China Healthy Snacks Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Low/No Fat & Salt Snacks (Low Fat Snacks, No Fat Snacks, Low Salt Snacks, No Salt Snacks), Low/No Sugar & Caffeine Snacks (Low Sugar Snacks, No Sugar Snacks, No Added Sugar Snacks, No Caffeine Snacks), Allergy/Free-from/Specialized Diet Snacks (Gluten-Free Snacks, Dairy-Free Snacks, Lactose-Free Snacks, Hypoallergenic Snacks, Keto Snacks, Meat-Free Snacks, No Allergens Snacks, Plant-Based Snacks, Vegan Snacks, Vegetarian Snacks, Weight Management Snacks), Fortified/Nutrient-Enhanced Snacks (Good Source of Antioxidants Snacks, Good Source of Minerals Snacks, Good Source of Omega-3s Snacks, Good Source of Vitamins Snacks, High Fibre Snacks, High Protein Snacks, Probiotic Snacks, Superfruit Snacks), Health & Wellness-Oriented Snacks (Bone and Joint Health Snacks, Brain Health and Memory Snacks, Cardiovascular Health Snacks, Digestive Health Snacks, Energy Boosting Snacks, Immune Support Snacks, Skin Health Snacks, Vision Health Snacks), Natural Snacks, Organic Snacks), By Product Type (Meat Snacks, Nuts, Seeds & Trail Mixes, Dried Fruit Snacks, Cereal & Granola Bars, Others), By Packaging (Bag & Pouches, Boxes, Cans, Jars, Others), By Sales Channel (Retail Offline, Retail Online)

- Food & Beverage

- Jan 2026

- VI0731

- 115

-

China Healthy Snacks Market Statistics and Insights, 2026

- Market Size Statistics

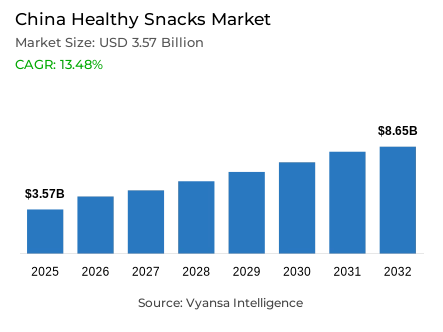

- Healthy snacks in China is estimated at USD 3.57 billion in 2025.

- The market size is expected to grow to USD 8.65 billion by 2032.

- Market to register a cagr of around 13.48% during 2026-32.

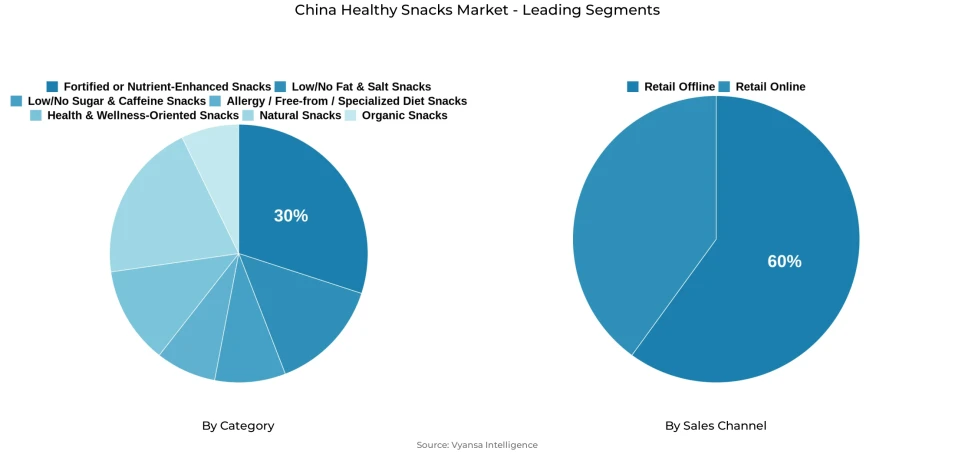

- Category Shares

- Fortified / nutrient-enhanced snacks grabbed market share of 30%.

- Competition

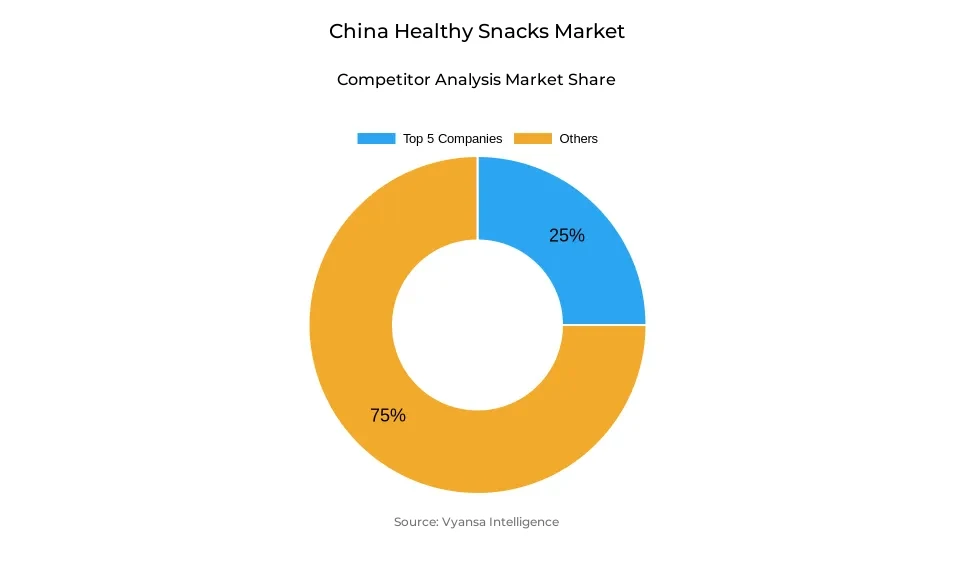

- More than 15 companies are actively engaged in producing healthy snacks in China.

- Top 5 companies acquired around 225% of the market share.

- True ApS; Tai Tai Co; PepsiCo Inc; Chocoladefabriken Lindt & Sprüngli AG; The PUR Co Inc etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 60% of the market.

China Healthy Snacks Market Outlook

The China Healthy Snacks Market, valued at USD 3.57 billion in 2025, is expected to grow sharply to USD 8.65 billion by 2032, registering a strong CAGR of 13.48%. Growth will continue to be supported by rising health awareness and a shift toward natural, low-sugar, and functional snacking options. While no-sugar snacks remain widely recognised, concerns about taste and overprocessing have caused slowdowns in some segments. However, categories like no-sugar confectionery and gum continue to expand as end users try to reduce sugar intake and manage ageing and dental health. At the same time, functional/fortified snacks, which hold 30% market share, are gaining traction as end users seek vitamins, collagen, and other nutrients that support metabolism and overall wellness.

As interest in functionality grows, brands are launching fortified gummies, enhanced biscuits, and sports-focused gum formats with added vitamins and amino acids. This is further supported by rising concerns around weight management, especially as obesity and lifestyle-related health risks gain more attention. End userss are increasingly looking for snacks that balance indulgence with guilt-free nutrition. Categories such as seaweed snacks, tofu snacks, and fortified fruit snacks are performing well as they combine taste with health benefits.

Looking ahead, low fat and no fat snacks are expected to grow at double-digit rates as health concerns intensify. Government-led initiatives promoting reduced fat and salt consumption will accelerate this shift. Similarly, high protein snacks are forecast to expand rapidly, especially within meat snacks, which already dominate the segment. Innovations such as high-protein chocolate, hybrid snacks containing tofu or whey, and plant-based protein formats will widen appeal and attract fitness-focused end users.

The retail offline channel, which currently accounts aroung 60% of sales, will remain dominant due to trust, accessibility, and strong availability of local brands. However, growing digital engagement, clearer labelling, and targeted marketing will further strengthen brand visibility across platforms. Together, rising preventive-health attitudes, new product innovation, and expanding retail access will support long-term, robust growth for China’s healthy snacks market

China Healthy Snacks Market Growth DriverRising Health Awareness and Government Support for Diet Reform

Rising nationalism about chronic illnesses has fueled healthier snack food options. According to the China Health Commission, more than 50% of Chinese nationals are already considered obese. Yet forecasts predict these statistics will possibly surge beyond 65% by 2030. China's Healthy 2030 strategy strengthens nutritional campaigns against an excessive diet, calling for lower sugar, salt, and fat consumption. All these factors affect snack food purchasing as well as developments within China.

These initiatives are fueling snack food product changes, with brands rolling out no sugar, low fat, and fortified product ranges. Health authorities prescribe limited consumption of salt at 6 grams daily, thus fueling demand for low sodium snack food products. Consequently, more and more people today prioritize and seek nutrient, function, and clean-label products that align with national health priorities and emerging wellness considerations.

China Healthy Snacks Market ChallengeNegative Perception of Processed No Sugar Snacks

However, as the market continues to expand, a growing sense of scepticism toward no-sugar products has increasingly come to the forefront. As sweetener alternatives are seen as associated with sugar-free products, people have reservations about these products taste. A survey conducted on modern end userss shows that more than 51% are skeptical about sweetener safety. These factors act as a major obstacle for market growth despite government approval and nutritional safety.

Moreover, with an ever-changing consumption pattern favoring products that are natural and less processed, there has been a certain reservation about sugar-free and highly fortified products. End users from an urban background have shown a marked liking for naturally sourced or organic snacking options compared to synthetic ones.

China Healthy Snacks Market TrendIncrease in Functional and Vitamin-Fortified Snacks for Metabolic Health

China snack-loving populace prefers fortified healthy bites with added vitamins and minerals. Studies have shown that more than 80% of Chinese people have deficiencies in at least two vitamins or minerals. As such, there’s been exciting innovation involving gummies, biscuits, and candies as mainstream brands start catering to the beauty and fitness niches with collagen and vitamin-enriched bites.

Functional snacking fits well with government nutrition policy and aims at making it easy for people to have nutrient enrichment, and there have been research findings indicating an increasing demand for functional products that have taste and health functions at the same time. These dual-functional products indicate an important transition within China's rapid developing snacking market.

China Healthy Snacks Market OpportunityRising Market for Low Fat, High Protein, and Lower Salt Snacks

The intersection of diet reform and health consciousness presents emerging opportunities within low-fat, high-protein, and low-sodium snack products. The government directives on lowering sodium consumption and overall nutrition policy have encouraged considerable interest among the general public in low-sodium diet alternatives. It has been revealed that 39% of Chinese are cutting down on meat consumption, with an inclination towards alternative meat sources enriched with protein.

To counter these emerging challenges, food product manufacturers develop new snack product categories with functionality and innovation, like high-protein meat crisps, low-fat nuts, and low-salt trail mix. Convergence among government-backed healthy food initiatives and an ever-growing fitness culture undeniably helps fuel market growth for fortified and low-fat snack food categories.

China Healthy Snacks Market Segmentation Analysis

By Category

- Low/No Fat & Salt Snacks

- Low Fat Snacks

- No Fat Snacks

- Low Salt Snacks

- No Salt Snacks

- Low/No Sugar & Caffeine Snacks

- Low Sugar Snacks

- No Sugar Snacks

- No Added Sugar Snacks

- No Caffeine Snacks

- Allergy/Free-from/Specialized Diet Snacks

- Gluten-Free Snacks

- Dairy-Free Snacks

- Lactose-Free Snacks

- Hypoallergenic Snacks

- Keto Snacks

- Meat-Free Snacks

- No Allergens Snacks

- Plant-Based Snacks

- Vegan Snacks

- Vegetarian Snacks

- Weight Management Snacks

- Fortified / Nutrient-Enhanced Snacks

- Good Source of Antioxidants Snacks

- Good Source of Minerals Snacks

- Good Source of Omega-3s Snacks

- Good Source of Vitamins Snacks

- High Fibre Snacks

- High Protein Snacks

- Probiotic Snacks

- Superfruit Snacks

- Health & Wellness-Oriented Snacks

- Bone and Joint Health Snacks

- Brain Health and Memory Snacks

- Cardiovascular Health Snacks

- Digestive Health Snacks

- Energy Boosting Snacks

- Immune Support Snacks

- Skin Health Snacks

- Vision Health Snacks

- Natural Snacks

- Organic Snacks

The segment with highest market share under category is Fortified / Nutrient-Enhanced Snacks. It contributes approximately 30% to the China Healthy Snacks Market. The market for this product is expanding because people are becoming more educated about healthy food, and there are rising health problems because of obesity, diabetes, and cardiovascular disease. The end end users in China are looking for healthy food products which have extra benefits such as added vitamins, proteins, and minerals. Food products with collagen, calcium, and taurine have become common among city dwellers who want aesthetics and health.

Key market participants like BUFFX and Wrigley have introduced fortified gummies and gums with multi-vitamin and collagen formulas, while Nabati leads in the market with its vitamin-enriched biscuit product. According to market research, it can be understood that there will be an increase in people choosing fortified convenience food due to an inclination toward healthier indulgent food.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under Sales Channel is retail Offline, which constitutes approximately 60% of the China Healthy Snacks Market. Supermarkets, hypermarkets, and convenience stores continue to be considered the preferred points of purchase given the visibility and availability of products, as well as the facility to check product labels before making purchases.

These stores are very vital for generating purchasing confidence among end-use end user, more so with health-positioned products that get added benefits, including fortified biscuits, protein bars, and low-fat nuts. Offline retail stores offer an essential platform for large brands like Nestlé, Mayushan Foods, and Bestore to launch new fortified or sugar-free snack food. Regular promotions at these stores assist in enhancing product awareness. As long as Chinese end-users are concerned with product freshness, offline retail stores are predicted to remain at the top position during the forecast period.

List of Companies Covered in China Healthy Snacks Market

The companies listed below are highly influential in the China healthy snacks market, with a significant market share and a strong impact on industry developments.

- True ApS

- Tai Tai Co

- PepsiCo Inc

- Chocoladefabriken Lindt & Sprüngli AG

- The PUR Co Inc

- Luohe Pingping Food Co Ltd

- Otsuka Holdings Co Ltd

- Sunny Fields Enterprise Ltd

- Ebara Foods Industry Inc

- Perfetti Van Melle Group

Competitive Landscape

China's health and wellness snacks market presented a diverse yet sharply competitive landscape shaped by shifting perceptions around processing, functionality, and health benefits. Mayushan Foods Co Ltd led no sugar snacks with a 13% value share, driven by its Greenmax brand, which dominated no sugar gum with an 80% share despite overall decline in the claim due to concerns over taste and overprocessing. In fortified/functional snacks, Nabati Group held a commanding lead in good source of vitamins products, benefiting from its overwhelming dominance in vitamin-enriched sweet biscuits. Within weight management, Tarami Co Ltd ranked first through strong performance in fruit-based snacks, while high protein snacks were led by Bestore Food Co Ltd, which maintained category leadership in high protein meat snacks as innovation from players like Lay's, Keep, and Nestlé intensified. Meanwhile, in no salt snacks, Crown Confectionery Co Ltd held leadership due to its strength in seafood snacks, though Green’s Bioengineering (Shenzhen) Co Ltd is poised to climb the rankings as no salt nuts, seeds, and trail mixes accelerate.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. China Healthy Snacks Market Policies, Regulations, and Standards

4. China Healthy Snacks Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. China Healthy Snacks Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Low/No Fat & Salt Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Low Fat Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. No Fat Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Low Salt Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. No Salt Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Low/No Sugar & Caffeine Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Low Sugar Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. No Sugar Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. No Added Sugar Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. No Caffeine Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Allergy / Free-from / Specialized Diet Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Gluten-Free Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Dairy-Free Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lactose-Free Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Hypoallergenic Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.5. Keto Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.6. Meat-Free Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.7. No Allergens Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.8. Plant-Based Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.9. Vegan Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.10. Vegetarian Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.11. Weight Management Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Fortified / Nutrient-Enhanced Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Good Source of Antioxidants Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Good Source of Minerals Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Good Source of Omega-3s Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Good Source of Vitamins Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.5. High Fibre Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.6. High Protein Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.7. Probiotic Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.8. Superfruit Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Health & Wellness-Oriented Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.1. Bone and Joint Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.2. Brain Health and Memory Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.3. Cardiovascular Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.4. Digestive Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.5. Energy Boosting Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.6. Immune Support Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.7. Skin Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.8. Vision Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Natural Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Organic Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Product Type

5.2.2.1. Meat Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Nuts, Seeds & Trail Mixes- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Dried Fruit Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Cereal & Granola Bars- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Packaging

5.2.3.1. Bag & Pouches- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Boxes- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Cans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Jars- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. China Low/No Fat & Salt Snacks Healthy Snacks Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Packaging- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. China Low/No Sugar & Caffeine Snacks Healthy Snacks Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Packaging- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. China Allergy / Free-from / Specialized Diet Snacks Healthy Snacks Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Packaging- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. China Fortified / Nutrient-Enhanced Snacks Healthy Snacks Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Packaging- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. China Health & Wellness-Oriented Snacks Healthy Snacks Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Packaging- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. China Natural Snacks Healthy Snacks Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Packaging- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. China Organic Snacks Healthy Snacks Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Packaging- Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Competitive Outlook

13.1. Company Profiles

13.1.1. Chocoladefabriken Lindt & Sprüngli AG

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. PUR Co Inc

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Luohe Pingping Food Co Ltd

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. Otsuka Holdings Co Ltd

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. Sunny Fields Enterprise Ltd

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. True ApS

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. Tai Tai Co

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. PepsiCo Inc

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. Ebara Foods Industry Inc

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

13.1.10. Perfetti Van Melle Group

13.1.10.1.Business Description

13.1.10.2.Product Portfolio

13.1.10.3.Collaborations & Alliances

13.1.10.4.Recent Developments

13.1.10.5.Financial Details

13.1.10.6.Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Product Type |

|

| By Packaging |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.