Brazil Two Wheeler Tire Market Report: Trends, Growth and Forecast (2026-2032)

By Vehicle Type (Scooter (Electric, ICE), Motorcycle (Electric, ICE)), By Demand Type (OEM, Aftermarket), By Sales Channel (Direct Sales, Multi Brand Stores & Exclusive Outlets, Online), By Tire Type (Radial, Bias), By Two Wheeler Engine Power (Up to 50 CC, 51 to 160 CC, 161 to 300 CC, 301 to 449 CC, Above 450 CC, Electric), By Tire Size (Front Tire Size (Tire Size 1, Tire Size 2, Tire Size 3, Tire Size 4, Tire Size 5), Rear Tire Size (Tire Size 1, Tire Size 2, Tire Size 3, Tire Size 4, Tire Size 5)), By Geography (Urban, Rural), By Price Category (Budget, Economy, Premium), By Region (North (Pará, Amazonas, Rondônia, Others), Northeast (Ceará, Pernambuco, Bahia, Maranhão, Others), Southeast (São Paulo, Minas Gerais, Others), South (Paraná, Rio Grande do Sul, Others), Center-West (Mato Grosso, Goiás, Others))

|

Major Players

|

Brazil Two Wheeler Tire Market Statistics and Insights, 2026

- Market Size Statistics

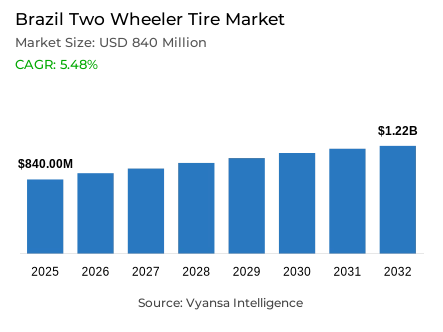

- Brazil two wheeler tire market is estimated at USD 840 million in 2025.

- The market size is expected to grow to USD 1.22 billion by 2032.

- Market to register a cagr of around 5.48% during 2026-32.

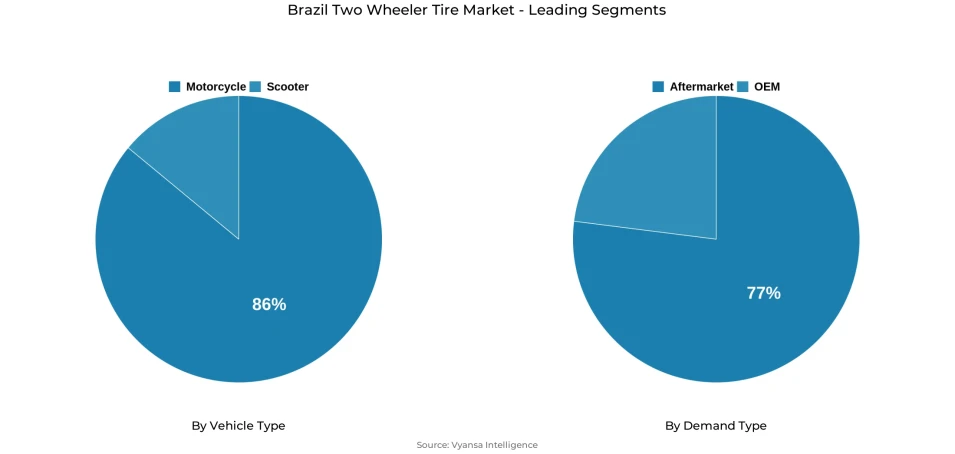

- Vehicle Type Shares

- Motorcycle grabbed market share of 80% in terms of units sold.

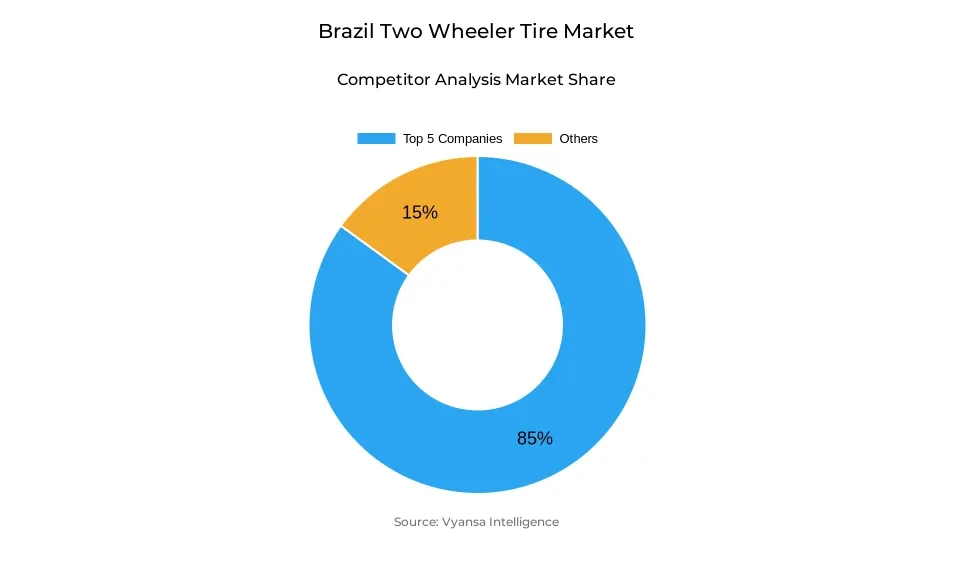

- Competition

- Brazil two wheeler tire market is currently being catered to by more than 25 companies.

- Top 5 companies acquired around 85% of the market share.

- Vipal; Maggion Tires; Borilli; Rinaldi; Bridgestone etc., are few of the top companies.

- Demand Type

- Aftermarket grabbed 80% of the market in terms of units sold.

- Faster Growing Tire Size Segment

- 110/90 -17M/C segment to register 5.49% CAGR during 2026-32.

Brazil Two Wheeler Tire Market Outlook

The Brazil market for two wheeler tires is moving through a moderate growth phase, with a projected increase from USD 840 million in 2025 to USD 1.22 billion by 2032 at a CAGR of 5.48%. The economy faces macro headwinds, but the two wheeler segment remains important for urban mobility and last mile usage. Domestic motorcycle production in Brazil recorded registrations of about 1.81 million units in 2024.

In the first nine months of 2025, the registrations for two-wheelers have crossed the 1.8 million mark. The sales of motorcycles have escalated over 10% yoy in 2025, and the sales of scooters have been surging at around 8% yoy, driven by the growing acceptance of electric scooters. The cumulative registration figures for two-wheelers in 2025 have been estimated at 1.26 million units, as reported by the Associação Brasileira dos Fabricantes de Motocicletas, Ciclomotores, Motonetas, Bicicletas e Similares (ABRACICLO). This strong penetration for two-wheelers is expected to drive the sales of two-wheeler tire products in the future periods of 2026-32.

The tire production is well aligned with an upward trend and is estimated to produce nearly 35 million two-wheeler tires by 2030. Such demand is fueled by the end user looking to upgrade their vehicle and also by commercial vehicles that will need high-performance tires to last them a long period of time. Brazil has an installed base to produce tires efficiently to meet local demand, which is necessary as the demands on tires differ as per the road and driving patterns that cause different levels of tires to degrade. Such an installed base reduces risks related to raw material prices and import tariffs.

Brazil Two Wheeler Tire Market Growth DriverFleet intensive usage fueling replacement cycles

Brazil’s two wheeler tire demand is increasingly driven by intensive fleet operations, particularly in logistics, food delivery, and mototaxi services. According to data from iFood, Brazil’s leading food delivery platform, over 270,000 delivery partners are active on motorcycles, predominantly in São Paulo, Rio de Janeiro, and Belo Horizonte. Each delivery rider averages 70–100 km per day, resulting in accelerated tire wear and more frequent replacement cycles compared to privately owned two wheelers. In São Paulo alone, more than 60,000 mototaxi and delivery bikes are estimated to be in daily operation as of 2024, based on figures from the São Paulo Traffic Engineering Company (CET) and local mobility reports. These vehicles endure stop and go city conditions, uneven pavement, and long operational hours — significantly reducing tire lifespan to as little as 5,000-8,000 km. That creates a recurring aftermarket opportunity for durable, high performance tires suited to fleet needs.

From a production perspective, manufacturers based in the Manaus Industrial Hub have increased output of replacement grade two wheeler tires to cater to these high-usage urban markets. Companies like Maggion and Vipal have also begun targeting fleet-specific segments with reinforced tread compounds and mobile replacement services. Such solutions cater directly to urban delivery fleets that cannot afford downtime from tire failure.

Therefore, the driving force behind the tire market is not just vehicle growth, but tire burnout rates driven by heavy, repetitive daily use. Tire makers with a focus on longevity, sidewall strength, and service accessibility are best positioned to meet the needs of this fast-replacing, high mileage user base, which is now central to Brazil’s two wheeler ecosystem.

Brazil Two Wheeler Tire Market ChallengeStructural and Economic Constraints Shaping Two-Wheeler Volume Growth

Brazil’s two wheeler market faces modest volume growth due to a combination of structural and economic factors. Despite production levels reaching approximately 1.57 million motorcycles in 2023 (ABRACICLO), expansion is restrained by broader macroeconomic challenges such as inflationary pressures and sluggish consumer spending, which temper new vehicle purchases. Additionally, urban infrastructure constraints and rising fuel costs reduce incentives for new two wheeler acquisitions beyond replacement demand.

Raw material price volatility also impacts tire manufacturers’ profitability and pricing strategies. Brazil relies heavily on imported synthetic rubber and other compounds, whose costs fluctuate due to global supply chain disruptions and geopolitical factors. Domestic natural rubber output, while growing, cannot fully offset this dependence. Moreover, Brazil imposes import tariffs on tires of 16–18%, balancing protectionism with pricing pressures in a competitive environment.

The transition toward electric two wheelers remains at an embryonic stage. As of 2024, electric motorcycles accounted for less than 2% of total sales (IBAMA), limiting the market’s ability to tap into emerging segments with potentially higher tire replacement rates. Consequently, tire demand growth is tied closely to traditional internal combustion engine motorcycles, where saturation and slower fleet turnover restrict unit expansion despite some premiumization trends.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Brazil Two Wheeler Tire Market TrendRapid adoption of larger tire sizes (110/90 17 M/C) and premium fitments

A significant trend shaping Brazil’s two‑wheeler tire market is the growing preference for larger, higher-specification tires, notably the 110/90 17 M/C size, which is expanding at a CAGR of approximately 5.49%. This shift corresponds with a consumer move from entry-level commuter motorcycles to more powerful mid-range bikes and premium scooters that demand tires capable of delivering enhanced stability, comfort, and performance for longer or leisure rides.

In response, manufacturers like Michelin and Bridgestone are introducing premium tire lines with advanced compounds, tubeless designs, and higher load ratings tailored for these upgraded models. The aftermarket is evolving accordingly, with customers increasingly seeking performance-oriented tires rather than just standard replacements, thus opening avenues for higher-margin products.

Additionally, the growth of high-mileage delivery fleets further fuels demand for more durable, performance-enhanced tires. These vehicles require reliable, upgraded tire specifications to withstand intensive usage, making the premiumisation of tire size and quality a defining feature of the market’s evolution in the near term.

Brazil Two Wheeler Tire Market OpportunityPremium & performance tires for growth in second tier cities

The two wheeler tire market in Brazil presents a rising opportunity in second-tier cities where economic expansion and motorcycle ownership are converging. According to Brazilian Institute of Geography and Statistics (IBGE), cities such as Campinas, Ribeirão Preto, Feira de Santana, and Joinville have recorded above average growth in motorcycle ownership over the past five years. With rising disposable incomes and broader access to credit, users in these cities are shifting from entry-level bikes to mid-range or premium models, requiring tires with better grip, load handling, and durability.

As per LUB (Brazilian Union of Motorcycle Manufacturers), the production of street motorcycles, often larger engine capacity and premium, saw a YoY growth of over 13% in 2022. This shift indicates not just more vehicles but better vehicles on the road, which logically demands higher-performing tires. Manufacturers like Michelin and Borilli are already positioning premium products (e.g., tubeless, sport-touring profiles) for these users, aiming to improve ride quality, handling, and safety, attributes increasingly valued outside the metro cores.

Moreover, Brazil already produces ~96% of regional motorcycle tire volume domestically, giving manufacturers the supply-side leverage. The real opportunity now lies in extending the aftermarket and servicing infrastructure to interior regions, where tire service density remains low. Offering value-added products (run-flat, puncture-resistant, dual-compound tires) with accessible installation and credit facilities can increase average revenue per customer.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Brazil Two Wheeler Tire Market Segmentation Analysis

By Vehicle Type

- Scooter

- Electric

- ICE

- Motorcycle

- Electric

- ICE

Motorcycles dominate Brazil’s two-wheeler tire market with an estimated 80% share, reflecting their extensive use for daily commuting and commercial applications. Brazil’s motorcycle production reached approximately 1.4 million units in 2025, highlighting a large installed base that drives substantial tire demand. Motorcycles offer superior utility in Brazil’s congested urban centers due to their maneuverability, speed, and ability to navigate traffic efficiently, making them preferred both by private users and commercial fleets such as delivery and mototaxi services.

Motorcycle sales in Brazil are growing due to increasing urban congestion, which makes motorcycles a faster and more flexible transportation option in crowded cities like São Paulo and Rio de Janeiro. Government incentives supporting local production and rising demand from younger riders’ further drive sales. The gradual introduction of electric motorcycles is also expanding the market, attracting environmentally aware buyers.

Additionally, the growing penetration of electric scooters are expected to bolster the market share of scooters in the forthcoming years. The Brazil government is implementing initiatives to promote electric mobility, including incentives for electric vehicle adoption and the development of charging infrastructure. These developments indicate a positive trajectory for the electric scooter market in Brazil.

By Demand Type

- OEM

- Aftermarket

The aftermarket segment commands a dominant 80% share of the Brazil two wheeler tire market, driven by the extensive and expanding fleet requiring regular tire replacements. In 2025, Brazil had approximately 39.2 million licensed motorcyclists, marking a 39% increase over the past decade and averaging 1.2 million new riders annually. This growth reflects stronger adoption of motorcycles for daily commuting, commercial use, and leisure, underpinning sustained demand for replacement tires.

The national motorcycle fleet exceeds 33.9 million units in 2025, representing 28% of all vehicles in circulation, a 40% rise over the last 10 years. Many of these motorcycles operate in high-mileage commercial applications such as delivery services and mototaxis, which accelerate tire wear and increase replacement frequency. This intensifies aftermarket tire demand far beyond new vehicle fitments.

On the OEM side, production is expected to reach about 1.95 million units by 2025, supported by rising urban mobility needs and investments from manufacturers like Bajaj. However, OEM tire demand grows moderately in comparison to the expanding installed base requiring replacement tires.

List of Companies Covered in Brazil Two Wheeler Tire Market

The companies listed below are highly influential in the Brazil two wheeler tire market, with a significant market share and a strong impact on industry developments.

- Vipal

- Maggion Tires

- Borilli

- Rinaldi

- Bridgestone

- Dunlop

- Michelin

- Levorin

- Continental

- Metzeler (Pirelli)

Recent Developments

- Michelin, 2025:

Michelin announced capacity expansion in Brazil to bolster production of motorcycle tires, targeting Brazil and Latin America fleets requiring higher spec replacements — the move aims to shorten lead times and reduce import dependence.

- Bridgestone, 2025:

Bridgestone introduced a new tubeless tire series for automatic scooters in Brazil, reinforcing its aftermarket positioning and capitalising on the rising scooter segment in urban centres.

- Continental, 2025:

Continental signed a partnership with a Brazilian distributor to improve reach in interior states, aiming to tap replacement tire demand in secondary cities and capture higher margin premium imports.

- Vipal, 2025:

Vipal announced a USD 20 million upgrade of its tire retreading and replacement tire facility in the Manaus industrial region, focused on commercial two wheeler tire flows and faster parts supply.

- Maggion Tires, 2025:

Maggion introduced a mobile fitment truck service for mototaxi fleets in São Paulo and Rio, enabling faster tire replacement for high mileage two wheelers and capturing service ecosystem share.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Brazil Two Wheeler Tire Market Policies, Regulations, and Standards

4. Brazil Two Wheeler Tire Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Brazil Two Wheeler Tire Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold (Thousand Units)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Vehicle Type

5.2.1.1. Scooter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Electric- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. ICE- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Motorcycle- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Electric- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. ICE- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Demand Type

5.2.2.1. OEM- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Aftermarket- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Sales Channel

5.2.3.1. Direct Sales- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Multi Brand Stores & Exclusive Outlets- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Online- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Tire Type

5.2.4.1. Radial- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Bias- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Two Wheeler Engine Power

5.2.5.1. Up to 50 CC- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. 51 to 160 CC- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. 161 to 300 CC- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. 301 to 449 CC- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Above 450 CC- Market Insights and Forecast 2022-2032, USD Million

5.2.5.6. Electric- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Tire Size

5.2.6.1. Front Tire Size- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.1. Tire Size 1- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.2. Tire Size 2- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.3. Tire Size 3- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.4. Tire Size 4- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.5. Tire Size 5- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Rear Tire Size- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.1. Tire Size 1- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.2. Tire Size 2- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.3. Tire Size 3- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.4. Tire Size 4- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.5. Tire Size 5- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Geography

5.2.7.1. Urban- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Rural- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Price Category

5.2.8.1. Budget- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Economy- Market Insights and Forecast 2022-2032, USD Million

5.2.8.3. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Region

5.2.9.1. North- Market Insights and Forecast 2022-2032, USD Million

5.2.9.1.1. Pará- Market Insights and Forecast 2022-2032, USD Million

5.2.9.1.2. Amazonas- Market Insights and Forecast 2022-2032, USD Million

5.2.9.1.3. Rondônia- Market Insights and Forecast 2022-2032, USD Million

5.2.9.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.9.2. Northeast- Market Insights and Forecast 2022-2032, USD Million

5.2.9.2.1. Ceará- Market Insights and Forecast 2022-2032, USD Million

5.2.9.2.2. Pernambuco- Market Insights and Forecast 2022-2032, USD Million

5.2.9.2.3. Bahia- Market Insights and Forecast 2022-2032, USD Million

5.2.9.2.4. Maranhão- Market Insights and Forecast 2022-2032, USD Million

5.2.9.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.9.3. Southeast- Market Insights and Forecast 2022-2032, USD Million

5.2.9.3.1. São Paulo- Market Insights and Forecast 2022-2032, USD Million

5.2.9.3.2. Minas Gerais- Market Insights and Forecast 2022-2032, USD Million

5.2.9.3.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.9.4. South- Market Insights and Forecast 2022-2032, USD Million

5.2.9.4.1. Paraná- Market Insights and Forecast 2022-2032, USD Million

5.2.9.4.2. Rio Grande do Sul- Market Insights and Forecast 2022-2032, USD Million

5.2.9.4.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.9.5. Center-West- Market Insights and Forecast 2022-2032, USD Million

5.2.9.5.1. Mato Grosso- Market Insights and Forecast 2022-2032, USD Million

5.2.9.5.2. Goiás- Market Insights and Forecast 2022-2032, USD Million

5.2.9.5.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.10. By Competitors

5.2.10.1. Competition Characteristics

5.2.10.2. Market Share & Analysis

6. Brazil Scooter Tire Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold (Thousand Units)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Vehicle Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Demand Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Tire Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Two Wheeler Engine Power- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Tire Size- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Geography- Market Insights and Forecast 2022-2032, USD Million

6.2.8.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.9.By Region- Market Insights and Forecast 2022-2032, USD Million

7. Brazil Motorcycle Tire Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold (Thousand Units)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Vehicle Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Demand Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Tire Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Two Wheeler Engine Power- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Tire Size- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Geography- Market Insights and Forecast 2022-2032, USD Million

7.2.8.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.9.By Region- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Michelin

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Levorin

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Rinaldi

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Continental

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Bridgestone

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Borilli

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Dunlop

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Maggion Tires

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Vipal

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Metzeler (Pirelli)

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Vehicle Type |

|

| By Demand Type |

|

| By Sales Channel |

|

| By Tire Type |

|

| By Two Wheeler Engine Power |

|

| By Tire Size |

|

| By Geography |

|

| By Price Category |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.