Canada Skin Care Market Report: Trends, Growth and Forecast (2025-2030)

By Product (Body Care, Facial Care, Hand Care, Skin Care Sets/Kits), By Category (Premium, Mass), By Gender (Men, Women, Unisex), By End User (Adults, Teenagers, Children), By Packaging (Tubes, Bottles, Jars, Others), By Sales Channel (Online, Offline)

- FMCG

- Dec 2025

- VI0101

- 120

-

Canada Skin Care Market Statistics, 2025

- Market Size Statistics

- Skin Care in Canada is estimated at $ 2.93 Billion.

- The market size is expected to grow to $ 3.17 Billion by 2030.

- Market to register a CAGR of around 1.32% during 2025-30.

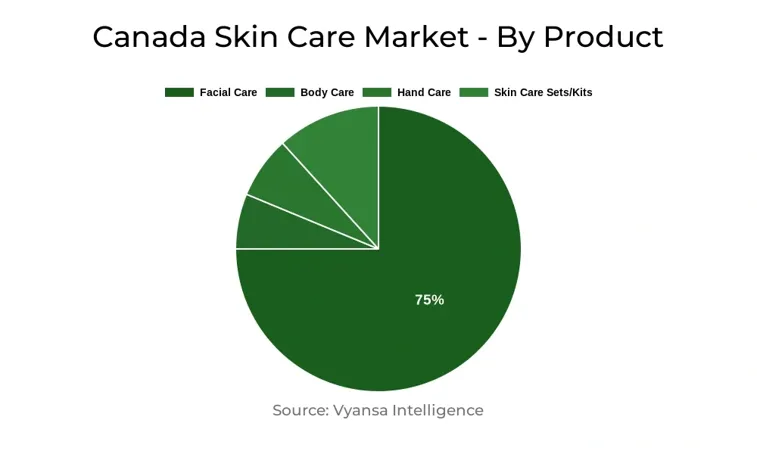

- Product Shares

- Facial Care grabbed market share of 75%.

- Competition

- More than 20 companies are actively engaged in producing Skin Care in Canada.

- Top 5 companies acquired 50% of the market share.

- Beiersdorf Canada Inc, Unilever Canada Inc, Clarins Canada Inc, L'Oréal Canada Inc, Procter & Gamble Inc etc., are few of the top companies.

- Sales Channel

- Retail Offline grabbed 75% of the market.

Canada Skin Care Market Outlook

Canada skin care market is primed for growth consistently between 2025 and 2030, it is being driven by increasing end users demand for organic, natural and dermocosmetic products. As the end users increasingly look for products with highly performing and naturally sourced ingredients. The brands will more than likely continue to innovate with clean-label products. Ingredients like aloe leaf juice, linseed extract, hyaluronic acid, and vitamin C are expected to see continuous demand, majorly for the anti-ageing and hydrating effects. Collagen products are also expected to continue to rise in popularity, with facial care leading the way for the category.

Demand will be driven by an ageing demographic and increased self-care activity. Consumers of all ages are increasingly adopting skin care as a component of preventive medicine, especially due to Canada's harsh winters that can cause dry and sensitive skin. Multi-functional products that provide benefits like anti-ageing, moisturising, and pollution protection will be in high demand. Anti-ageing skin care will be the most vibrant segment in particular, because of its broad-based appeal and changing formulations.

Distribution channels such as pharmacies and retail e-commerce are likely to continue being predominant, with customers focussing on convenience, value, and product assortment. Trends such as buy-online-pick-up-in-store (BOPIS), same-day delivery, and subscription models will fuel e-commerce development. On the other hand, problems for beauty specialists are likely to continue due to heightened competition and changing consumer focus.

Sustainability will be a significant trend driving product and packaging innovation. Brands launching refillable and sustainable packaging solutions are poised to succeed. With ongoing interest in transparency and responsible sourcing, the market trend is promising, with solid growth prospects in both mass and premium segments.

Canada Skin Care Market Growth Driver

The increasing trend towards dermocosmetic products and multi-functional offerings is poised to propel skin care demand in Canada. Inspite of persistent macroeconomic pressures, a high cost of living notwithstanding, consumers still give importance to skin care as part of self-care. Value-for-money products, natural and clean formulations, and wellness-motivated products are in demand. Informed purchasing choices and changing wellness behaviors, particularly among younger age groups, are driving demand for preventative skin care.

At the same time, anti-ageing products are likely to drive category growth, backed by Canada's aging population and rising immigration. Consumers in every age group are looking for solutions that address hydration, diminishing fine lines, and texture, particularly across cold winter seasons. Critical ingredients such as hyaluronic acid, retinoids, and vitamin C are at the forefront of new product launches. With the improving economy, sales of premium and specialized products are likely to improve even more.

Canada Skin Care Market Trend

Clean beauty and sustainability will be prominent trends, as Canada consumers increasingly look to green options as a baseline for purchasing skincare products. Companies are answering with solutions that offer product efficacy and care for the planet. An important trend in this area is the rising popularity of refill packaging, which is anticipated to continue its growth throughout 2025–2030.

Refill products not only minimize waste but are also cheaper than single-use packaged products, which makes them more desirable to consumers. Dior Prestige Night Cream with Midnight Rosapeptide, for instance, demonstrates this movement by providing a refill product, allowing customers to have luxury skincare with less negative environmental effects. This model is part of the wider beauty industry movement toward circularity—where minimizing waste and recycling packaging are the initial steps toward more sustainable consumption.

Canada Skin Care Market Opportunity

Shoppers are anticipated to increasingly look for natural and performing ingredients in their skin care regimens in 2025-30. This trend is inspiring companies to prioritize clean-label products using naturally sourced materials recognized for their ability to improve the skin. For instance, Canada company Bee Rx sells beauty items such as Anti-Ageing Facial Serum and Lip Plumping Serum containing 100% natural ingredients like high-strength bee venom and New Zealand Kanuka honey. These point to the increasing demand for effective yet eco-friendly skin care.

As concern about ingredient safety and responsible sourcing increases, brands that focus on non-toxic, cruelty-free, and eco-friendly formulations will most likely receive greater consumer backing. This makes it easier for such players to target a bigger market segment, particularly as transparency and environmental awareness continue to shape buying habits throughout the Canada skin care market.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 2.93 Billion |

| USD Value 2030 | $ 3.17 Billion |

| CAGR 2025-2030 | 1.32% |

| Largest Category | Facial Care segment leads with 75% market share |

| Top Drivers | Rising Demand for Dermocosmetics & Multi-Functional Solutions to Support Market Growth |

| Top Trends | Refillable Packaging to Drive the Shift Toward Sustainable Beauty |

| Top Opportunities | Rising Preference for Natural & High-Performance Skin Care Ingredients |

| Key Players | Beiersdorf Canada Inc, Unilever Canada Inc, Clarins Canada Inc, L'Oréal Canada Inc, Procter & Gamble Inc, Johnson & Johnson (Canada) Inc, Estée Lauder Cosmetics (Canada) Ltd, Deciem Inc, Alberto-Culver Canada Inc, Pierre Fabre Dermo-Cosmetique Canada Inc and Others. |

Canada Skin Care Market Segmentation Analysis

Facial Care segment has the highest market share in product type category. In 2024, facial care was the top category in the Canada Skin Care Market with high demand for anti-ageing products. People of all ages are using ingredients such as hyaluronic acid, retinoids, and vitamin C to minimize fine lines and maintain moisture levels in the skin. Cleansers were also a significant contributor by not only wiping out dirt and cosmetics but also enhancing the texture of skin, majorly in the cities which are facing pollution.

After facial care, skin care sets/kits was the highest performing category in 2024. They showed a whole skincare routine in a single package, making it convenient for consumers to sample new products without buying full sizes. They also give value for money and are trendy gift items. Lip care products showed considerable growth as well, as they combat dryness during the harsh Canada winters.

Top Companies in Canada Skin Care Market

The top companies operating in the market include Beiersdorf Canada Inc, Unilever Canada Inc, Clarins Canada Inc, L'Oréal Canada Inc, Procter & Gamble Inc, Johnson & Johnson (Canada) Inc, Estée Lauder Cosmetics (Canada) Ltd, Deciem Inc, Alberto-Culver Canada Inc, Pierre Fabre Dermo-Cosmetique Canada Inc, etc., are the top players operating in the Canada Skin Care Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Canada Skin Care Market Policies, Regulations, and Standards

4. Canada Skin Care Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Canada Skin Care Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Firming Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. General Purpose Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Facial Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.1. Acne Treatments- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.2. Face Masks- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3. Facial Cleansers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.1. Liquid- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.2. Cream- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.3. Gel- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.4. Bar Cleansers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.5. Facial Cleansing Wipes- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4. Moisturisers and Treatments- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4.1. Basic Moisturisers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4.2. Anti-Agers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.5. Lip Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.6. Toners- Market Insights and Forecast 2020-2030, USD Million

5.2.1.3. Hand Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.4. Skin Care Sets/Kits- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Category

5.2.2.1. Premium- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Women- Market Insights and Forecast 2020-2030, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By End User

5.2.4.1. Adults- Market Insights and Forecast 2020-2030, USD Million

5.2.4.2. Teenagers- Market Insights and Forecast 2020-2030, USD Million

5.2.4.3. Children- Market Insights and Forecast 2020-2030, USD Million

5.2.5.By Packaging

5.2.5.1. Tubes- Market Insights and Forecast 2020-2030, USD Million

5.2.5.2. Bottles- Market Insights and Forecast 2020-2030, USD Million

5.2.5.3. Jars- Market Insights and Forecast 2020-2030, USD Million

5.2.5.4. Others- Market Insights and Forecast 2020-2030, USD Million

5.2.6.By Sales Channel

5.2.6.1. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.6.2. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Canada Body Care Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By Category- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Gender- Market Insights and Forecast 2020-2030, USD Million

6.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

6.2.5.By Packaging- Market Insights and Forecast 2020-2030, USD Million

6.2.6.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. Canada Facial Care Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Category- Market Insights and Forecast 2020-2030, USD Million

7.2.3.By Gender- Market Insights and Forecast 2020-2030, USD Million

7.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

7.2.5.By Packaging- Market Insights and Forecast 2020-2030, USD Million

7.2.6.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. Canada Hand Care Market Statistics, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2020-2030, USD Million

8.2.2.By Gender- Market Insights and Forecast 2020-2030, USD Million

8.2.3.By End User- Market Insights and Forecast 2020-2030, USD Million

8.2.4.By Packaging- Market Insights and Forecast 2020-2030, USD Million

8.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

9. Canada Skin Care Sets/Kits Market Statistics, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2020-2030, USD Million

9.2.2.By Gender- Market Insights and Forecast 2020-2030, USD Million

9.2.3.By End User- Market Insights and Forecast 2020-2030, USD Million

9.2.4.By Packaging- Market Insights and Forecast 2020-2030, USD Million

9.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. L'Oréal Canada Inc

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Procter & Gamble Inc

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Johnson & Johnson (Canada) Inc

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Estée Lauder Cosmetics (Canada) Ltd

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Deciem Inc

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Beiersdorf Canada Inc

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Unilever Canada Inc

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Clarins Canada Inc

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Alberto-Culver Canada Inc

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Pierre Fabre Dermo-Cosmetique Canada Inc

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Category |

|

| By Gender |

|

| By End User |

|

| By Packaging |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.