Canada Colour Cosmetics Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Eye Make-Up (Eye Liner/Pencil, Eye Shadow, Mascara, Others), Facial Make-Up (BB/CC Creams, Blusher/Bronzer/Highlighter, Foundation/Concealer, Powder, Others), Lip Products (Lip Gloss, Lip Liner/Pencil, Lipstick, Others), Nail Products (Nail Polish, Nail Treatments/Strengthener, Polish Remover, Others), Colour Cosmetics Sets/Kits), By Price (Premium, Mass), By Gender (Men, Women, Unisex), By Packaging Type (Travel/Mini Size, Standard Size, Professional/Salon Size), By Form (Creams/Gels, Lotions, Sprays, Solid, Others), By Nature (Organic, Inorganic), By Sales Channel (Retail Offline, Retail Online)

- FMCG

- Feb 2026

- VI0948

- 120

-

Canada Colour Cosmetics Market Statistics and Insights, 2026

- Market Size Statistics

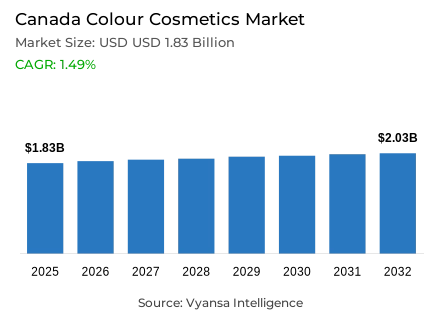

- Colour cosmetics in Canada is estimated at USD 1.83 billion in 2025.

- The market size is expected to grow to USD 2.03 billion by 2032.

- Market to register a cagr of around 1.49% during 2026-32.

- Category Shares

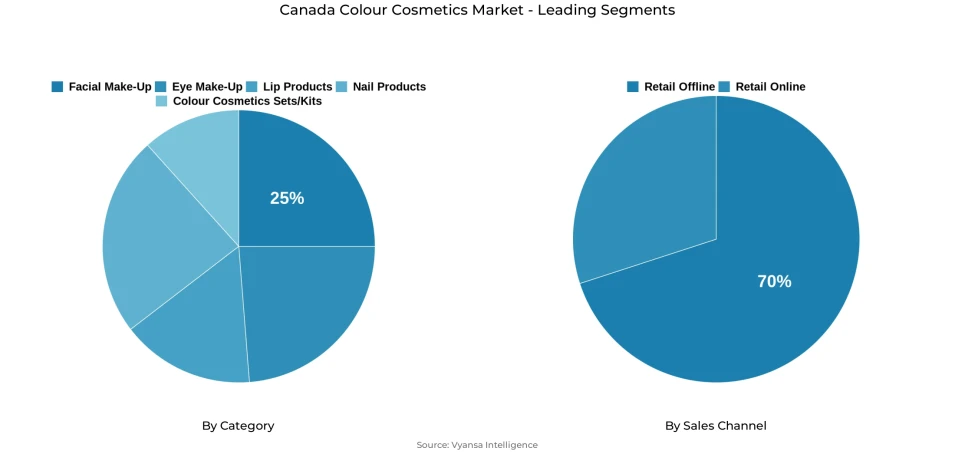

- Facial make-up grabbed market share of 25%.

- Competition

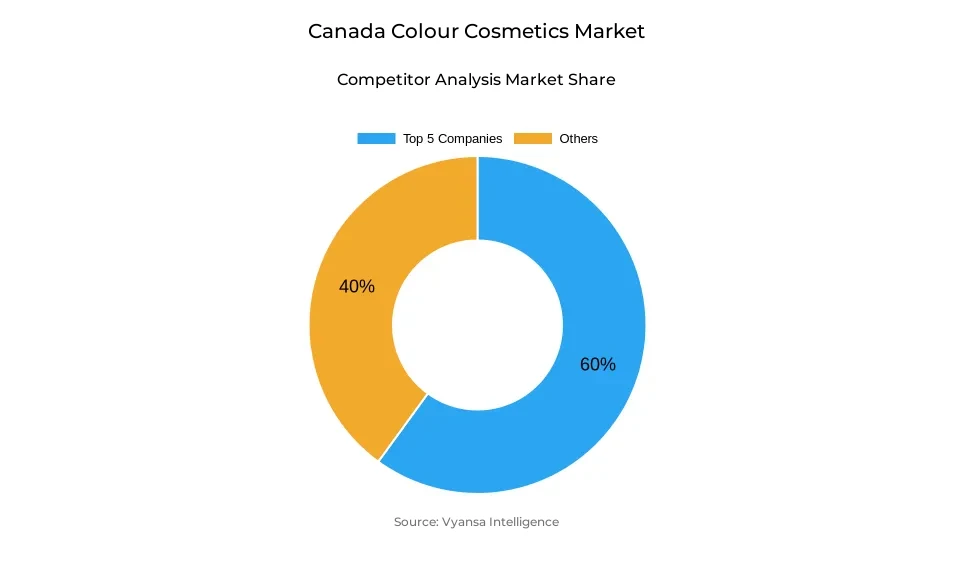

- More than 20 companies are actively engaged in producing colour cosmetics in Canada.

- Top 5 companies acquired around 60% of the market share.

- Clarins Canada Inc; Shiseido (Canada) Inc; Mary Kay Canada Inc; L'Oréal Canada Inc; Estée Lauder Cosmetics (Canada) Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 70% of the market.

Canada Colour Cosmetics Market Outlook

The Canada Colour Cosmetics Market has a long-term moderate outlook because the macroeconomic conditions have shown slow stabilization and population increase, which is largely fuelled by immigration and hence increasing the number of end users. The market is estimated at USD 1.83 billion in the year 2025 and is estimated to grow to USD 2.03 billion in the year 2032, which will give the market a compound annual growth rate of 1.49%. The continued growth in the market will be supported by the constant need of up-end products with the differentiating positioning as being in the category of affordable luxury goods especially with the rising trend that colour cosmetic formulations are including an element of skincare and sun care functionality in their positioning. As facial makeup takes up 25% of the market, the foundation formulations of hybrids, the tinted moisturizers, and the sun-protection-enhanced products are going to continue playing a vital role in the daily routine of beauty.

A beauty product segment is expected to be the most vibrant within the period of the forecast because eye makeup is driven by visual-oriented online platforms such as Tik Tok and Instagram where tutorials and new trends in the beauty market encourage people to test new products. The multifunctional product format will receive further traction in the market since end user will be more conscious of time-saving high value items. The examples of innovation include Skincare-Based foundation technologies and high-performance products that include the Trait d Hermes pencil by Hermes as examples of the brand adaptation to the growing end user requirements of versatility, high performance products and high quality features.

The offline retail outlets are estimated to keep the market dominance with 70% market share consisting of beauty specialty retailers and the well acclaimed pharmacy sector players. However, retail retail online will keep developing strategic value by offering end users more convenient product offerings, more product range, and more promotional value propositions. This will be supported by omnichannel retail strategies and the ability to deliver orders in-the-day and subscription based designs that will make online platforms increasingly important channels of distribution.

In the future, the market expansion will obtain further encouragement in the increased end user demand to the holistic wellbeing concepts, which will compel the brands to broaden their scope beyond the traditional cosmetic limits. New wellness-related products such as the strategic addition of spa and self-care service range products by the Lush Cosmetics, are pointers of new differentiation. As the multifunctional formulations, high-quality standards, and the focus on wellness continue to be innovative and develop, the Canada Colour Cosmetics Market is set to be stable in its growth until 2032.

Canada Colour Cosmetics Market Growth DriverSkin-Enhancing and Sun-Care Ingredients Elevate Product Value

The increasing integration of skincare and sun-care functional benefits with colour cosmetic formulations is one of the main forces that aid category expansion and premiumization. The current end user population is showing a growing inclination towards products that provide hydration, protection against the sun and barrier protection as well as cosmetic coverage; this marks a paradigm change as the modern world is now moving towards a multitasking approach to beauty products. Skin cancer has been the most common diagnosed category of cancer in Canada with more than 80,000 cases/year- surpassing breast, prostate, lung, and colon cancer cases combined- reported by the Canadian Skin Cancer Foundation and Health Canada, thus fueling long term public awareness on the risks of ultraviolet exposure and the importance of sun protection. This increased level of health awareness stimulates the pattern of using hybrid product formulations such as SPF-enhanced foundations, tinted moisturizers, and skincare-enhanced makeup formulations to boost the perceived value proposition of the colour cosmetics past the strictly aesthetic payoff.

The shift in multifunctional formulation architectures is strategically aligned with the more general trend of clean beauty end users, specifically involving younger end users aged 15–34, who represent a demographic group characterized by a higher rate of involvement in the cosmetic and personal care segments of the market. This is a highly tech-sophisticated, digitally-connected end user market that is actively pursuing efficient and skin-friendly products driven by online customer reviews, social media and ingredient transparency disclosure, which substantially reinforce the need of cosmetic products that combine beauty augmentation with demonstrated dermatological health and wellness adjudication and qualification.

Canada Colour Cosmetics Market ChallengeRising Living Costs Pressure Discretionary Beauty Spending

Macroeconomic pressures form a major problem to the colour cosmetics market since the elevated living standards affect the amount of discretionary funds that end users can spend materially. Canada had received a significant degree of inflationary pressure, whereby inflation hit a forty year peak of 8.1% in June 2022, and sustained high housing, energy, and grocery prices that would continue to limit household budgets in 2023 and well into 2024. This sustained economic strain declares the amount of disposable income to indulge in leisure spending and develops a pattern of thrifty spending habits forcing many end users to allocate more spend to basic areas of spending than high-end or experimental beauty purchases.

Even though large end user groups are still trying to find affordable luxury products and alternatives with lower prices, the price sensitivity caused by inflation is a major limitation to the experimentation with new colour cosmetic brands and end users are spending less often. As the price comparison practices escalate with the use of the online medium and marketing schemes, demand tends to shift to the competitively priced brands and marketing promotions. This operating environment places structural pressure on the manufacturers to negotiate between innovation requirements and the affordability needs and to manage high cost of production increasing the pressure on the brands to support premium price positioning with stronger performance claims, true multifunctional benefits or overpowering ethical value propositions and not by implementing marketing communications alone.

Canada Colour Cosmetics Market TrendShift Toward Natural, Clean, and Ethical Beauty Formulations

A notable trend shaping the Canada market is the growing preference among end users for natural, organic, and ethically positioned cosmetic products, driven largely by younger demographics with high digital engagement and greater access to product information. It is related to the growing pressure exerted on ingredient compositions and the avoidance of parabens as well as synthetic fragrances, and certain preservative compounds, which can be viewed as a result of increased awareness about expectancies through the safety and transparency of ingredient claims in cosmetic products. This regulatory framework is further enforced by the Cosmetic Ingredients Hotlist provided by Health Canada, which bans or provides cautionary information regarding the majority of cosmetic ingredients, which confirms the end user concerns and supports the growing demand of products promoting the positioning of clean, vegan and cruelty-free or plant-based active ingredients.

This trend is especially dominant in the group of Millennial and Generation Z demographic groups, as well as end user segments that will always be more willing to spend money on ethical, environmental-friendly, and sustainably sourced alternatives in colour cosmetics. In product development areas, the shift is manifested as increased vegan formulations, transparency sourcing, and plant-based active ingredients, and at the same time alters innovation pipelines and affects brand positioning in the form of packaging design, marketing stories, and transparency of the supply chain disclosure. With the increasingly rigorous regulatory frameworks and the shift in end user demands, the disproportionate value increase will be given to those brands, which focus on clean formulation and ethical credentials.

Canada Colour Cosmetics Market OpportunityPopulation Growth and Immigration Expand the Consumer Base

Canada accelerating population growth trajectory provides a structural and substantial opportunity for colour cosmetics market expansion. According to Statistics Canada, the nation recorded its highest population increase in over five decades, growing 3.2% between January 1, 2023 and January 1, 2024, driven predominantly by immigration with 97.6% of population growth attributable to net migration. This rapidly expanding and increasingly diverse population base widens the beauty end user demographic, increases aggregate demand across cosmetic categories, and creates heightened requirements for shade-inclusive, culturally aligned colour cosmetic solutions serving varied skin tones and end user preferences.

Diverse skin tone profiles and cultural beauty preferences create significant opportunities for brands to expand shade range portfolios, adapt formulations for varied undertone requirements, and develop products specifically engineered for diverse skin types and textural profiles. As newcomer populations integrate into Canada's multicultural beauty marketplace and establish consumption patterns, interest in both premium and mass-market colour cosmetics expands, particularly when supported by robust social media engagement, inclusive marketing strategies, and accessible product availability across retail and digital distribution channels. Brands systematically tailoring product development, shade inclusivity initiatives, and marketing narratives to multicultural demographics are positioned to capture disproportionate market share gains from this demographic-driven structural opportunity.

Canada Colour Cosmetics Market Segmentation Analysis

By Category

- Eye Make-Up

- Eye Liner/Pencil

- Eye Shadow

- Mascara

- Others

- Facial Make-Up

- BB/CC Creams

- Blusher/Bronzer/Highlighter

- Foundation/Concealer

- Powder

- Others

- Lip Products

- Lip Gloss

- Lip Liner/Pencil

- Lipstick

- Others

- Nail Products

- Nail Polish

- Nail Treatments/Strengthener

- Polish Remover

- Others

- Colour Cosmetics Sets/Kits

The dominant segment within category classification is facial makeup, which commands 25% of the Canada colour cosmetics market. As a daily-use essential for numerous working professionals, students, and social media-engaged end users, facial makeup remains central to contemporary beauty routines. Its sustained appeal is supported by hybrid formulation innovations that integrate skincare and sun care functional benefits—including hydration, SPF protection, and active ingredient delivery—thereby satisfying end user preferences for convenience and multifunctionality. This positioning aligns strategically with the broader market shift toward clean beauty and high-performance products offering enhanced value propositions during periods of economic constraint.

Throughout the forecast period, facial makeup is positioned to retain category leadership as product innovation continues integrating skin-enhancing features and natural ingredient compositions. The category will derive additional growth momentum from visual-first digital platforms including TikTok and Instagram, where flawless skin aesthetics and foundation application techniques drive sustained engagement and trial behavior among younger demographic segments.

By Sales Channel

- Retail Offline

- Retail Online

The dominant segment within distribution channel classification is retail offline, which commands 70% of the Canada colour cosmetics market. Beauty specialty retailers and pharmacy channel operators remain the strongest contributors, with retail operators including Sephora, Shoppers Drug Mart, and its Beauty Boutique format offering extensive product assortments, premium selections, and personalized service experiences. Retail offline maintains competitive advantage in product testing capabilities—essential for color matching foundation, concealer, and lip shade products—positioning it as the preferred distribution channel even as price sensitivity intensifies.

Throughout the forecast period, retail offline will continue maintaining channel leadership attributable to its experiential retail advantages and trusted product curation capabilities. However, retailers' ongoing omnichannel expansion initiatives—including same-day delivery services, click-and-collect functionality, and subscription-based models—will enable offline operators to maintain market share while accommodating the steady expansion of retail online channels.

List of Companies Covered in Canada Colour Cosmetics Market

The companies listed below are highly influential in the Canada colour cosmetics market, with a significant market share and a strong impact on industry developments.

- Clarins Canada Inc

- Shiseido (Canada) Inc

- Mary Kay Canada Inc

- L'Oréal Canada Inc

- Estée Lauder Cosmetics (Canada) Ltd

- Coty (Canada) Inc

- Groupe Marcelle

- Revlon Canada Inc

- New Avon Co

- Cosnova GmbH

Competitive Landscape

Canada colour cosmetics market remained highly competitive, with L’Oréal Canada retaining its leadership despite a slight decline in share, driven by pressure on both its premium and mass brands. Its portfolio—L’Oréal Paris, Maybelline New York, Lancôme, NYX, Garnier and Essie—continued to dominate shelf presence, yet intensified competition allowed Estée Lauder Cosmetics to emerge as the most dynamic performer, supported by strong equity in MAC, Clinique, Estée Lauder and Bobbi Brown. The landscape also saw rapid growth from E.L.F. Cosmetics, whose affordable, vegan formulations resonated strongly with value-conscious and ethically minded shoppers, while its expanded presence at Shoppers Drug Mart boosted visibility. Celebrity-driven r.e.m. beauty further diversified offerings with its fully vegan line and 60-shade Sweetener Foundation. As smaller players gain traction and omnichannel retail strengthens, competition in Canada’s colour cosmetics sector is deepening, reshaping leadership dynamics and broadening consumer choice.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Canada Colour Cosmetics Market Policies, Regulations, and Standards

4. Canada Colour Cosmetics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Canada Colour Cosmetics Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Eye Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Eye Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Eye Shadow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Mascara- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Facial Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. BB/CC Creams- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Blusher/Bronzer/Highlighter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Foundation/Concealer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Lip Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Lip Gloss- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Lip Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lipstick- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Nail Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Nail Polish- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Nail Treatments/Strengthener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Polish Remover- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Colour Cosmetics Sets/Kits- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Price

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Packaging Type

5.2.4.1. Travel/Mini Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Standard Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Professional/Salon Size- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Form

5.2.5.1. Creams/Gels- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Lotions- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Sprays- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Solid- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Nature

5.2.6.1. Organic- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Inorganic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Canada Eye Make-Up Colour Cosmetics Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Canada Facial Make-Up Colour Cosmetics Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Canada Lip Products Colour Cosmetics Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Canada Nail Products Colour Cosmetics Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Canada Colour Cosmetics Sets/Kits Colour Cosmetics Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Price- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Gender- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. L'Oréal Canada Inc

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Estée Lauder Cosmetics (Canada) Ltd

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Coty (Canada) Inc

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Groupe Marcelle

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Revlon Canada Inc

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Clarins Canada Inc

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Shiseido (Canada) Inc

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Mary Kay Canada Inc

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. New Avon Co

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Cosnova GmbH

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Price |

|

| By Gender |

|

| By Packaging Type |

|

| By Form |

|

| By Nature |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.