Canada Menstrual Care Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Pantyliners, Tampons (Applicator Tampons, Digital Tampons), Towels (Standard Towels (Standard Towels with Wings, Standard Towels Without Wings), Slim/Thin/Ultra-Thin Towels (Slim/Thin/Ultra-Thin Towels with Wings, Slim/Thin/Ultra-Thin Towels Without Wings)), Intimate Wipes, Menstrual Cups, Period Underwear), Nature (Disposable, Reusable), Age Group (Up to 18 Years, 19-30 Years, 31-40 Years, 40 Years and Above), Sales Channel (Retail Offline, Retail Online)

- FMCG

- Feb 2026

- VI0656

- 115

-

Canada Menstrual Care Market Statistics and Insights, 2026

- Market Size Statistics

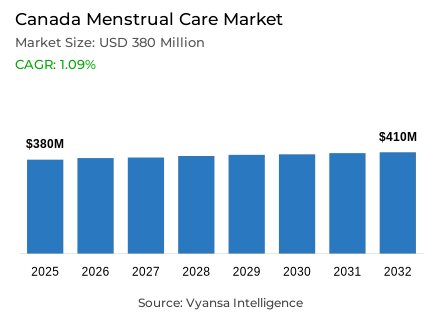

- Menstrual care in Canada is estimated at USD 380 million.

- The market size is expected to grow to USD 410 million by 2032.

- Market to register a cagr of around 1.09% during 2026-32.

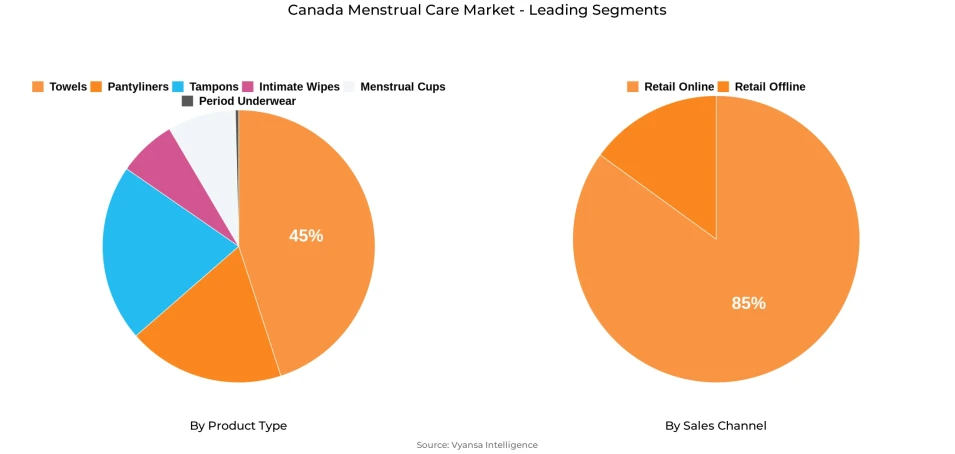

- Product Type Shares

- Towels grabbed market share of 45%.

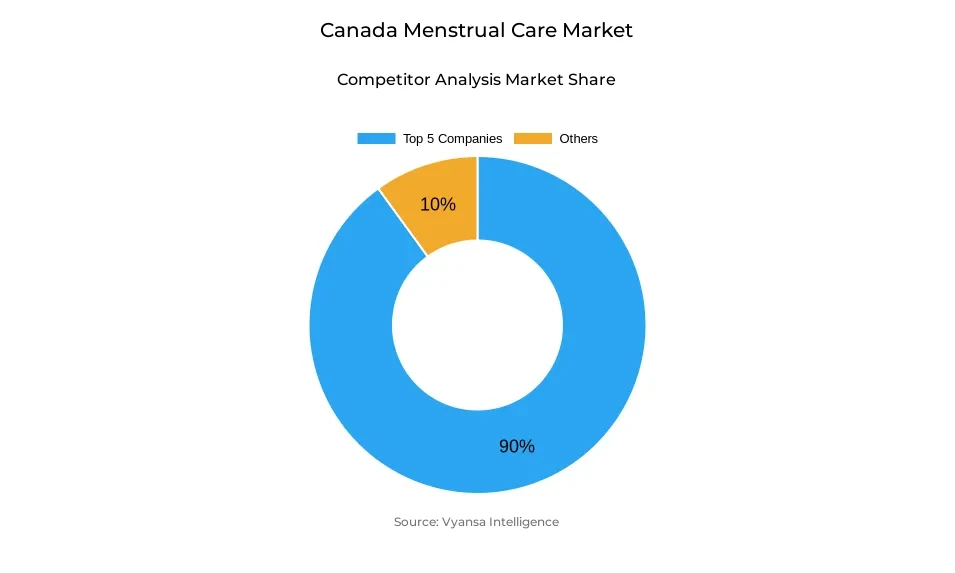

- Competition

- More than 10 companies are actively engaged in producing menstrual care in Canada.

- Top 5 companies acquired around 90% of the market share.

- Sobeys Inc; Bodywise (UK) Ltd; Jean Coutu Group (PJC) Inc; Procter & Gamble Inc; Kimberly-Clark Canada Inc etc., are few of the top companies.

- Sales Channel

- Retail online grabbed 85% of the market.

Canada Menstrual Care Market Outlook

The Canada Menstrual Care Market was valued at around USD 380 million in 2025 and is expected to reach approximately USD 410 million by 2032, at a CAGR of around 1.09% during 2026-2032. In fact, the market has reached maturity but remains stable due to high demand for basic hygiene products and continuous innovation with regards to comfort, safety, and sustainability. Continuous growth has been further ensured through sustained adoption of materials that are responsible towards the environment and new hypoallergenic and dermatologically tested products introduced in response to emerging trends for intimate health.

Towels maintain their lead in the market, holding a share of about 45% of the total sales. Reliability, comfort, and product differentiation are driving growth, especially since brands have been introducing day and night variants that meet the needs of end users. However, it’s pantyliners that are emerging as a key growth driver, benefiting from their convenience and frequency of use. The expanding category reflects the shift in consumer preferences towards more multifunctional products used daily. In contrast, tampons see stable or relatively lower demand due to evolving perceptions of comfort and increasing awareness of alternative products.

Key players in the competitive landscape include Kimberly-Clark, Johnson & Johnson, and Essity, among others that have continued to invest in product innovation, sustainability initiatives, and factory expansions. Plastic reduction, comfort improvement, and eco-friendly portfolio expansion have made these companies well positioned within the market. Smaller entrants with a focus on biodegradable and reusable menstrual goods are gaining traction and attracting Canada's environmentally conscious end users.

By sales channel, retail offline captures almost 85% share of market revenue, driven by strong penetration through supermarket, pharmacy, and hypermarket channels. Online retail, however, is growing with the increased adoption of digital platforms for end-buyers and subscription services, especially among young consumers who value convenience and privacy. Overall, the outlook for the menstrual care segment in Canada is one of steady, sustainable growth underpinning innovation, health awareness, and the increasing influence of eco-friendly buyer behavior.

Canada Menstrual Care Market Growth DriverComfort and Health-Conscious Preferences Reinforce Product Demand

Canada menstrual care market continues to see a steady recovery, driven by easing inflation and improving consumer confidence. While the temporary decline in 2023 was brought about by price sensitivity and prolonged use of the product, demand regained its pace in 2024 as affordability and stability in supply were restored. Government-led initiatives, such as the Menstrual Equity Fund pilot program that ran from September 2023 to March 2024, also helped with accessibility and awareness. Comfort has emerged as the top purchase driver, with 44.88% of the surveyed stating that it is a key desired feature and 29.68% claiming it is their top reason to pay more.

Demographic changes also support market growth, especially for older end users. According to Statistics Canada, 19% of Canadas were aged 65 and over in 2024, boosting demand for slim or ultra-thin towels suitable for light urinary incontinence and perimenopausal needs. This growing focus on comfort, health, and product functionality continues to strengthen the foundation of menstrual care demand across Canada.

Canada Menstrual Care Market ChallengeSafety Concerns and Price Sensitivity Limit Growth Momentum

Despite consistent value growth, the Canada menstrual care market remains challenged by lingering price sensitivity and consumer concerns around safety. While inflation softened from 2023, persistent cost pressures led many end users to switch to lower-cost formats or consider ways to make products last longer. The Consumer Price Index (CPI) inflation remained at an average of 3.4% in 2024, as measured by the Bank of Canada, keeping affordability top of mind for household spending.

Tampon volumes were down due to an increased sense of caution from a U.S.-based study that raised concern over potential lead content in tampons. The safety issue dampened momentum within the category, and value sales suffered as a result. The MEF pilot programme was intended to make products more available, but its narrow duration reduced its wider impact. These factors have combined to create a selective and cautious market landscape where disclosure, product safety, and affordability are basic requirements to maintain brand trust and long-term growth.

Canada Menstrual Care Market TrendSocial-Impact Branding Strengthens Market Leadership

Social-impact initiatives will be a defining trend in Canada menstrual care market, as this supports the leadership and relevance of established players. At the end of 2024, Procter & Gamble's Always brand dominated this category by partnering with global events, including becoming the official period product of Paris 2024, a campaign that resonated with social cause-conscious Canada consumers. Always benefits from its wide retail presence across Shoppers Drug Mart, Walmart, Loblaws, Amazon, and Costco, ensuring widespread accessibility.

Similarly, Kimberly-Clark’s Kotex solidified its position by announcing sustainability-related measures, promising to source 50% fewer natural forest fibres in Canada and Alaska by 2025. Such pledges address the increased call for corporate accountability and environmental responsibility. These social and environmental branding positions have become key differentiators that enable leading brands to maintain consumer loyalty amidst increasing competition from organic and eco-conscious competitors.

Canada Menstrual Care Market OpportunityGrowing demand for organic and naturally positioned alternatives

The future for the menstrual care market in Canada lies in the rise of organic and naturally formulated products. This is driven by increased awareness among consumers about the product composition and health implications, therefore using alternatives free from dyes, synthetic fibers, and chemicals. Thus, the above shift has benefited organic brands such as Natracare, Cora, and L. Organic, reinforcing safety, transparency, and environmental responsibility in their approach. In the wake of health concerns with traditional tampons, these brands show strong engagement and loyalty.

Private labels posted mixed results: while pad sales surged ahead of branded competitors, tampon sales declined due to reduced confidence in conventional options. This opens up opportunities for innovation in the directions of sustainability and safety. According to data from Environment and Climate Change Canada, 77% of Canadas are actively seeking out eco-friendly products, a sure sign that sustainable menstrual care will pay off in the long run. Those brands willing to invest in transparency regarding ingredients and ethical production methods will reap the best rewards in this evolving trust-based market.

Canada Menstrual Care Market Segmentation Analysis

By Product Type

- Pantyliners

- Tampons

- Towels

- Intimate Wipes

- Menstrual Cups

- Period Underwear

The segment with highest market share underBy product type, is towels, accounting for around 70% of the Brazil menstrual care market. The convenience, comfort, and accessibility of towels, both in urban and rural areas, continue to keep this market in the lead. This makes towels affordable, suitable for daily use, and hence favored by Brazilian women across different age groups. The strength of this segment is further reflected in the demand for night-time variants, such as Johnson & Johnson’s Sempre Livre Conforto Noturno, designed with features that enhance absorption and comfort while ensuring better protection.

While alternative products are emerging, such as tampons and menstrual cups, towels are still the most trusted and widely bought category. Innovations in materials, such as hypoallergenic and biodegradable materials, further strengthen their position. The focus on natural composition, softness, and skin-friendly properties is in line with growing consumer awareness of hygiene and comfort, which will keep towels in the leading position throughout the forecast period.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under sales channel is Retail offline holds a share of about 90% in the Sales Channel segment in the Brazil menstrual care market. Supermarkets, hypermarkets, and pharmacies have emerged as the leading retailing formats for purchases since they offer ease of access, frequent promotional offers, and consumer confidence in traditional retailing formats. Pharmacies are especially trustworthy because they have a wide range of products available, sometimes in collaboration with local healthcare providers who give discounts and advice.

While e-commerce is gaining considerable momentum, offline retail remains the mainstay for menstrual care purchases in Brazil. Consumers like to see and feel products, especially when it comes to new or sensitive-care products, before buying them. In-store visibility for leading brands is good due to attractive displays and in-person promotions. This enduring preference for offline shopping, combined with the extensive retail network in Brazil, keeps the segment as the main distribution channel for menstrual care products.

List of Companies Covered in Canada Menstrual Care Market

The companies listed below are highly influential in the Canada menstrual care market, with a significant market share and a strong impact on industry developments.

- Sobeys Inc

- Bodywise (UK) Ltd

- Jean Coutu Group (PJC) Inc

- Procter & Gamble Inc

- Kimberly-Clark Canada Inc

- Edgewell Personal Care Brands LLC

- Playtex Canada Ltd

- Shoppers Drug Mart Corp

- Seventh Generation Inc

Market News & Updates

- Procter & Gamble Inc, 2021-2025:

P&G continued to introduce global product innovations into the Canadian assortment, with ongoing marketing through 2023-2025

- Kimberly‑Clark Canada, 2023-2025:

Kimberly‑Clark maintained Kotex and related brands in Canada, introducing comfort- and eco-oriented SKUs

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Canada Menstrual Care Market Policies, Regulations, and Standards

4. Canada Menstrual Care Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Canada Menstrual Care Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Pantyliners- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Applicator Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Digital Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Standard Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.1. Standard Towels with Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.2. Standard Towels Without Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Slim/Thin/Ultra-Thin Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2.1. Slim/Thin/Ultra-Thin Towels with Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2.2. Slim/Thin/Ultra-Thin Towels Without Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Intimate Wipes- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Menstrual Cups- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Period Underwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Nature

5.2.2.1. Disposable- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Reusable- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Age Group

5.2.3.1. Up to 18 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. 19-30 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. 31-40 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. 40 Years and Above- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Canada Pantyliners Menstrual Care Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Canada Tampons Menstrual Care Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Canada Towels Menstrual Care Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Canada Intimate Wipes Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Age Group- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Canada Menstrual Cups Menstrual Care Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Age Group- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Canada Period Underwear Menstrual Care Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Nature- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Age Group- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Procter & Gamble Inc

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Kimberly-Clark Canada Inc

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Edgewell Personal Care Brands LLC

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Playtex Canada Ltd

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Shoppers Drug Mart Corp

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Sobeys Inc

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Bodywise (UK) Ltd

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Jean Coutu Group (PJC) Inc

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Seventh Generation Inc

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Nature |

|

| By Age Group |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.