China Jewellery Market Report: Trends, Growth and Forecast (2026-2032)

Category (Costume Jewellery, Fine Jewellery), Type (Earrings, Neckwear, Rings, Wristwear, Other), Collection (Diamond, Non-Diamond), Material Type (Gold, Platinum, Metal Combination, Silver), Sales Channel (Retail Offline, Retail Online), End User (Men, Women)

- FMCG

- Dec 2025

- VI0619

- 130

-

China Jewellery Market Statistics and Insights, 2026

- Market Size Statistics

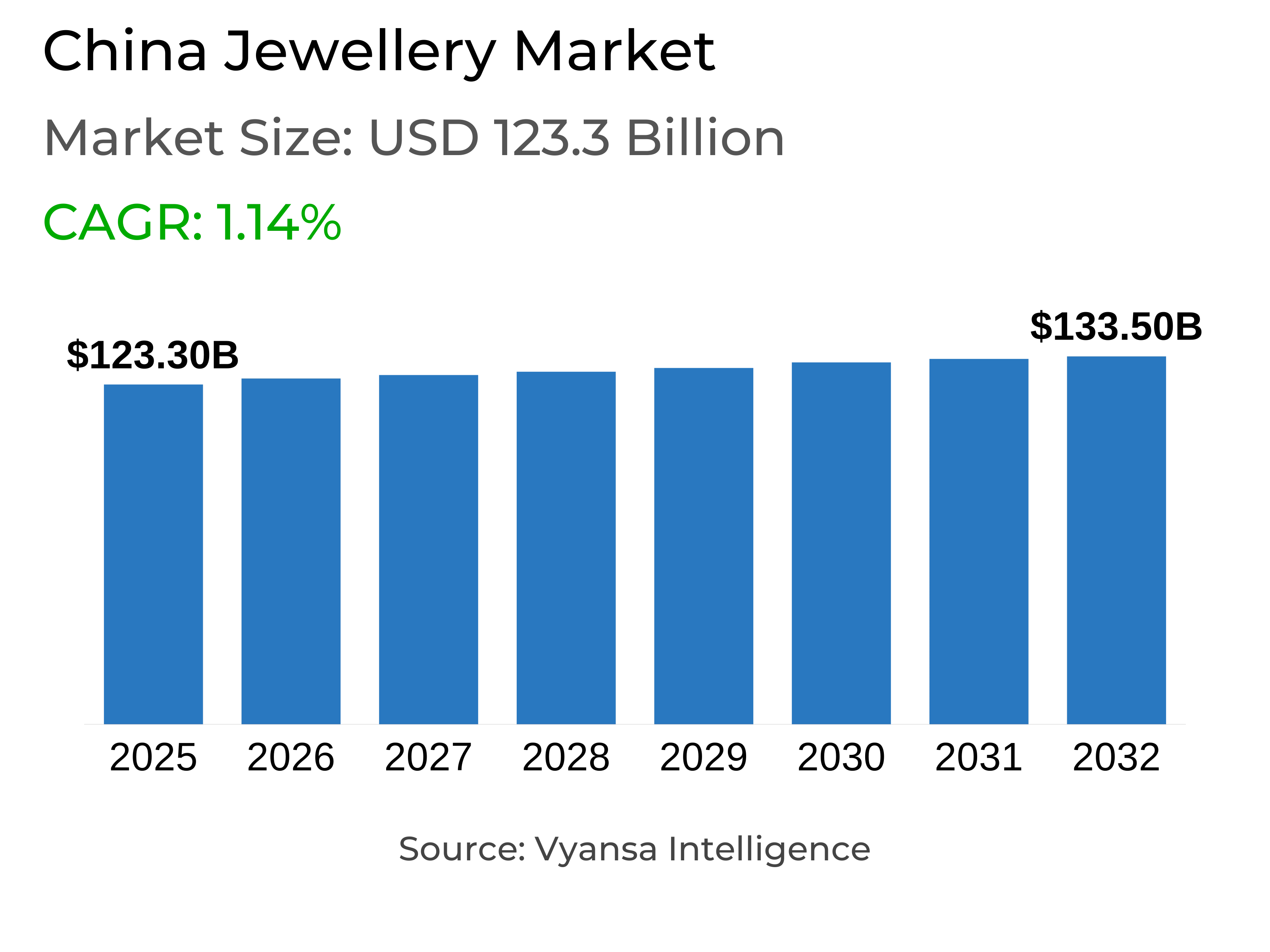

- Jewellery in china is estimated at USD 123.3 billion.

- The market size is expected to grow to USD 133.5 billion by 2032.

- Market to register a cagr of around 1.14% during 2026-32.

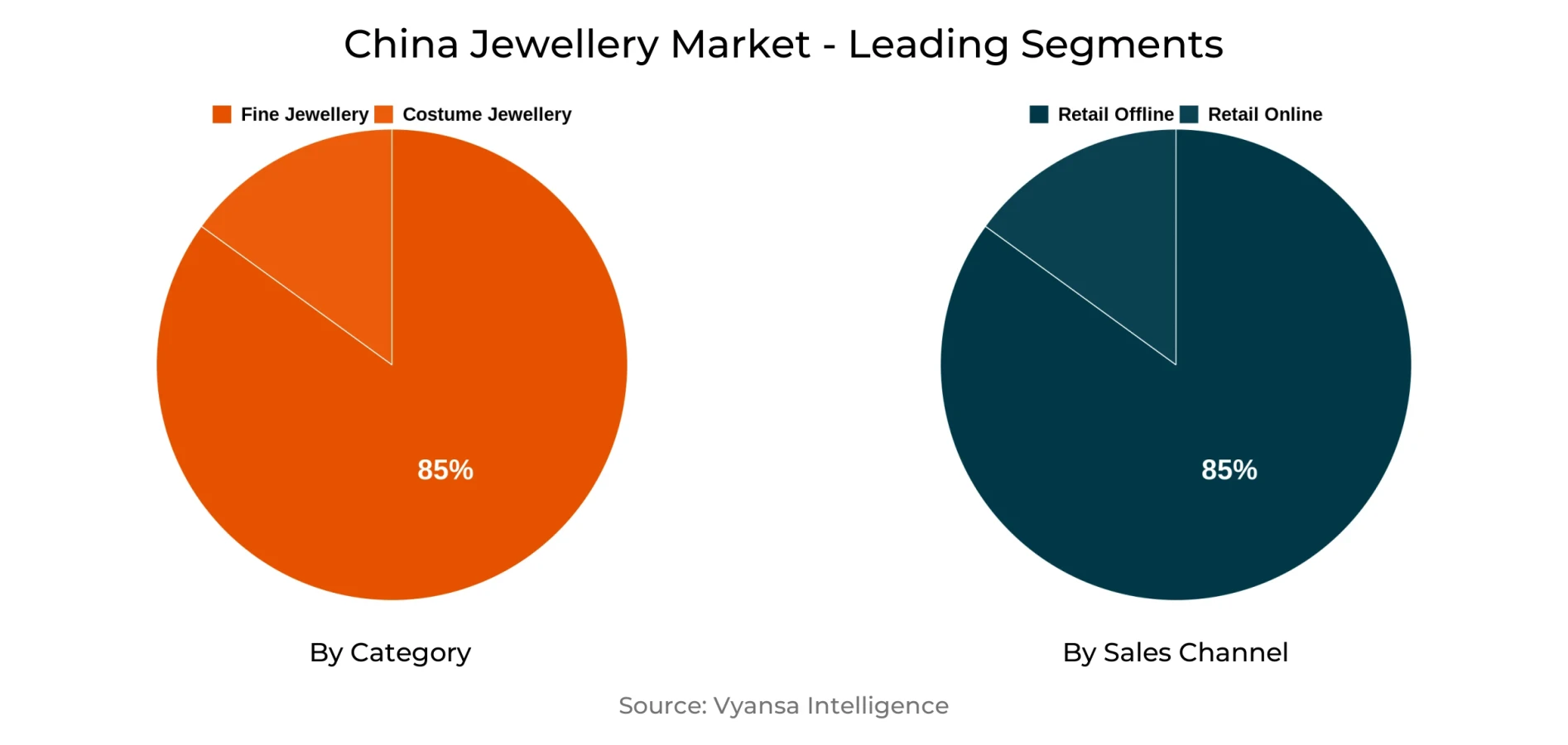

- Category Shares

- Fine jewellery grabbed market share of 85%.

- Fine jewellery to witness a volume cagr of around 2.58%.

- Competition

- More than 20 companies are actively engaged in producing jewellery in china.

- Top 5 companies acquired around 30% of the market share.

- Compagnie Financière Richemont SA, Chow Sang Sang Holdings International Ltd, Tiffany & Co, Chow Tai Fook Jewellery Group Ltd, Lao Feng Xiang Co Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

China Jewellery Market Outlook

The jewellery market in China is valued at around USD 123.3 billion in 2025 and is expected to reach to around USD 133.5 billion by 2032, growing at a CAGR of around 1.14% during 2026-2032. Growth is supported by rising gold prices, improving domestic demand, and strong cultural pride. Fine jewellery dominates the market and accounts for around 85% share as end user sees it as priceless, collectable, and long lasting. Gold is still the most favored metal, while high end custom jewellery pieces continue to attract wealthy buyers.

Cultural influence plays a big role in shaping jewellery choices. The “Modern Chinese Style” trend, which combines traditional elements like gold, jade, and pearls with modern designs, is becoming more popular. End users continues to favor jewellery that symbolizes Chinese heritage and individuality, enabling brands to connect more deeply with them.

Retail offline channels remain dominant, accounting for around 85% of total sales. prefer physical stores where they can see and touch the jewellery before buying. However, retail e-commerce platforms and live streaming are gradually increasing, particularly for lower end costume jewellery items. This mix of retail offline trust and retail e-commerce engagement will shape how jewellery is sold in the future.

Competition in the market is moderate, with the top five companies holding around 30% of the total share. Most local and international brands are competing with design innovation, digital marketing, and cultural storytelling. Those brands that have a blend of heritage and modern style are likely to perform well in the future years.

China Jewellery Market Growth Driver

Growing Demand Supported by Rising Gold Prices and Cultural Pride

Demand for Jewellery is increasing as more end users choose to shop locally and spend on quality pieces. Increased gold prices and stable return of end user confidence are contributing to the growth of the market. Fine jewellery continues to out perform costume jewellery because it is seen as valuable, collectible, and easy to customise. Luxury products remain in favor among wealthy end users who seek exclusive and meaningful designs.

Meanwhile, the emergence of the "Modern Chinese Style" is influencing jewellery selection. End users are showing more pride in Chinese culture and prefer designs that reflect traditional elements. Bangles and other cultural heritage inspired pieces are getting more popular than Western designs. This combination of cultural pride and popularity of gold is fueling consistent growth in the nation's jewellery market.

China Jewellery Market Challenge

Cooling Demand for Pearl and Jade Jewellery Limits Growth

Pearl and jade jewellery are now experiencing weaker demand after an earlier period of strong interest. Many end users rushed to buy pearls due to worries about future quality, which reduced later sales and created a gap in ongoing demand. Much of the market's buying power has been consumed by the initial round of purchases and is now resulting in slower movement in stores. In addition, some high end pearl buyers are now purchasing from Japan because of better exchange rates, which is further reducing local sales and eroding market confidence.

At the same time, jade jewellery is also under the same pressure. Although jade is still a favored material and in great demand in the resale market, this has led to decline in the prices of new pieces. Lower first hand prices and less new purchases are holding back the overall jewellery market, keeping overall growth slower and more uncertain in the forecast period.

China Jewellery Market Trend

Strategic Brand Upgrades to Attract Generation Z

Fashion jewellery brands are turning their attention to strategic refreshment in order to better appeal the Generation Z, whose influence in the market is growing rapidly. This generation likes gather information about the products online, is practical in its approach towards brand names, and tends to be less brand loyal compared to older groups. Brands are turning to more innovative, digital, and interactive marketing techniques in order to get their attention. Social media interaction, influencer partnerships, and unique online experiences are becoming valuable means of establishing early trust and relation with such young end users.

Moreover, unlike Millennials, who primarily value personalization, Generation Z is more interested in brand culture and social significance. Because jewellery can help individuals reflect who they are, brands are reforming their image to reflect cultural awareness and authenticity. Many are focusing on environmental actions, supporting the community, and other meaningful causes and combining these efforts with product designs to fit Gen Z's strong sense of values and social responsibility.

China Jewellery Market Opportunity

Rising Demand for Modern Chinese Style Designs

Jewellery brands have tremendous growth potential by focusing on designs that are inspired by Chinese culture. End users are becoming interested in items that feature traditional elements like gold, jade, pearls, and bangles presented in modern wats. By blending these cultural traits with new and innovative designs, brands will be able to appeal to both young and old generations that appreciate meaning and personal style together.

This emphasis allows brands to differentiate themselves within a competitive marketplace and charge higher pricing for culturally rich designs. With increasing pride in Chinese heritage, more end users are likely to choose jewellery that connects personal expression with cultural identity. Brands that offer this harmony between tradition and modern designs are likely to see steady growth in the future.

China Jewellery Market Segmentation Analysis

By Category

- Costume Jewellery

- Fine Jewellery

The segment with the highest share under the category type is Fine Jewellery, holding around 85% of the total market. The segment remains on the top position due to the strong demand for gold and other precious materials, which are perceived as luxury goods as well as secure investments. Fine jewellery is favored by end users because of its collectible and customizable nature, and hence it is more resilient even during periods of weak purchasing power. Luxury items, particularly those crafted from gold, are still in demand among wealthy end users who are concerned with quality and long term value.

Costume jewellery, while more affordable, accounts for a lower percentage as it experiences low growth due to declining end user confidence. End users are opting for symbolic purchases that reflects cultural and emotional value over short term fashion. Consequently, fine jewellery continues to dominate the market and is expected to maintain its leading position throughout the forecast period.

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share under the sales channel is Retail Offline, accounting for around 85% of the market. Due to the unique nature of jewellery, most end users still prefer buying in physical stores. Jewellery is a high value product where direct contact, visual inspection, and trust in quality are the plays an important factors in influencing buying decisions. This in person experience makes end users more confident in materials, design, and authenticity, which retail e-commerce channels cannot yet compete with. Therefore, retail offline channels remain dominant in terms of overall sales.

But retail e-commerce channels are gradually transforming the market structure. New digital and social media platforms are gaining popularity, particularly for fashion and costume jewellery. The growing use of live-stream selling allows brands to connect directly with end users. Even so, retail offline remains the strongest channel and is expected to keep leading during the forecast period.

Top Companies in China Jewellery Market

The top companies operating in the market include Compagnie Financière Richemont SA, Chow Sang Sang Holdings International Ltd, Tiffany & Co, Chow Tai Fook Jewellery Group Ltd, Lao Feng Xiang Co Ltd, Shanghai Lao Miao Gold Co Ltd, Chow Tai Seng Jewellery Co Ltd, Mokingran Jewellery Group Co Ltd, Guangdong CHJ Industry Co Ltd, Luk Fook Holdings (International) Ltd, etc., are the top players operating in the china jewellery market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Canada Jewellery Market Policies, Regulations, and Standards

4. Canada Jewellery Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Canada Jewellery Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Costume Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Fine Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Type

5.2.2.1. Earrings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Neckwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Rings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Wristwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Collection

5.2.3.1. Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Non-Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material Type

5.2.4.1. Gold- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Platinum- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Metal Combination- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Silver- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel

5.2.5.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Canada Costume Jewellery Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Canada Fine Jewellery Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Pandora Canada Ltd

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Charm Jewelry Ltd

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Michael Hill International Ltd

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Cartier International Inc

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Birks Group Inc

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Swarovski Canada Ltd

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Tiffany & Co Canada

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Chopard & Cie SA

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Compagnie Financière Richemont SA

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. H&M Hennes & Mauritz Inc

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Type |

|

| By Collection |

|

| By Material Type |

|

| By Sales Channel |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.