVMH Moët Hennessy

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Viña Concha y Toro S.A.

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Viña Santa Rita S.A.

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Viña Santa Carolina S.A.

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.VSPT Wine Group

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Viña La Rosa S.A.

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.E&J Gallo Winery Inc

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Casa Vinícola Los Frailes

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Pernod Ricard Groupe

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Hijos de Antonio Barceló SA

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.