Canada Baby and Child-Specific Products Market Report: Trends, Growth and Forecast (2026-2032)

Product (Hair Care, Skin Care, Sun Care, Toiletries, Baby Wipes, Diapers, Medicated), Category (Premium, Mass), Sales Channel (Retail Online, Retail Offline)

- FMCG

- Dec 2025

- VI0569

- 125

-

Canada Baby and Child-Specific Products Market Statistics and Insights, 2026

- Market Size Statistics

- Baby and Child-Specific Products in Canada is estimated at $ 255 Million.

- The market size is expected to grow to $ 280 Million by 2032.

- Market to register a CAGR of around 1.35% during 2026-32.

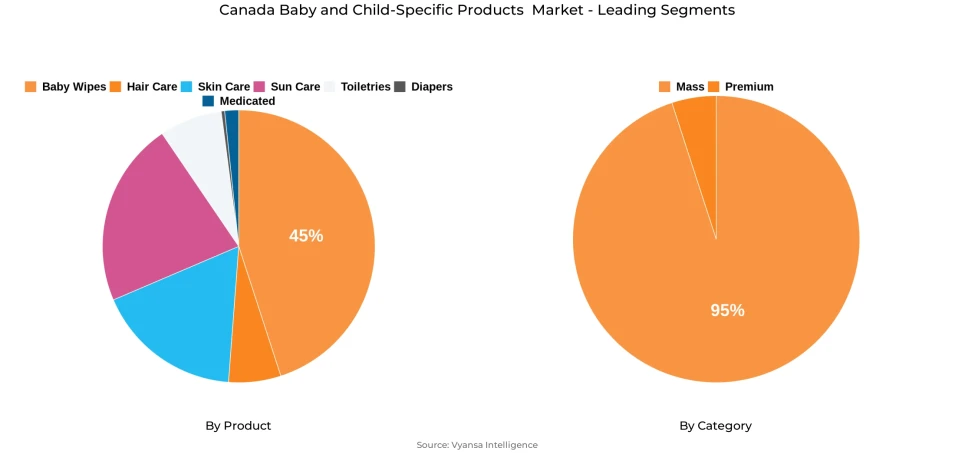

- Product Shares

- Baby Wipes grabbed market share of 45%.

- Competition

- More than 15 companies are actively engaged in producing Baby and Child-Specific Products in Canada.

- Top 5 companies acquired around 65% of the market share.

- Edgewell Personal Care Brands LLC, Centura Brands Inc, Leda Health Innovations Inc, Procter & Gamble Inc, Kimberly-Clark Canada Inc etc., are few of the top companies.

- Category

- Mass grabbed 95% of the market.

Canada Baby and Child-Specific Products Market Outlook

The Canada baby and child-specific products market will expand steadily from an estimated $255 million in 2025 to $280 million by 2032. Expansion will be driven by growing end users interest in health, wellness, and sustainability, as end users increasingly favour natural and gentle formulations for sensitive or eczema-prone skin. Multi-purpose products delivering benefits combined in one formula, such as shampoo and body wash together, will continue to be popular, providing convenience and value. Nappy rash remedies and baby toiletries will remain the most dynamic categories during the forecast period.

The leading five players accounting for about 65% of overall market share. Major brands such as Pampers, Johnson's Baby, and Kandoo are predicted to maintain leadership positions, riding on established formulations, licensed character partnerships, and extensive product ranges. Gentleness, dermatological testing, and hypoallergenicity will continue to drive end users' choice, especially among end users looking for safe products for babies and little children.

Mass-market items will still lead the distribution, representing 95% of retailing sales. Hypermarkets and big retail chains will still be first channels because of their extensive range, value for money, and promotions. Retail Retail online, in turn, will continue being a major channel as continued investments in online foodstore platforms, same-day ordering and delivery, and omnichannel services provide convenience to busy end users and enhance availability of niche or premium brands.

Sustainability and green packaging will continue to gain momentum, in addition to products that cater to individual dermatological requirements. Products like refillable bubble bath and shampoo pouches, and formulations paraben-free, phthalate-free, sulphate-free, dyed-free, fragranced-free, and steroid-free, will appeal to end users seeking safety, effectiveness, and eco-friendliness. Such trends will sustain value growth in the market to meet the changing expectations of modern end users.

Canada Baby and Child-Specific Products Market Growth Driver

Increasing Demand for Soft and Health-Focused Formulations

The drivers of the market are mainly end users increasing need for products with gentle, health-oriented, and dermatologically proven ingredients. End users are increasingly aware of the sensitive skin of their children and are consciously opting for hypoallergenic, fragrance-free, and clinically tested products. Paraben, sulphate, and dye-free formulations are taking precedence as end users look for products that are safe and effective for delicate skin. Brands that provide clinically tested products like eczema care washes or tear-free shampoos are experiencing robust demand.

Increased emphasis on health, wellness, and transparency in baby care formulations is a reflection of a larger lifestyle change across end users. With skin-related sensitivities increasing, naturally derived and dermatologist-recommended baby products continue to see stable demand, driving end users confidence and market expansion.

Canada Baby and Child-Specific Products Market Trend

Increased Demand for Natural and Multi-Functional Products

The key trends influencing the marketplace is increasing demand for natural, clean-label, and multi-functional baby care products. end users are increasingly opting for 2-in-1 or all-in-one products like merged shampoo and body wash products that make routines simpler and offer value and safety. Products with added natural ingredients like coconut oil, oatmeal, and chamomile are gaining traction due to skin-soothing and gentle attributes.

This trend reflects end users' need for convenience and wellness-driven decisions in daily care. Multi-purpose, natural formulations not only save time but also reflect the larger movement to sustainable and health-focused lifestyles. As this trend becomes more established, brands that lead with safe, effective, and naturally inspired combinations will be best positioned to continue leading market growth.

Canada Baby and Child-Specific Products Market Opportunity

Dermatological Innovation Driving Future Product Development

Future prospects in the Canada Baby and Child-Specific Products Market will revolve around dermatological innovation, as end users seek out products with sensitive and eczema-friendly formulas. Products formulated with dermatologist input and supported by clinical trials are likely to experience high adoption. Products that include ingredients like colloidal oatmeal, coconut oil, and natural emollients will become popular for their soothing properties, redness-reducing capacity, and ability to shield the skin barrier.

As the consciousness of infant skin health grows, brands that are willing to invest in scientifically progressive but mild solutions will be on a strong growth trajectory. Enlarging portfolios with medical-grade efficacy coupled with natural ingredients will appeal to end users who are increasingly looking for tried, trusted, safe, and transparent products. This trend towards dermatologically engineered innovation will be the hallmark of the next generation of product development and differentiation in the marketplace.

Canada Baby and Child-Specific Products Market Segmentation Analysis

By Product

- Hair Care

- Skin Care

- Sun Care

- Toiletries

- Baby Wipes

- Diapers

- Medicated

The segment with highest market share under Product Shares is Baby Wipes, accounting for 45% of the total market. This dominance is attributed to their essential role in daily baby care routines, offering convenience, hygiene, and affordability for parents. Despite price sensitivity during inflationary periods, baby wipes continue to record steady demand, as they are viewed as indispensable products for maintaining infant hygiene. Cost-conscious parents increasingly opt for mass-market brands that provide both reliability and value for money, reinforcing the segment’s solid position in the market.

The category benefits from innovation in gentle and skin-safe formulations. Brands such as Pampers and Huggies have strengthened their presence with hypoallergenic, fragrance-free variants suitable for sensitive skin. Licensed merchandise like Paw Patrol-themed wipes further enhances product appeal among children, helping maintain engagement and steady value growth within this key segment.

By Category

- Premium

- Mass

The segment with highest market share under Category is Mass, holding an impressive 95% share of the Canada Baby and Child-Specific Products Market. This overwhelming dominance reflects parents’ ongoing focus on affordability and accessibility amid economic pressures. Mass brands like Pampers, Huggies, and Johnson’s Baby remain trusted household names, offering quality at reasonable prices through widely available retail channels such as hypermarkets and online platforms.

The mass segment’s leadership is also supported by continuous innovation that balances safety and cost efficiency. Products are formulated to be gentle, hypoallergenic, and dermatologically tested while remaining within budget-friendly price points. As consumers continue to seek dependable, multi-functional, and value-driven options, the mass category is expected to sustain its lead across the forecast period, ensuring accessibility and consistent growth in Canada’s evolving baby care landscape.

Top Companies in Canada Baby and Child-Specific Products Market

The top companies operating in the market include Edgewell Personal Care Brands LLC, Centura Brands Inc, Leda Health Innovations Inc, Procter & Gamble Inc, Kimberly-Clark Canada Inc, Johnson & Johnson (Canada) Inc, Beiersdorf Canada Inc, L'Oréal Canada Inc, Burt's Bees Inc, Paladin Labs Inc, etc., are the top players operating in the Canada Baby and Child-Specific Products Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Canada Baby and Child-Specific Product Market Policies, Regulations, and Standards

4. Canada Baby and Child-Specific Product Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Canada Baby and Child-Specific Product Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Hair Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Skin Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Sun Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Toiletries- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Baby Wipes- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Diapers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Medicated- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Category

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Sales Channel

5.2.3.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Canada Baby and Child-Specific Hair Care Product Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Canada Baby and Child-Specific Skin Care Product Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Canada Baby and Child-Specific Sun Care Product Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Canada Baby and Child-Specific Toiletries Product Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Canada Baby and Child-Specific Baby Wipes Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Canada Baby and Child-Specific Diapers Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Canada Baby and Child-Specific Medicated Product Market Statistics, 2022-2032F

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in US$ Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Competitive Outlook

13.1. Company Profiles

13.1.1. Procter & Gamble Inc

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. Kimberly-Clark Canada Inc

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Johnson & Johnson (Canada) Inc

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. Beiersdorf Canada Inc

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. L'Oréal Canada Inc

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. Edgewell Personal Care Brands LLC

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. Centura Brands Inc

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. Leda Health Innovations Inc

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. Burt's Bees Inc

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

13.1.10. Paladin Labs Inc

13.1.10.1.Business Description

13.1.10.2.Product Portfolio

13.1.10.3.Collaborations & Alliances

13.1.10.4.Recent Developments

13.1.10.5.Financial Details

13.1.10.6.Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.