Canada Industrial Gases Market Report: Trends, Growth and Forecast (2026-2032)

By Gas Type (Nitrogen Gas, Oxygen Gas, Carbon Dioxide Gas, Argon Gas, Helium Gas, Hydrogen Gas, Other), By Supply Mode (Cylinders, Bulk, On-Site Production, Captive, Other), By Application (Combustion and Process Oxygen, Welding and Metal Fabrication, Inerting Blanketing and Heat Treating, Cryogenics and liquefaction, Chemical Synthesis and Hydrogenation, Purging and Purifications, Analytical and Calibration), By End User Industry (General Manufacturing, Food, Metallurgy, Chemicals, Healthcare, Electronics, Refining & Energy, Glass, Pulp & Paper, Others)

|

Major Players

|

Canada Industrial Gases Market Statistics and Insights, 2026

- Market Size Statistics

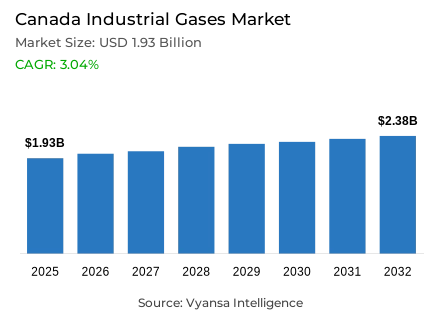

- Industrial gases in Canada is estimated at USD 1.93 billion in 2025.

- The market size is expected to grow to USD 2.38 billion by 2032.

- Market to register a cagr of around 3.04% during 2026-32.

- Gas Type Shares

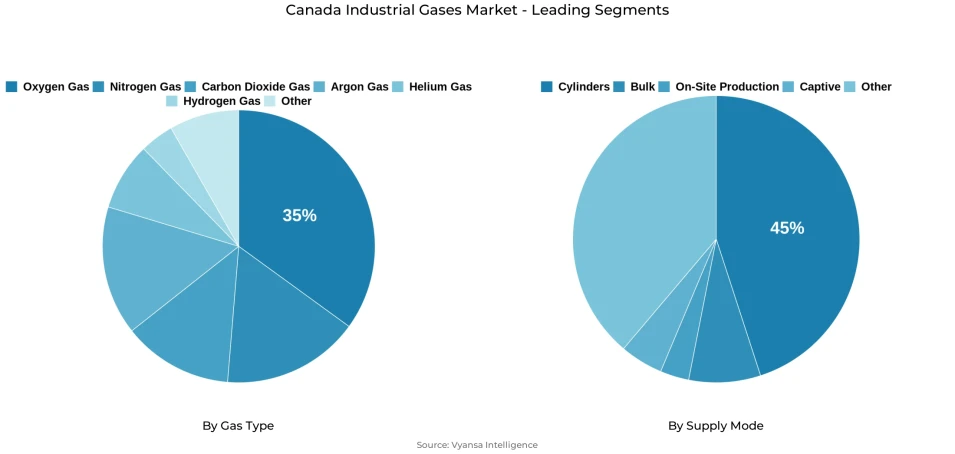

- Oxygen gas grabbed market share of 35%.

- Competition

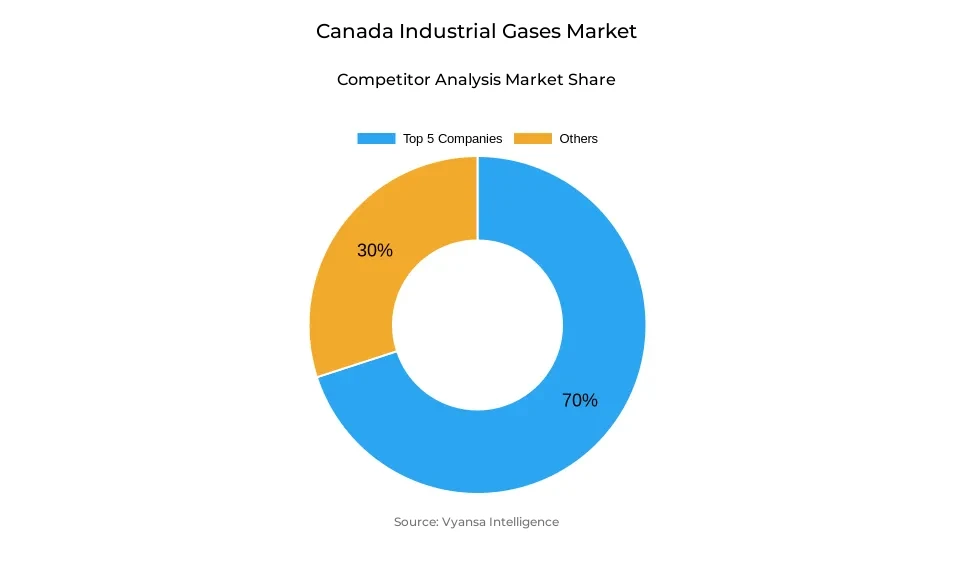

- More than 5 companies are actively engaged in producing industrial gases in Canada.

- Top 5 companies acquired around 70% of the market share.

- Iwatani Corporation; Xebec Adsorption; Nippon Sanso Holdings; Linde; Air Liquide etc., are few of the top companies.

- Supply Mode

- Cylinders grabbed 45% of the market.

Canada Industrial Gases Market Outlook

The Canada industrial gases market, progressively expanding in the forecast phase of 2026-32, is propelled by the growing demands of the healthcare, manufacturing, and new technology industries for the constant supply of oxygen, nitrogen, and high purity gases. The healthcare sector is also a huge driving force for the market, where the primary usage of special oxygen is for respiratory treatments, anesthesia, or other critical procedures. The industrial gas market in Canada showed the value of USD 1.93 billion in 2025, further estimated to reach USD 2.38 billion by the end of 2032, with a compound annual growth rate of approximately 3.04% between the forecast years of 2026-32.

The manufacturing sector further propels the market as metal fabrication, welding, steel production, electronics assembly, and chemical plants all require a steady supply of gases to sustain their overall production capacity. The capacity utilization ratio of industries and the manufacturing sector in Canada illustrates the overall production levels being sustained; this further sustains the overall demand from the end-user sector to acquire higher levels of precision, safety, and efficiency. Oxygen leads the overall demand of the different types of gases with a total share of 35%.

Changes in regulations are also impacting the market dynamics. Updates from Transport Canada, within the Transportation of Dangerous Goods regulations, are raising the compliance burden for suppliers and the end-users of the product. These regulations bring in stricter cyclinder specifications, processing of documentation, and processing of handling, so there are investments in advanced systems, but the simplicity of processes brings in reliability in the chain of supply.

The mode of supply also remains a significant aspect of the market outlook, with cylinders continuing to hold the dominant 45% share based on portability and the ability to supply the entire region, including the distant areas, meaning that the mode of supply for cylinder will continue to be the key mode as the Canadian industrial gases supply industry continues to develop by 2032.

Canada Industrial Gases Market Growth DriverRising Healthcare Utilization and Expanding Manufacturing Needs

The healthcare sector in Canada is still realizing robust demands for medical-grade oxygen, which is still a critical component in the treatment and care of patients with breathing disorders, as well as in certain medical procedures. The reliance on oxygen therapy at healthcare facilities continues to drive the consumption levels of industrial gases, and the scaled-up nature of the healthcare sector is a critical determinant in the requirements for medical-grade oxygen as an intrinsic component of the sector’s setup.

Concomitantly, Canada also gets further boostages from the manufacturing industry because oxygen, nitrogen, and other gases are still in strong demand in welding, metal fabrication, steel production, and precisionmanufacturing. The domestic production of steel in the country has reached 12.0 million metric tonnes in 2024. Given the 79.3% utilization level of industry in Q2 2025 and 76.7% utilization of the manufacturing sector, the increasing production level of the food industry, electronic assembly, other chemical manufacturing sectors further enhances the demand serviced by the industrial gas industry.

Canada Industrial Gases Market ChallengeRegulatory Pressures on Transport and Handling Compliance

The Canadian market for industrial gases is increasingly faced with compliance challenges due to the recent Transport Canada regulations introduced from January 2025. The regulations bring with them new dimensions of cylinder sizes, a new process of carbon dioxide filling, and enhanced safety standards for transport vehicles carrying pressure vessels. With the movement towards compliance with international standards concerning dangerous goods, the cost structure of players within the Canadian industrial gas market is likely to increase due to compliance with certification procedures.

Additional complexities of compliance in the Transportation of Dangerous Goods regime further accentuate these challenges in the supply chains. The complex documentation, identification, and packaging regulations demand specific training and expertise in handling, adding to the complexities of end users and suppliers. The entry barriers are quite steep for smaller stakeholders in terms of expensive safety facilities, whereas larger players are burdened by regular inspections and transportation limitations. These factors together impair flexibility in logistics and increase distribution costs in the Canadian industrial gas market.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Canada Industrial Gases Market TrendAccelerating Transition Toward Green Hydrogen Production

Canada has begun witnessing a paradigm shift in favor of green hydrogen, which has received considerable support from new job creation in clean energy and investments in projects of this nature on a grand scale. Projects which are set to become operational in the coming years show a rapidly intensifying domestic focus on low-carbon hydrogen technology in Canada, thus placing hydrogen among increasingly vital industrial gases.

Steel production, chemical production, and heavy transport are integrating hydrogen-based systems to meet the targets meant for the long-term future and fight climate change. The use of hydrogen-based direct reduction and other clean-tech solutions is growing and increasing the demand for high-purity gas solutions. The investments in other provinces in Alberta, British Columbia, and Atlantic Canada are improving the availability of hydrogen and helping meet both conventional uses and clean tech uses for growth markets. This is further strengthening the future use of hydrogen in this market.

Canada Industrial Gases Market OpportunityGrowth Momentum from Semiconductor and Electronics Manufacturing

The growing Canadian semiconductor and electronics industry presents a bright spot for gas suppliers. High purity helium and special gases are still a requirement in wafer processing, temperature-controlled manufacturing, and more advanced processes and thus support stable gas demand. This industry’s growth represents investment within precision manufacturing and advanced and digital technology.

Canada’s competitive costs in electricity, expertise in technology, and favorable R&D environment are adding to the attractiveness of local semiconductor & electronics manufacturing. A burgeoning growth in artificial intelligence, quantum technology, and latest electronic components is increasing demands for high-purity industrial gases that are necessary in micro-scale fabrication environments. This emerging segment is an entirely different and rapidly increasing demand source from conventional sectors and offers a host of lucrative chances for industrial gas players in the upcoming years.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Canada Industrial Gases Market Segmentation Analysis

By Gas Type

- Nitrogen Gas

- Oxygen Gas

- Carbon Dioxide Gas

- Argon Gas

- Helium Gas

- Hydrogen Gas

- Other

Oxygen maintains the largest share in the Canada industrial gases market at 35%, reflecting its essential role across healthcare, manufacturing, and heavy industrial operations. Its importance in steelmaking, welding, metal cutting, and furnace optimization supports consistent usage, while hospitals continue to rely on medical-grade oxygen for critical respiratory and surgical needs. Steel production volume of 12.0 million metric tonnes underscores oxygen’s position as a foundational industrial gas within national supply portfolios.

Beyond core industrial applications, oxygen demand extends into environmental remediation, wastewater treatment, and infrastructure-related activities that require oxidation and purification support. Major construction, transit development, and associated manufacturing activity contribute additional downstream oxygen requirements. These diverse applications across healthcare, industrial production, environmental systems, and infrastructure expansion ensure oxygen’s sustained 35% share, reaffirming its role as the market’s leading gas type serving a wide array of Canadian end users.

By Supply Mode

- Cylinders

- Bulk

- On-Site Production

- Captive

- Other

Cylinder-based delivery holds the largest share in the Canada industrial gases market at 45%, driven by its portability, flexibility, and suitability for dispersed end users. Medical facilities, welding shops, laboratories, and distributed manufacturing sites rely heavily on cylinders due to their ease of deployment and ability to support variable usage without the need for fixed storage or on-site generation systems. This structure aligns well with Canada’s geographic distribution, where facilities operate across both urban centers and remote industrial zones.

Transport Canada’s strengthened cylinder standards and testing protocols reinforce the reliability and safety of this dominant supply mode, even as compliance costs rise. Standardization supports consistent delivery practices and boosts confidence among end users in healthcare, fabrication, food processing, and emerging electronics applications. The ability to reach geographically diverse industrial locations and provide point-of-use supply ensures cylinder distribution maintains its established 45% share, securing its position as the leading supply mode across Canada’s industrial gases landscape.

List of Companies Covered in Canada Industrial Gases Market

The companies listed below are highly influential in the Canada industrial gases market, with a significant market share and a strong impact on industry developments.

- Iwatani Corporation

- Xebec Adsorption

- Nippon Sanso Holdings

- Linde

- Air Liquide

- Air Products and Chemicals

- Messer Group

- Taiyo Nippon Sanso Corporation

Market News & Updates

- Air Products, 2025:

Air Products labeled its blue hydrogen plant in Edmonton, Alberta as an “underperforming project” during its strategy review. However, the company will still finish the project because long-term contracts cover around 50% of the plant’s output for a major customer. Costs have risen to C$1.3–3.3 billion, up from the original C$1.3 billion budget. The company will use its existing pipeline system that links three nearby sites to deliver hydrogen to local refineries.

- Linde, 2025:

Linde Canada operates a strong nationwide distribution network supported by its online store and customer portal. The company has 88+ store locations across the country and supplies key gases such as oxygen, nitrogen, argon, carbon dioxide, and specialty gases. These gases serve industries like energy, mining, and healthcare, ensuring reliable supply and strong customer service throughout 2025.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Canada Industrial Gases Market Policies, Regulations, and Standards

4. Canada Industrial Gases Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Canada Industrial Gases Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Quantity Sold in Tons

5.2. Market Segmentation & Growth Outlook

5.2.1.By Gas Type

5.2.1.1. Nitrogen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.2. Oxygen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.3. Carbon Dioxide Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.4. Argon Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.5. Helium Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.6. Hydrogen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.7. Other- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.By Supply Mode

5.2.2.1. Cylinders- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.2. Bulk- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.3. On-Site Production- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.4. Captive- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.By Application

5.2.3.1. Combustion and Process Oxygen- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.2. Welding and Metal Fabrication- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.3. Inerting Blanketing and Heat Treating- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.4. Cryogenics and liquefaction- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.5. Chemical Synthesis and Hydrogenation- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.6. Purging and Purifications- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.7. Analytical and Calibration- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.By End User Industry

5.2.4.1. General Manufacturing- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.2. Food- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.3. Metallurgy- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.4. Chemicals- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.5. Healthcare- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.6. Electronics- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.7. Refining & Energy- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.8. Glass- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.9. Pulp & Paper- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.10. Others- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Canada Nitrogen Gas Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Quantity Sold in Tons

6.2. Market Segmentation & Growth Outlook

6.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

6.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7. Canada Oxygen Gas Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Quantity Sold in Tons

7.2. Market Segmentation & Growth Outlook

7.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8. Canada Carbon Dioxide Gas Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Quantity Sold in Tons

8.2. Market Segmentation & Growth Outlook

8.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9. Canada Argon Gas Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Quantity Sold in Tons

9.2. Market Segmentation & Growth Outlook

9.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10. Canada Helium Gas Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.1.2. By Quantity Sold in Tons

10.2. Market Segmentation & Growth Outlook

10.2.1. By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10.2.3. By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11. Canada Hydrogen Gas Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.1.2. By Quantity Sold in Tons

11.2. Market Segmentation & Growth Outlook

11.2.1. By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11.2.3. By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Linde

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Air Liquide

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Air Products and Chemicals

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Messer Group

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Taiyo Nippon Sanso Corporation

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Iwatani Corporation

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Xebec Adsorption

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Nippon Sanso Holdings

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Gas Type |

|

| By Supply Mode |

|

| By Application |

|

| By End User Industry |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.