Chile Colour Cosmetics Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Eye Make-Up (Eye Liner/Pencil, Eye Shadow, Mascara, Others), Facial Make-Up (BB/CC Creams, Blusher/Bronzer/Highlighter, Foundation/Concealer, Powder, Others), Lip Products (Lip Gloss, Lip Liner/Pencil, Lipstick, Others), Nail Products (Nail Polish, Nail Treatments/Strengthener, Polish Remover, Others), Colour Cosmetics Sets/Kits), By Price (Premium, Mass), By Gender (Men, Women, Unisex), By Packaging Type (Travel/Mini Size, Standard Size, Professional/Salon Size), By Form (Creams/Gels, Lotions, Sprays, Solid, Others), By Nature (Organic, Inorganic), By Sales Channel (Retail Offline, Retail Online)

- FMCG

- Feb 2026

- VI0949

- 110

-

Chile Colour Cosmetics Market Statistics and Insights, 2026

- Market Size Statistics

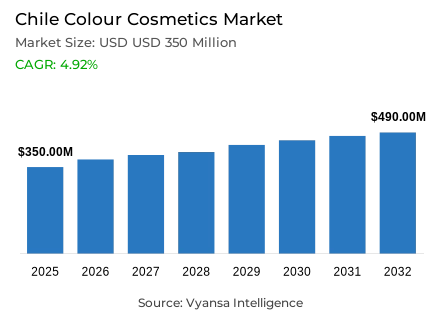

- Colour cosmetics in Chile is estimated at USD 350 million in 2025.

- The market size is expected to grow to USD 490 million by 2032.

- Market to register a cagr of around 4.92% during 2026-32.

- Category Shares

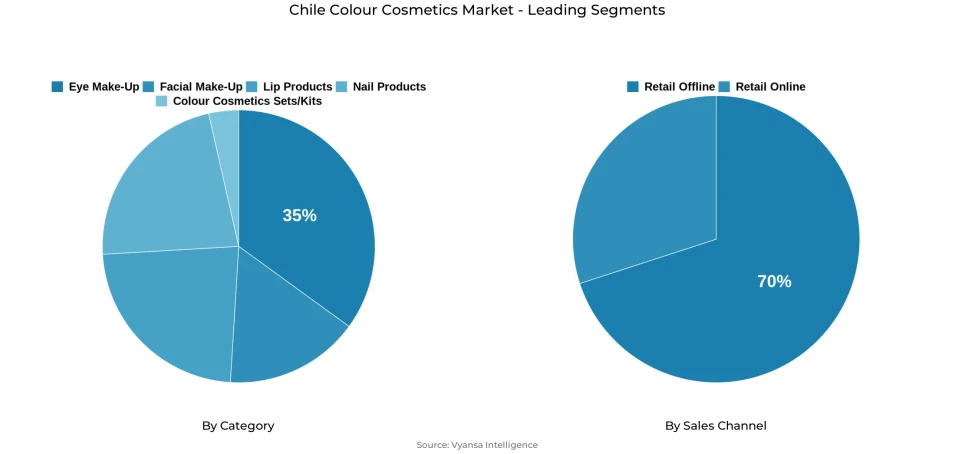

- Eye make-up grabbed market share of 35%.

- Competition

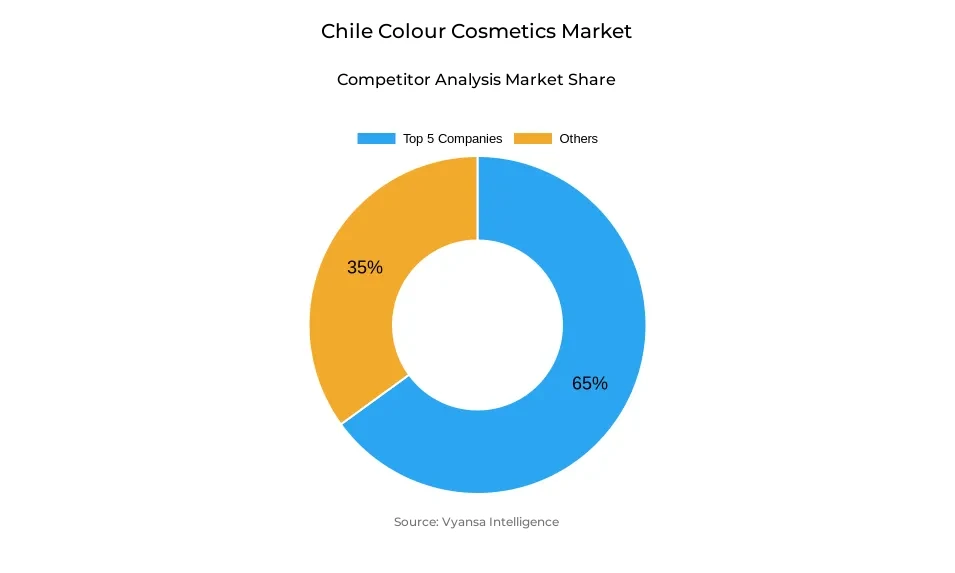

- More than 15 companies are actively engaged in producing colour cosmetics in Chile.

- Top 5 companies acquired around 65% of the market share.

- Cosméticos Avon SA; Cósmetica Davis Co; Laboratorio Petrizzio SA; L'Oréal Chile SA; Cosméticos Ebel SA etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 70% of the market.

Chile Colour Cosmetics Market Outlook

The Chile colour cosmetics market is also expected to exhibit a continuous growth over the forecast period, which can be supported by the strong level of innovation and by the increasing effect of younger end user demographics. It is a USD 350 million market in 2025 which is projected to be USD 490 million in 2032, equivalent to compound annual growth rate of 4.92%. Market demand will enjoy the progressive beauty culture despite the long-term price sensitivity dynamics due to the active social media trend spreading, influencer-created content, and increasing end user interest in expressive and bold aesthetic presentation. The eye make-up, which is dominating the market with 35% market share will not lose its category leadership, underpinned by the long-term end user attention to mascara formulations and the eye product innovation with colour.

The level of competition is expected to increase due to the increased market awareness of low-cost imported goods and especially those of Asian retailers as suppliers. These similar offerings offer similar quality features at very convenient prices, which promotes more fragmentation of the market, and disrupts well-established premium and mass-market brands. At the same time, the facial make-up is also predicted to continue its growth pace, with the brands launching new shade extensions, new textures, and hybridization skincare-make-up formulation ideas. Low-cost product lines will gain more market share by being aggressive in pricing and ensuring faster product development cycles.

The distribution dominance will be retained by retail offline channels which comprise 70% of the total sales, especially via beauty specialist retailers and perfumery chains which actively bring on board international brand portfolio and limited edition collections. Nevertheless, retail online will not lose its status of the quickest developing distribution channel because virtual try-on technologies, custom-made recommendation algorithm, and loyalty programme initiatives will improve the experiences of end users during the entire shopping process.

Over the forecast horizon, the changing end user behavioural patterns in Chile will largely influence the colour cosmetics market. Gen Z will keep on propelling product experimentation, which will require new format development, rich colour palette, and a high turnover rate of products. Limited-edition collections, influencer collaboration launches, and dynamics around the so-called dupe culture will keep on being a strong market force and require brands to shorten their product life cycles and act on new trend signals quickly. These market changes alongside growing access to the global portfolios of beauty brands will enable a strong category growth by 2032.

Chile Colour Cosmetics Market Growth DriverYouth Influence and Social Media Accelerate Cosmetics Adoption

The growing influence of younger end-user groups, particularly Generation Z, is reshaping the Chile colour cosmetics market, as their distinct beauty preferences and purchasing behaviours increasingly determine product demand and buying patterns. Chile is one of the most urbanized nations worldwide, as about 88% of the entire population lives in urban regions as of 2023, which is a significant level of concentration in large urban centers. The digitally connected end users in these metropolitan regions who are highly responsive towards beauty trends spread on such platforms as Tik Tok and Instagram are the end users of these cities who represent the most responsive group in the context of modern beauty trends, with 87.2% use of Instagram and 66% active use of Tik Tok as platforms to discover products and conduct product research. This level of engagement fosters an ongoing exploration of risky colour palettes, glossy finish formulations and frequent product innovation cycles which continue to generate a strong interest in such trend-sensitive categories as eye makeup and lip products.

The digital connectivity infrastructure in the market is center-stage in increasing the product visibility and increasing the pace of trend adoption in the market. Chile is shown to have an internet penetration rate of 91% at the individual end user level, as well as a household penetration rate of 96.5% as of 2024, and allows a high degree of access to global content regarding beauty trends, the influence of influencers, and platforms that review products digitally. Since end users, especially young demographic groups, are becoming excessively absorbed into online tutorial materials, user-created content, and popularity recommendation platforms, they are organizing new, expressive cosmetic items that embrace unique aesthetic inclinations and cultural trend associations. This notably high degree of digital interaction is still capable of driving product discovery engines, prompting high recurrence buying behaviour across age groups, and maintaining demand around the trend-based colour cosmetic placed in the framework of novelty and self-expression values.

Chile Colour Cosmetics Market ChallengeInflationary Pressure Weakens Spending Power

The major challenges facing the Chile colour cosmetics market is the fact that macroeconomic volatility and long-term inflationary pressure on end user purchasing power capacity has affected it. High inflation above 8.7%–9.9% reached its peak in mid-2023 and settled slowly to about 4.2% by the end of 2023 as restrictive monetary policy controls became effective and high prices in the key consumption sectors such as food, energy and utilities remained to squeeze household disposable income allocations. Increased spending needs at the necessity categories lower financial flexibility in the discretionary purchases making end users much more price-sensitive in imposing their spending on cosmetics and other non-necessity categories of products.

It is this affordability constraint that leads to the downward trends of volume demand in the major market segments amidst the increment of value due to increasing levels of unit pricing and premiumisation in the high-end end user segments. With the heightened household cost pressures, especially in smaller urban areas and lower-income geographic territories, end users begin to move their buying behavior to the value-based substitutes such as the mass-market brands, the discount product selections, and the home-labeled products. The dynamics of economic pressure restrain end user experimentation with innovations in premium formulations and also limit the frequency with which end users purchase cosmetics, particularly in the middle and lower-income groups of end users. This relationship increases the competitive level among brand players making them to provide more compelling value propositions, differentiate performance benefits more clearly, and offer competitive pricing models to sustain end user loyalty in a price-constrained market situation.

Chile Colour Cosmetics Market TrendDigital Beauty Technologies Transform Consumer Engagement

The fast embrace and assimilation of digital beauty tech, such as virtual try-on services, artificial intelligence-powered shade matching tools, and algorithmic product recommendation engines, is a current trend in the Chile colour cosmetics market. The strong and almost-universal digital infrastructure in Chile justifies this market transformation—91% of the individual population and 96.5% of households have internet access—which enable them to form a technology-oriented end user base that will be willing to use the platforms of digital beauty experience. With a growing number of end users viewing and creating beauty-related content on Tik Tok, Instagram, and new social platforms, virtual testing and augmented reality technology provided by global brand portfolios increases the level of purchase confidence, decision paralysis, and decisive purchasing behaviors in the foundation, lipsticks, eye makeup, and specialty products segments.

These digital technology solutions demonstrate particular appeal among younger demographic segments who actively consume and produce beauty-focused content and exhibit heightened receptivity to innovative shopping experience formats. With Chile ranking among Latin America's highest users of social media platforms and digital commerce infrastructure, virtual try-on technology functions as a crucial connection between online browsing activity and purchase conversion, reducing colour suitability concerns and enabling confident product selection without physical testing requirements. As established and emerging brand participants systematically integrate artificial intelligence, machine learning capabilities, and augmented reality features into retail websites, mobile applications, and retail online platforms, the digital shopping experience increasingly establishes itself as a core driver of product engagement, competitive differentiation, and omnichannel growth momentum, particularly within categories where shade accuracy and undertone matching represent critical purchase decision factors.

Chile Colour Cosmetics Market OpportunityGrowing Preference for Affordable Imports Expands Access

A significant market opportunity emerges from rising availability of competitively priced imported cosmetics, which broadens market access for price-sensitive end user segments and expands product variety across retail distribution channels. Cosmetics imports to Chile totalled approximately USD 589 million in 2023, with makeup comprising USD 289 million and fragrances USD 300 million, sourced from diverse geographic origins including France, the United States, China, and Spain. These affordable imported products—particularly from emerging Asian supplier networks—enable retailers, perfumeries, and variety stores to expand product assortments with trending colour palettes, dupe alternative formulations, and innovative format concepts at competitive price points, encouraging trial behaviour among younger shoppers and price-conscious end users seeking aesthetic expression without premium expenditure requirements.

Import-driven competitive intensity additionally accelerates market dynamism by challenging traditional pricing structure conventions and prompting established market participants to reconsider value propositions and product positioning strategies. Chile maintains an extensive network of 35 trade agreements covering nearly 86% of global gross domestic product, including 22 Free Trade Agreements that provide duty-free or preferential tariff access for signatory nations' cosmetics exports—notably the U.S. Chile FTA provides completely duty-free bilateral cosmetics trade while standard tariff rates of 6% apply to non-FTA import flows. This open trade environment, combined with 6% baseline tariff structures and numerous bilateral duty-free frameworks, renders market entry relatively accessible for international and emerging brand participants. As end user receptivity to global, accessible cosmetic products strengthens and retail channels continue expanding distribution network capabilities, the Chilean market benefits from enhanced product diversification, accelerated trend cycle velocity, and sustained end user excitement among younger, digitally engaged demographic segments seeking affordable innovation solutions.

Chile Colour Cosmetics Market Segmentation Analysis

By Category

- Eye Make-Up

- Eye Liner/Pencil

- Eye Shadow

- Mascara

- Others

- Facial Make-Up

- BB/CC Creams

- Blusher/Bronzer/Highlighter

- Foundation/Concealer

- Powder

- Others

- Lip Products

- Lip Gloss

- Lip Liner/Pencil

- Lipstick

- Others

- Nail Products

- Nail Polish

- Nail Treatments/Strengthener

- Polish Remover

- Others

- Colour Cosmetics Sets/Kits

Eye make-up represents the dominant category within Chile colour cosmetics market, commanding a 35% market share. This category continues benefiting from robust innovation activity, frequent new product launches, and rising end user interest in bold colour presentations, shimmering finish formulations, and expressive aesthetic looks driven by social media trend dynamics. Mascara, particularly, supports consistent category turnover attributable to its abbreviated usage lifespan and essential role within daily beauty routines. The affordability characteristics of numerous mass-market eye make-up options further stimulate repeat purchase behaviour, rendering the segment especially resilient even amid declining overall demand patterns.

Throughout the 2026–2032 forecast period, eye make-up is projected to maintain its market leadership position as younger generational cohorts increasingly treat cosmetics as a medium of self-expression. Influencer collaboration initiatives, novel texture innovations, and intelligent formulations offering performance benefits including extended wear duration or conditioning ingredient incorporation will continue attracting end user trial and expanding usage occasion breadth. Growing availability of accessible international brand portfolios will further reinforce category dominance positioning.

By Sales Channel

- Retail Offline

- Retail Online

Retail offline channels represent the dominant sales channel within Chile's colour cosmetics market, accounting for 70% of total market value. Direct selling historically led the category however, beauty specialist retailers and perfumery establishments have emerged as central growth drivers attributable to their constant brand rotation practices, competitive pricing model structures, and capability to introduce foreign brand labels rapidly. Retail establishments including Preunic and Maicao additionally expand private label product offerings, providing end users with access to trending colour options and innovative formats at affordable price points.

Throughout the forecast period, retail offline channels will continue maintaining market dominance as end users value in-store browsing experiences, physical product testing capabilities, and limited-time collection discovery opportunities factors demonstrating particular importance among Generation Z end user segments. Although retail online demonstrates rising momentum, the tactile and exploratory characteristics inherent to colour cosmetics will sustain physical retail's position at the core of purchasing behaviour patterns, supported by ongoing innovation activity and broader product assortment expansion.

List of Companies Covered in Chile Colour Cosmetics Market

The companies listed below are highly influential in the Chile colour cosmetics market, with a significant market share and a strong impact on industry developments.

- Cosméticos Avon SA

- Cósmetica Davis Co

- Laboratorio Petrizzio SA

- L'Oréal Chile SA

- Cosméticos Ebel SA

- DBS Chile SA

- Cela Cosméticos SA

- Natura Cosméticos SA

- Laboratorio Arensburg SAIC

- Cosmética Nacional SA

Competitive Landscape

Chile colour cosmetics market remained highly competitive, with L’Oréal sustaining its long-standing leadership through a diversified portfolio spanning luxury, professional, mass, and dermocosmetic brands, supported by strong inclusivity-driven product launches. However, competitive pressure intensified as DBS Chile SA, representing Cosnova’s Catrice and Essence, delivered the fastest value growth by rapidly introducing trend-aligned collections and expanding its footprint through the 370 sq m DBS Beauty Store and international expansion into Peru. Smaller players within “others” also gained traction as retailers imported foreign labels with competitive pricing, while beauty specialists strengthened private-label offerings, deepening market fragmentation and increasing competition across both mass and premium segments.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Chile Colour Cosmetics Market Policies, Regulations, and Standards

4. Chile Colour Cosmetics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Chile Colour Cosmetics Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Eye Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Eye Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Eye Shadow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Mascara- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Facial Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. BB/CC Creams- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Blusher/Bronzer/Highlighter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Foundation/Concealer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Lip Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Lip Gloss- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Lip Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lipstick- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Nail Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Nail Polish- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Nail Treatments/Strengthener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Polish Remover- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Colour Cosmetics Sets/Kits- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Price

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Packaging Type

5.2.4.1. Travel/Mini Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Standard Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Professional/Salon Size- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Form

5.2.5.1. Creams/Gels- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Lotions- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Sprays- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Solid- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Nature

5.2.6.1. Organic- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Inorganic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Chile Eye Make-Up Colour Cosmetics Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Chile Facial Make-Up Colour Cosmetics Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Chile Lip Products Colour Cosmetics Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Chile Nail Products Colour Cosmetics Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Chile Colour Cosmetics Sets/Kits Colour Cosmetics Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Price- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Gender- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. L'Oréal Chile SA

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Cosméticos Ebel SA

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. DBS Chile SA

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Cela Cosméticos SA

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Natura Cosméticos SA

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Cosméticos Avon SA

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Cósmetica Davis Co

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Laboratorio Petrizzio SA

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Laboratorio Arensburg SAIC

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Cosmética Nacional SA

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Price |

|

| By Gender |

|

| By Packaging Type |

|

| By Form |

|

| By Nature |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.