Global Cobalt Alloy Powder Market Report: Trends, Growth and Forecast (2026-2032)

By Composition (High-Speed Steel, Superalloys, Magnetic Alloys), By Application (Aerospace, Medical Implants, Power Generation, Tooling), By Alloy Type (Cobalt-Chromium Alloys, Cobalt-Nickel Alloys, Cobalt-Iron Alloys, Cobalt-Molybdenum Alloys, Others), By Production Method (Atomization (Gas, Water, Plasma), Chemical Reduction, Electrolytic Methods, Mechanical Alloying), By Region (North America, Latin America, Europe, Middle East & Africa, Asia Pacific)

- Chemical

- Jan 2026

- VI0836

- 215

-

Global Cobalt Alloy Powder Market Statistics and Insights, 2026

- Market Size Statistics

- Global cobalt alloy powder market is estimated at USD 41.23 billion in 2025.

- The market size is expected to grow to USD 55.94 billion by 2032.

- Market to register a CAGR of around 4.46% during 2026-32.

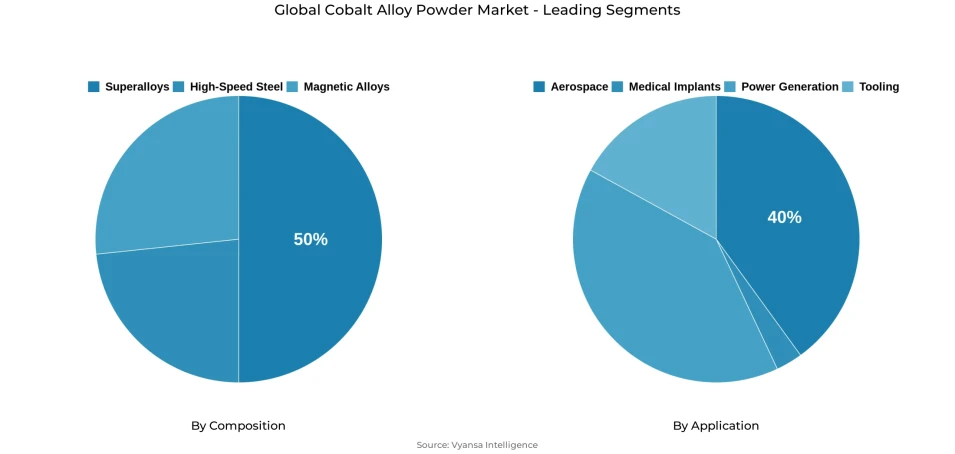

- Composition Shares

- Superalloys grabbed market share of 50%.

- Competition

- Global cobalt alloy powder market is currently being catered to by more than 25 companies.

- Top 5 companies acquired around 50% of the market share.

- Hitachi Metals; Global Tungsten & Powders; Heraeus Holding; Carpenter Technology; Sandvik Materials Technology etc., are few of the top companies.

- Application

- Aerospace grabbed 40% of the market.

- Region

- North America leads with a 40% share of the global market.

Global Cobalt Alloy Powder Market Outlook

The global Cobalt Alloy powder market is expected to experience a stable growth in the period between 2026 and 2032, which is supported by the continued demand in the aerospace, defense, and advanced mobility industries. The essential role of cobalt-based superalloys is still highlighted by high-performance requirements in aircraft turbine engines, propulsion systems, and critical structural components. The market is estimated at USD 41.23 billion in 2025 and is estimated to grow to USD 55.94 billion in 2032 at a CAGR of about 4.46%. The long-term demand fundamentals in high-temperature and high-stress applications are further supported by concomitant growth in electric mobility and power generation.

The benefits of material performance remain a key to market stability. Cobalt alloys have melting points exceeding 1,300°C and are more resistant to corrosion, fatigue and thermal cycling, making them suitable in extreme operating conditions. The compositional market is dominated by superalloys, which constitute about 50% of the total market demand, thus indicating their established application in aerospace engines, industrial gas turbines, and defense propulsion systems. Although short-term pricing pressure is caused by refined cobalt surpluses, long-cycle aerospace programs and specification-based procurement maintain demand continuity.

Application wise, aerospace is the biggest segment with about 40% of the world market. Demand is pegged on commercial aircraft recovery, military modernization programmes and the ongoing development of high efficiency propulsion systems. Additive manufacturing adoption also supports the consumption of cobalt alloy powders by allowing the creation of complex, lightweight parts with less material waste and reduced lead times, especially in low-volume, high-complexity aerospace and defense applications.

North America dominates the global market with an estimated 40% share regionally, supported by a well-established aerospace and defence ecosystem, stable defence expenditure, and high-tech manufacturing capabilities. Long-term supply security and market resilience are supported by stable consumption patterns, policy support of domestic processing and recycling. Although the Asia-Pacific and European regions are still significant as secondary markets, the industrial depth and specification-based demand in North America still support the global market growth up to 2032.

Global Cobalt Alloy Powder Market Growth Driver

Aerospace and Advanced Mobility Anchoring Long-Term Demand

The robust growth in the aerospace, defense, and advanced mobility industries remains the foundation of the long-term growth in the Global Cobalt Alloy Powder Market. The cobalt-based superalloys have become essential materials due to high-performance requirements in aircraft turbine engines, propulsion systems, and other critical structural components. By 2023, almost half of the U.S. cobalt usage was in superalloys, indicating a deep-rooted dependency in aerospace production. Similar increases in electric mobility also support the fundamentals of demand, as the global electric-vehicle fleet is expected to grow to about 250 million units by 2030 and EV battery demand is expected to grow by about 340 GWh to over 3,500 GWh by 2030. These intersecting curves enhance downstream cobalt alloys demand in aerospace propulsion, power generation, and sophisticated industrial systems.

Cobalt superalloys provide high performance in high operating temperatures with a high melting point of more than 1,300°C and high corrosion and fatigue resistance. In 2023, the world production of cobalt mines was approximately 230 000 tonnes, with more than 80 000 tonnes of this produced in the Democratic Republic of Congo and Indonesia, which serve as the primary suppliers of the high-value applications. Aircraft manufacturers, gas turbine manufacturers, and integrators of renewable-energy systems still use cobalt alloys to design lightweight, high-duty components that can be exposed to high temperatures over extended periods. The market share of about 40% of North America and the consistent consumption trends with superalloys constituting approximately half of domestic consumption support the sustainability of demand in the well-established aerospace and defence value chains.

Global Cobalt Alloy Powder Market Challenge

Structural Supply Risks and Pricing Instability Constraining Visibility

The Global Cobalt Alloy Powder Market is faced with structural weaknesses in its supply chain that have continued to pose a limitation to the market, mainly due to geographic concentration and high price volatility. Approximately 75% of mined cobalt in the world is produced in the Democratic Republic of Congo, and over 75% of all refined cobalt in the world is processed in China, thus posing high geopolitical and supply-chain risk. This concentration makes long-term sourcing plans of alloy-powder manufacturers and end users, especially those with fixed-price or long-cycle aerospace contracts, difficult. Uncertainty is also enhanced by financial-market forces, whereby cobalt prices are volatile by an estimated 75% more than crude oil, which increases vulnerability to speculative trading and cost-forecasting issues.

These pressures have been exacerbated by market imbalances with refined cobalt going into 2025 with an estimated surplus of about 27,000 metric tonnes, a situation that is likely to continue until 2028. The pace of aggressive expansion of Chinese refiners and Indonesian producers has exceeded the growth in demand in the near term in battery and alloy applications, putting a long-term downward pressure on prices and margins. In developed markets like the United States, recycling only supplies about 25% of the cobalt usage, which restricts the flexibility of secondary-supplies. The piling up of inventories in Asia also limit the stability of prices, which discourage investment in new processing and alloy-powder capacity despite the underlying fundamentals of structural demand in the long run.

Global Cobalt Alloy Powder Market Trend

Precision Manufacturing and Additive Technologies Reshaping Demand

Additive manufacturing is becoming a structurally significant catalyst of demand in the Global Cobalt Alloy Powder Market, especially in aerospace, defense, and high-value industrial markets. Cobalt-based superalloys and cobalt-chromium powders are also becoming a choice of advanced manufacturing because of their high thermal stability, strength, and wear resistance in extreme conditions. The use of 3-D printing technologies has been accelerated by the need by manufacturers to have design flexibility, material efficiency and rapid prototyping capabilities that cannot be achieved through traditional casting methods. Early adopters have been aerospace and defense programs, with low volume and high complexity components, which has further supported the need to have tightly controlled powder specifications and high-quality cobalt alloys.

The laser powder-bed fusion and directed-energy deposition techniques are becoming popular in the manufacture of turbine blades, engine components, and complex structural parts with little wastage of materials. Additive methods also minimise tooling needs and lead times compared to traditional manufacturing, which is in line with industry priorities of cost optimisation and supply-chain resilience. Cobalt alloys are always superior to pure metals in terms of thermal cycling and corrosive environment, which justifies their use in aerospace propulsion, energy systems, and medical devices. This technological change is a structural change over the long term, which places precision cobalt-alloy powders as high-margin products in high-technology manufacturing systems.

Global Cobalt Alloy Powder Market Opportunity

Circular Economy Integration and End-Market Diversification Potential

The development of battery recycling facilities is a major strategic potential of the Global Cobalt Alloy Powder Market as it will decrease reliance on primary mining and increase the supply sources. Currently, advanced hydrometallurgical and pyrometallurgical processes are able to recover minerals at a rate of between 80% and 95%, and the most successful operators are able to record recovery efficiencies of over 99% of cobalt and nickel. Energy-transition calculations suggest that recycling would be able to cover almost 40% of primary cobalt demand in the next decade and possibly meet up to 80% of demand by 2050, assuming scale-up of collection and investment in processing. These forces create avenues where alloy-powder manufacturers can have access to stable secondary feedstock by vertical integration or long-term recycling agreements.

The estimated growth of the global electric-vehicle fleet to about 250 million units by 2030 will create a large amount of end-of-life batteries in recycling streams since 2032, which will create a predictable secondary cobalt supply. New markets in Asia-Pacific and Latin America provide further growth opportunities, with cobalt-alloy powders finding use in renewable-energy systems, industrial machinery, and sophisticated automotive systems. In North America, where it has approximately 40% market share, policy frameworks like the Inflation Reduction Act are encouraging domestic recycling and processing investments, and thus improving the business case of circular supply chains and increasing long-term supply security to end users.

Global Cobalt Alloy Powder Market Regional Analysis

By Region

- North America

- Latin America

- Europe

- Middle East & Africa

- Asia Pacific

North America leads the Global Cobalt Alloy Powder Market with an estimated 40% share, supported by a deeply entrenched aerospace and defense ecosystem and advanced manufacturing infrastructure. The United States hosts major aircraft and engine manufacturers, including Boeing, Lockheed Martin, GE Aviation, and Pratt & Whitney, alongside a dense network of specialized suppliers concentrated in states such as California, Connecticut, and Texas. Regional demand is reinforced by consistent defense spending, commercial aviation programs, and regulatory incentives promoting domestic processing and recycling. Canada further strengthens regional supply, producing over 5,000 tonnes of cobalt concentrate in 2023, a year-on-year increase of approximately 44%.

Asia-Pacific and Europe represent secondary hubs with distinct dynamics. China dominates refined cobalt processing and battery manufacturing, consuming the majority of refined cobalt while expanding domestic alloy powder capacity for aerospace and automotive use. Europe maintains steady demand from aerospace suppliers, energy systems, and medical device manufacturers but remains import-dependent for primary cobalt. While North America reflects industrial maturity and pricing stability, Asia-Pacific’s rapid industrialization and cost advantages signal long-term competitive pressures, underscoring the importance of technical differentiation and supply chain security for Western suppliers.

Global Cobalt Alloy Powder Market Segmentation Analysis

By Composition

- High-Speed Steel

- Superalloys

- Magnetic Alloys

Superalloys represent the largest share within the composition segment of the Global Cobalt Alloy Powder Market, accounting for approximately 50% of total demand. Their dominance reflects irreplaceable performance advantages in aerospace, defense, and high-temperature industrial applications where operational requirements exceed the capabilities of alternative alloy systems. Cobalt-based superalloys deliver superior creep resistance, corrosion protection, and thermal fatigue endurance compared to nickel-based counterparts, justifying their widespread specification in aircraft engines, industrial gas turbines, and military propulsion systems. Typical compositions include nickel-cobalt-chromium matrices strengthened with tungsten and molybdenum, optimized for continuous operation beyond 1,100°C under severe mechanical stress.

Remaining composition segments collectively account for the other 50% of market share and include cobalt-chrome medical grades, wear-resistant cutting tool alloys, and emerging additive manufacturing-specific powders. Cobalt-chrome compositions support orthopedic implants and surgical instruments requiring biocompatibility and corrosion resistance, while cutting tool alloys serve industrial machining applications. Additive manufacturing grades are gaining traction but remain comparatively smaller in volume. Despite diversification, superalloys retain structural dominance due to their unmatched suitability for load-bearing, high-temperature environments, ensuring continued leadership within the composition landscape.

By Application

- Aerospace

- Medical Implants

- Power Generation

- Tooling

Other application segments collectively account for around 60% of demand and include industrial gas turbines, automotive components, medical implants, and cutting tools. Power generation operators specify cobalt alloys for stationary turbine components, while automotive suppliers adopt cobalt-chromium alloys for turbocharger and performance engine parts. Medical device manufacturers rely on cobalt-chrome powders for implants and dental prosthetics, benefiting from premium pricing and regulatory insulation. Additive manufacturing adoption across aerospace and medical applications further supports incremental demand growth by enabling complex geometries and weight optimization for high-value end users.

Market Players in Global Cobalt Alloy Powder Market

These market players maintain a significant presence in the Global cobalt alloy powder market sector and contribute to its ongoing evolution.

- Hitachi Metals

- Global Tungsten & Powders

- Heraeus Holding

- Carpenter Technology

- Sandvik Materials Technology

- Allegheny Technologies

- VDM Metals

- Aperam

- Sumitomo Metal Mining

- JFE Chemical

- Tanaka Chemical

- Resonac Holdings

- L&F Co.

- JFE Steel

- 3M

Market News & Updates

- Carpenter Technology Corporation, 2025:

Carpenter Technology Corporation advanced its cobalt-base metal powder portfolio engineered specifically for high-performance aerospace, medical, orthopedic, oil and gas, and industrial applications with documented superior wear, erosion resistance, and temperature performance characteristics. In October 2025, the company issued powder surcharge notices for iron and cobalt-based powder products reflecting volatile market pricing dynamics and raw material cost fluctuations. The company maintained its established position as a leading U.S. specialty materials producer serving the additive manufacturing, aerospace, and medical device markets, with cobalt alloy powders meeting stringent military and aerospace qualification standards that enable critical applications in defense systems and high-reliability industries.

- Allegheny Technologies Inc. (ATI), 2025:

Allegheny Technologies reported a titanium melting expansion facility at Richland, Washington, which became operational at the end of 2024 with product qualifications ongoing through 2025, achieving a 35% increase in aerospace and defense-grade titanium bar production above 2022 baseline levels. The company strengthened its market position through strategic acquisitions bolstering its titanium and stainless steel capabilities, while focusing development efforts on high-performance alloy powders specifically engineered for demanding aerospace applications including cobalt-based specialty alloys serving fighter jet engines and defense systems. Sales revenues reflected robust growth in both aerospace and energy sectors during 2025, underpinned by increased demand for premium specialty materials across these critical end-markets.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Cobalt Alloy Powder Market Policies, Regulations, and Standards

4. Global Cobalt Alloy Powder Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Cobalt Alloy Powder Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Composition

5.2.1.1. High-Speed Steel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Superalloys- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Magnetic Alloys- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Aerospace- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Medical Implants- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Power Generation- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Tooling- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Alloy Type

5.2.3.1. Cobalt-Chromium Alloys- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Cobalt-Nickel Alloys- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Cobalt-Iron Alloys- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Cobalt-Molybdenum Alloys- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Production Method

5.2.4.1. Atomization (Gas, Water, Plasma)- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Chemical Reduction- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Electrolytic Methods- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Mechanical Alloying- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Region

5.2.5.1. North America

5.2.5.2. Latin America

5.2.5.3. Europe

5.2.5.4. Middle East & Africa

5.2.5.5. Asia Pacific

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. North America Cobalt Alloy Powder Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Composition- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Alloy Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Production Method- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Country

6.2.5.1. US

6.2.5.2. Canada

6.2.5.3. Mexico

6.2.5.4. Rest of North America

6.3. US Cobalt Alloy Powder Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in USD Million

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Cobalt Alloy Powder Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in USD Million

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Cobalt Alloy Powder Market Statistics, 2022-2032F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in USD Million

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

7. Latin America Cobalt Alloy Powder Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Composition- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Alloy Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Production Method- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Country

7.2.5.1. Brazil

7.2.5.2. Rest of Latin America

7.3. Brazil Cobalt Alloy Powder Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in USD Million

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8. Europe Cobalt Alloy Powder Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Composition- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Alloy Type- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Production Method- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Country

8.2.5.1. Germany

8.2.5.2. France

8.2.5.3. UK

8.2.5.4. Italy

8.2.5.5. Spain

8.2.5.6. Netherlands

8.2.5.7. Belgium

8.2.5.8. Russia

8.2.5.9. Poland

8.2.5.10. Turkey

8.2.5.11. Rest of Europe

8.3. Germany Cobalt Alloy Powder Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in USD Million

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.4. France Cobalt Alloy Powder Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in USD Million

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.5. UK Cobalt Alloy Powder Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in USD Million

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.6. Italy Cobalt Alloy Powder Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in USD Million

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.7. Spain Cobalt Alloy Powder Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in USD Million

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.8. Netherlands Cobalt Alloy Powder Market Statistics, 2022-2032F

8.8.1.Market Size & Growth Outlook

8.8.1.1. By Revenues in USD Million

8.8.2.Market Segmentation & Growth Outlook

8.8.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

8.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.9. Belgium Cobalt Alloy Powder Market Statistics, 2022-2032F

8.9.1.Market Size & Growth Outlook

8.9.1.1. By Revenues in USD Million

8.9.2.Market Segmentation & Growth Outlook

8.9.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

8.9.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.10. Russia Cobalt Alloy Powder Market Statistics, 2022-2032F

8.10.1. Market Size & Growth Outlook

8.10.1.1. By Revenues in USD Million

8.10.2. Market Segmentation & Growth Outlook

8.10.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

8.10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.11. Poland Cobalt Alloy Powder Market Statistics, 2022-2032F

8.11.1. Market Size & Growth Outlook

8.11.1.1. By Revenues in USD Million

8.11.2. Market Segmentation & Growth Outlook

8.11.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

8.11.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.12. Turkey Cobalt Alloy Powder Market Statistics, 2022-2032F

8.12.1. Market Size & Growth Outlook

8.12.1.1. By Revenues in USD Million

8.12.2. Market Segmentation & Growth Outlook

8.12.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

8.12.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9. Middle East & Africa Cobalt Alloy Powder Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Composition- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Alloy Type- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Production Method- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Country

9.2.5.1. UAE

9.2.5.2. Saudi Arabia

9.2.5.3. Rest of Middle East & Africa

9.3. UAE Cobalt Alloy Powder Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in USD Million

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.4. Saudi Arabia Cobalt Alloy Powder Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in USD Million

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10. Asia Pacific Cobalt Alloy Powder Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Alloy Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Production Method- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Country

10.2.5.1. China

10.2.5.2. Japan

10.2.5.3. South Korea

10.2.5.4. India

10.2.5.5. Australia

10.2.5.6. Thailand

10.2.5.7. Rest of Asia Pacific

10.3. China Cobalt Alloy Powder Market Statistics, 2022-2032F

10.3.1. Market Size & Growth Outlook

10.3.1.1. By Revenues in USD Million

10.3.2. Market Segmentation & Growth Outlook

10.3.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

10.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.4. Japan Cobalt Alloy Powder Market Statistics, 2022-2032F

10.4.1. Market Size & Growth Outlook

10.4.1.1. By Revenues in USD Million

10.4.2. Market Segmentation & Growth Outlook

10.4.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

10.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.5. South Korea Cobalt Alloy Powder Market Statistics, 2022-2032F

10.5.1. Market Size & Growth Outlook

10.5.1.1. By Revenues in USD Million

10.5.2. Market Segmentation & Growth Outlook

10.5.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

10.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.6. India Cobalt Alloy Powder Market Statistics, 2022-2032F

10.6.1. Market Size & Growth Outlook

10.6.1.1. By Revenues in USD Million

10.6.2. Market Segmentation & Growth Outlook

10.6.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

10.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.7. Australia Cobalt Alloy Powder Market Statistics, 2022-2032F

10.7.1. Market Size & Growth Outlook

10.7.1.1. By Revenues in USD Million

10.7.2. Market Segmentation & Growth Outlook

10.7.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

10.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.8. Thailand Cobalt Alloy Powder Market Statistics, 2022-2032F

10.8.1. Market Size & Growth Outlook

10.8.1.1. By Revenues in USD Million

10.8.2. Market Segmentation & Growth Outlook

10.8.2.1. By Composition- Market Insights and Forecast 2022-2032, USD Million

10.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Carpenter Technology

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Sandvik Materials Technology

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Allegheny Technologies

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. VDM Metals

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Aperam

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Hitachi Metals

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Global Tungsten & Powders

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Heraeus Holding

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Sumitomo Metal Mining

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. JFE Chemical

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

11.1.11. Tanaka Chemical

11.1.11.1.Business Description

11.1.11.2.Product Portfolio

11.1.11.3.Collaborations & Alliances

11.1.11.4.Recent Developments

11.1.11.5.Financial Details

11.1.11.6.Others

11.1.12. Resonac Holdings

11.1.12.1.Business Description

11.1.12.2.Product Portfolio

11.1.12.3.Collaborations & Alliances

11.1.12.4.Recent Developments

11.1.12.5.Financial Details

11.1.12.6.Others

11.1.13. L&F Co.

11.1.13.1.Business Description

11.1.13.2.Product Portfolio

11.1.13.3.Collaborations & Alliances

11.1.13.4.Recent Developments

11.1.13.5.Financial Details

11.1.13.6.Others

11.1.14. JFE Steel

11.1.14.1.Business Description

11.1.14.2.Product Portfolio

11.1.14.3.Collaborations & Alliances

11.1.14.4.Recent Developments

11.1.14.5.Financial Details

11.1.14.6.Others

11.1.15. 3M

11.1.15.1.Business Description

11.1.15.2.Product Portfolio

11.1.15.3.Collaborations & Alliances

11.1.15.4.Recent Developments

11.1.15.5.Financial Details

11.1.15.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Composition |

|

| By Application |

|

| By Alloy Type |

|

| By Production Method |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.