Brazil Truck Tire Market Report: Trends, Growth and Forecast (2026-2032)

By Truck Type (Light Truck, Medium Truck, Heavy & Ultra Heavy Truck), By Demand Type (OEM, Aftermarket), By Sales Channel (Direct Sales, Multi Brand Stores & Exclusive Outlets, Online), By Tire Type (Radial, Bias), By Tire Size (Tire Size 1, Tire Size 2, Tire Size 3, Tire Size 4, Tire Size 5), By Price Category (Budget, Economy, Premium), By Region (North (Pará, Amazonas, Rondônia, Others), Northeast (Ceará, Pernambuco, Bahia, Maranhão, Others), Southeast (São Paulo, Minas Gerais, Others), South (Paraná, Rio Grande do Sul, Others), Center-West (Mato Grosso, Goiás, Others))

|

Major Players

|

Brazil Truck Tire Market Statistics and Insights, 2026

- Market Size Statistics

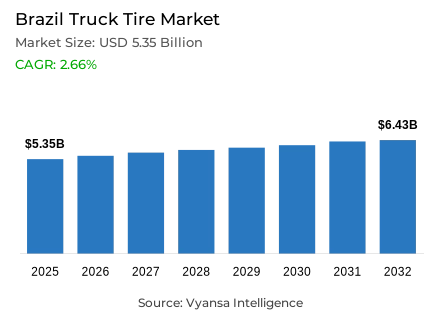

- Brazil truck tire market is estimated at USD 5.35 billion in 2025.

- The market size is expected to grow to USD 6.43 billion by 2032.

- Market to register a cagr of around 2.66% during 2026-32.

- Truck Type Shares

- Heavy & Ultraheavy Trucks grabbed market share of 45% in terms of units sold.

- Competition

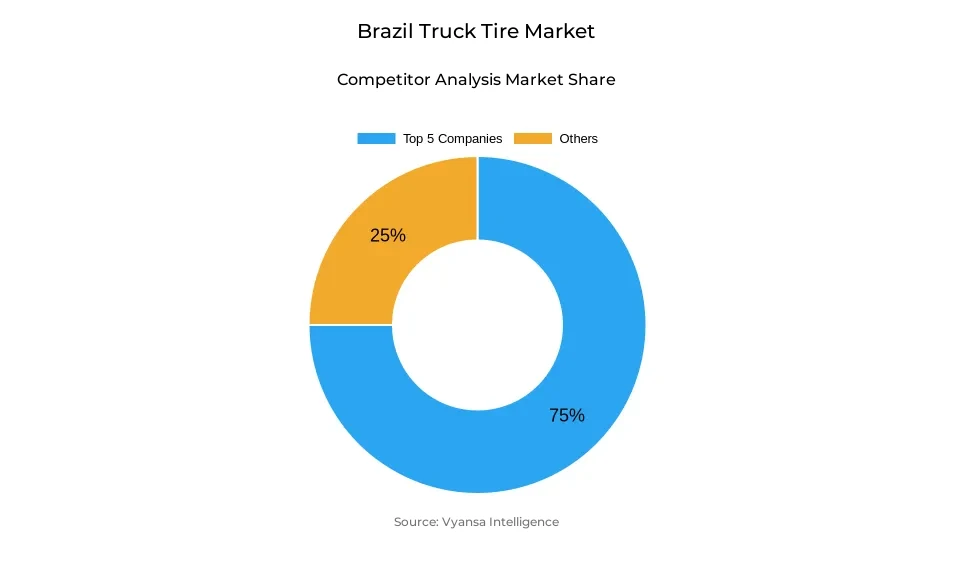

- Brazil truck tire market is currently being catered to by more than 25 companies.

- Top 5 companies acquired around 75% of the market share.

- Sumitomo Rubber; Continental; Yokohama Rubber; Prometeon; Michelin etc., are few of the top companies.

- Demand Type

- Aftermarket grabbed 70% of the market in terms of units sold.

- Faster Growing Tire Size Segment

- 275/80R22.5 segment to register 6.5% CAGR during 2026-32.

Brazil Truck Tire Market Outlook

The Brazil Truck Tire Market is witnessing steady growth driven by rising domestic truck production and exports. In 2025, the Brazilian truck tire market size was estimated at USD 5.35 billion, and is further expected to soar to USD 6.43 billion by 2032. The market is forecasted to grow at a CAGR of around 2.66%.

In 2025, Brazil produced a total of 132,587 trucks, including 65,644 heavy trucks, 43,243 semi-heavy trucks, 6,983 medium-duty trucks, 15,514 light trucks, and 1,203 semi-light trucks. Bus production reached 24,030 units. Exports of trucks accounted for 16,272 units, including 1,019 total trucks in January, and heavy trucks contributing 1,581 units over nine months. Domestic registration data from Brazilian Association of Automotive Vehicle Manufacturers shows Mercedes-Benz and FCA (Fiat/Dodge) leading production for heavy and light trucks, respectively, reflecting the increasing demand for OEM tires for fleet operators and logistics companies.

The aftermarket demand remains high, particularly for heavy and ultra-heavy trucks, driven by continuous vehicle operations and road logistics expansion. Greenfield investments in truck manufacturing and tire plants in São Paulo and Minas Gerais, worth over USD 250 million, are expected to support tire supply. Cross-border trade with Argentina and Chile has increased, with an estimated USD 120 million in truck exports facilitating aftermarket replacement tire demand. The introduction of electric and hybrid heavy trucks by Volkswagen and Iveco, along with fleet modernization programs supported by BNDES and World Bank financing, further accelerates demand for high-durability truck tires.

Additionally, increasing road freight transport, Brazilian Ministry of Transport reports a 3.2% annual rise in truck-kilometers travelled, directly increases tire wear, boosting replacement tire sales. Tires for high-mileage trucks, are projected to witness the fastest growth at 6.5% CAGR during 2025 32. Overall, the synergy of rising truck production, export growth, investment in manufacturing, and logistics expansion is supporting consistent market growth.

Brazil Truck Tire Market Growth DriverExpansion of Domestic Truck Manufacturing and Fleet Modernization

The Brazil truck tire market is influenced by the growing domestic truck manufacturing industry. The number of manufacturers, such as Mercedes-Benz, FCA (Fiat/Dodge), Volkswagen Caminhões e Ônibus, and Iveco, invests in production capacity expansions in São Paulo and Rio Grande do Sul. Greenfield investments over USD 250 million will likely expand both tire supply chains and complementary businesses, including the production of radial tires for heavy-duty transportation.

Fleet modernization programs, with the support of the World Bank, BNDES, and private logistic companies, are also replacing old trucks with higher-performance trucks that require more durable and high-performance tires. ANFAVEA registration of new trucks in the country showed that Mercedes-Benz manufactured more than 1,600 units per month, FCA close to 1,400 units per month, and Iveco from 500 to 600 units a month, which generates a constant demand for both OEM and after-sales tires. Cross-border trade with neighboring countries such as Argentina and Chile adds to the need for strong truck tires, with exports amounting to about USD 120 million.

This ongoing expansion in truck production, modernization of fleets, and supportive government policies collectively maintain the demand for tires and are the main determinant of market growth from 2025 to 2032.

Brazil Truck Tire Market ChallengeRaw Material Price Volatility and Supply Chain Constraints

The truck tire market faces challenges due to fluctuations in raw material prices, particularly natural rubber and synthetic polymers. Global natural rubber prices increased by 12% in 2025, impacting tire manufacturing costs. Additionally, semi-heavy and heavy truck tires require higher quantities of steel belts and reinforcing fibers, making cost management critical.

Supply chain constraints, including limited tire curing capacity and delays in imports of specialized polymers from Asia, have occasionally resulted in extended lead times for both OEM and aftermarket tires. Combined with fluctuating fuel prices affecting fleet operators’ budgets, these factors may constrain investment in new tires. Manufacturers must strategically manage raw material sourcing and consider local production partnerships to mitigate these risks.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Brazil Truck Tire Market TrendIntegration of Smart Tire Technology

A notable trend is the adoption of smart tire technology by at least five major manufacturers, including Michelin, Bridgestone, and Continental. Sensors embedded in tires monitor pressure, temperature, and tread wear in real-time, allowing fleet operators to optimize maintenance schedules and reduce downtime. Pilot programs in São Paulo and Rio Grande do Sul fleets indicate a 7% reduction in tire-related operational costs and improved fuel efficiency.

This shift toward intelligent tires is further supported by government incentives for fleet efficiency under BNDES programs and private logistics partnerships. By 2032, over 20% of new heavy and ultra-heavy trucks in Brazil are expected to feature smart tire integration, enhancing safety, performance, and lifecycle management.

Brazil Truck Tire Market OpportunityRise in Logistics and Cross-Border Freight

Opportunities in the Brazil logistics industry are substantial for the tire market. The transportation of goods by road, contributing to over 60% of total domestic cargo carried, registered annual growth of 3.2% for truck-kilometers. Increasing exports to neighboring nations, totaling 16,272 units in the year 2025, and the adoption of long-range fleet management create demand for tires with high durability.

Expenditures on the development of industrial zones and greenfield investments in truck manufacturing facilities in the amount of USD 250 million in the states of São Paulo and Minas Gerais are likely to improve the production capacity of trucks and truck tires. Upgrades in highways, cargo routes, and intermodal terminals boost tire replacement turns, thereby increasing the aftermarket business that already represents 70% of the market.

This can benefit the companies by providing high-quality, fuel-efficient tires, particularly in size 275/80R22.5. Joint ventures with logistics concerns in the field of tire maintenance can add to growth opportunities.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Brazil Truck Tire Market Segmentation Analysis

By Truck Type

- Light Truck

- Medium Truck

- Heavy & Ultra Heavy Truck

The Heavy & Ultra Heavy Truck Tires segment dominates the Brazil truck tire market, accounting for 45% of the overall market in 2025. This dominance is closely linked to the robust production of heavy trucks and ultra-heavy trucks in Brazil, which reached a total of 65,644 units in 2025. These vehicles are primarily used in long-haul transport, mining, and infrastructure projects, creating sustained demand for durable and high-performance tires. Monthly production data indicates consistent output, with peak production observed in May at 6,007 units and stable levels across other months, reflecting strong industrial and logistics activity. Exports of heavy trucks further boost this tire segment. In the first eight months of 2025, Brazil exported 12,325 heavy and ultra-heavy trucks, reinforcing the need for quality OEM and replacement tires to serve both domestic and international markets. This segment benefits from heavy investment by truck manufacturers such as Mercedes-Benz, Volkswagen Trucks and Buses, and Iveco, which continue to expand assembly lines, improve vehicle technology, and introduce new models tailored for high-load and cross-border logistics.

The aftermarket for heavy truck tires is also strong, supported by replacement cycles driven by fleet operators and logistics companies. Regulatory support for infrastructure development, including federal road modernization projects, has increased fleet operations, creating consistent tire demand. Moreover, cross-border trade with Mercosur countries and new greenfield manufacturing units by OEMs further stimulate tire consumption. Financial institutions, including the World Bank and local development banks, have provided credit lines for fleet expansion and modernization, indirectly supporting tire demand.

Technological developments in tire compounds, such as enhanced wear resistance, fuel efficiency, and retreadability, are being adopted by 3–4 leading manufacturers including Michelin, Bridgestone, and Pirelli. These innovations increase the lifecycle of heavy truck tires, allowing operators to optimize operational costs while ensuring safety and compliance with Brazilian and international transport standards. Overall, the heavy and ultra-heavy truck tire segment is projected to maintain steady growth from 2025 to 2032, underpinned by strong production, export activity, aftermarket demand, and technological adoption, making it the largest and most strategic segment in the Brazil truck tire market.

By Demand Type

- OEM

- Aftermarket

The Aftermarket segment leads the Brazil market for truck tires, accounting for a dominant 70% market share in 2025. The factor driving this market is the replacement rate demanded by the commercial segment, specifically the total replacement frequency for heavy and ultra-heavy trucks, necessitated by their intensive usage in the freight, logistics, and construction sectors. According to 2025 production, the total production for trucks in Brazil was 132,587 units, while the production for the heavy segment alone was 65,644 units. Trucks need periodic tire changeovers, prompting demand for the aftermarket segment. The fleet renewal and expansion initiatives initiated by automakers, including Volkswagen, Mercedes-Benz, and Iveco, have also fueled the aftermarket segment. According to the Brazil market, the registration pattern is positive, indicating steady sales with a registration level of over 6,000 units for the total heavy segment, ensuring a steady flow of vehicles for the replacement market. Also, Brazil’s exports for 2025 breached the 12,000 units mark for trucks, prompting the tire replacement for other markets, fueling the aftermarket segment.

Cross-border trade in Mercosur and the development of logistics corridors have increased the demand for tire replacements. Greenfield projects and JVs in tire manufacturing are helping to expand the distribution chains, and tires are becoming available in remote areas to fleet operators. The latest tire technology of higher tread performance, fuel efficiency, and retreadable materials is being used in the leading tire makers like Michelin, Bridgestone, and others.

The initiatives of the government regarding development of transport infrastructure, development of roads, and safety regulations concerning heavy vehicles stimulate the need for tire performance among transport operators, thereby further fueling the growth of the aftermarket industry. Telematics and fleet management solutions enable transport operators to monitor tire performance, hence ensuring proper tire changeovers. The aftermarket industry is projected to record steady growth at a compound annual growth rate aligned with the overall market forecast, thereby remaining the major driver of the Brazil truck tire market between 2025 and 2032.

List of Companies Covered in Brazil Truck Tire Market

The companies listed below are highly influential in the Brazil truck tire market, with a significant market share and a strong impact on industry developments.

- Sumitomo Rubber

- Continental

- Yokohama Rubber

- Prometeon

- Michelin

- JK Tire

- Bridgestone

- Goodyear

- Maggion Tires

Recent Developments

- Michelin, 2025:

Michelin introduced smart tire technology for heavy trucks in São Paulo and Rio Grande do Sul, integrating real-time monitoring of tire pressure, tread depth, and temperature to optimize maintenance schedules.

- Bridgestone, 2025:

Bridgestone inaugurated a USD 120 million greenfield plant in Minas Gerais, increasing radial tire production for heavy trucks and meeting rising domestic and export demand.

- Continental, 2025:

Continental expanded its retail and service centers across Brazil to support fleet operators, offering premium retread and maintenance programs.

- Titan, 2025:

Titan partnered with logistics firms exporting to Argentina and Chile, ensuring timely tire supply and maintenance support for long-haul operations.

- Prometeon, 2025:

Prometeon launched energy-efficient tires for heavy trucks, reducing fuel consumption by 5% and extending tire life by 12% under Brazilian road conditions.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Brazil Truck Tire Market Policies, Regulations, and Standards

4. Brazil Truck Tire Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Brazil Truck Tire Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold (Thousand Units)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Truck Type

5.2.1.1. Light Truck- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Medium Truck- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Heavy & Ultra Heavy Truck- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Demand Type

5.2.2.1. OEM- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Aftermarket- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Sales Channel

5.2.3.1. Direct Sales- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Multi Brand Stores & Exclusive Outlets- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Online- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Tire Type

5.2.4.1. Radial- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Bias- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Tire Size

5.2.5.1. Tire Size 1- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Tire Size 2- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Tire Size 3- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Tire Size 4- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Tire Size 5- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Price Category

5.2.6.1. Budget- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Economy- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Region

5.2.7.1. North- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.1. Pará- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.2. Amazonas- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.3. Rondônia- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Northeast- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2.1. Ceará- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2.2. Pernambuco- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2.3. Bahia- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2.4. Maranhão- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.7.3. Southeast- Market Insights and Forecast 2022-2032, USD Million

5.2.7.3.1. São Paulo- Market Insights and Forecast 2022-2032, USD Million

5.2.7.3.2. Minas Gerais- Market Insights and Forecast 2022-2032, USD Million

5.2.7.3.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.7.4. South- Market Insights and Forecast 2022-2032, USD Million

5.2.7.4.1. Paraná- Market Insights and Forecast 2022-2032, USD Million

5.2.7.4.2. Rio Grande do Sul- Market Insights and Forecast 2022-2032, USD Million

5.2.7.4.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.7.5. Center-West- Market Insights and Forecast 2022-2032, USD Million

5.2.7.5.1. Mato Grosso- Market Insights and Forecast 2022-2032, USD Million

5.2.7.5.2. Goiás- Market Insights and Forecast 2022-2032, USD Million

5.2.7.5.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Brazil Light Truck Tire Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold (Thousand Units)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Demand Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Tire Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Tire Size- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Region- Market Insights and Forecast 2022-2032, USD Million

7. Brazil Medium Truck Tire Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold (Thousand Units)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Demand Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Tire Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Tire Size- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Region- Market Insights and Forecast 2022-2032, USD Million

8. Brazil Heavy & Ultra Heavy Truck Tire Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Units Sold (Thousand Units)

8.2. Market Segmentation & Growth Outlook

8.2.1.By Demand Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Tire Type- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Tire Size- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Price Category- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Region- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Yokohama

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Prometeon

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Goodyear

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Continental

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Michelin

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Sumitomo

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Bridgestone

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Maggion Tires

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Sumitomo Rubber

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Company 10

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Truck Type |

|

| By Demand Type |

|

| By Sales Channel |

|

| By Tire Type |

|

| By Tire Size |

|

| By Price Category |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.