Colombia Bottled Water Market Report: Trends, Growth and Forecast (2026-2032)

By Type of Water (Carbonated Bottled Water, Flavoured Bottled Water, Functional Bottled Water, Still Bottled Water (Purified Water, Mineral Water, Spring Water, Plain Water)), By Packaging Material (Plastic Bottles, Glass Bottles, Metal Cans, Others (Tetra Pack Cartons, Bioplastics, etc.)), By Price Point (Mass, Premium), By Sales Channel (On Trade, Off Trade (Retail Offline, Retail Online))

- FMCG

- Feb 2026

- VI0892

- 125

-

Colombia Bottled Water Market Statistics and Insights, 2026

- Market Size Statistics

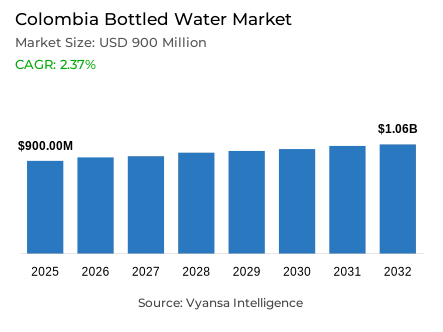

- Bottled water in Colombia is estimated at USD 900 million in 2025.

- The market size is expected to grow to USD 1.06 billion by 2032.

- Market to register a cagr of around 2.37% during 2026-32.

- Type of Water Shares

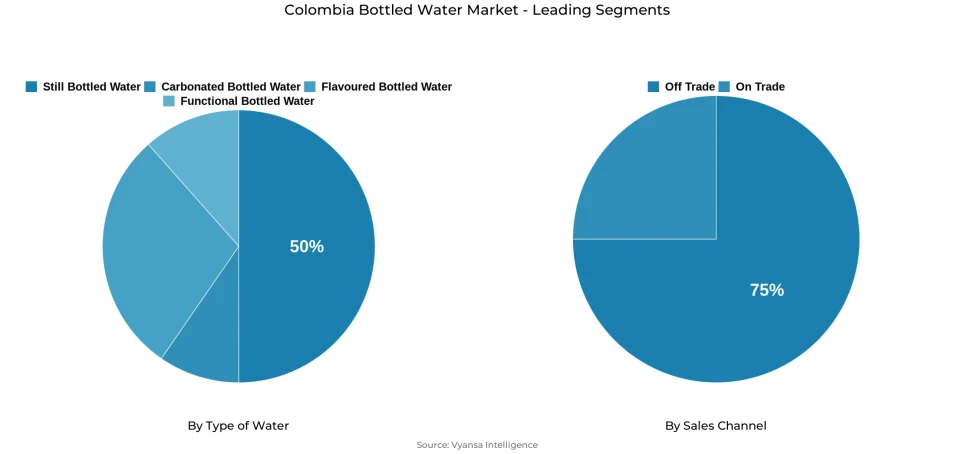

- Still bottled water grabbed market share of 50%.

- Competition

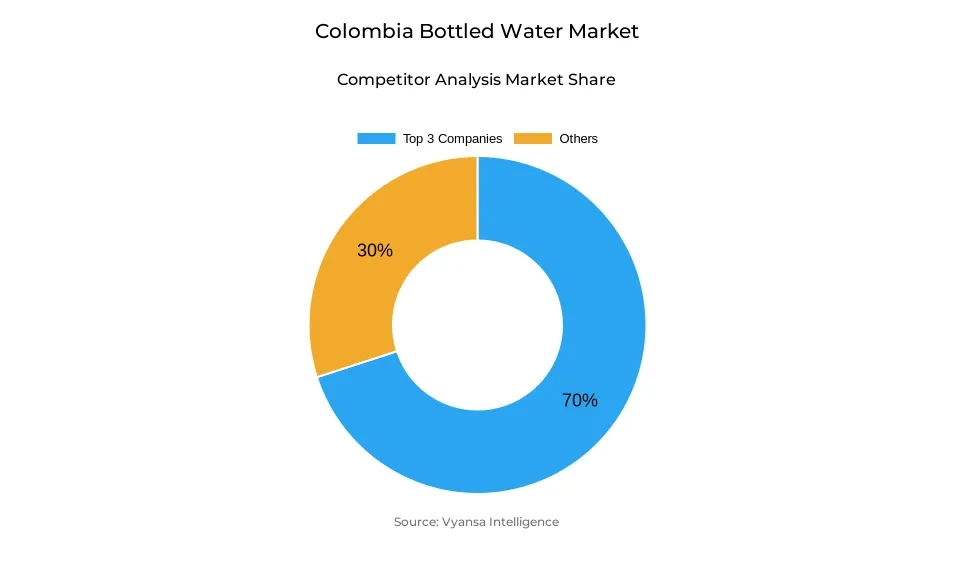

- Bottled water in Colombia is currently being catered to by more than 5 companies.

- Top 3 companies acquired around 70% of the market share.

- Ajecolombia SA; Postobón SA; Fomento Económico Mexicano SAB de CV etc., are few of the top companies.

- Sales Channel

- Off trade grabbed 75% of the market.

Colombia Bottled Water Market Outlook

The Colombia Bottled Water Market is estimated to be USD 900 million in 2025 and is expected to grow steadily to USD 1.06 billion in 2032 with a compound annual growth rate of about 2.37% in the period 2026-2032. Structural constraints in the availability of safely managed drinking water are the basic pillars of this growth outlook. Bottled water continues to be a fundamental daily hydration option to a large proportion of households with only approximately 74% of the population having access to safely managed services. It is a necessity in most areas and not a luxury item, which grounds the steady levels of demand among income groups and geographies.

This dependence is still being supported by persistent infrastructure and sanitation deficiencies. The low coverage of wastewater treatment and the risk of contamination of rivers and groundwater undermine the trust in municipal supplies, especially in regions vulnerable to industrial or urban discharge. Such circumstances limit the development of trust in tap water and maintain the position of bottled water as a safer substitute. As a result, the growth in demand is less influenced by the lifestyle changes and more by the necessity to be reliable and healthy in daily hydration.

In the general category, bottled water will continue to lead with an estimated 50% of the total market volume. Its flavorlessness, its suitability to all age groups, and its daily use in drinking and cooking make it the default choice in cases where water quality issues continue to arise. The continued focus on credibility of purification and practical packaging helps it to remain dominant in everyday household use.

Off trade channels are expected to hold approximately 75% of the total sales. Local grocers still remain important because of proximity and habitual buying, whereas supermarkets, hypermarkets, and discounters are gaining market share as end users seek value in the face of increasing prices. Retail online is a smaller yet steadily growing element, which is leading to a slow redistribution in off-trade and not a structural change out of it.

Colombia Bottled Water Market Growth DriverStructural Gaps in Safe Drinking Water Access Supporting Bottled Water Demand

The ongoing limitations to the availability of safely controlled drinking water continue to affect hydration choices across Colombia. Statistics provided by the WHO/UNICEF Joint Monitoring Programme indicate that only about 74% of the population has access to safely managed drinking water services, with almost a quarter of the population relying on other sources. In areas where the municipal networks are not available or they are not of the desired quality, the bottled water is a reliable and instant solution to the daily hydration. To many families, it offers a guarantee against health hazards associated with untreated or intermittently supplied tap water, which further solidifies its position as a basic need and not a luxury purchase.

This reliance is indicative of deeper structural failures in national water infrastructure and not temporary behavioral adaptations. With consumers seeking regular and secure hydration amidst the disproportionate service delivery, the bottled water demand is still rooted in the urban peripheries and rural areas. The ongoing infrastructure shortage provides a strong foundation that supports the consumption levels and, thus, makes bottled water a necessary alternative to the systemic water-access constraints instead of a lifestyle choice.

Colombia Bottled Water Market ChallengeInfrastructure and Sanitation Deficiencies Limiting Public Water Confidence

Although there have been gradual improvements in the development of water-infrastructure, the discrepancy in service delivery and sanitation coverage remains a critical limitation. According to national and international monitoring data, only about 17% of domestic wastewater in Colombia is treated safely, allowing untreated effluents to contaminate rivers and groundwater sources. This has a direct negative impact on the perceived safety of tap water, particularly in areas below urban centres or industrial activity, where consumers associate public supply with high contamination risk. As a result, this situation hinders the process of regaining trust in the municipal water systems.

The lack of wastewater treatment increases the public-health problems and slows the process of providing safe water to everyone. Societies with poor sanitation systems experience frequent warnings, service failures, and quality concerns that strengthen the use of bottled options. These systemic failures are a core hindrance to reducing bottled-water addiction because trust in the public systems cannot be rebuilt without corresponding improvements in treatment capacity, monitoring, and consistent service delivery across the country.

Colombia Bottled Water Market TrendHeightened Awareness of Water Quality and Health Protection Needs

Growing awareness of environmental degradation and water-quality risks is transforming hydration practices in Colombia. Environmental surveillance shows that only about 53% of the evaluated water bodies meet the acceptable ambient water-quality standards, highlighting the continued pressure of pollution. This knowledge is disseminated in the popular press, and it strengthens the belief that natural and urban water sources are under constant contamination. To this end, bottled water is increasingly being perceived by consumers as a regulated and reliable alternative that reduces exposure to health hazards related to compromised sources.

This shift is indicative of a more general shift towards precautionary consumption, as opposed to reactive behaviour. Families are focusing on hydration options that provide reliability and perceived security despite changes in the supply in the community. Bottled water meets these expectations by providing standard quality and traceability. The trend underscores the active role of environmental realities and health consciousness in shaping demand trends, which in turn supports the role of bottled water in the modern hydration trends.

Colombia Bottled Water Market OpportunityTrust-Based Positioning Through Quality Assurance and Transparency

The continued lack of reliability in the water supply of the population opens clear prospects to the bottled-water companies to strengthen their long-term applicability. By focusing on high-quality assurance, open sourcing, and compliance with global safety standards, brands can stand out in a market that is sensitive to trust. In areas where the public systems cannot guarantee quality, bottled water with verifiable purity standards can build trust among consumers who desire reliable daily hydration. This strategic focus matches product value to current public-health issues.

Moreover, product characteristics, there is additional growth potential in proactive communication regarding water safety and quality standards. Educational programs that explicitly describe the testing procedures, source protection, and health protection appeal to families that have to deal with unpredictable water conditions. Suppliers can enhance loyalty and credibility by aligning brand stories with larger water safety goals and community involvement.

Colombia Bottled Water Market Segmentation Analysis

By Type of Water

- Carbonated Bottled Water

- Flavoured Bottled Water

- Functional Bottled Water

- Still Bottled Water

- Purified Water

- Mineral Water

- Spring Water

- Plain Water

Still Bottled Water holds the highest share in the Colombia Bottled Water Market, accounting for approximately 50% of total market share. Its leadership stems from its role as the most basic and universally accepted hydration option for everyday use. End users prioritize still water due to its neutral taste, suitability across all age groups, and alignment with routine household consumption. In areas where confidence in tap water quality is low, still water becomes the default choice for drinking, cooking, and regular hydration, reinforcing its dominance within the overall category.

Ongoing innovation within this segment further sustains its market position. Producers emphasize purification processes, natural source credibility, and convenient packaging formats that support both home storage and on-the-go usage. These attributes ensure still bottled water remains embedded in daily consumption habits, positioning it as the backbone of bottled water demand across diverse income groups and geographic regions.

By Sales Channel

- On Trade

- Off Trade

- Retail Offline

- Retail Online

Off Trade channels collectively account for approximately 75% of bottled water sales in the Colombia Bottled Water Market, encompassing traditional trade, modern retail, discounters, and retail online platforms. Small local grocers remain the largest single contributor within off-trade due to dense neighborhood coverage and habitual purchasing patterns among end users. However, their share is gradually declining as rising beverage prices following the health tax push households toward more value-oriented retail formats. Supermarkets and hypermarkets are increasingly capturing volume by offering price transparency, bulk purchasing options, and stronger promotional mechanics that appeal to cost-conscious end users.

Within the off-trade structure, discounters such as D1 and Ara are the primary growth engines. Their rapid store expansion, consistently low pricing, and high traffic flows are attracting both branded suppliers and price-sensitive end users. Retail online, while still a small component of off-trade, is gaining traction through convenience, targeted discounts, and sponsored product placements on platforms such as Éxito. Together, these shifts indicate a gradual redistribution of share within off-trade rather than a structural channel displacement.

List of Companies Covered in Colombia Bottled Water Market

The companies listed below are highly influential in the Colombia bottled water market, with a significant market share and a strong impact on industry developments.

- Ajecolombia SA

- Postobón SA

- Fomento Económico Mexicano SAB de CV

Competitive Landscape

Colombia’s bottled water market is led by Postobón, which maintains dominance through its extensive distribution network reaching over 430,000 points of sale, with strong penetration in small local grocers. Its kid-focused flavoured range, Agua Cristal Saborizada, has reinforced brand relevance among families by combining health positioning with playful flavours and formats. At the same time, private label has emerged as the fastest-growing competitive force, driven by aggressive pricing and simple flavour variety. Discounters such as D1, through its OMI brand, have gained traction by offering significantly cheaper flavoured water options in multiple sizes, making private labels attractive across income groups and intensifying price-based competition against established national brands.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Colombia Bottled Water Market Policies, Regulations, and Standards

4. Colombia Bottled Water Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Colombia Bottled Water Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Volume (Million Litres)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Type of Water

5.2.1.1. Carbonated Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Flavoured Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Functional Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Still Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Purified Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Mineral Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Spring Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Plain Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Packaging Material

5.2.2.1. Plastic Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Glass Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Metal Cans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Others (Tetra Pack Cartons, Bioplastics, etc.)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Point

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. On Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Off Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Colombia Carbonated Bottled Water Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Volume (Million Litres)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Colombia Flavoured Bottled Water Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Volume (Million Litres)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Colombia Functional Bottled Water Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Volume (Million Litres)

8.2. Market Segmentation & Growth Outlook

8.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Colombia Still Bottled Water Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Volume (Million Litres)

9.2. Market Segmentation & Growth Outlook

9.2.1.By Type of Water- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Price Point- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Postobón SA

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Fomento Económico Mexicano SAB de CV

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Ajecolombia SA

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Type of Water |

|

| By Packaging Material |

|

| By Price Point |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.